What is XAW ETF?

XAW, functioning as an index ETF, provides a seamless and efficient avenue for international market exposure. It stands out as an attractive addition to portfolios primarily centered on Canadian stocks. This fund’s unique approach involves investing in a diversified basket of index funds, allowing investors to harness growth opportunities beyond the confines of the Canadian market. It proves to be a strategic choice for long-term investors, emphasizing simplicity and effectiveness in achieving global diversification.

Notably, XAW’s scope is comprehensive, capturing large, mid, and small-cap companies across 22 developed market countries (excluding Canada) and 27 emerging market countries. This is achieved primarily through investments in six ETFs, ensuring a broad representation of companies in various stages of development.

Crucially, XAW’s investment strategy extends to securities of one or more ETFs managed by BlackRock or an affiliate. This distinctive feature adds a layer of expertise and reliability to the fund’s composition, aligning with the interests of investors seeking a well-managed and diversified approach to international market participation. In essence, XAW remains an ideal choice for long-term investors, offering a holistic and expertly managed pathway to global diversification.

The Case for International Diversification

One of the key reasons for XAW’s popularity is that it serves as a powerful diversification tool. Many Canadians have portfolios heavily weighted towards Canadian assets, often for reasons of familiarity, favorable tax treatment, and avoiding currency risk. However, limiting your investments to Canada comes with significant risks. The Canadian market represents only about 3% of the global economy, and it is highly concentrated in sectors like financials, energy, and materials. This leaves Canadian investors exposed to sector-specific and regional risks.

By investing in XAW, Canadians can reduce these risks and gain exposure to the broader global economy. The ETF includes companies from the United States, Europe, Asia, and emerging markets, providing a much more balanced portfolio across sectors and geographies. This helps mitigate the risks of relying too heavily on a single country’s economy or market trends.

XAW also removes the need for investors to buy multiple international ETFs. Instead, it bundles global exposure into a single, low-cost product, simplifying the process for DIY investors who prefer a hands-off approach.

Cost Efficiency: Low Management Fees and MER

Another reason why XAW appeals to Canadian investors is its cost efficiency. With a management expense ratio (MER) of around 0.22%, XAW is a relatively cheap way to gain broad international exposure. Compared to mutual funds, which often have MERs exceeding 2%, XAW’s low fee structure allows investors to keep more of their returns over the long term.

In addition, because XAW bundles different regions into a single product, investors save on transaction costs, avoiding the need to buy multiple individual ETFs for U.S., international developed markets, and emerging markets.

Tax Considerations for DIY Investors

One thing to keep in mind when investing in XAW is foreign withholding tax on dividends. When holding international equities in non-registered accounts or Tax-Free Savings Accounts (TFSAs), Canadian investors may face foreign withholding taxes that reduce the total return from dividends. These taxes can be difficult or impossible to recover in certain account types, such as the TFSA, which is not recognized as a tax shelter outside Canada.

However, holding XAW in a Registered Retirement Savings Plan (RRSP) can help mitigate this issue. Thanks to tax treaties between Canada and other countries, you may avoid foreign withholding taxes when holding U.S. and international equities in an RRSP, making it a more tax-efficient way to invest in international assets.

XAW vs XEQT iShares all equity ETF

XEQT stands out as an all-in-one ETF, offering investors a comprehensive and fully diversified portfolio that encompasses both Canadian and international markets. This single investment vehicle eliminates the need for multiple holdings, providing a convenient solution for those seeking broad market exposure. In contrast, XAW focuses exclusively on international markets, excluding Canada, making it an essential component for building a fully diversified portfolio when paired with a Canadian index ETF like XIC.

For investors opting for a multi-ETF approach, combining XIC and XAW, the iShares Core MSCI All Country World ex Canada Index ETF, proves to be an excellent choice. This strategy involves regular rebalancing but results in a slightly lower fee, appealing to those comfortable with a more hands-on approach.

On the other hand, XEQT offers a straightforward alternative for those desiring simplicity in their investment strategy. By encompassing a diverse range of holdings, including XEF and IMEG, XEQT presents an attractive choice for investors looking for an uncomplicated yet highly diversified investment solution. Ultimately, the decision between XEQT and a multi-ETF approach hinges on individual preferences for simplicity, involvement in rebalancing, and fee considerations.

XEQT holdings

| ITOT | ISHARES CORE S&P TOTAL U.S. STOCK | 46.06% |

| XEF | ISHARES MSCI EAFE IMI INDEX | 24.55% |

| XIC | ISHARES S&P/TSX CAPPED COMPOSITE | 23.98% |

| XEC | ISHARES MSCI EMERGING MARKET | 4.98% |

Tax implications of owning ETFs that invest in US and International stocks

There are tax implications when holding an ETF that invests in US and international stocks. Any dividend received will be reduced by withholding taxes depending on the scenarios below. The table below provides a summary:

| Canadian ETF: 1$ dividend scenario | Taxes | Dividend received |

| 1- Holding US or International stocks directly | -0.15$ (withholding tax from US or foreign jurisdiction) Creditable | 0.85$ |

| 2- Holding US listed ETFs that invest in US stocks | -0.15$ (withholding tax from US or foreign jurisdiction) Creditable | 0.85$ |

| 3- Holding US listed ETFs that invest in International stocks | -0.15$ (withholding tax from foreign jurisdiction) Non creditable -0.13 (withholding tax from US) Creditable | 0.72$ |

The chart is designed for illustrative purposes only and is subject to change. Please consult a tax specialist for more information.

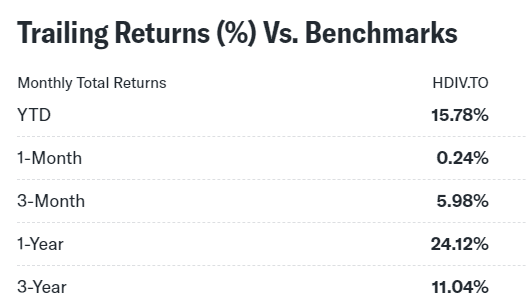

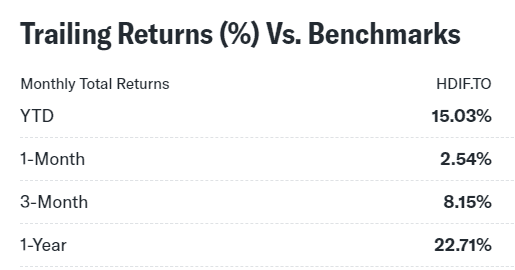

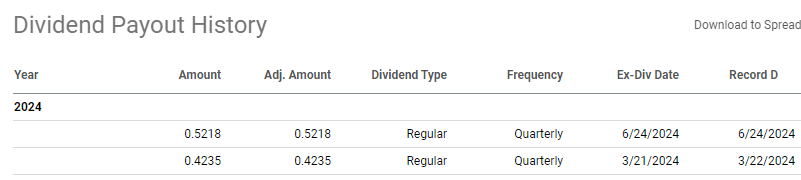

XAW ETF historical performance and dividend yield

[stock_market_widget type=”table-quotes” template=”color-text” color=”#1613F3″ assets=”XAW.TO” fields=”symbol,ytd_return,three_year_average_return,five_year_average_return” links=”{‘XAW.TO’:{}}” display_header=”true” display_chart=”false” display_currency_symbol=”true” pagination=”true” search=”false” rows_per_page=”15″ sort_field=”logo_name_symbol” sort_direction=”asc” alignment=”left” api=”yf”]

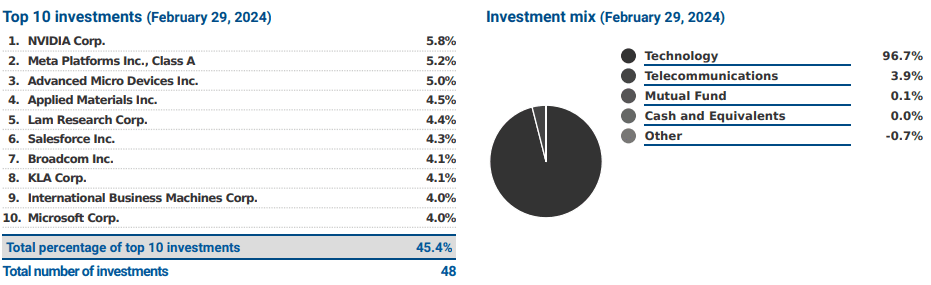

XAW ETF holdings

| Ticker | Name | Weight % |

|---|---|---|

| IVV | ISHARES CORE S&P 500 ETF | 53.02 |

| XEF | ISHARES MSCI EAFE IMI INDEX | 26.08 |

| XEC | ISHARES MSCI EMERGING MARKET | 11.17 |

| ITOT | ISHARES CORE S&P TOTAL U.S. STOCK | 3.83 |

| IJH | ISHARES CORE S&P MID-CAP ETF | 3.66 |

| IJR | ISHARES CORE S&P SMALL-CAP ETF | 2.14 |

| USD | USD CASH | 0.10 |

| CAD | CAD CASH | 0.01 |