Introduction

The Harvest Retirement Income ETF (HRIF) deserves attention for those particularly interested in retirement income solutions. HRIF is designed to offer a combination of income and growth by investing in an actively managed portfolio of equities. Let’s delve into what makes HRIF a notable option for investors, especially those nearing or in retirement.

Objective of HRIF ETF

- Objective: The Harvest Retirement Income ETF aims to provide unitholders with a monthly cash distribution. There is also opportunity for capital appreciation. It targets a mix of equity income securities, focusing on quality companies with the potential for long-term growth.

- Strategy: HRIF typically includes a diversified set of holdings across various sectors and geographies. The idea is to generate income through dividends and capital gains. The fund maintains a focus on companies that exhibit stability and growth potential.

Portfolio HRIF ETF

| ETF Name | Weight | Sector |

|---|---|---|

| Harvest Brand Leaders Plus Income (HBF) | 14.4% | Diversified |

| Harvest Equal Weight Global Utilities Income (HUTL) | 14.3% | Utilities |

| Harvest Canadian Equity Income Leaders (HLIF) | 14.0% | Diversified |

| Harvest Tech Achievers Growth & Income (HTA) | 13.9% | Information Technology |

| Harvest US Bank Leaders Income (HUBL) | 13.7% | US Banks |

| Harvest Healthcare Leaders Income (HHL) | 13.4% | Health Care |

| Harvest Travel & Leisure Income (TRVI) | 13.3% | Diversified |

| Harvest Premium Yield Treasury (HPYT) | 2.7% | Government Bonds |

Why HRIF?

- Income Focus with Growth Potential: HRIF is particularly appealing to retirees or those close to retirement who are looking for a steady stream of income. The ETF’s strategy of investing in income-generating equities allows for a focus on distribution, which is crucial for investors relying on their investment for regular income.

- Diversification: By investing in a range of sectors and geographies, HRIF offers diversification, which is key in managing risk, especially for retirees who may have a lower risk tolerance. Diversification can help smooth out returns and protect against sector-specific downturns.

- Professional Management: HRIF is actively managed, meaning a team of professionals selects the holdings based on rigorous analysis. This can be an advantage for investors who prefer not to manage their own portfolios or those who value professional oversight in selecting quality income-generating investments.

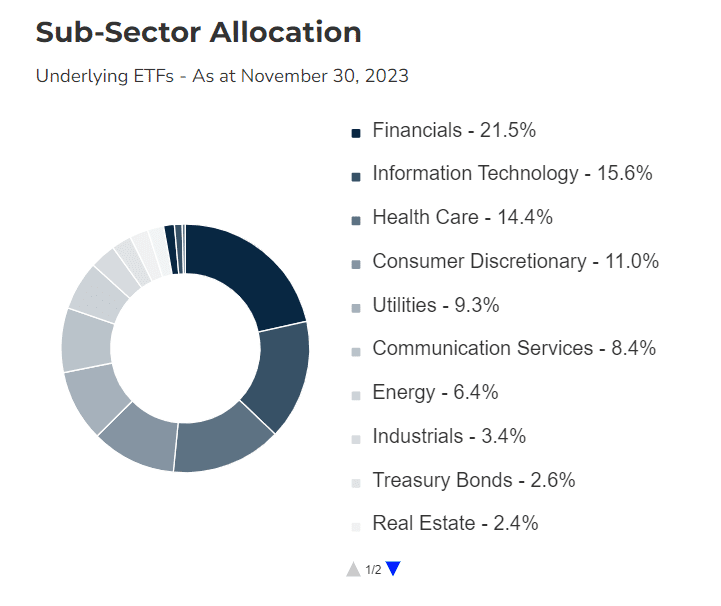

HRIF ETF Sector allocation

Considerations

- Fees: As with any managed fund, it’s important to consider the fees associated with HRIF. Higher fees can eat into returns over time, so weigh the cost against the potential benefits of professional management and strategy.

- Market Risks: While HRIF aims to invest in stable, income-producing equities, it’s still subject to market risks. Economic downturns, sector-specific issues, or global events can affect the performance of the investments within the ETF.

- Performance: Look at the historical performance of HRIF, but remember that past performance is not indicative of future results. Consider how the ETF has done in various market conditions and how it aligns with your risk tolerance and time horizon.

Conclusion

The Harvest Retirement Income ETF (HRIF) is an option worth considering for those focused on generating income in their retirement years. With its strategy of investing in a diversified portfolio of income-generating equities, HRIF seeks to provide a balance between income and growth. As with any investment, it’s crucial to understand your own financial situation, risk tolerance, and investment goals. Consult with a financial advisor to determine if HRIF or any other investment is a suitable part of your retirement planning strategy. Happy and wise investing!