In this article, we’ll delve into 15 top monthly dividend stocks in Canada, renowned as “Dividend Aristocrats.” These are stalwarts of the TSX, offering consistent monthly dividends to shareholders, making them ideal for generating steady passive income. You’ll notice a significant presence of REITs (Real Estate Investment Trusts) in this list, reflecting their popularity in the monthly dividend space. For each entity, we will detail crucial information like dividend yield, payout ratio, and historical performance.

The “Canadian Dividend Aristocrats” are part of an esteemed index managed by Standard and Poors, known as the S&P Canadian Dividend Aristocrats. To qualify, companies must have increased their dividends for at least five consecutive years. For those interested in exploring the entire roster of these prestigious stocks, we’ll direct you to the comprehensive list of Canadian Dividend Aristocrats.

This post is also available in Video format!

Why invest in Canadian dividend aristocrats

If you are asking yourself, what is the typical profile of a dividend aristocrat stock? I have listed some common characteristics below:

Dividend aristocrats tend to dominate their industry

• The vast majority are companies that are well established in their sector. They manage to generate significant profits thanks to their comfortable position against the competition. They also sometimes operate in regulated markets such as electric utilities with almost no competition;

Safe heaven during turbulent times

• “Dividend aristocrats” are sometimes considered by the financial market as safe havens in the event of a market correction or decline. Indeed, dividend aristocrats are generally less volatile than the market, and there are less targeted by speculators;

Strong financial statements

• “Dividend aristocrats” will tend to have a better financial situation in terms of liquidity than the rest of the market. Their levels of liquidity or debt are generally better than the rest of the market;

Limited growth but there are exceptions

• In general, dividend aristocrats are mature businesses. That is, the growth potential is quite limited. However, some companies can pay dividends and invest in their growth. Usually, the dividend payout ratio is a good indicator. If the rate is low, it means the business is saving some money to grow. Business with high dividend pay out ratio have no financial resources left to grow.

- 7 Best Dividend stocks to buy now (safe dividends and growth)

- Best dividend stocks to buy – Dividend aristocrats 2023

- US Stocks that pay monthly dividends (Full list by sector)

How to select monthly dividend stocks?

Look at the payout ratio

The dividend payout ratio is the amount of dividend distributed by a company divided by the total earnings. For example, a company makes a profit of $ 100 and pays $ 40 in dividends. Its payout ratio is 40%.

If the ratio is high, the company pays almost all of its profits in dividends. There will be little money left in the coffers to innovate or expand to new markets;

It is preferable to invest in a company where the dividend payout ratio is low or medium. The reasoning is that these companies will have money set aside to invest in new projects and thus create growth;

Another variation of payout ratio (Trailing div / Earnings) is the payout ratio to cash (Div / Free cash flows). Earnings can be easily manipulated, so analysts use the payout ratio to cash to assess the safety of dividends better. The website ‘Marketbeat‘ provides the payout ratio to cash for Canadian stocks.

Focus on total return

When one wishes to invest in a dividend-paying stock, it is essential to pay attention to its performance and growth potential. The most common mistake is to invest in stocks with high dividend yields. This strategy is risky. Here’s why :

• A stock can pay a high dividend yield, but is it sustainable? Some companies have a payout ratio that is close to and even exceeds 100%. They manage to post desirable dividend yields, but if we look at the growth prospects, it’s almost nil;

• Investors sometimes shun companies for lack of growth potential or actual risk of lower revenues in the future. These companies experience a drop in the price of their shares, and this causes the dividend yield to become abnormally high. Sooner or later, these businesses will have to cut their dividend.

Monthly dividend stocks Canada (Aristocrats)

The most important measure to evaluate dividend aristocrats’ stocks is without a doubt the dividend streak. It’s simply the number of years, in a row, that the company has increased its dividends.

| Ticker -Company | Div Streak |

| GRT.UN -Granite REIT | 12 |

| EIF -Exchange Income Fund | 11 |

| FN -First National Financial | 11 |

| AP.UN -Allied Properties REIT | 11 |

| CAR.UN -Canadian Apartment Properties | 10 |

| IIP.UN -Interrent REIT | 10 |

| PKI -Parkland Corporation | 9 |

| SIS -Savaria Corporation | 9 |

| CRT.UN -CT REIT | 9 |

| CSH.UN -Chartwell Retirement Res | 6 |

| SRU.UN -SmartCentres REIT | 7 |

| BDGI -Badger Infrastructure Sol | 6 |

Note: SGR-UN, AQN, KEY, ONEX and GR.UN were removed from the list of Canadian Dividend Aristocrats as of April 2023.

Dividend yield, Pay out ratio and P/E ratio

Monthly dividend stocks Canada – updated daily

The yield is a measure of the amount of dividends paid out by a company relative to its stock price. A higher dividend yield may be attractive to investors seeking income, but it may also indicate that the company is paying out a large proportion of its earnings as dividends, which could limit its ability to reinvest in the business.

Payout ratio measures the percentage of a company’s earnings that are paid out as dividends. A high payout ratio may indicate that the company is prioritizing dividends over reinvestment, which could limit growth prospects.

P/E ratio is a valuation ratio that measures the price of a stock relative to its earnings per share. A high P/E ratio may indicate that investors have high expectations for future growth, while a low P/E ratio may indicate that investors have lower expectations or concerns about the company’s future prospects.

Monthly dividend stocks Canada

SIS – Savaria Corp

A Global Leader in Accessibility Solutions

Savaria Corporation, with a market capitalization of $1 billion, is a global leader in the accessibility industry. The company specializes in designing, manufacturing, distributing, and installing a wide array of accessibility equipment, catering to the needs of elderly and physically challenged individuals worldwide.

Comprehensive Product Portfolio

Savaria’s product portfolio is extensive, including solutions such as stairlifts for both straight and curved stairs, vertical and inclined wheelchair lifts, as well as elevators designed for residential and commercial use. This comprehensive range of offerings ensures that Savaria can meet the diverse needs of its customers.

Expanding Horizons

Beyond accessibility equipment, Savaria extends its product line to encompass pressure management products for the medical market, medical beds tailored for long-term care facilities, and specialized medical equipment for the safe handling of patients, such as ceiling lifts and slings. The company also engages in vehicle conversions and adaptations for personal and commercial purposes, further diversifying its reach.

Investor Appeal as a Dividend Aristocrat

Savaria stands out as a Canadian Dividend Aristocrat, reflecting its commitment to shareholder value. With an impressive five-year dividend growth rate of 12.2%, the company offers investors an attractive monthly dividend yield of 3.5%. While the current payout ratio is relatively high at about 83% of adjusted earnings, Savaria’s potential for growth in the coming years could facilitate a reduction in this ratio, making it a more comfortable proposition.

Unlocking Value: Analyst Consensus

Market analysts have set a 12-month price target of $19.50 for Savaria stock, which represents a significant discount of 24% from its current trading price of $14.78 per share. This potential upside of nearly 32% underscores Savaria’s appeal as an investment opportunity, particularly in light of the growing demand for accessibility solutions amid an aging global population. Additionally, the company’s commitment to dividend growth adds another layer of appeal for income-focused investors. Savaria is poised to continue its leadership in the accessibility industry, offering investors a promising combination of growth potential and income generation.

GRT-UN Granite REIT

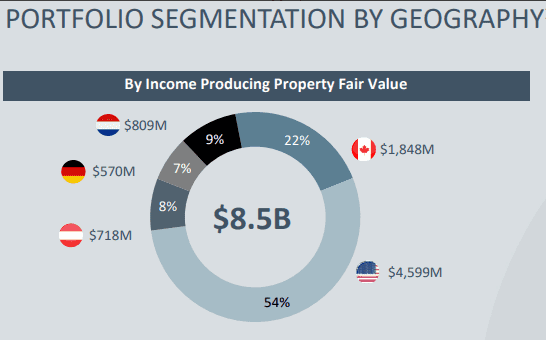

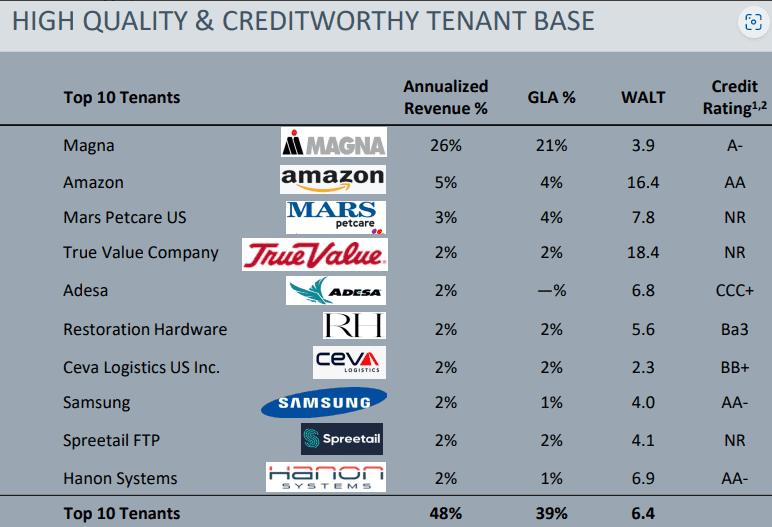

Granite REIT (GRT-UN) is a Canadian-based real estate investment trust specializing in industrial properties, including warehouses and logistics and distribution centers. A significant strength of Granite REIT is its high-quality portfolio of assets, strategically located in key markets in North America and Europe. This positioning allows it to serve a broad range of tenants, including many multinational corporations. The trust benefits from the growing demand for industrial and logistics spaces, driven by e-commerce and global trade, ensuring a stable and often growing income stream.

However, Granite faces challenges typical to the industrial real estate sector. Market fluctuations can impact the industrial sector differently than residential or commercial spaces, with shifts in global trade policies or economic downturns affecting demand. Its international presence, while a strength, also exposes it to currency risk and varying regulatory environments. Additionally, as with all real estate investments, it is sensitive to interest rate changes, which can affect financing costs. Despite these challenges, Granite’s focus on essential and high-demand real estate, along with its robust tenant base, provides a resilient and promising investment structure.

investors’ presentation – Top 10 tenants – Monthly dividend stocks Canada

investors’ presentation – Monthly dividend stocks Canada

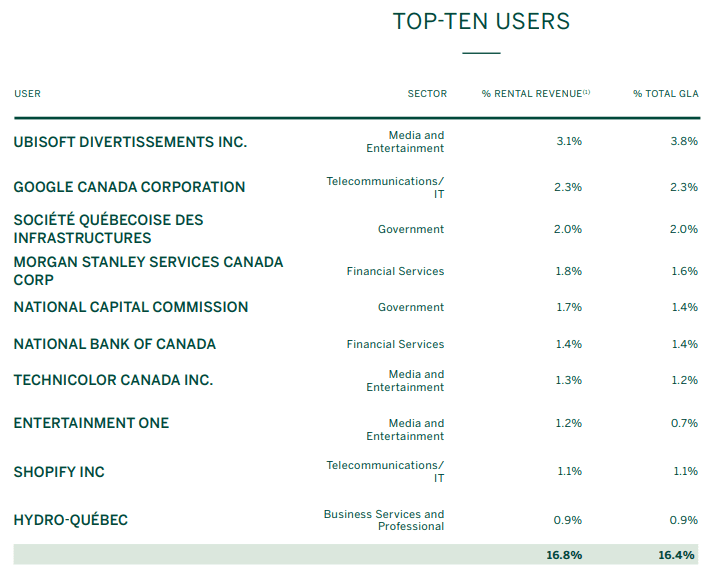

AP.UN -Allied Properties REIT

Allied is a leading owner, manager and developer of data centers and centrally located urban workspaces.

Assets

Allied Properties holds a portfolio of assets strategically located in major Canadian cities, which I consider favorable from a geographical standpoint. During the pandemic, the company managed to increase its cashflows, surpassing pre-pandemic levels, demonstrating its resilience. The majority of Allied’s portfolio consists of urban workspaces and offices, which could be of interest to investors who anticipate a faster return to office environments for businesses.

It’s important to note that unlike RioCan, which has a diversified portfolio including residential and commercial retail, Allied’s focus is primarily on office buildings and data centers. Additionally, Allied Properties has a track record of increasing its dividend for 11 consecutive years, which may be appealing to income-oriented investors.

Risks

However, there are factors to consider. The increasing adoption of hybrid work arrangements in the business world may have an impact on the real estate sector overall. Furthermore, rising costs, including financing expenses, have the potential to affect profit margins. The 2023 results, while solid, indicated the influence of rising interest expenses on the company’s financial performance. On a positive note, Allied strategically completed a significant asset sale, alleviating some pressure on its balance sheet.

In conclusion, Allied Properties offers an interesting investment opportunity with its central urban assets and strong cashflow rebound. Nevertheless, investors should remain cautious and monitor the evolving workplace trends and the potential challenges associated with rising costs in the real estate sector. Allied’s commitment to dividend growth and its focused portfolio should be considered when evaluating it as an investment option.Ass

investors’ presentation – Top 10 tenants – Monthly dividend stocks Canada

Exchange Income Fund (EIF)

Exchange Income Corporation (EIF) is a diversified, acquisition-oriented company focused on opportunities in aerospace, aviation, and manufacturing sectors, primarily in North America. A significant strength lies in its diversified portfolio of companies, which helps mitigate risk and allows for steady revenue streams, particularly from its aerospace and aviation services that often include long-term contracts. The company’s strategic acquisitions have historically expanded its market presence and driven growth.

However, EIF’s weaknesses include exposure to industry-specific risks. The aerospace and aviation sectors are highly susceptible to economic cycles and regulatory changes, which can impact demand for its services. Additionally, these sectors are capital-intensive, requiring continual investment in technology and equipment to remain competitive. Global economic volatility, such as fluctuating fuel prices or currency exchange rates, also poses challenges. Despite these concerns, EIF’s focus on niche markets with high barriers to entry and its strong history of dividend payments showcase its resilience and strategic planning.

First National Financial (FN)

First National Financial Corporation (FN) is one of Canada’s largest non-bank lenders, offering a wide array of residential and commercial mortgages. A significant strength of First National is its strong reputation and established position in the Canadian mortgage market, which has allowed for a stable and diverse client base. The company’s innovative approach to mortgage servicing and underwriting, along with its efficient online platform, enhances customer experience and operational efficiency.

On the downside, as a financial institution, First National is sensitive to interest rate fluctuations and regulatory changes in the housing market. Changes in mortgage rules or economic downturns can affect borrowing and lending patterns, potentially impacting revenues. Additionally, intense competition from banks and other non-bank lenders could pressure profit margins. While First National has a robust risk management framework, its focus on the Canadian real estate market does expose it to regional economic shifts and property market corrections.

Canadian Apartment Properties (CAR.UN)

Canadian Apartment Properties REIT, known as CAPREIT (CAR.UN), is a prominent Canadian real estate investment trust specializing in apartment buildings, townhouses, and land lease communities. A key strength is its diverse portfolio, offering a wide range of residential properties across Canada, which helps mitigate risks associated with regional market fluctuations. This diversification is bolstered by its consistent performance in occupancy rates and rent growth, contributing to stable revenue streams.

However, CAPREIT faces certain weaknesses. As with many in the real estate sector, it is sensitive to interest rate changes. Rising rates can increase borrowing costs, impacting profitability. Additionally, the company is subject to regulatory changes in the housing market, including rent control laws that can limit income growth. The reliance on the Canadian market also exposes it to specific economic and geographical risks. Despite these challenges, CAPREIT’s strategic portfolio and management have historically navigated market conditions effectively.

Interrent REIT (IIP.UN)

InterRent REIT (IIP.UN) is a growth-oriented real estate investment trust focused on increasing shareholder value through the acquisition and management of properties primarily within the multi-residential sector. A major strength of InterRent is its strategic growth approach, concentrating on expanding its portfolio in high-growth urban markets, which has historically led to robust income growth and capital appreciation. The company’s effective property management strategies aim to enhance the value of its assets and optimize operational efficiencies, contributing to a strong occupancy rate and stable cash flows.

However, InterRent faces typical industry-related weaknesses. Its focus on multi-residential properties means it is susceptible to market fluctuations, including changes in occupancy rates and rent controls that can limit income growth. The real estate market is also affected by broader economic factors, such as interest rate hikes, which can increase borrowing costs and affect profitability. Despite these challenges, InterRent’s commitment to portfolio quality and geographic diversification within Canada helps it maintain a resilient operational structure.

Parkland Corporation (PKI)

Parkland Corporation is a leading marketer of fuel and petroleum products. Investors have benefited from steadily rising dividends for 9 consecutive years.

One of its key strengths is its diversified business model, which includes retail fuel locations, commercial and wholesale operations, and supply arrangements, allowing for multiple revenue streams. The company’s extensive distribution network and strategic acquisition practices have historically driven growth and expanded market presence.

However, Parkland also faces certain challenges. The company operates in a highly competitive and regulated market, with fluctuations in global oil prices directly impacting costs and profitability. Its operations are capital intensive, requiring continual investment in infrastructure and compliance with environmental regulations. Additionally, as a fuel distributor, it is susceptible to shifts in consumer demand, particularly with increasing environmental concerns and the transition towards renewable energy sources. Despite these challenges, Parkland’s commitment to expanding its convenience retail offerings and growing its renewable energy segments illustrates its adaptability and focus on long-term sustainability.

CT REIT (CRT.UN)

CT REIT, a real estate investment trust, owns and manages retail properties in Canada. It has maintained a dividend streak of 9 years, delivering consistent income to investors.

CRT.UN focuses on retail properties, largely anchored by Canadian Tire, which is a significant tenant. A major strength of CT REIT is the long-term, stable lease agreements with Canadian Tire, providing a reliable income stream. The quality and location of its properties, often in prime retail spots, add to its appeal and stability. The REIT’s conservative leverage and strong affiliation with Canadian Tire offer financial stability and growth opportunities through property development and acquisitions.

However, CT REIT’s focus on retail properties, particularly with a significant tenant like Canadian Tire, presents concentration risks. Changes in the retail landscape, consumer habits, or the financial health of its primary tenant can impact its performance. The retail sector is also vulnerable to economic downturns, affecting occupancy rates and rental income. Additionally, as with many REITs, it is sensitive to interest rate fluctuations, which can affect borrowing costs and capital expenses. Despite these challenges, CT REIT’s strategic management and strong tenant relationships provide a solid foundation for navigating the retail real estate sector.

Chartwell Retirement Res (CSH.UN)

Chartwell Retirement Res operates senior living and long-term care facilities. While it has a relatively shorter dividend streak of 6 years, it has been a reliable income generator.

Chartwell is one of the largest operators in the Canadian senior living sector, focusing on retirement and long-term care facilities. A significant strength is its extensive portfolio of properties across various regions, providing a diversified revenue base. The aging population in Canada suggests a growing demand for senior living options, positioning Chartwell to capitalize on this demographic trend. The company’s focus on providing a range of services from independent living to assisted living and long-term care caters to various needs, enhancing its marketability.

However, Chartwell faces challenges inherent in the healthcare and residential care industry. Operational costs are high, including staffing, maintenance, and regulatory compliance, which can impact margins. The sector is highly regulated, and changes in government funding or regulations can affect profitability. Additionally, the sensitivity to economic downturns can impact occupancy rates and the ability of residents to afford services. Despite these potential issues, Chartwell’s established presence and focus on quality care and community living provide a solid foundation within the growing senior care market.

SmartCentres REIT (SRU.UN)

SmartCentres REIT specializes in retail real estate and operates shopping centers and other retail properties. With 7 consecutive years of dividend increases, it offers both income and growth potential.

A key strength is its strong tenant base, with Walmart as a major anchor, providing a stable and predictable income stream. The trust’s focus on value-oriented retail properties strategically located in prime areas ensures high foot traffic and tenancy demand, contributing to its overall occupancy and financial stability. SmartCentres’ ability to adapt by diversifying into mixed-use developments also illustrates its commitment to growth and resilience.

However, SmartCentres faces challenges typical of the retail real estate sector. The evolving retail landscape, driven by e-commerce and changing consumer preferences, poses risks to traditional brick-and-mortar retail spaces. The concentration in retail might limit flexibility compared to more diversified REITs. Additionally, economic downturns can impact consumer spending and retail health broadly, potentially affecting occupancy rates and rents. Despite these concerns, SmartCentres’ strategic partnership with Walmart and focus on community-centric mixed-use developments provide a strong base to navigate the changing retail environment.

Badger Infrastructure Sol (BDGI)

Badger Infrastructure Solutions provides non-destructive excavation services. While its dividend streak is 6 years, it has shown commitment to rewarding shareholders with regular payouts.

A major strength of Badger is its specialized service, which is critical in infrastructure development, maintenance, and utility work, providing a niche market with less competition. The company’s extensive fleet and geographic reach across North America offer scalability and accessibility to various markets, enhancing its customer base and operational flexibility.

However, BDGI faces certain industry-specific challenges. Its services are closely tied to the health of construction, infrastructure, and utilities sectors, making it susceptible to economic cycles and capital spending in these areas. Regulatory changes and environmental considerations can also impact operational practices and costs. Moreover, while specialized, the market for hydrovac services is competitive, and maintaining technological edge and operational efficiency is crucial. Despite these challenges, Badger’s established reputation, commitment to safety, and operational expertise position it as a key player in the excavation and infrastructure service industry.