Covered call ETFs have gained immense popularity among Canadian investors, with several of these ETFs being managed with billions of dollars in assets. In this article, we will explore the top covered call ETFs available in Canada. Investors are drawn to covered call ETFs for three compelling reasons:

High dividend yield: thanks to the premiums earned when writing call options, the manager under certain conditions can earn premiums and enhance distributions;

Low volatility. Writing a call option is a conservative strategy aimed at reducing volatility;

Great for passive income: if you’re main objective is to achieve high dividend yields and build passive income, then covered call ETFs are a good option. But, remember the high dividend yield comes at a price which very low growth potential.

This post is available in video format!

US Stocks that pay monthly dividends (Full list by sector)

Executive summary

How writing a call option works?

Options make it possible to hedge a possible decline in a security and thus limit its loss through a gain on the option. To apply this hedging strategy, you have to take a short position on a call option, in other words sell a call.

The sale of calls achieves two objectives:

· Set the sale price of these securities (exercise price) and therefore set an acceptable loss.

· Collect a premium, i.e. additional income, or limit losses if the strike price is reached.

The option seller will be obligated to deliver the securities if exercised at the price fixed in advance. In this case the market will have evolved contrary to these expectations, it will have appreciated. The option investor will sell his securities for less than the market price.

Covered call options protect against downside risk. This being said, the covered call strategy provides limited downside protection. Also, when you write a covered call, you give up some of the stock’s potential gains. Covered call ETFs will tend to have a higher yield and a lower performance.

How had Covered call ETF’s performed historically?

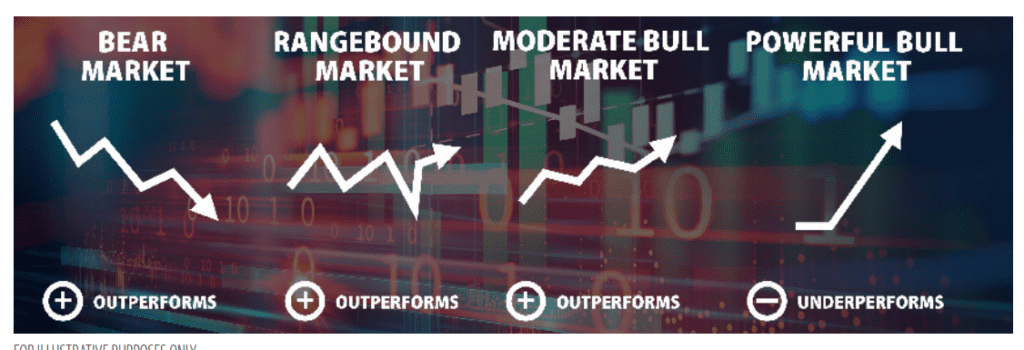

In historical contexts characterized by bear markets, range-bound markets, and moderate bull markets, a covered call strategy has typically demonstrated the ability to outperform its underlying securities. However, during robust bull markets, when the underlying securities experience frequent rises beyond their strike prices, covered call strategies have historically exhibited slower growth. Nevertheless, even in these bullish phases, investors typically realize moderate capital appreciation alongside the accrual of dividends and call premiums.

List of Best Covered Call ETF in Canada

Performance and dividend yield comparison

Updated daily

| Div Yld FY | |

| ZWB | 6.99 |

| ZWC | 6.86 |

| ZWP | 7.67 |

| ZWH | 6.11 |

| ZWK | 7.74 |

| HTA | 9.30 |

| HBF | 7.63 |

| LIFE | 8.22 |

| HDIF | 10.65 |

| HDIV | 10.03 |

| HMAX | 15.05 |

Full list of ‘Dividend Kings’ stocks by sector

6 Best Long-Term Dividend Stocks with high total returns

Analysis – Best covered call ETFs Canada

Diversified ETFs

ZWC is a great option if you are seeking a diversified ETF that invests in the Canadian Economy. This fund offers an attractive yield. Since it’s a covered call ETF, it was less impacted by the recent correction in the market. The long term performance is decent.

HDIV and HDIF are strong competitors to ZWC. These ETFs are diversified accorss various sectors. They use the covered call strategy plus additional leverage to push even higher the dividend yield. Since these two ETFs are relatively new, their performance and MER are not yet published. One thing is certain, though, the MER for both HDIV and HDIF will definitely be higher than ZWC. Also, the additional leverage used by these funds enhances the yield but also creates more risk for investors.

ZWH is ideal for investors looking for US dividends in their portfolio. This fund invests in large US corporations such as Apple. Microsoft…etc. It has also excellent sector diversification. In the same category, HBF is a great choice too. HBF invests mainly in large US corporations that hold brand power in their industries. The fund had a great historical performance in addition to an attractive yield.

Sector ETFs

Banking

ZWB is an excellent play if you are seeking exposure to Canadian banks. The long term performance is also great. Canadian banks are known for their solid dividends and most major Canadian banks are dividend aristocrats. Another strong competitor to ZWB is HMAX. It’s a new fund offered by Hamilton ETF. The fund invests in the Canadian banking sector. This fund aims to provide an attractive dividend yield (target 13%) using a covered call strategy. The strategy consists of writing call options on (50% of the portfolio) to collect premiums and maximize monthly distributions.

Technology

HTA boast an amazing long term performance thanks to its 100% exposure to large Teck stocks. However, the performance since the start of the year is the worst among all the ETFs selected. Some consider this a perfect time to buy on weakness to benefit from the enhanced yield and the future potential of Tech stocks.

Finally, LIFE is an excellent ETF that offers exposure to the healthcare sector. In total, 20 large health stocks make up LIFE’s portfolio.

Dividend frequency: Best Covered Call ETF Canada

| Frequency | |

| ZWB | Monthly |

| ZWC | Monthly |

| ZWP | Monthly |

| ZWH | Monthly |

| ZWK | Monthly |

| HTA | Monthly |

| HBF | Monthly |

| LIFE | Monthly |

| HDIF | Monthly |

| HDIV | Monthly |

| HMAX | Monthly |

Review of UMAX: Hamilton Utilities Yield Maximizer ETF (13% Target yield)

Practice example: covered call strategy

An investor has 100 shares of Company A in his portfolio. Company A’s share is worth $ 30. He anticipates a stagnation or a slight drop in its price and he is ready to sell them at the price of 26 $. He decides to sell a call with the following characteristics:

• Exercise price: $ 26; • Maturity: April; • Option price: $ 4; • Quantity: 100

He collects the following amount: 4 x 100 or 400 $ (premium)

Two cases should be distinguished:

CASE 1

Company A’s share price rose above the breakeven point of $ 30. And, the break-even point = exercise price + premium = 26 + 4 = 30

The buyer of the option will choose to exercise his right to buy and, as the seller of the call, the seller will have to sell the shares at the strike price.

During this operation:

- the seller sold his shares for $ 26, which constitutes an acceptable loss for him.

- the seller collected the amount of the premium of $ 4, which helped boost the performance of his investments (yield).

CASE 2

Company A’s share price has fallen below the breakeven point of $ 30.

The buyer of the option will choose not to exercise his right to buy and the seller will not have to sell his shares.

Thanks to this operation, the seller keeps his shares in the portfolio and he collected the amount of the premium which generated an additional return.

ZWB – BMO Covered Call Canadian Banks

The ZWB aims to provide exposure to a portfolio of dividend-paying securities (Canadian Banks), while collecting premiums related to call options. The portfolio is chosen on the basis of the criteria below:

• dividend growth rate; • yield; • payout ratio and liquidity.

ZWB holdings

| Name | Weight |

| BMO Equal Weight Banks ETF | 27.2% |

| Bank of Montreal | 12.9% |

| Canadian Imperial Bank of Commerce | 12.7% |

| Royal Bank of Canada | 12.1% |

| National Bank of Canada | 11.9% |

| The Toronto-Dominion Bank | 11.9% |

| Bank of Nova Scotia | 11.4% |

ZWC –BMO CDN High Div Covered Call

The BMO Canadian High Dividend Covered Call ETF (ZWC) has been designed to provide exposure to a dividend focused portfolio, while earning call option premiums. The underlying portfolio is yield-weighted and broadly diversified across sectors.

The fund selection methodology uses 4 factors: – Liquidity; – Dividend growth rate; – Yield and payout ratio.

ZWC is an excellent option for conservative investors looking for a steady income and low volatility. It’s tax-efficient because the dividends are all coming from Canadian companies. The financial sector and Energy represents 53% of the total overall sector allocation.

ZWC ETF Holdings

| Company Name | Allocation |

|---|---|

| Canadian National Railway Co | 5.4% |

| BCE Inc | 5.2% |

| TELUS Corp | 5.1% |

| Enbridge Inc | 5.0% |

| Royal Bank of Canada | 5.0% |

| Canadian Imperial Bank of Commerce | 4.9% |

| Bank of Nova Scotia | 4.7% |

| The Toronto-Dominion Bank | 4.6% |

| Manulife Financial Corp | 4.3% |

ZWP – BMO Europe High Dividend Covered Call ETF

The BMO Europe High Dividend Covered Call ETF (ZWP) has been designed to provide exposure to a dividend focused portfolio. These dividend paying companies are selected based on:

- dividend growth rate,

- yield,

- payout ratio and liquidity.

ZWP Dividend ETF Holdings

| Company Name | Allocation |

|---|---|

| Roche Holding AG | 4.0% |

| Nestle SA | 4.0% |

| Novartis AG | 4.0% |

| GlaxoSmithKline PLC | 4.0% |

| Sanofi SA | 3.8% |

| TotalEnergies SE | 3.7% |

| Unilever PLC | 3.7% |

| Enel SpA | 3.7% |

Geographic allocation

| Countries | Weight |

| Switzerland | 23.66% |

| Germany | 24.24% |

| United Kingdom | 18.76% |

| France | 16.72% |

| Other (multiple countries) | 16.62% |

Sector allocation

| Type | Fund |

| Information Technology | 6.22 |

| Industrials | 12.18 |

| Consumer Discretionary | 11.56 |

| Consumer Staples | 11.78 |

| Health Care | 16.56 |

| Financials | 14.79 |

| Materials | 9.48 |

| Communication | 8.10 |

| Energy | 3.89 |

| Utilities | 3.66 |

ZWH – BMO US High Dividend Covered Call ETF

ZWH has been designed to provide exposure to a dividend focused portfolio, while earning call option premiums. The underlying portfolio is yield-weighted and broadly diversified across sectors. The Fund utilizes a rules-based methodology that considers the following criteria:

dividend growth rate,

yield,

payout ratio,

liquidity.

ZWH Dividend ETF Holding

| Company Name | Allocation |

|---|---|

| Apple Inc | 4.2% |

| Microsoft Corp | 4.2% |

| Coca-Cola Co | 4.1% |

| AbbVie Inc | 4.1% |

| The Home Depot Inc | 4.1% |

| Procter & Gamble Co | 4.1% |

| Pfizer Inc | 4.0% |

Geographic allocation

| Country | Fund |

| USA | 100.0% |

Sector allocation

| Sector | Fund |

| Information Technology | 22.61% |

| Industrials | 8.39% |

| Consumer Discretionary | 10.06% |

| Health Care | 12.40% |

| Financials | 15.50% |

| Materials | 4.36% |

| Communication | 9.58% |

| Consumer Staples | 7.35% |

| Energy | 3.86% |

| Utilities | 3.84% |

| Real estate | 2.05% |

Please consult issuers’ website for up-to-date figures

ZWK -BMO Covered Call US Banks

The BMO Covered Call U.S. Banks ETF (ZWK) is professionally managed by BMO Global Asset Management. The fund has been designed to provide exposure to a portfolio of U.S. banks while earning call option premiums.

The fund invests in 38 US Banks. It’s ideal for investors looking for dividend income. The dividend yield on November 24th was 6.19%!

The fact that the fund uses call options accomplishes two things:

- increases the dividend yield;

- reduces volatility but also growth potential. So, it’s something to keep in mind.

| Weight (%) | Name |

|---|---|

| 5.86% | SIGNATURE BANK/NEW YORK NY |

| 5.58% | CITIZENS FINANCIAL GROUP INC |

| 5.55% | REGIONS FINANCIAL CORP |

| 5.52% | AMERIPRISE FINANCIAL INC |

| 5.52% | M&T BANK CORP |

| 5.46% | SVB FINANCIAL GROUP |

| 5.43% | KEYCORP |

| 5.41% | TRUIST FINANCIAL CORP |

| 5.40% | FIFTH THIRD BANCORP |

| 5.38% | BMO EQUAL WEIGHT US BANKS INDEX ETF |

HTA -Harvest Tech Achievers Growth & Income

HTA is an ETF that invests in an equally weighted portfolio of 20 large-cap technology companies (globally). In order to generate an enhanced monthly distribution yield, an active covered call strategy is engaged.

Covered call strategies are great as they generate additional income for investors (in the form of premiums). The strategy is somewhat conservative and aims at preserving the capital invested primarily. On the other hand, the strategy limits potential growth.

| Name | Weight | Sector |

|---|---|---|

| NVIDIA Corporation | 6.9% | Semiconductors |

| Advanced Micro Devices, Inc. | 6.5% | Semiconductors |

| QUALCOMM Inc | 6.5% | Semiconductors |

| Intuit Inc. | 5.5% | Software |

| Apple Inc. | 5.3% | Technology Hardware |

| Applied Materials | 5.2% | Semiconductors |

| Keysight Technologies | 5.2% | Electronic Equipment |

| Broadcom Inc. | 5.1% | Semiconductors |

| Microsoft Corp | 5.1% | Software |

| Adobe Inc. | 5.0% | Software |

HBF – Harvest Brand Leaders Plus Income

HBF is an equally weighted portfolio of 20 large companies selected from the world’s Top 100 Brands. The ETF is designed to provide a consistent monthly income stream with an opportunity for growth. In order to generate an enhanced monthly distribution yield, an active covered call strategy is engaged.

HBF Holding details

| Company Name | Allocation |

|---|---|

| JPMorgan Chase & Co | 5.4% |

| Royal Dutch Shell PLC ADR Class A | 5.3% |

| McDonald’s Corp | 5.3% |

| Alphabet Inc Class A | 5.2% |

| Microsoft Corp | 5.2% |

| Citigroup Inc | 5.1% |

| The Walt Disney Co | 5.1% |

HBF Sector breakdown

| Sector | % Allocation |

|---|---|

| Financial Services | 20.2% |

| Technology | 20.1% |

| Comm. Services | 15.3% |

LIFE– Evolve Global Healthcare Enhance Yld ETF

LIFE seeks to replicate the performance of the Solactive Global Healthcare 20 Index. This is an equally weighted index of 20 global health care companies.

LIFE ETF writes covered call options on up to 33% of the portfolio securities, at the discretion of the Manager. The level of covered call option writing may vary based on market volatility and other factors.

LIFE.B is non hedged. LIFE is Canadian hedged to reduce exchange risk.

Though LIFE ETFs offer a interesting yield, the performance was negative.

LIFE and LIFE-B high dividend ETF Holdings

| NAME | WEIGHT | COUNTRY |

| Danaher Corp | 5.18% | UNITED STATES |

| Novartis AG | 5.12% | SWITZERLAND |

| Intuitive Surgical Inc | 5.10% | UNITED STATES |

| CSL Ltd | 5.08% | AUSTRALIA |

| AstraZeneca PLC | 5.07% | BRITAIN |

| Pfizer Inc | 5.01% | UNITED STATES |

| AbbVie Inc | 5.01% | UNITED STATES |

| Medtronic PLC | 4.92% | IRELAND |

| Sanofi | 4.88% | FRANCE |

| GlaxoSmithKline PLC | 4.86% | BRITAIN |

HDIF -Harvest Diversified Monthly Income ETF

HDIF is a relatively new fund from Harvest ETFs (created on Feb 2022). It’s a covered call ETF and its main target audience are income/dividend investors.

HDIF is a fund of funds. It means this ETF invests in other ETFs to provide investors with diversification across various sectors of the economy ( Healthcare, Global Brands, Technology, Utilities, and US Banks). The primary objective is to provide a higher yield than traditional dividend ETFs by using a covered call strategy.

Additional facts about HDIF:

– The portfolio is reconstituted and rebalanced quarterly (minimum);

– The covered call strategy is applied on up to 33% of each equity securities held in underlying portfolios.

Sector allocation

| Sector | % Allocations |

|---|---|

| Financial Services | 31.8% |

| Healthcare | 21.8% |

| Technology | 23.4% |

| Comm. Services | 15.0% |

| Utilities | 13.7% |

HDIF ETF review: Portfolio

| ETF | Allocation |

|---|---|

| HUTL Harvest Equal Weight Glbl Utilts Inc | 20.5 |

| HHL Harvest Healthcare Leaders Inc | 20.3 |

| HBF Harvest Brand Leaders Plus Inc | 20.7 |

| HUBL Harvest US Bank Leaders Income Cl A | 20.7 |

| HTA Harvest Tech Achievers Gr&Inc | 20.7 |

| HLIF Harvest Canadian Equity Income Leaders ETF | 23.3 |

| Cash and other Liabilities | (26.2) |

Please visit issuers’ website for most up-to-date data

HDIV -Hamilton Enhanced Multi-Sector Covered Call

HDIV is a passive covered call ETF. It’s ideal for investors who seek high dividend income and low volatility. HDIV invests in a basket of 7 covered call & sector focus ETFs. The fund manager uses also cash leverage of 25% to enhance yield and growth potential. The index tracked is The Solactive Multi-Sector Covered Call ETFs Index TR x 1.25.

The ETFs held within HDIV invest primarly in large corporations. In addition to using the covered call strategy, the funds ensure diversification of your investments across various sectors. See below the list of the 7 ETFs that make up HDIV:

| HEP – Horizons Enhanced Income Gold Producers |

| NXF – CI Energy Giants Covered Call |

| ZWU – BMO Covered Call Utilities |

| HHL – Harvest Healthcare Leaders Income |

| FLI – CI U.S. & Canada Lifeco Income |

| ZWB – BMO Covered Call Canadian Banks |

| HTA – Harvest Tech Achievers Growth & Income |

All the funds that make up HDIV are covered call ETFs offered by various issuers such as: Harverst, BMO, CI Financial and Horizons.

Video HDIV overview

HMAX – Hamilton Canadian Financials Yield Maximizer

HMAX ETF is a new fund offered by Hamilton ETF. The fund invests in the Canadian banking sector. This fund aims to provide an attractive dividend yield (target 13%) using a covered call strategy. The strategy consists of writing call options on (50% of the portfolio) to collect premiums and maximize monthly distributions.

HMAX ETF Holdings

| NAME | WEIGHT |

| Royal Bank of Canada | 23.1% |

| Toronto-Dominion Bank | 20.5% |

| Bank of Montreal | 11.5% |

| Bank of Nova Scotia | 10.5% |

| Brookfield Corp | 10.0% |

| Canadian Imperial Bank of Commerce | 6.7% |

| Manulife Financial | 6.0% |

| Sun Life Financial | 4.8% |

| Intact Financial | 4.1% |

| National Bank of Canada | 4.1% |

HMAX ETF sector allocation

█ Asset Management 10.0%

█ Banks 76.4%

█ Insurance 14.9%

Video

Q&A

Do covered call ETFs pay dividends?

Yes, Covered call ETF’s offer an excellent dividend yield. Their dividend yield is usually superior to ‘regular’ dividend ETF’s. Thanks to premiums collected issuing covered calls, the manager boost the fund distributions (Dividends plus Premiums), thus the dividend yield is usually high.

Some Covered Call ETFs use leverage to enhance returns even higher.

Do covered calls beat the market?

During market corrections, the answer would be probably yes. In essence, the covered call strategy is a convervative strategy that tends to forego profits for stability and income.

In a bull markets, covered call ETFs would have a lousy performance. A ‘regular’ dividend ETF would definitely perform better in bull market that a Covered call ETF.

If you are retired or close to retiring, a covered call ETF could be a better option for you. For young investors building wealth, covered call ETFs are not a good choice because they deprive their holders of growth perspective.

How risky is covered calls?

Covered call ETFs are generally low to medium risk funds. However, if the fund manager uses leverage, the fund would be considered medium to high risk.