HDIV is an excellent option for income-focused investors who seek high dividend yields with lower volatility. This ETF employs a covered call strategy that aims to enhance income by collecting premiums on call options while providing diversified exposure across sectors.

What HDIV Accomplishes for Investors:

High Monthly Income

With high average yield of approx. 12%, HDIV is structured to deliver consistent monthly income. This makes it attractive for investors who rely on regular cash flows, such as retirees or income-seekers.

Source: Hamilton website

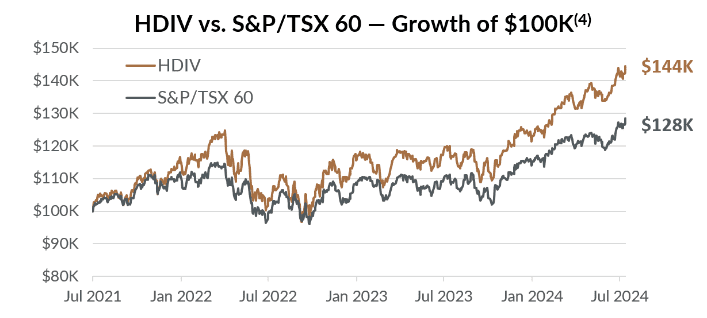

The chart compares the growth of $100K invested in HDIV versus the S&P/TSX 60 from July 2021 to July 2024. Over this period, HDIV has significantly outperformed the S&P/TSX 60.

- HDIV grew to $144K, while the S&P/TSX 60 reached $128K, highlighting HDIV’s superior returns.

- The chart shows that HDIV’s growth was more pronounced during market recoveries and periods of steady gains. This is likely due to the ETF’s covered call strategy, which generates additional income through option premiums, boosting returns.

- While both investments experienced volatility, HDIV offered higher income through its regular dividends, helping it to outpace the index.

This performance makes HDIV appealing for investors seeking both income and growth, although they should be aware of the capped upside in bull markets.

Low Volatility Exposure

By holding a diversified basket of covered call ETFs across key sectors like financials, utilities, healthcare, energy, and gold, HDIV reduces overall portfolio volatility. Covered call strategies help cushion market declines by generating income through premiums, which helps offset losses.

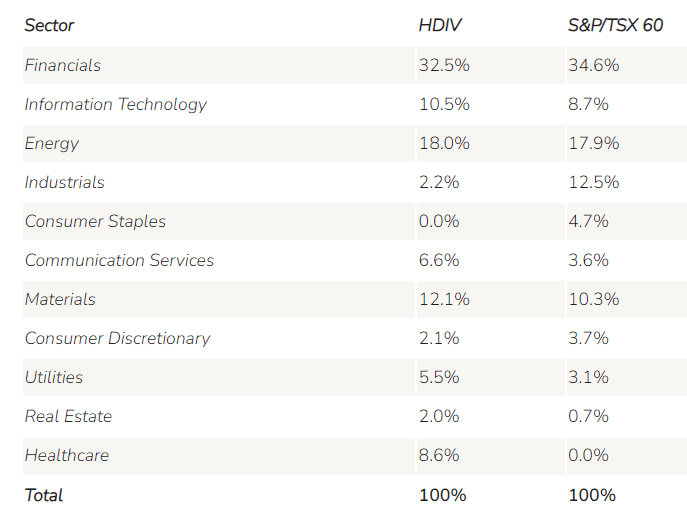

Diversification Across Key Sectors

HDIV provides exposure to a variety of sectors that are less correlated with each other, helping investors balance risks. HDIV addresses the lack of sector breadth in the Canadian equity market by diversifying beyond the S&P/TSX 60. The Canadian market is heavily concentrated in sectors like financials, energy, and utilities, with fewer options in technology and healthcare. To counterbalance this, HDIV invests in the larger U.S. technology and healthcare sectors via its Hamilton Technology YIELD MAXIMIZER™ ETF (QMAX) and Hamilton Healthcare YIELD MAXIMIZER™ ETF (LMAX). This approach provides better diversification than the S&P/TSX 60, giving investors broader exposure while maintaining similar sector allocations for stability and income generation.

Enhanced Growth Potential with Cash Leverage

HDIV employs a 25% cash leverage to boost returns, aiming to outperform traditional covered call strategies. While leverage can increase both gains and losses, HDIV’s diversified sector exposure makes this approach more balanced.

Key Considerations before considering HDIV:

Downside Risk: While covered call strategies provide income, they also cap upside potential in strong bull markets. Investors may see underperformance compared to broad market indices during rapid market rallies.

MER and Expenses: The management expense ratio (MER) of HDIV is relatively high at 2.39%, which could reduce net returns over time.

Income vs. Growth — Should You DRIP or Take Cash?

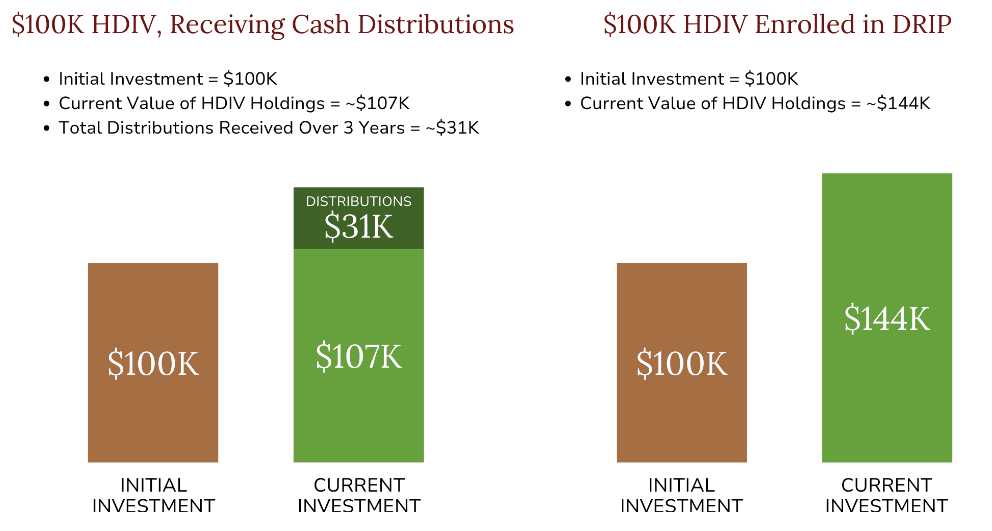

Investors in covered call ETFs often prioritize generating regular monthly income, focusing less on overall portfolio growth. For these income-focused investors, opting for cash distributions may be the best choice to support their cash flow needs. However, for those aiming to build long-term wealth, a Distribution Reinvestment Plan (DRIP) can be a powerful strategy.

In a DRIP, instead of receiving monthly cash payments, investors automatically reinvest their dividends to purchase more units of the ETF. This allows for compounding growth over time, which can significantly increase the value of a portfolio in the long run.

To illustrate this, let’s compare the outcomes of two $100K investments in HDIV (since inception):

- One portfolio that takes cash distributions.

- Another that participates in a DRIP.

Over time, the portfolio using DRIP can accumulate more units, potentially leading to greater overall value due to compounding, while the cash distribution portfolio prioritizes immediate income. Choosing between these strategies depends on your financial goals—whether you prefer immediate income or are focused on long-term growth.

Conclusion: Expected Outcome for HDIV Investors

Investors can expect steady monthly income and lower volatility with HDIV. However, they should be prepared for capped upside potential in strong markets. The ETF is ideal for conservative investors seeking income, or for tactical plays during market downturns by growth investors looking to mitigate risk.