My personal take HDIF vs HDIV

Despite having a higher MER, HDIV appears to be a more favorable option for income-oriented investors, boasting a superior yield and total return. It’s crucial to consider that this comparison relies solely on a one-year historical analysis, making it unjust to declare a decisive winner within such a limited timeframe. Both funds operate as covered call ETFs, generating monthly income through premiums from option-selling activities. Additionally, they fall under the category of funds of funds, composed of various ETFs. (HDIF vs HDIV)

While HDIF exclusively invests in Harvest-issued ETFs, HDIV takes a more diversified approach by including ETFs from BMO, Hamilton, Horizons, and others, positioning itself better in terms of diversification.

Both ETFs share similar drawbacks, particularly the covered call strategy employed by both, limiting upside potential for the portfolio.

Both funds utilize 25% leverage, which has the potential to increase yields and performance but also introduces additional risk, especially in a high-interest rate environment.

It’s essential to recognize that both funds cater to a specific niche of investors prioritizing income. While I personally advocate for investors to seek a balance between growth and income, I caution that, in the long run, covered call ETFs may exhibit unstable yields and underwhelming total return (price performance + dividend yield).

Executive summary HDIF vs HDIV

| Aspect | HDIF | HDIV |

|---|---|---|

| Investment Approach | Fund of funds, diversified portfolio of Harvest’s ETFs | Fund of funds, diversified portfolio of ETFs |

| Primary Objective | Higher yield through covered call strategy + Moderate potentiel growth | Higher yield through covered call strategy + Moderate potentiel growth |

| Underlying Holdings | Harvest’s covered call ETFs | Seven covered call ETFs from different issuers (sector-focused ETFs) |

| Yield | 11.39% | 12.21% |

| Leverage | 25% leverage | 25% leverage |

| MER (Management Expense Ratio) | 1.98% | 2.39% |

| Risk Management | Covered call strategy on up to 33% of equity securities | Unknown |

| Frequency of Dividend Distribution | Monthly basis, consistently at the targeted rate | Monthly basis, consistently at the targeted rate |

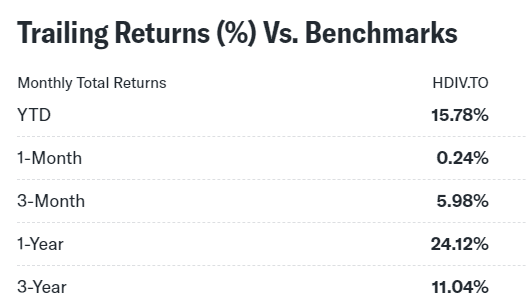

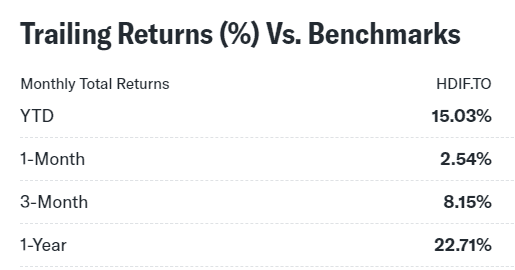

Performance comparison

Investment objective

HDIF: Harvesting Diversification for Enhanced Monthly Income

Harvest Diversified Monthly Income ETF (HDIF) takes center stage as a unique fund of funds, delving into diverse sectors. This article unveils its covered call strategy and explores its distinctive approach, focusing on delivering high yields through dividends and premiums. With a target yield exceeding 9%, HDIF offers consistency in monthly dividends and the allure of 25% leverage at institutional rates, all at a competitive Management Expense Ratio (MER) of 1.98%.

HDIV: Harvesting Global Investments for Income and Stability

Harvest Global Investments Ltd. introduces HDIV, a passive covered call ETF designed for income-seeking investors with a penchant for low volatility. This segment delves into HDIV’s strategic investment in seven covered call and sector-focused ETFs, emphasizing large corporations. Unraveling its risk management approach and expense structure, HDIV showcases a nuanced path for investors aiming for both yield and stability, sporting a MER of 2.39% and an expense ratio of 0.65%.

Under the Hood: Unveiling Their Underlying Holdings

This section peels back the layers, comparing the underlying holdings of HDIF and HDIV. HDIF’s venture into Harvest’s covered call ETFs contrasts with HDIV’s meticulous selection of seven ETFs from different issuers, aligning with its focus on large corporations. The common thread? Both deploy covered call strategies, introducing an extra income stream while navigating the complexities of risk management.

HDIF

| Ticker | ETF Name |

|---|---|

| HTA | Harvest Tech Achievers Growth & Income ETF |

| HBF | Harvest Brand Leaders Plus Income ETF |

| HLIF | Harvest Canadian Equity Income Leaders ETF |

| HHL | Harvest Healthcare Leaders Income ETF |

| HUTL | Harvest Equal Weight Global Utilities Income ETF |

| HUBL | Harvest US Bank Leaders Income ETF |

| TRVI | Harvest Travel & Leisure Income ETF |

HDIV

| TICKER | NAME | WEIGHT |

| NXF | CI Energy Giants Covered Call ETF | 20.9% |

| HMAX | Hamilton Canadian Financials Yield Maximizer ETF | 18.7% |

| HFIN | Hamilton Enhanced Canadian Financials ETF | 18.3% |

| GLCC | Horizons Gold Producer Equity Covered Call ETF | 18.0% |

| HTA | Harvest Tech Achievers Growth & Income ETF | 17.1% |

| HHL | Harvest Healthcare Leaders Income ETF | 16.2% |

| UMAX | Hamilton Utilities Yield Maximizer ETF | 12.3% |

| HUTS | Hamilton Enhanced Utilities ETF | 3.8% |

Covered Call ETFs: High Yields or Hidden Hazards?

Full review of ZWU – BMO Covered Call Utilities ETF

Latest posts

- QYLD ETF Review: Global X Nasdaq-100 Covered Call ETF

- Review JEPQ: JPMorgan Nasdaq Equity Premium Income ETF

- Best US Dividend ETF in canada (2025)!

- Best High-Interest Savings Account ETFs In Canada (2024)

- Review of XEI – Ishares S&P TSX Comp High Div Index ETF

- Review of VDY – Vanguard FTSE Canadian High Dividend Yield Index

- JEPI vs JEPQ: Which ETF is the Best Investment for You?