Investing in covered call ETFs can generate income while maintaining exposure to the stock market. The JPMorgan Equity Premium Income ETF (JEPQ) and the Global X NASDAQ 100 Covered Call ETF (QYLD) are two prominent options. Here’s a clear and concise guide to help you decide which ETF is better suited for your investment goals.

Executive summary

| Feature | JEPQ | QYLD |

|---|---|---|

| Issuer | JPMorgan | Global X |

| Underlying Index | Proprietary strategy aligned with Nasdaq 100 | NASDAQ-100 BuyWrite V2 Index |

| Expense Ratio | 0.35% | 0.60% |

| Dividend Yield | Approx. 7-8% | Approx. 10-12% |

| Holdings | U.S. large cap growth stocks | Primarily tech stocks (NASDAQ-100) |

| Covered Call Strategy | Out-of-the-money (OTM) options on a portion of the portfolio | At-the-money (ATM) options on the entire portfolio |

| Risk and Volatility | Lower, seeks less volatility than Nasdaq 100 | Higher due to concentration in tech stocks |

| Capital Appreciation | Aims to provide capital appreciation potential | Limited potential for capital appreciation |

| Approach | Data science-driven investment approach | Index tracking with covered calls |

| Total Return Potential | Higher due to capital appreciation and income combination | Primarily income-focused, lower total return potential |

Analysis

Both JEPQ and QYLD offer unique benefits tailored to different investment goals. However, when it comes to investing, focusing solely on income without considering total return can be detrimental in the long run. Total return, which includes both income and capital appreciation, is essential for ensuring that your investment grows over time.

Why Total Return Matters

Total return is a critical measure of an investment’s performance. It accounts for both the income generated from dividends or interest and the capital gains achieved through the appreciation of the investment’s value. By focusing on total return, investors can ensure their portfolio not only generates income but also grows in value, helping to outpace inflation and meet long-term financial goals.

JEPQ: Balancing Income and Growth

If you’re looking for an investment strategy that balances income and growth while maintaining lower volatility, JEPQ is likely the better choice. Here’s why:

Balanced Strategy: JEPQ provides a steady income stream through dividends while also offering the potential for capital appreciation. This dual approach ensures that your investment can grow over time, enhancing total return.

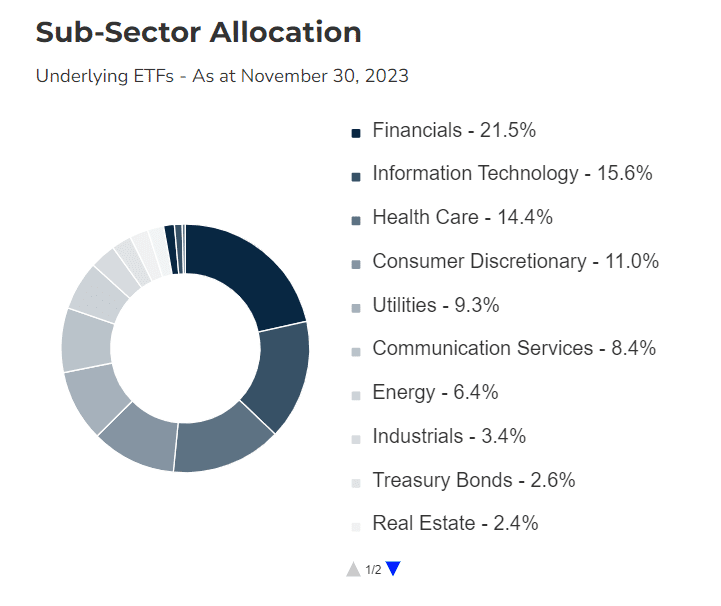

Diversified Portfolio: JEPQ invests in large-cap U.S. growth stocks across various sectors, reducing the risk associated with concentration in a single industry. This diversification helps stabilize returns and mitigates the impact of sector-specific downturns.

Cost-Effective: With a lower expense ratio of 0.35%, JEPQ is more cost-effective, allowing more of your investment to work for you. Lower fees mean higher net returns over the long term.

Lower Volatility: JEPQ aims to deliver returns with less volatility compared to the Nasdaq 100. This makes it a more stable investment, suitable for investors who are risk-averse or nearing retirement.

Data-Driven Approach: JEPQ uses a proprietary, data-driven investment strategy to maximize risk-adjusted returns. This sophisticated approach helps in constructing a portfolio that balances risk and reward effectively.

QYLD: High Income, Higher Risk

QYLD might be suitable if your primary goal is to generate high current income and you are willing to accept higher risk and limited growth potential. Here are the key points to consider:

High Dividend Yield: QYLD generates a substantial dividend yield, typically around 10-12%, by selling at-the-money (ATM) covered call options on the NASDAQ-100 index. This strategy maximizes income but limits the potential for capital appreciation.

Tech Concentration: QYLD is heavily concentrated in tech stocks, which can lead to higher volatility. While tech stocks can offer strong growth, their performance can be more unpredictable, adding to the investment’s risk.

Higher Expenses: With an expense ratio of 0.60%, QYLD is more expensive than JEPQ. Higher fees can erode net returns, particularly in a low-growth environment.

Limited Capital Appreciation: The use of ATM options caps the upside potential of the portfolio, meaning that while QYLD provides high income, it sacrifices the possibility of significant capital gains.

Making the Right Choice

When deciding between JEPQ and QYLD, it’s important to align your choice with your investment goals and risk tolerance.

Choose JEPQ if:

- You seek a balanced approach with both income and potential for capital growth.

- You prefer a diversified portfolio that reduces risk and volatility.

- You are cost-conscious and prefer a lower expense ratio.

- You want to invest in a fund that uses a data-driven approach to maximize risk-adjusted returns.

- You prioritize total return and want to ensure your investment grows over time.

Choose QYLD if:

- You prioritize high current income and are less concerned about capital growth.

- You are comfortable with higher risk and volatility associated with a tech-heavy portfolio.

- You understand that the use of ATM options limits the potential for capital appreciation.

- You are willing to pay a higher expense ratio for a strategy that maximizes income generation.

Conclusion

Both JEPQ and QYLD have their advantages, but understanding the importance of total return is crucial for long-term investment success. Sacrificing potential growth for higher income can limit your portfolio’s overall performance. Therefore, for most investors, JEPQ’s balanced approach to income and growth, along with its lower volatility and cost-effectiveness, makes it a compelling choice.

QYLD, with its high income potential, may appeal to those seeking immediate cash flow and willing to accept higher risks and limited growth.

Consider your financial goals, risk tolerance, and investment strategy before making a decision. Prioritizing total return ensures your investment grows over time, providing both income and capital appreciation.

Invest wisely and stay informed! If you have any questions or want to learn more, feel free to leave a comment below.