In this post, we will be going over 11 high dividend yields ETFs. All the ETFs selected pay over 6% in dividend yield! We will start by comparing the performance and MER. Then, we will discuss how to select the best ETF among the ones selected. for each ETF, we will provide all pertinent financial data.

How to analyze a high dividend ETF in Canada

Analyzing a high dividend ETF in Canada involves considering several key factors:

Total Return: Remember that an investment’s profit or loss results from both dividend income and capital gain or loss. It’s essential to assess the fund’s long-term performance, aiming for an ETF that offers satisfactory capital appreciation along with a high dividend yield.

Diversification: Opt for diversified ETFs whenever possible, as they tend to be safer. Some high-yield ETFs focus on specific sectors like Financials, Energy, or Gold. However, those concentrating on Energy and Gold have displayed poor long-term performance and come with high volatility risks.

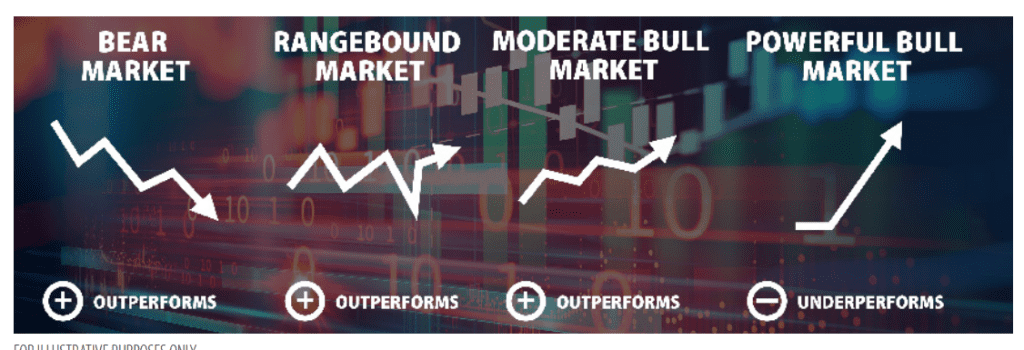

Covered Call ETFs: It’s crucial to understand how high dividend ETFs achieve their impressive yields. Most of these ETFs utilize covered call options, allowing them to collect earned options premiums, which are then added to the dividends paid to investors. However, this strategy limits the upside potential of the ETF’s held stocks.

In summary, a covered call ETF tends to outperform competitors during market corrections but may underperform during market rallies. This strategy is particularly suitable for low volatility baskets of securities, but its effectiveness diminishes when applied to high volatility assets like gold and energy stocks.

Top 5 Best Canadian REITs ETF in 2023

Review: XDV – Ishares Canadian Select Dividend Index

8 Best Covered Call ETF Canada – High dividend yield

Volume and Liquidity: Consider the ETF’s volume and liquidity. ETFs with higher assets under management generally offer lower trading costs due to narrower bid-ask spreads.

Management Expense Ratio: Evaluate the Management Expense Ratio (MER) of the ETF. A lower MER can result in cost savings for investors over the long term.

Dividend yield and Beta comparison

| Name | Div yield | MER |

| High Dividend Yield (Diversified) | ||

| ZWC – BMO CDN High Div Covered Call | 6.63 | 0.72 |

| HDIV -Hamilton Enhanced Multi-Sector Covered Call | 9.58 | na |

| HDIF -Harvest Diversified Monthly Income ETF | 10.05 | na |

| ZWH – BMO US High Dividend Covered Call | 5.58 | 0.71 |

| ZWS – BMO US High Dividend Covered Call Hedged to CAD | 5.63 | 0.71 |

| High Dividend Yield (Europe) | ||

| ZWE – BMO Europe High Div CC CAD Hedge | 6.37 | 0.71 |

| ZWP – BMO Europe High Div Cov Call | 6.48 | 0.71 |

| High Dividend Yield (Sector Focused) | ||

| LIFE – Evolve Global Healthcare Enhance Yld | 6.42 | 0.68 |

| CALL – Evolve US Banks Enhanced Yield | 6.48 | 0.69 |

| LIFE-B – Evolve Global Healthcare Enhance Yld Unheg | 5.88 | 0.68 |

| FIE – Ishares CDN Fin Mthly Income | 5.85 | 0.89 |

| HPF – Harvest Energy Leaders Plus Income | 4.43 | 1.71 |

High dividend ETF Canada – Source: Barchart.com

Historical performance

Source: Updated daily

Popular high dividend ETF Canada

Review of HPF Harvest Energy Leaders Plus Income ETF

Investment Strategy: Partially Covered Call Strategy for Income Enhancement and Downside Protection in the Energy Sector with a focus on Dividend Stocks

HPF has exhibited lackluster historical performance, even with its implemented covered call strategy. Concerns arise as dividends may not be secure, given the potential for major players in the energy industry to reduce their dividend payouts. If you maintain a positive outlook on energy stocks, it might be more prudent to hold them directly rather than investing in HPF. With HPF, the trade-off involves exchanging potential income for the prospect of growth.

Review of ZWC BMO CDN High Dividend Covered Call ETF

Investment Strategy: Covered Call Strategy for Income Augmentation and Downside Protection in the Canadian Dividend Market

ZWC stands out as a compelling choice for conservative investors seeking a stable income stream and minimal volatility. The utilization of the covered call strategy effectively boosts the yield, although it does impose constraints on long-term growth potential. It is crucial to bear this trade-off in mind when considering ZWC as an investment option.

Moreover, ZWC demonstrates tax efficiency as all its dividends originate from Canadian companies, which can be advantageous for tax-conscious investors.

Review of HDIV and HDIF

HDIV and HDIF pose robust competition to ZWC. These ETFs offer diversification across multiple sectors and employ the covered call strategy, combined with additional leverage, to achieve even greater dividend yields. However, it’s worth noting that as these two ETFs are relatively new, their performance history and Management Expense Ratios (MER) have not yet been made available.

Nonetheless, it’s almost certain that the MER for both HDIV and HDIF will exceed that of ZWC. This higher expense ratio is a trade-off for the enhanced yield generated through the additional leverage. Investors should be aware that while this leverage can boost returns, it also introduces heightened risk to their investment portfolios. Careful consideration and assessment of risk tolerance are advisable when evaluating these options.

Review of ZWE and ZWP – BMO Europe High Dividend CC CAD ETF

Investment Strategy: Covered Call Strategy for Income Enhancement and Downside Protection in the European Dividend Market

ZWE and ZWP represent attractive investment options that focus on high-quality European stocks, including companies such as Volkswagen and Nestlé. These ETFs employ a covered call strategy designed to safeguard against market downturns while simultaneously boosting yields.

It’s important to note that both ZWP and ZWE share identical portfolios, with the key distinction lying in their approach to currency risk management. ZWE employs Canadian hedging to mitigate exchange rate risk, while ZWP is a non-hedged ETF, meaning it does not employ currency hedging strategies. Investors should carefully consider their risk tolerance and currency exposure preferences when selecting between these two options.

Review of LIFE and LIFE-B Evolve Global Healthcare Enhance Yld ETF

Investment Strategy: Partially covered call strategy to enhance income and protect against downturn / Global / Healthcare / Dividend

LIFE and LIFE-B emerge as top-tier ETF options for those seeking exposure to the healthcare sector, with a particular focus on dividend yield. Their outstanding performance, notably during the pandemic, underscores their resilience in the face of market volatility. However, it’s worth noting that several analysts express concerns about the global healthcare sector’s current state, suggesting it may be overvalued. In light of this, a prudent approach might involve waiting for a market pullback before considering an investment.

Nevertheless, the long-term outlook for the healthcare industry remains positive, indicating potential for growth over time.

A key differentiator between the two ETFs is their approach to currency risk management: LIFE.B is non-hedged, while LIFE employs Canadian hedging to reduce exposure to exchange rate fluctuations. Investors should carefully assess their risk tolerance and currency risk preferences when choosing between these options.

Review of ZWH and ZWS BMO US High Dividend Covered Call ETF

The strategy used: Covered call strategy to enhance income and protect against downturn / US / Dividend

ZWH and ZWS present compelling investment options for individuals seeking exposure to a portfolio of high-quality US stocks while also desiring a reliable income stream. These ETFs implement a covered call strategy that, while it does impose limitations on potential growth, provides a valuable layer of protection in the event of a market downturn.

It’s essential to note that ZWS employs Canadian hedging to mitigate exposure to currency fluctuations, whereas ZWH is a non-hedged ETF. Investors should carefully evaluate their risk tolerance and currency risk preferences when deciding between these two offerings, as these factors can significantly impact the performance and stability of their investments.

Review of CALL – Evolve US Banks Enhanced Yield ETF

The strategy used: Partially covered call strategy to enhance income and protect against downturn / US / Banking / Dividend

CALL invests in major US Banks and seeks primarily to provide income through dividends and call premiums. The covered call strategy limits the ability of the fund to capture the growth in the US banking industry.

CALL is non hedged

CALL-B is Canadian hedged to reduce currency exchange risk.

Review of FIE – Ishares CDN Fin Monthly Income ETF

Strategy used: Canada / Banking / Dividend

FIE is primarily focused on investments in Canadian banks and does not employ a covered call strategy. It represents an attractive option for investors who hold a positive outlook on the Canadian banking sector and seek direct exposure to it. However, it’s worth noting that the Management Expense Ratio (MER) for FIE may be relatively high, especially given its limited holdings, which mainly consist of the six major Canadian banks.

HPF – Harvest Energy Leaders Plus Income

Harvest Energy Leaders Plus Income ETF is an equally weighted portfolio of 20 large global energy companies. The ETF is designed to provide a consistent monthly income stream with an opportunity for growth. In order to generate an enhanced monthly distribution yield, an active covered call strategy is engaged.

HPF High dividend ETF Holdings

| Security | Weight % |

| Hess Corporation | 5.1 |

| Phillips 66 | 5.1 |

| Valero Energy Corporation | 5.0 |

| Parkland Corporation | 5.0 |

| EOG Resources, Inc. | 5.0 |

| Suncor Energy Inc. | 5.0 |

| TC Energy Corporation | 4.9 |

| Pembina Pipeline Corporation | 4.9 |

| HollyFrontier Corporation | 4.9 |

| Enbridge Inc. | 4.9 |

| Equinor ASA | 4.9 |

| Exxon Mobil Corporation | 4.9 |

| ConocoPhillips | 4.9 |

ZWC – BMO CDN High Div Covered Call

The BMO Canadian High Dividend Covered Call ETF (ZWC) has been designed to provide exposure to a dividend focused portfolio, while earning call option premiums. The underlying portfolio is yield-weighted and broadly diversified across sectors.

The fund selection methodology uses 4 factors: – Liquidity; – Dividend growth rate; – Yield and payout ratio.

What’s unique about this ETF is that it uses covered calls to protect against downside risk. This being said, the covered call strategy provides limited downside protection. Also, when you write a covered call, you give up some of the stock’s potential gains. These ETFs will tend to have a higher yield and a lower performance.

The financial sector and Energy represents 56% of the total overall sector allocation.

ZWC High dividend ETF Holdings

| Weight (%) | Name |

| 4.96% | TORONTO-DOMINION BANK |

| 4.91% | BCE INC |

| 4.91% | ROYAL BANK OF CANADA |

| 4.71% | CANADIAN IMPERIAL BANK OF COMMERCE |

| 4.61% | BANK OF NOVA SCOTIA |

| 4.24% | MANULIFE FINANCIAL CORP |

| 4.20% | TRANSCANADA CORP |

| 4.10% | ENBRIDGE INC |

| 3.81% | BANK OF MONTREAL |

| 3.77% | GREAT-WEST LIFECO INC |

ZWE and ZWP – BMO Europe High Div Covered Call

These 2 ETFs are part of the BMO Europe High Dividend Covered Call ETFs. They have been designed to provide exposure to a dividend focused portfolio. These dividend paying companies are selected based on:

- dividend growth rate,

- yield,

- payout ratio and liquidity.

Their holdings include well known and mostly large cap European companies such as (Total, Volkswagen, Nestle…etc).

Both ZWP and ZWE have the same holdings. ZWE is Canadian hedged to reduce exchange risk. ZWP is a non hedge ETF.

ZWE and ZWP high dividend ETF Holdings

| Weight (%) | Name |

| 4.18% | VOLKSWAGEN AG PFD |

| 3.99% | NESTLE SA |

| 3.99% | UNILEVER PLC |

| 3.96% | SIEMENS AG |

| 3.85% | ALLIANZ SE |

| 3.80% | RIO TINTO PLC |

| 3.77% | TOTAL SE |

| 3.74% | BASF SE |

| 3.62% | NOVO NORDISK A/S |

| 3.49% | LVMH MOET HENNESSY LOUIS VUITTON SE |

LIFE and LIFE-B – Evolve Global Healthcare Enhance Yld ETF

LIFE seeks to replicate the performance of the Solactive Global Healthcare 20 Index. This index equally weights 20 global healthcare companies.

LIFE ETF writes covered call options on up to 33% of the portfolio securities, at the discretion of the Manager. The level of covered call option writing may vary based on market volatility and other factors.

LIFE.B does not employ currency hedging and is suitable for investors comfortable with currency risk.

LIFE utilizes Canadian hedging to reduce exchange rate risk, making it a choice for investors seeking reduced exposure to fluctuations in exchange rates between the fund’s assets and the Canadian dollar.

Though LIFE ETFs offer a interesting yield, the performance was negative.

LIFE and LIFE-B high dividend ETF Holdings

| NAME | WEIGHT | COUNTRY |

| Danaher Corp | 5.18% | UNITED STATES |

| Novartis AG | 5.12% | SWITZERLAND |

| Intuitive Surgical Inc | 5.10% | UNITED STATES |

| CSL Ltd | 5.08% | AUSTRALIA |

| AstraZeneca PLC | 5.07% | BRITAIN |

| Pfizer Inc | 5.01% | UNITED STATES |

| AbbVie Inc | 5.01% | UNITED STATES |

| Medtronic PLC | 4.92% | IRELAND |

| Sanofi | 4.88% | FRANCE |

| GlaxoSmithKline PLC | 4.86% | BRITAIN |

ZWH and ZWS – BMO US High Dividend Covered Call ETF

BMO US High Dividend Covered Call has been designed to provide exposure to a dividend focused portfolio, while earning call option premiums. The underlying portfolio is yield-weighted and broadly diversified across sectors. The Fund utilizes a rules-based methodology that considers the following criteria:

dividend growth rate,

yield,

payout ratio,

liquidity.

What’s unique about this ETF is that it uses covered calls to protect against downside risk. In my opinion, the covered call strategy provides limited downside protection. Also, when you write a covered call, you give up some of the stock’s potential gains. These ETFs will tend to have a higher yield and a lower performance.

ZWS is Canadian hedged while ZWH is non hedged.

ZWH and ZWS High dividend ETF holdings

| Weight (%) | Name |

| 4.41% | BANK OF AMERICA CORP |

| 4.32% | HOME DEPOT INC/THE |

| 4.22% | CISCO SYSTEMS INC/DELAWARE |

| 4.13% | JPMORGAN CHASE & CO |

| 4.09% | INTERNATIONAL BUSINESS MACHINES CORP |

| 4.07% | MICROSOFT CORP |

| 3.91% | ABBVIE INC |

| 3.83% | CHEVRON CORP |

| 3.75% | AT&T INC |

| 3.70% | PFIZER INC |

Holdings (ZWP) as of May 7th

| Weight (%) | Name | Bloomberg Ticker |

| 98.86% | BMO US HIGH DIVIDEND COVERED CALL ETF | ZWH |

| 1.14% | CASH | – |

CALL and CALL-B – Evolve US Banks Enhanced Yield ETF

Evolve US Banks Enhanced Yield ETF invests primarily in the equity constituents of the Solactive Equal Weight US Bank Index Canadian Dollar Hedged, while writing covered call options on up to 33% of the portfolio securities, at the discretion of the Manager. The level of covered call option writing may vary based on market volatility and other factors.

The index tracks the performance of major U.S. banks.

This ETF is available under two different tickers:

CALL: This version of the ETF is non-hedged, meaning it does not employ currency hedging strategies. Investors in CALL will be exposed to currency exchange risk, which can affect the fund’s returns if there are fluctuations in exchange rates between the fund’s underlying assets and the investor’s home currency.

CALL-B: This version of the ETF is Canadian hedged, indicating that it utilizes currency hedging techniques to mitigate currency exchange risk. Investors in CALL-B will have reduced exposure to fluctuations in exchange rates between the fund’s assets and the Canadian dollar.

CALL and CALL-B High dividend ETF Holdings

| NAME | WEIGHT |

| Ameriprise Financial Inc | 5.49% |

| US Bancorp | 5.18% |

| Bank of America Corp | 5.15% |

| Wells Fargo & Co | 5.09% |

| PNC Financial Services Group Inc/The | 5.04% |

| Citizens Financial Group Inc | 5.02% |

| Western Alliance Bancorp | 5.01% |

| KeyCorp | 4.96% |

| First Republic Bank/CA | 4.95% |

| Signature Bank/New York NY | 4.93% |

GLCC – Horizons Enhanced Income Gold Prod ETF

HEP invests in North American listed companies that are primarily exposed to gold mining and exploration. The holdings at the time of each reset are the largest and most liquid issuers in their sector.

To mitigate downside risk and generate income, HEP will generally write covered call options on 100% of the portfolio securities. The level of covered call option writing may vary based on market volatility and other factors and is at the discretion of the manager.

HEP High dividend ETF Holdings

| Security Name | Weight |

| NEWMONT CORP | 8.31% |

| OSISKO GOLD ROYALTIES LTD | 8.09% |

| PAN AMERICAN SILVER CORP | 8.06% |

| FRANCO-NEVADA CORP | 7.74% |

| ROYAL GOLD INC | 7.74% |

| ANGLOGOLD ASHANTI LTD ADR | 7.42% |

| ENDEAVOUR MINING CORP | 7.06% |

| WHEATON PRECIOUS METALS CORP | 6.78% |

| YAMANA GOLD INC | 6.61% |

| KINROSS GOLD CORP | 6.51% |

FIE – Ishares CDN Fin Mthly Income

Seeks to maximize total return and to provide a stable stream of monthly cash distributions. This fund has a high exposure to the financial sector. FIE is a Canadian dividend income ETF.

FIE ETF Holdings

| Name | Weight (%) |

| ISHARES S&P/TSX CANADIAN PREFFERED | 20.87 |

| iShs Canadian Corp Bnd Idx ETF | 10.17 |

| CANADIAN IMPERIAL BANK OF COMMERCE | 8.61 |

| ROYAL BANK OF CANADA | 8.30 |

| MANULIFE FINANCIAL CORP | 7.19 |

| TORONTO DOMINION | 7.09 |

| SUN LIFE FINANCIAL INC | 6.94 |

| NATIONAL BANK OF CANADA | 6.49 |

| POWER CORPORATION OF CANADA | 5.73 |

| IA FINANCIAL INC | 3.64 |

Disclaimer

The data on this website is for your information only. It does not constitute investment advice, or advice on tax or legal matters. Any information provided on this website does not constitute investment advice or investment recommendation nor does it constitute an offer to buy or sell or a solicitation of an offer to buy or sell shares or units in any of the investment funds or other financial instruments described on this website. Should you have any doubts about the meaning of the information provided herein, please contact your financial advisor or any other independent professional advisor.