For this post, we will share the list of US stocks that pay monthly dividends! All these stocks are American companies (mid or large cap) with a minimum market capitalization of $300M. I excluded small caps stocks, because they are generally more risky. You will also find at the end of this post my top picks, 6 monthly dividend paying stocks with a track record of increasing their dividends.

Monthly dividend stocks are a great way to generate a regular passive income. As you can see below, the list is dominated by Reits (real estate investment trusts). For each company, we will provide the dividend yield, the pay out ratio and the dividend growth over the past five years.

Full list of ‘Dividend Kings’ stocks by sector

Best dividend stocks to buy – Dividend aristocrats

Canadian dividend aristocrats list by sector

How to select monthly dividend stocks?

Look at the payout ratio

The dividend payout ratio is the amount of dividend distributed by a company divided by the total earnings. For example, a company makes a profit of $ 100 and pays $ 40 in dividends. Its payout ratio is 40%.

If the ratio is high, the company pays almost all of its profits in dividends. There will be little money left in the coffers to innovate or expand to new markets;

It is preferable to invest in a company where the dividend payout ratio is low or medium. The reasoning is that these companies will have money set aside to invest in new projects and thus create growth;

Another variation of payout ratio (Trailing div / Earnings) is the payout ratio to cash (Div / Free cash flows). Earnings can be easily manipulated, so analysts use the payout ratio to cash to assess the safety of dividends better. The website ‘Marketbeat‘ provides the payout ratio to cash for Canadian stocks.

Focus on total return

When one wishes to invest in a stocks that pay monthly dividends, it is essential to pay attention to their performance and growth potential. The most common mistake is to invest in stocks with high dividend yields. This strategy is risky. Here’s why :

• A stock can pay a high dividend yield, but is it sustainable? Some companies have a payout ratio that is close to and even exceeds 100%. They manage to post desirable dividend yields, but if we look at the growth prospects, it’s almost nil;

• Investors sometimes shun companies for lack of growth potential or actual risk of lower revenues in the future. These companies experience a drop in the price of their shares, and this causes the dividend yield to become abnormally high. Sooner or later, these businesses will have to cut their dividend.

Real Estate

| Ticker | Name | Dividend Yield | Years of Dividend Increases |

| O | Realty Income Corp. | 5.8% | 26 |

| STAG | STAG Industrial Inc | 4.0% | 13 |

| ADC | Agree Realty Corp. | 5.3% | 11 |

| LAND | Gladstone Land Corp | 4.3% | 9 |

| EPR | EPR Properties | 8.4% | 3 |

| APLE | Apple Hospitality REIT Inc | 5.9% | 2 |

| WSR | Whitestone REIT | 4.2% | 2 |

| AGNC | AGNC Investment Corp | 14.8% | 0 |

| ARR | ARMOUR Residential REIT Inc | 14.9% | 0 |

| DX | Dynex Capital, Inc. | 12.8% | 0 |

| EARN | Ellington Residential Mortgage REIT | 13.7% | 0 |

| GIPR | Generation Income Properties Inc | 12.4% | 0 |

| GOOD | Gladstone Commercial Corp | 8.9% | 0 |

| LTC | LTC Properties, Inc. | 7.2% | 0 |

| ORC | Orchid Island Capital Inc | 16.5% | 0 |

| SLG | SL Green Realty Corp. | 5.8% | 0 |

| BREUF | Bridgemarq Real Estate Services Inc | 0.0% | |

| BSRTF | BSR Real Estate Investment Trust | 0.0% | |

| CDPYF | Canadian Apartment Properties Real Estate Investment Trust | 0.0% | |

| CWYUF | SmartCentres Real Estate Investment Trust | 0.0% | |

| FRMUF | Firm Capital Property Trust | 0.0% | |

| HRUFF | H&R Real Estate Investment Trust | 0.0% | |

| RIOCF | RioCan Real Estate Investment Trust | 0.0% |

List of dividend aristocrats that pay monthly dividends

Financial Services

| Ticker | Name | Dividend Yield | Years of Dividend Increases |

| MAIN | Main Street Capital Corporation | 6.1% | 9 |

| GAIN | Gladstone Investment Corporation | 6.9% | 2 |

| GLAD | Gladstone Capital Corp. | 9.8% | 2 |

| HRZN | Horizon Technology Finance Corp | 11.8% | 2 |

| PFLT | PennantPark Floating Rate Capital Ltd | 11.0% | 2 |

| PPRQF | Choice Properties Real Estate Investment Trust | 5.3% | 2 |

| SCM | Stellus Capital Investment Corp | 12.2% | 2 |

| ITUB | Itau Unibanco Holding S.A. | 6.2% | 1 |

| BBD | Banco Bradesco S.A. | 1.8% | 0 |

| DREUF | Dream Industrial Real Estate Investment Trust | 5.4% | 0 |

| EFC | Ellington Financial Inc | 13.7% | 0 |

| GROW | U.S. Global Investors, Inc. | 3.1% | 0 |

| OXSQ | Oxford Square Capital Corp | 13.2% | 0 |

| PSEC | Prospect Capital Corp | 13.2% | 0 |

| SLRC | SLR Investment Corp | 10.8% | 0 |

| CHWWF | Chesswood Group Limited | 0.0% | |

| FNLIF | First National Financial Corporation | 0.0% | |

| TBCRF | Timbercreek Financial Corp | 0.0% |

Energy

| Ticker | Name | Dividend Yield | Years of Dividend Increases |

| PRT | PermRock Royalty Trust | 12.5% | 2 |

| CRT | Cross Timbers Royalty Trust | 7.6% | 0 |

| PBT | Permian Basin Royalty Trust | 3.7% | 0 |

| PVL | Permianville Royalty Trust | 7.5% | 0 |

| SBR | Sabine Royalty Trust | 7.7% | 0 |

| SJT | San Juan Basin Royalty Trust | 6.7% | 0 |

| FRHLF | Freehold Royalties Ltd | 0.0% | |

| HGTXU | Hugoton Royalty Trust | 0.0% | |

| PEYUF | Peyto Exploration & Development Corp. | 0.0% | |

| PIFYF | Pine Cliff Energy Ltd | 0.0% | |

| PRMRF | Paramount Resources Ltd. | 0.0% | |

| SPGYF | Whitecap Resources Inc | 0.0% |

Utilities

| Ticker | Name | Dividend Yield | Years of Dividend Increases |

| GWRS | Global Water Resources Inc | 2.4% | 9 |

| NPIFF | Northland Power Inc. | 0.0% | |

| TRSWF | TransAlta Renewables Inc | 0.0% |

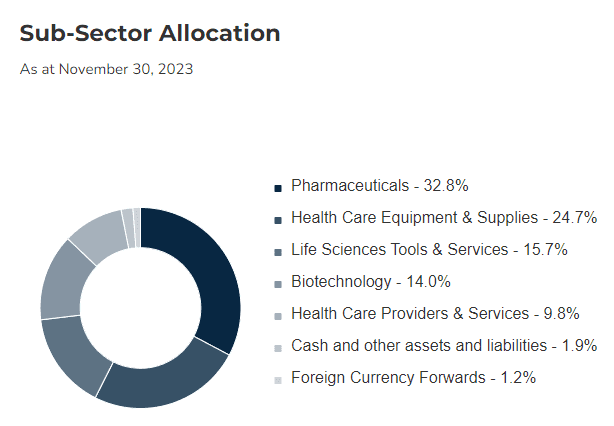

Healthcare

| Ticker | Name | Dividend Yield | Years of Dividend Increases |

| LWSCF | Sienna Senior Living Inc | 7.1% | 0 |

| EXETF | Extendicare Inc | 0.0% |

Industrial

| Ticker | Name | Sector | Years of Dividend Increases |

| EIFZF | Exchange Income Corp | Industrials | 2 |

| SISXF | Savaria Corp. | Industrials |

Monthly dividend payers with a track record of paying and increasing their dividends

| Ticker | Name | Sector | Price | Dividend Yield | Years of Dividend Increases |

| O | Realty Income Corp. | Real Estate | $52.87 | 5.8% | 26 |

| STAG | STAG Industrial Inc | Real Estate | $37.24 | 4.0% | 13 |

| ADC | Agree Realty Corp. | Real Estate | $56.84 | 5.3% | 11 |

| GWRS | Global Water Resources Inc | Utilities | $12.52 | 2.4% | 9 |

| LAND | Gladstone Land Corp | Real Estate | $13.08 | 4.3% | 9 |

| MAIN | Main Street Capital Corporation | Financial Services | $47.01 | 6.1% | 9 |