Introduction

In our Harvest ETF reviews, we delve into the diverse array of ETFs offered by Harvest Portfolios Group, each designed to cater to specific sectors and investment strategies. Renowned for their emphasis on generating income, these ETFs have garnered attention from a broad spectrum of investors. Our objective review will dissect the strategies, sector focuses, and overarching methodologies of some of the leading Harvest ETFs, providing clarity on how they may align with your investment goals and portfolio needs.

Covered Call Strategy in Harvest ETFs

Many of Harvest ETFs employ a covered call strategy to enhance income return for investors. This involves holding a portfolio of stocks and selling call options on the same stock. It’s a popular strategy for income-focused funds, including those by Harvest. Understanding how this works, along with its advantages and drawbacks, is crucial for investors considering these ETFs.

How Covered Call Strategy Works in Harvest ETFs

- Holding Stocks: Initially, the ETF holds shares of companies, often in specific sectors like healthcare, technology, or energy.

- Selling Call Options: The fund then sells call options on these stocks. Essentially, they’re giving someone else the right to buy the stock at a predetermined price within a specific period.

- Generating Income: The fund earns income from selling these options, which is then distributed to shareholders, typically resulting in higher yield distributions.

Advantages of Covered Call Strategy

- Enhanced Income: The primary advantage is the generation of additional income from the premiums received from selling the call options, which can be especially attractive in low yield environments.

- Downside Protection: Premiums received can offer some downside protection. In a falling market, the income from the options can offset some of the capital losses from the underlying stock.

- Portfolio Stability: This strategy can potentially reduce volatility in the ETF’s returns, as income is generated consistently from the option premiums.

Drawbacks of Covered Call Strategy

- Capped Upside: When a call option is sold, the maximum profit from the underlying stock is capped. If the stock surges past the strike price of the option, the ETF doesn’t benefit from those additional gains, as the stock might be called away.

- Complexity and Costs: Implementing a covered call strategy adds complexity to fund management, which can lead to higher costs. These might include transaction fees and the need for more active management.

- Underperformance in Bull Markets: In strong bull markets, the covered call strategy might lead to underperformance relative to the market or similar ETFs without such a strategy. This is because the potential high returns from the stocks are limited due to the sold call options.

Covered Call Strategy in Context of Harvest ETFs

Harvest ETFs, such as HHL, HTA, HPF, HBF, and HRIF, utilize this strategy aiming to provide a mix of income generation and growth. Each ETF applies the covered call strategy in line with its sector focus and investment objectives. For example, an ETF focusing on tech might sell calls against a portion of its holdings in high-growth tech stocks, aiming to balance income with growth potential.

While the covered call strategy can enhance income and provide some level of protection in down markets, it’s important for investors to be aware of the trade-offs, especially the capped upside potential and the possibility of underperformance during strong market rallies. Investors interested in Harvest ETFs should consider how these strategies align with their income needs, risk tolerance, and investment horizon.

| SYMBOL | NAME | FUND INCEPTION DATE |

|---|---|---|

| HHL.TO | Harvest Healthcare Leaders Income ETF | Mar 9, 2020 |

| HTA.TO | Harvest Tech Achievers Growth & Income ETF | May 25, 2015 |

| HPF.TO | Harvest Energy Leaders Plus Income ETF | Oct 20, 2014 |

| HBF.TO | Harvest Brand Leaders Plus Income ETF | Mar 9, 2020 |

| HRIF.TO | Harvest Diversified Equity Income ETF | Apr 12, 2023 |

| HUTL.TO | Harvest Equal Weight Global Utilities Income |

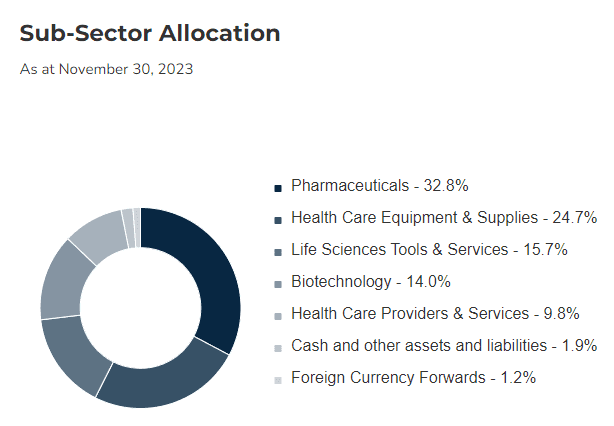

Harvest Healthcare Leaders Income ETF (HHL)

- Strategy & Holdings: HHL invests in 20 leading healthcare companies globally, aiming for equal weight distribution. The sector’s resilience and growth prospects make it attractive.

- Performance & Risks: While healthcare is seen as a defensive sector, regulatory changes and rapid innovation can impact performance. Reviewing past performance and sector trends is key.

| Name | Weight | Country |

|---|---|---|

| Agilent Technologies, Inc. | 5.6% | United States |

| Boston Scientific Corporation | 5.3% | United States |

| Danaher Corporation | 5.3% | United States |

| Abbott Laboratories | 5.2% | United States |

| Medtronic PLC | 5.2% | United States |

| Thermo Fisher Scientific Inc. | 5.2% | United States |

| UnitedHealth Group Incorporated | 5.0% | United States |

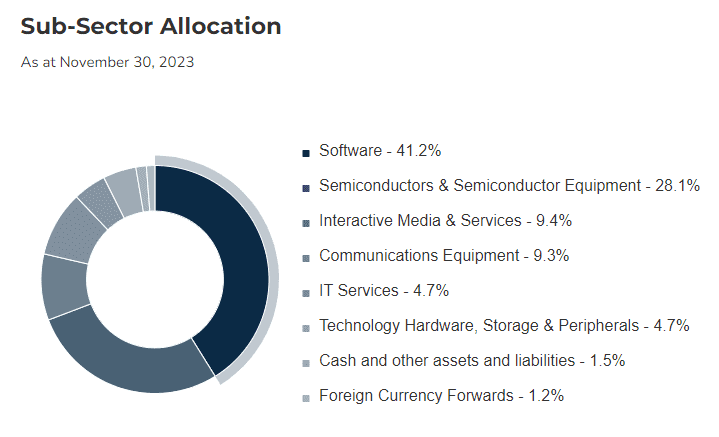

HTA – Harvest Tech Achievers Growth & Income ETF

- Strategy & Holdings: Focusing on large-cap technology firms, HTA seeks growth and income. The technology sector offers high growth potential but comes with higher volatility.

- Performance & Risks: The fast-paced nature of tech means quick gains but also significant risks. Investors should consider their appetite for risk and sector cycles.

| Name | Weight | Country |

|---|---|---|

| CrowdStrike Holdings, Inc. | 5.9% | United States |

| Salesforce, Inc. | 5.6% | United States |

| ServiceNow, Inc. | 5.3% | United States |

| Intuit Inc. | 5.2% | United States |

| Motorola Solutions, Inc. | 5.2% | United States |

| Synopsys, Inc. | 5.2% | United States |

| Micron Technology, Inc. | 5.0% | United States |

| Oracle Corporation | 5.0% | United States |

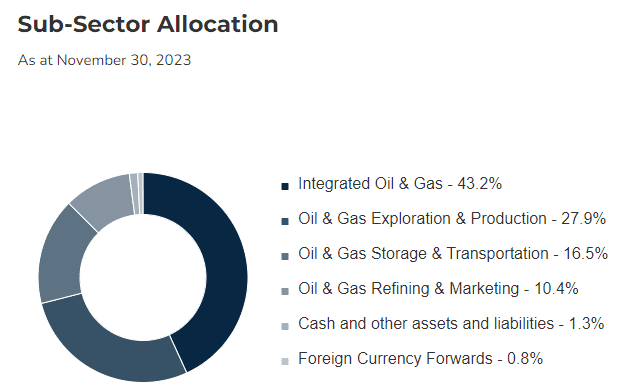

HPF – Harvest Energy Leaders Plus Income ETF

- Strategy & Holdings: By investing in a diversified portfolio of the world’s largest energy companies, HPF aims for regular income and capital appreciation.

- Performance & Risks: Energy markets are often volatile, influenced by geopolitical and environmental factors. While the sector can offer high returns, it can also present significant risks.

| Name | Weight | Country |

|---|---|---|

| Phillips 66 | 5.7% | United States |

| Enbridge Inc. | 5.5% | Canada |

| Pembina Pipeline Corporation | 5.5% | Canada |

| TC Energy Corporation | 5.5% | Canada |

| Canadian Natural Resources Limited | 5.1% | Canada |

| Eni S.p.A. | 5.1% | United States |

| TotalEnergies SE | 5.1% | United States |

HBF – Harvest Brand Leaders Plus Income ETF

- Strategy & Holdings: HBF targets globally recognized brands, aiming for steady income and growth by investing in companies with strong brand value.

- Performance & Risks: Well-known brands can provide stability, but shifts in consumer preferences and global economic conditions can affect performance.

| Name | Weight | Country |

|---|---|---|

| JPMorgan Chase & Co. | 5.2% | United States |

| Verizon Communications Inc. | 5.2% | United States |

| Morgan Stanley | 5.1% | United States |

| NIKE, Inc. | 5.1% | United States |

| Alphabet Inc. | 5.0% | United States |

| Costco Wholesale Corporation | 5.0% | United States |

| United Parcel Service, Inc. | 5.0% | United States |

HRIF – Harvest Retirement Income ETF

- Strategy & Holdings: Designed for retirement income, HRIF focuses on equities known for dividends and stability. It’s diversified across sectors to manage risk.

- Performance & Risks: HRIF’s focus on income may appeal to retirees, but like all investments, it’s subject to market fluctuations and specific sector risks.

| ETF Name | Weight | Sector |

|---|---|---|

| Harvest Brand Leaders Plus Income (HBF) | 14.4% | Diversified |

| Harvest Equal Weight Global Utilities Income (HUTL) | 14.3% | Utilities |

| Harvest Canadian Equity Income Leaders (HLIF) | 14.0% | Diversified |

| Harvest Tech Achievers Growth & Income (HTA) | 13.9% | Information Technology |

| Harvest US Bank Leaders Income (HUBL) | 13.7% | US Banks |

| Harvest Healthcare Leaders Income (HHL) | 13.4% | Health Care |

| Harvest Travel & Leisure Income (TRVI) | 13.3% | Diversified |

| Harvest Premium Yield Treasury (HPYT) | 2.7% | Government Bonds |

HUTL – Harvest Equal Weight Global Utilities Income

The investment objective of the Harvest Equal Weight Global Utilities Income ETF is to provide investors with exposure to the defensive and income-generating characteristics typically associated with utility companies, while also seeking to minimize concentration risk and provide broader exposure to the global utility sector.

In simpler terms, the ETF aims to provide investors with a way to potentially make money by investing in a diversified portfolio of utility companies from around the world. Because utility companies provide essential services and are generally seen as stable and reliable, the ETF may be attractive to investors looking for a way to generate steady income and potentially reduce their investment risk.

The Harvest Equal Weight Global Utilities Income ETF is an investment fund that aims to help investors make money by investing in a diversified portfolio of utility companies from around the world, including Canada, the United States, Europe, and Asia.

Utility companies are businesses that provide essential services like electricity, water, and gas to homes and businesses. They are generally seen as stable and reliable because people need these services no matter what’s happening in the economy.

The ETF invests in a portfolio of utility stocks that is equally weighted. This helps to spread out the risk and make sure that no one company has too much influence over the performance.

Conclusion

When considering Harvest ETFs, it’s crucial to look at individual investment goals, risk tolerance, and the ETFs’ expense ratios and performance history. While Harvest’s offerings provide opportunities for income and sector-specific exposure, investors should be mindful of the inherent risks and market fluctuations. Diversification, even within a portfolio of ETFs, can help manage risk. Always consider consulting with a financial advisor to ensure that any investment aligns with your long-term financial objectives. Whether you’re drawn to the potential stability of healthcare, the rapid growth of technology, the dynamics of energy, or the resilience of global brands, understanding each sector’s nuances will guide you to make informed decisions. Happy and informed investing!