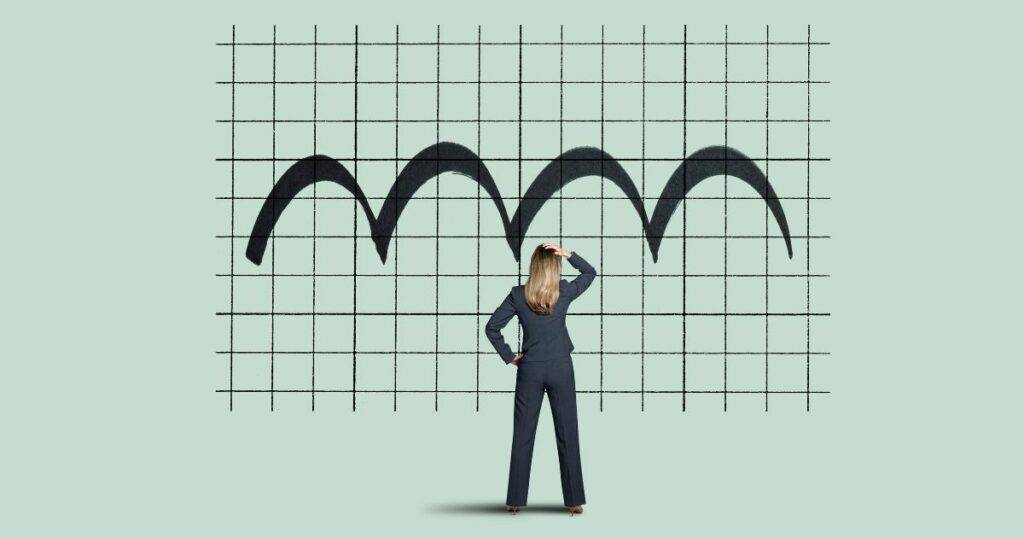

In uncertain times, traditional stocks can be a roller-coaster of highs and lows. For the risk-averse investor, each dip can bring a pang of anxiety. Enter SPLV, the Invesco S&P 500® Low Volatility ETF, an investment designed to smooth out the ride. Let’s delve into the details of SPLV and understand why it might be the right fit for your portfolio.

What is SPLV?

SPLV stands for Invesco S&P 500® Low Volatility ETF. It’s an exchange-traded fund that focuses on stocks from the S&P 500 Index exhibiting the lowest volatility over the past 12 months. Rather than chasing the highest returns, SPLV seeks to minimize the bumps along the way by investing in typically more stable companies.

Investment Strategy

The ETF selects the 100 least volatile stocks in the S&P 500, allocating more weight to those with the least variation in their share price. It provides exposure to utilities, health care, and consumer staples—industries less sensitive to economic cycles. By doing so, SPLV may underperform during market rallies but offers potential protection in downturns.

Benefits of SPLV

– Risk Management: By investing in low-volatility stocks, SPLV can help reduce portfolio risk without complete withdrawal from the equity markets.

– Diversification: SPLV’s sector allocation differs from the broader S&P 500, offering diversification benefits in contrast to market-cap-weighted index funds.

– Dividends: The fund’s holdings often pay stable dividends, providing an additional income stream for investors.

Performance

SPLV’s performance won’t typically match the S&P 500 since it aims to lower volatility, not maximize gains. The ETF seeks to deliver a more consistent return, even if it means occasionally trailing the high-flying stocks. In times of market stress, SPLV has historically lost less than the market average, an attractive feature for conservative investors.

SPLV as Part of Your Portfolio

Incorporating SPLV into your portfolio can be a move towards stability, especially if you are nearing retirement or have a low tolerance for risk. It can serve as a defensive anchor, potentially offsetting losses in more volatile investments.

Drawbacks

While stability is an advantage, there’s a trade-off. SPLV may lag during bull markets when high-volatility stocks outperform. Investors with a long-term perspective and higher risk tolerance may find SPLV too conservative.

Conclusion

For those looking to dial back the risk in their investment approach, the Invesco S&P 500® Low Volatility ETF (SPLV) offers a solution. By leaning into sectors known for their stability and sustained performance in the face of market turmoil, SPLV allows investors to stay the course with reduced exposure to drastic swings.

Remember, every investment carries some risk, and it’s important to review an ETF’s prospectus and consult a financial advisor to ensure it aligns with your investment goals and strategy.

Happy investing, and may your portfolio glide steadily on the waves of the financial markets with the inclusion of SPLV.