What’s the objective of XDV ETF?

The iShares Canadian Select Dividend Index ETF (XDV Stock) provides long-term capital growth by investing in 30 high yielding Canadian companies in the Dow Jones Canada Total Market Index.

XDV pays a monthly dividend income which can be appealing for investor who are looking for a frequent payout.

[stock_market_widget type=”card” template=”basic” color=”#5679FF” assets=”XDV.TO” display_currency_symbol=”true” api=”yf”]

[stock_market_widget type=”chart” template=”basic” color=”#5679FF” assets=”XDV.TO” range=”1mo” interval=”1d” axes=”true” cursor=”true” range_selector=”true” display_currency_symbol=”true” api=”yf”]

Updated daily – XDV ETF

What is Dow Jones Canada Select Dividend Index?

The index universe is defined as all dividend-paying companies listed on the Toronto Stock Exchange, excluding income trusts.

The dow Jones Canada Select Dividend Index is rebalanced annually in March. It has 29 constituents of the index. Below, we will detail the methodology used to select the ‘best dividend stocks’.

Methodology

Selected stocks should meet the requirements below:

-Be part of the Index Universe.

-Only stocks that paid dividends in each of the previous five years are selected.

-Enough trading volume

-A five-year average dividend coverage ratio of greater than or equal to 125%. The formula used: Earning per Share / Annual Dividend per Share

The approved stocks are then re-screened by ranking them in descending order by using the indicated annual dividend yield (not including any special dividends). The maximum number of constituents is 30.

Constituent Weightings: Constituent weightings are assigned annually based on IAD. The weight of any individual company is restricted to 10% within the index. Such restrictions are implemented on a quarterly basis

VEQT review: Vanguard All-Equity ETF Portfolio

6 Canadian Dividend Stocks with high dividend growth

XDV ETF vs VDY vs XEI

In this section, we will compare XDV with Both XEI – Ishares S&P TSX Comp High Div Index ETF and VDY Vanguard FTSE CDN High Div Yld Index. See tables below:

Table 1: AUM and MER

| ETF | AUM* | MER* |

| XDV – Ishares Canadian Select Div Index | 1,734 | 0.55 |

| XEI – Ishares S&P TSX Comp High Div Index | 1,088 | 0.22 |

| VDY – Vanguard FTSE CDN High Div Yld Index | 1,137 | 0.21 |

Looking at the management fees, VDY and XEI are attractive. XDV stands at 0.55% which is the highest MER among our three contenders.

Table 2: Performance comparison and analysis

[stock_market_widget type=”table-quotes” template=”color-header-border” color=”#5679FF” assets=”XDV.TO,XEI.TO,VDY.TO” fields=”symbol,ytd_return,three_year_average_return,five_year_average_return” links=”{‘XDV.TO’:{},’XEI.TO’:{},’VDY.TO’:{}}” display_header=”true” display_chart=”false” display_currency_symbol=”true” pagination=”true” search=”false” rows_per_page=”5″ sort_field=”logo_name_symbol” sort_direction=”asc” alignment=”left” api=”yf”]

Performance updated daily

| ETF | Div yld % |

| XDV | 4.64 |

| XEI | 4.51 |

| VDY | 4.33 |

Analysis

Performance:

The tables above indicate that VDY is ahead in terms of short-term performance. VDY’s exceptional performance can be attributed to the financial sector, which makes up almost 60% of its portfolio.

For long term performance, VDY is slightly better than both XEI and XDV.

Diversification, Volatility and Dividend yield:

XDV holds 30 high dividend-paying stocks in its holdings while VDY 39 and XEI 77. Thus, XEI offers better diversification. In terms of volatility, all three ETFs have the exact Beta suggesting the same level of risk. XEI has the highest dividend yield, but VDY and XDV are close.

Conclusion:

XEI has the upper hand when it comes to diversification. This ETF is not biased towards a specific sector, while Canadian banks dominate XDV and VDY.

[stock_market_widget type=”table-quotes” template=”basic” assets=”XDV.TO” fields=”symbol,price,change_pct,52_week_low,52_week_high” links=”{‘XDV.TO’:{}}” display_header=”true” display_chart=”false” display_currency_symbol=”true” pagination=”true” search=”false” rows_per_page=”5″ sort_field=”logo_name_symbol” sort_direction=”asc” alignment=”left” api=”yf”]

10 Best Dividend ETF in Canada

Top 10 Best Growth ETF in Canada!

Table 3: Dividend schedule and Beta

| ETF | Monthly Div | Beta* |

| XDV | Yes | 0.9 |

| XEI | Yes | 1.1 |

| VDY | Yes | 0.9 |

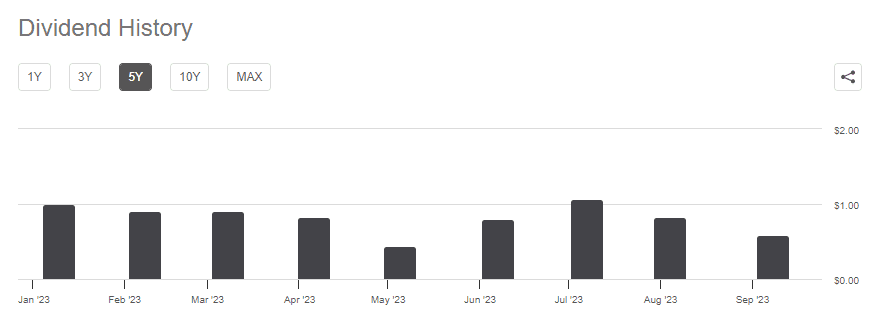

XDV Stock dividend history

XDV pays dividends on a monthly basis. Please refer the last column of the table below for the amount of dividend distribution.

| Amount | Dividend Type | Frequency | Ex-Div Date | Record Date | Pay Date | Declare Date |

|---|---|---|---|---|---|---|

| 0.1200 | Regular | Monthly | 1/25/2024 | 1/26/2024 | 1/31/2024 | 1/19/2024 |

| 0.1150 | Regular | Monthly | 12/28/2023 | 12/29/2023 | 1/4/2024 | 12/20/2023 |

| 0.1150 | Regular | Monthly | 11/21/2023 | 11/22/2023 | 11/30/2023 | 11/15/2023 |

| 0.1150 | Regular | Monthly | 10/25/2023 | 10/26/2023 | 10/31/2023 | 10/19/2023 |

XDV Stock holdings

| Name | Weight % |

|---|---|

| CANADIAN IMPERIAL BANK OF COMMERCE | 9,11 |

| BANK OF MONTREAL | 7,00 |

| ROYAL BANK OF CANADA | 6,33 |

| CANADIAN TIRE LTD CLASS A | 6,17 |

| BANK OF NOVA SCOTIA | 5,06 |

| TC ENERGY CORP | 4,95 |

| LABRADOR IRON ORE ROYALTY CORP | 4,94 |

| BCE INC | 4,92 |

| TORONTO DOMINION | 4,77 |

| NATIONAL BANK OF CANADA | 3,94 |

XDV Sectors allocation

| Type | Fonds |

|---|---|

| Finance | 55,66 |

| COMMUNICATION | 11,82 |

| Services publics | 11,12 |

| Énergie | 6,75 |

| Consommation discrétionnaire | 6,17 |

| Matières | 5,77 |

| Valeurs industrielles | 2,32 |

| Liquidités et/ou produits dérivés | 0,39 |