In the world of exchange-traded funds (ETFs), one innovative offering has been generating significant buzz – the YieldMax™ TSLA Option Income Strategy ETF, known by its ticker symbol TSLY. This actively managed fund has a unique approach to generating income for investors by selling call options specifically on Tesla Inc. (TSLA). While the prospect of substantial dividend yields ranging from 30% to 70% may sound appealing, a closer look reveals significant risks associated with TSLY ETF that may make it less suitable for most investors. In this article, we will delve into TSLY’s strategy, its appeal, and why it might not be the right choice for everyone.

Understanding TSLY’s Investment Strategy

TSLY’s primary objective is to generate monthly income through an innovative investment strategy. Its core approach involves selling or writing call options on shares of Tesla Inc. (TSLA). However, what sets TSLY apart from other covered call ETFs is its exclusive focus on TSLA.

The fund’s strategy essentially mirrors being long on Tesla. It achieves this by purchasing at-the-money (ATM) call options while simultaneously selling an equivalent number of ATM put options, both with the same expiration date. These positions typically have terms ranging from six months to one year. This combination creates a return profile similar to owning Tesla stock directly.

To further enhance its income generation, TSLY sells an equal amount of call options that are generally 5% to 15% out-of-the-money (OTM), and typically with expirations of one month or less. The proceeds from these options are distributed to shareholders, resulting in an eye-catching distribution yield of approximately 39.5%. The yield is annualized based on the latest dividend payment.

Additionally, TSLY manages its collateral by holding short-term U.S. Treasuries, which currently generate cash flow for the fund.

JEPI vs JEPQ: Which ETF is the Best Investment for You?

Analyzing TSLY’s Risk Factors

While the lure of high dividend yields may make TSLY seem like a tempting investment opportunity, it’s crucial to consider the significant risks associated with this ETF.

Volatility and Sensitivity to Tesla’s Performance:

TSLY’s strategy is closely tied to the performance of Tesla Inc., a company known for its extreme stock price volatility. This high sensitivity to Tesla’s stock price means that TSLY can experience substantial fluctuations in its share price. Investors should be prepared for the potential for both significant gains and losses.

Limited Upside Potential:

One of Tesla’s key selling points for investors has been its potential for substantial capital gains. However, TSLY’s strategy, designed to maximize income through options, limits its participation in any significant price gains of Tesla stock. This means that investors in TSLY may miss out on the full benefits of Tesla’s stock appreciation.

Market Conditions:

TSLY’s strategy does not include taking defensive positions, even during adverse market conditions. This lack of flexibility can expose investors to heightened risks during market downturns or economic crises, potentially leading to significant losses.

Distribution Cuts and Capital Erosion:

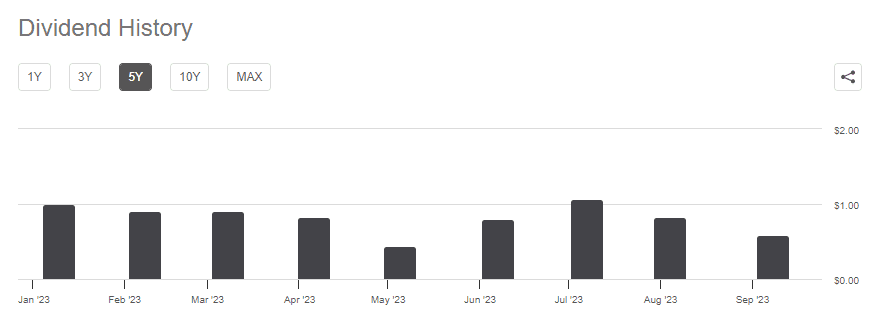

TSLY has experienced distribution cuts and capital erosion since its inception. This trend may continue as it relies on the premiums collected from selling call options to sustain its high distribution yield. Such a strategy may not be sustainable in the long run, putting shareholder income at risk.

Source: Seeking alpha

Comparative Analysis:

When comparing TSLY to more conventional covered call ETFs like XYLD, it becomes apparent that TSLY’s characteristics are more pronounced, primarily due to Tesla’s extreme volatility. For the average retiree or income-focused investor, the risk-reward tradeoff of TSLY may not be as appealing as that of a broader-market ETF.

Should You Consider Investing in TSLY ETF?

While there is no inherent flaw in TSLY’s strategy, its suitability depends on an investor’s risk tolerance, investment goals, and understanding of the underlying risks. Here are some factors to consider when deciding whether to invest in TSLY:

Risk Tolerance:

TSLY is inherently risky due to its direct exposure to Tesla’s stock price and its focus on options trading. Investors with a low risk tolerance may find TSLY’s volatility and potential for losses unsuitable for their portfolios.

Investment Goals:

If your primary objective is to generate high income through dividends, TSLY may seem attractive. However, if you also seek capital appreciation or have a long-term investment horizon, TSLY’s limited upside potential may not align with your goals.

Diversification:

Diversification is a fundamental principle of risk management in investing. TSLY’s concentrated exposure to a single stock, Tesla, can lead to higher risks. Consider how this ETF fits into your broader investment strategy and whether it complements or detracts from your overall portfolio diversification.

Market Conditions:

Be aware that TSLY’s performance is highly contingent on market sentiment towards Tesla. If you believe that Tesla’s stock is poised for significant gains, a direct investment in TSLA may offer better returns without the limitations imposed by TSLY’s strategy.

TSLY Dividends

| Amount | Dividend Type | Ex-Div Date | Record Date | Pay Date | Declare Date |

|---|---|---|---|---|---|

| 0.4046 | Regular | 2/7/2024 | 2/8/2024 | 2/9/2024 | 12/14/2023 |

| 0.5565 | Regular | 1/5/2024 | 1/8/2024 | 1/9/2024 | 12/14/2023 |

| 0.6039 | Regular | 12/7/2023 | 12/8/2023 | 12/13/2023 | 1/25/2023 |

| 0.5846 | Regular | 11/8/2023 | 11/9/2023 | 11/16/2023 | 1/25/2023 |

| 0.5769 | Regular | 10/6/2023 | 10/10/2023 | 10/16/2023 | 1/25/2023 |

| 0.5849 | Regular | 9/8/2023 | 9/11/2023 | 9/18/2023 | 1/25/2023 |

Conclusion

The YieldMax TSLA Option Income Strategy ETF (TSLY) offers an intriguing approach to income generation through selling call options on Tesla Inc. (TSLA). However, its unique strategy comes with a set of substantial risks that may not be suitable for all investors. While TSLY can generate impressive dividend yields, its sensitivity to Tesla’s stock price, limited upside potential, and exposure to market conditions make it a risky proposition. This is true particularly for retirees or those seeking long-term capital appreciation.

Investors considering TSLY should carefully assess their risk tolerance, investment goals, and portfolio diversification needs before deciding whether to include this ETF in their investment strategy. For those who prioritize income generation and are comfortable with the inherent risks, TSLY may have a place in their portfolios. However, prudent investors should approach TSLY with caution and a full understanding of the potential rewards and pitfalls it presents.