Intro

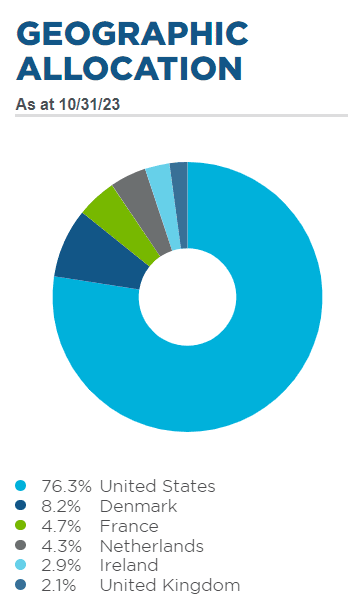

DXG ETF is a actively managed fund. The fund invests primarily in a diversified portfolio of equity securities of businesses located around the world that pay or are expected to pay a dividend or distribution. These securities are selected actively based on size, profitability and liquidity. Around 70% of the funds holdings are invested in US companies.

Should you buy DXG

| Aspect | Details |

|---|---|

| Advantages | |

| Diversification Strategy | Combination of index and actively managed ETFs for portfolio risk mitigation. |

| Market Exposure | Provides exposure to both US and international markets. |

| Volatility | Low Beta (0.84) indicates lower volatility compared to the overall market. |

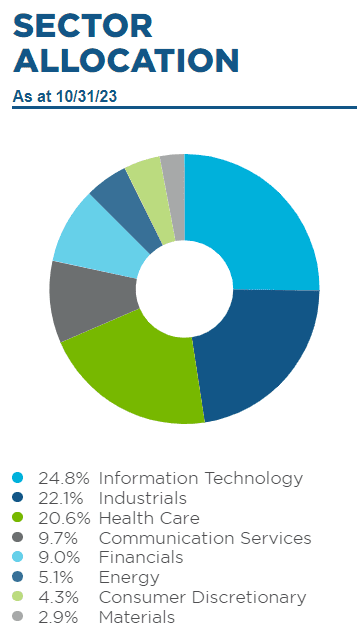

| Sector Diversification | Offers a well-rounded investment approach. |

| Disadvantages | |

| Tax Implications | Withholding taxes due to international market investments. |

| Alternative Options | Index ETFs may be more cost-effective for exclusive US market exposure (lower MER). |

| Dividend Distributions | Lacks monthly or quarterly distributions; dividends are either reinvested or paid annually. |

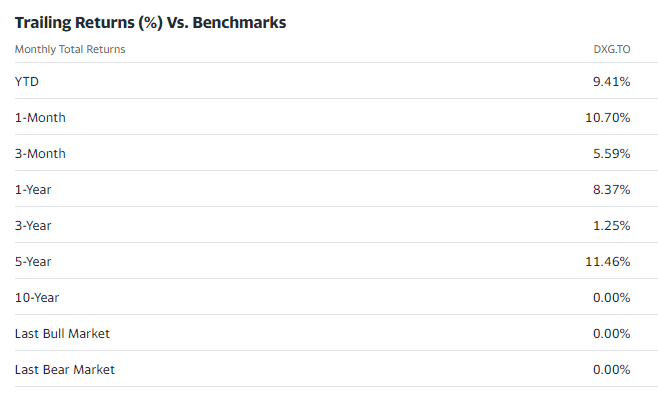

Considering the merits of purchasing DXG, several advantages and disadvantages warrant attention. On the positive side, the combination of index and actively managed ETFs presents a compelling strategy for diversification, effectively mitigating portfolio risk. DXG emerges as an attractive choice for investors seeking exposure to both US and international markets simultaneously, underscored by its 5-star rating on Morningstar. Notably, the fund has outperformed both peers in its category and the MSCI world index, showcasing its competitive edge. With a commendably low Beta of 0.84, DXG exhibits lower volatility compared to the overall market, enhancing its appeal. Additionally, the fund boasts sector diversification, contributing to a well-rounded investment approach.

However, potential downsides include the taxation implications of investing in international markets, leading to withholding taxes. For those seeking exclusive exposure to the US market, alternative options such as index ETFs may be more cost-effective due to lower Management Expense Ratio (MER). Moreover, DXG lacks monthly or quarterly dividend distributions, with dividends either reinvested or paid annually, a factor investors should consider based on their income preferences.

DXG Historical performance

DXG Holdings

TOP 10 EQUITY HOLDINGS (%)

| As at 10/31/23 | |

|---|---|

| Novo Nordisk A/S | 8.3 |

| Meta Platforms, Inc. | 6.0 |

| Microsoft Corporation | 5.3 |

| ServiceNow, Inc. | 5.2 |

| Uber Technologies, Inc. | 5.1 |

| Synopsys, Inc. | 5.0 |

| Eli Lilly and Company | 4.9 |

| Safran SA | 4.7 |

| Airbus SE | 4.3 |

| Palo Alto Networks, Inc. | 3.9 |

DXG ETF Sector Breakdown

Geographic breakdown