In this article, we’ll go over the best Canadian Dividend ETFs. To be clear, we are interested here in exchange-traded funds that invest exclusively in Canadian companies. From a tax standpoint, the ETFs are more beneficial since ETFs that invest in non-Canadian companies are subject to withholding tax on any distribution of dividends. We started by selecting the 16 most popular ETFs in this category. Next, we compared these ETFs based on several criteria (strategy, div yield, and MER). For each ETF, we also provide the objective and the holdings.

Executive summary

Strategies adopted by Canadian Dividend ETFs

Portfolio managers can adopt a variety of strategies to generate income. There are four trends on the market:

Diversified Dividend ETFs

These ETFs are the most common. They invest in the best Canadian companies in terms of dividend yield and growth potential. These funds invest your money in several sectors of the economy. However, due to the nature of the Canadian economy, it’s not surprising to see these funds dominated by the banking and energy sector.

Preferred shares ETFs

These ETFs invest in preferred shares issued by the most prominent Canadian companies. A preferred share is a hybrid product between common stock and a bond. It’s similar to a bond because the issuer agrees to pay an agreed-upon yield. However, preferred shareholders benefit very little from the appreciation in the market value of the issuing company. Generally speaking, preferred equity ETFs will have a high dividend yield but a meager growth potential.

Dividend ETFs using Call Options

These ETFs write call options on the securities held in their portfolio for two main objectives: 1- to protect themselves in the event of a significant drop in the value of the securities held and 2- to collect the premiums and thus enhance distributions. These funds are very popular in Canada despite the poor long-term performance they generate.

Bank ETFs

These ETFs invest in the largest Canadian banks. It’s both a sector play and a dividend income strategy.

15 Best Monthly Dividend Stocks in Canada for passive income

Comparison MER, Assets under management and volatility

| Name | AUM* | MER* |

| ZWB – BMO Covered Call Canadian Banks | 2,234 | 0.72 |

| ZPR – BMO Laddered Pref Share | 2,186 | 0.50 |

| HPR – Horizons Active Pref Share | 1,774 | 0.64 |

| XDV – iShares Can Select Dividend Indx | 1,760 | 0.55 |

| CPD – Ishares S&P TSX CDN Pref | 1,460 | 0.50 |

| ZWC – BMO CDN High Div Covered Call | 1,161 | 0.72 |

| XEI – Ishares S&P TSX Comp High Div Indx | 1,040 | 0.22 |

| VDY – FTSE Canadian High Div Yield Indx | 1,101 | 0.21 |

| CDZ –iShares S&P/TSX Can Div Aristo Indx | 975 | 0.66 |

| FIE – Ishares CDN Fin Mthly Income | 926 | 0.89 |

| PDC – Invesco Can Dividend Index | 776 | 0.56 |

| ZDV – BMO Canadian Div | 713 | 0.39 |

| XDIV –iShares CoreMSCI Can Quality Div Indx | 478 | 0.11 |

| DGRC – CI Canada Quality Div Growth Index | 377 | 0.24 |

| RBNK – RBC CDN Bank Yield Index | 119 | 0.32 |

| RCD – RBC Quant CDN Dividend Leaders | 111 | 0.42 |

Source Barchart AUM: total assets under management in millions. MER management expense ratio.

Comparison sector exposure and strategy

| Name | Banking | Energy | Strategy |

| ZWB | 100% | – | Call options |

| ZPR | 35.8% | 20.59% | Preferred shares |

| HPR | 50.41% | 21.62% | Preferred shares |

| XDV | 53.8% | 6.0% | Diversified |

| CPD | 29.58% | 18.14% | Preferred shares |

| ZWC | 39.9% | 13.6% | Call options |

| XEI | 30.1% | 29.6% | Diversified |

| VDY | 58.1% | 22.9% | Diversified |

| CDZ | 28.6% | 16.1% | Diversified |

| FIE | 83.54% | 5.14% | Bank ETF |

| PDC | 51.3% | 21.0% | Diversified |

| ZDV | 39.7% | 13.4% | Diversified |

| XDIV | 59.3% | 14.2% | Diversified |

| DGRC | 31.8% | 6.7% | Diversified |

| RBNK | 98.8% | – | Bank ETF |

| RCD | 32.7% | 13.9% | Diversified |

Full list of ‘Dividend Kings’ stocks by sector – 2024

HDIV ETF review: Hamilton Enhanced Multi-Sector Covered Call

Comparison performance and dividend yield

| ETF | Div yld average |

| ZWB | 6.79 |

| ZPR | 5.82 |

| HPR | 5.77 |

| XDV | 4.30 |

| CPD | 5.33 |

| ZWC | 6.64 |

| XEI | 4.34 |

| VDY | 4.15 |

| CDZ | 3.70 |

| FIE | 6.94 |

| PDC | 3.94 |

| ZDV | 4.13 |

| XDIV | 4.02 |

| DGRC | 2.66 |

| RBNK | 4.08 |

| RCD | 3.58 |

[stock_market_widget type=”table-quotes” template=”basic” assets=”ZWB.TO,ZPR.TO,HPR.TO,XDV.TO,CPD.TO,ZWC.TO,XEI.TO,VDY.TO,CDZ.TO,FIE.TO,PDC.TO,ZDV.TO,XDIV.TO,DGRC.TO,RBNK.TO,RCD.TO” fields=”symbol,ytd_return,three_year_average_return,five_year_average_return” links=”{‘ZWB.TO’:{},’ZPR.TO’:{},’HPR.TO’:{},’XDV.TO’:{},’CPD.TO’:{},’ZWC.TO’:{},’XEI.TO’:{},’VDY.TO’:{},’CDZ.TO’:{},’FIE.TO’:{},’PDC.TO’:{},’ZDV.TO’:{},’XDIV.TO’:{},’DGRC.TO’:{},’RBNK.TO’:{},’RCD.TO’:{}}” display_header=”true” display_chart=”false” display_currency_symbol=”true” pagination=”true” search=”false” rows_per_page=”18″ sort_field=”logo_name_symbol” sort_direction=”asc” alignment=”left” api=”yf”]

Source TD Market research

Analysis and comments

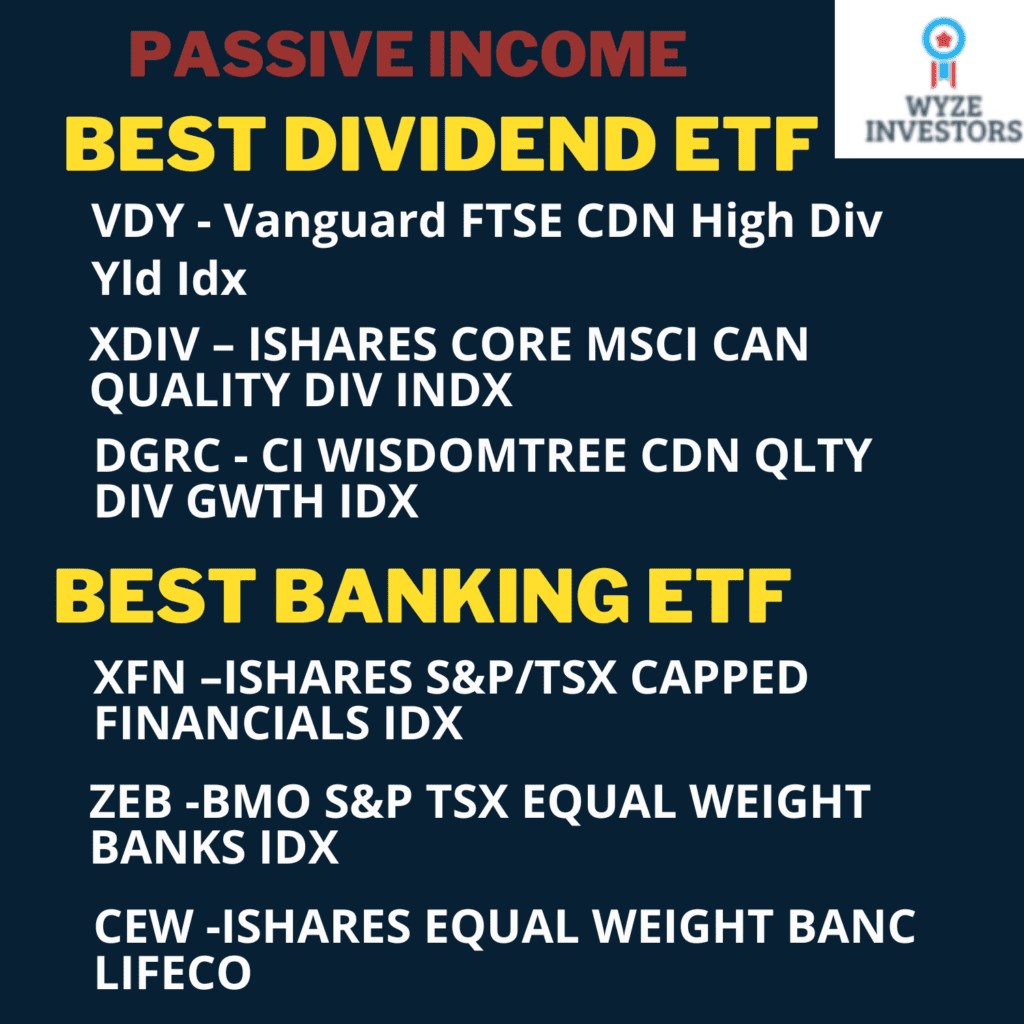

Best Canadian Diversified Dividend ETF

In my opinion, XDV iShares Canadian Select Dividend Indx and VDY FTSE Canadian High Dividend Yield Indx are the best Canadian diversified dividend ETFs.

They combine low volatility, attractive returns, and good performance. VDY has a Morningstar Rating of 5 Stars and a low MER 0.21%!

Diversified Canadian Dividend ETFs are better in terms of long-term performance than their competitors below.

Best Canadian Dividend Preferred Share ETF

Comparison between Horizons HPR, BMO ZPR, and iShares CPD

In terms of performance, the above ETFs are very close, with a slight lead for HPR Horizons Active

My favorite is BMO’s ZPR, though, because its management fee is lower at 0.50% versus 0.60% for HPR. ZPR is more diversified than HPR, which remains dominated by the banking sector. Thanks to the rate reset feature, ZPR should offer more stability.

Best Dividend ETF with a Covered Call Option Strategy

Comparison between ZWB BMO Covered Call Canadian Banks and ZWC – BMO CDN High Div Covered Call

Bank of Montreal offers two very popular ETFs in this category: ZWB and ZWC. ZWB invests mainly in the banking sector, while ZWC is more diversified. What’s unique about these ETFs is that they use covered calls to protect against downside risk.

The covered call strategy provides limited downside protection. Also, when you write a covered call, you give up some of the stock’s potential gains. These ETFs will tend to have a higher yield and a lower performance. In a nutshell, a covered call ETF will outperform its competitors in corrections and underperform in a market rally. I find this strategy to be well suited when used on a low volatility basket of securities.

In terms of dividend yields, ZWB and ZWC are both unbeatable (approx. 6%). By analyzing long term historical performance, ZWB has had a better long-term performance than ZWC.

Please note covered call ETFs are more and more popular and new ETFs are now available from Harvest, Horizons and Hamilton. You can review the posts below for more info and I also encourage you to visit issuers’ websites:

- HDIV ETF review: Hamilton Enhanced Multi-Sector Covered Call

- 8 Best Covered Call ETF Canada – High dividend yield

Best Bank ETF (RBNK vs FIE)

Canadian Banks are known for their financial strength. Their Dividends are attractive and stable. FIE Ishares CDN Fin Mthly Income and RBNK RBC CDN Bank Yield Index are both great choices. If you want exposure to the Canadian banking industry focusing on earning dividends, these ETFs will undoubtedly answer your goals. Both pay a relatively stable monthly dividend.

RBNK has a lower MER than FIE. In terms of performance, RBNK offers a better total return than FIE. The only catch is that RBNK is probably less liquid than FIE. The latter (FIE) has assets under management of over 900 Million dollars while RBNK is relatively a small fund of only 119 Million.

How to choose a good dividend ETF

– Total return: Though the focus here is on the dividend yield, you have to keep in mind the total return. The profit or loss we make on any investment combines both dividend income and capital gain or loss. Looking at the long-term performance of the fund is crucial. An ETF that provides a good capital appreciation with a high dividend yield is preferable.

–Diversification: A diversified ETF is always a safer option. Some high yield ETFs are sector-specific (Financials, Energy or Gold). The ones focused on Energy and Gold have had an inferior long-term performance and carry high volatility risk.

–Volume and liquidity of the ETF. The higher the asset under management, the lower the trading costs of the ETF (difference between the bid and ask price).

–Management expense ratio.

ZWB – BMO Covered Call Canadian Banks

The ZWB aims to provide exposure to a portfolio of dividend-paying securities (Canadian Banks), while collecting premiums related to call options. The portfolio is chosen on the basis of the criteria below:

• dividend growth rate, yield, and payout ratio and liquidity.

ZWB holdings

| Name | Weight |

| BMO Equal Weight Banks ETF | 27.2% |

| Bank of Montreal | 12.9% |

| Canadian Imperial Bank of Commerce | 12.7% |

| Royal Bank of Canada | 12.1% |

| National Bank of Canada | 11.9% |

| The Toronto-Dominion Bank | 11.9% |

| Bank of Nova Scotia | 11.4% |

ZPR – BMO Laddered Pref Share ETF

The BMO Laddered Preferred Share Index ETF (ZPR) has been designed to replicate, to the extent possible, the performance of the Solactive Laddered Canadian Preferred Share Index, net of expenses. The Fund invests in and holds the Constituent Securities of the Index in the same proportion as they are reflected in the Index.

HPR – Horizons Active Pref Share ETF

The investment objective of the Horizons Active Preferred Share is to provide dividend income while preserving capital by investing primarily in preferred shares of Canadian companies. The ETF may also invest in preferred shares of companies located in the United States and fixed income securities of Canadian and U.S. issuers. The ETF, to the best of its ability, seeks to hedge its non-Canadian dollar currency exposure to the Canadian dollar at all times. HPR is a popular ETF and has asset under management in excess of 1 Billion dollars.

XDV – iShares Canadian Select Dividend Index ETF

XDV seeks long-term capital growth by replicating the performance of the Dow Jones Canada Select Dividend Index, net of expenses.

| Name | Weight |

| Canadian Imperial Bank of Commerce | 8.5% |

| Canadian Tire Corp Ltd Class A | 6.8% |

| Bank of Montreal | 6.3% |

| Labrador Iron Ore Royalty Corp | 6.2% |

| Royal Bank of Canada | 6.0% |

| BCE Inc | 4.7% |

| TC Energy Corp | 4.7% |

| Bank of Nova Scotia | 4.7% |

| The Toronto-Dominion Bank | 4.3% |

| National Bank of Canada | 3.9% |

CPD – Ishares S&P TSX CDN Pref

Seeks to replicate the S&P/TSX Preferred Share Index, net of expenses.

XEI – iShares Core S&P/TSX Composite High Dividend Index ETF

This ETF objective is to replicate the performance of the S&P/TSX Composite High Dividend Index ETF. The fund’s objective is long term capital growth by investing in Canadian companies operating across diversified sectors. XEI pays a monthly dividend income which can be appealing for investor who are looking for a frequent payout.

XEI portfolio

| Name | Weight |

| Enbridge Inc | 5.2% |

| Royal Bank of Canada | 5.1% |

| Canadian Natural Resources Ltd | 5.1% |

| The Toronto-Dominion Bank | 5.0% |

| BCE Inc | 5.0% |

| Suncor Energy Inc | 4.9% |

| TC Energy Corp | 4.8% |

| Bank of Nova Scotia | 4.8% |

| Nutrien Ltd | 4.5% |

| Bank of Montreal | 4.0% |

VDY – Vanguard FTSE Canadian High Dividend Yield Index ETF

FTSE Canadian High Dividend Yield Index ETF tracks the performance of the FTSE Canada High Dividend Yield Index, which consists of Canadian stocks having a high dividend yield. Due to the nature of the Canadian market, this fund has large portion of its investment portfolio in Energy and Financials.

VDY holdings

| Name | Weight |

| Royal Bank of Canada | 14.1% |

| The Toronto-Dominion Bank | 12.5% |

| Enbridge Inc | 7.9% |

| Bank of Nova Scotia | 7.7% |

| Bank of Montreal | 6.5% |

| Canadian Imperial Bank of Commerce | 4.9% |

| TC Energy Corp | 4.7% |

| BCE Inc | 4.4% |

| Canadian Natural Resources Ltd | 4.1% |

| Manulife Financial Corp | 3.7% |

CDZ – S&P/TSX Canadian Dividend Aristocrats Index Fund

The S&P/TSX Canadian Dividend Aristocrats includes only large companies that are part of the TSX and who have increased their dividend consistently for at least 5 years period. This fund has been around for a while now.

CDZ holdings

| Name | Weight |

| Keyera Corp | 3.4% |

| SmartCentres | 3.0% |

| Pembina Pipeline Corp | 2.8% |

| Enbridge Inc | 2.8% |

| Canadian Natural Resources Ltd | 2.5% |

| Power Corporation of Canada | 2.4% |

| Fiera Capital Corp | 2.3% |

| Great-West Lifeco Inc | 2.1% |

| BCE Inc | 2.1% |

| Canadian Imperial Bank of Commerce | 2.1% |

FIE – Ishares CDN Fin Mthly Income

Ishares CDN Fin Monthly Income seeks to maximize total return and to provide a stable stream of monthly cash distributions. FIE has a high exposure to the financial sector.

FIE holdings

| Name | Weight |

| iShares S&P/TSX Cdn Prefr Shr ETF Comm | 20.7% |

| iShares Core Canadian Corporate Bd ETF | 10.0% |

| Canadian Imperial Bank of Commerce | 9.1% |

| Royal Bank of Canada | 8.5% |

| The Toronto-Dominion Bank | 7.0% |

| Sun Life Financial Inc | 6.5% |

| Manulife Financial Corp | 6.5% |

| National Bank of Canada | 6.5% |

| Power Corporation of Canada | 6.0% |

PDC – Invesco Canadian Dividend Index ETF

Invesco Canadian Dividend Index ETF seeks to replicate the performance of the NASDAQ Select Canadian Dividend Index. Don’t be confused with NASDAQ, the companies are 95% Canadian. The fund applies strict criteria to select only companies that have increased their dividend overtime and that offer a high yield.

PDC holdings

| Name | Weight |

| Enbridge Inc | 8.5% |

| Royal Bank of Canada | 7.9% |

| The Toronto-Dominion Bank | 7.9% |

| Bank of Nova Scotia | 7.8% |

| Bank of Montreal | 7.6% |

| Canadian Natural Resources Ltd | 4.2% |

| BCE Inc | 4.1% |

| TELUS Corp | 4.0% |

| TC Energy Corp | 4.0% |

| Canadian Imperial Bank of Commerce | 4.0% |

ZDV – BMO Canadian Dividend ETF

BMO Canadian Dividend ETF seeks exposure to companies that exhibit growth in paying dividends. The fund has a large number of holding and allocates a maximum of 5% per position.

ZDV holdings

| Name | Weight |

| Enbridge Inc | 5.2% |

| Royal Bank of Canada | 5.0% |

| Bank of Nova Scotia | 5.0% |

| BCE Inc | 4.9% |

| The Toronto-Dominion Bank | 4.9% |

| Canadian Imperial Bank of Commerce | 4.7% |

| TELUS Corp | 4.0% |

| Bank of Montreal | 3.9% |

| Canadian National Railway Co | 3.9% |

| TC Energy Corp | 3.9% |

XDIV – iShares Core MSCI Canadian Quality Dividend Index ETF

XDIV invests in Canadian stocks with strong financials. The companies selected pay above-average dividend yields and have either paid steady or increasing dividends.

XDIV holdings

| Name | Weight |

| Canadian Imperial Bank of Commerce | 9.4% |

| Royal Bank of Canada | 9.2% |

| Bank of Nova Scotia | 9.0% |

| TC Energy Corp | 8.9% |

| The Toronto-Dominion Bank | 8.8% |

| Manulife Financial Corp | 8.5% |

| Nutrien Ltd | 7.7% |

| Sun Life Financial Inc | 6.8% |

| Fortis Inc | 4.6% |

| Power Corporation of Canada | 4.0% |

DGRC – CI Canada Quality Div Growth Index

CI Wisdomtree CDN Qlty Div Gwth Idx holdings provide exposure to dividend-paying Canadian companies with growth characteristics.

DGRC holdings

| Name | Weight |

| Rogers Communications Inc Class B | 5.3% |

| Thomson Reuters Corp | 5.2% |

| Royal Bank of Canada | 5.0% |

| Shaw Communications Inc Class B | 5.0% |

| Bank of Nova Scotia | 5.0% |

| Bank of Montreal | 5.0% |

| The Toronto-Dominion Bank | 5.0% |

| Canadian Imperial Bank of Commerce | 4.9% |

| TC Energy Corp | 4.9% |

| Canadian National Railway Co | 4.9% |

RBNK – RBC CDN Bank Yield Index

RBC Canadian Bank Yield Index ETF seeks to replicate the Solactive Canada Bank Yield Index. The latter is focused only on the Canadian banking industry.

RBNK holdings

| Name | Weight |

| Canadian Imperial Bank of Commerce | 25.7% |

| Bank of Nova Scotia | 24.0% |

| Royal Bank of Canada | 16.6% |

| The Toronto-Dominion Bank | 15.9% |

| Bank of Montreal | 8.5% |

| National Bank of Canada | 8.0% |

RCD – RBC Quant CDN Dividend Leaders

RBC Quant Canadian Dividend Leaders ETF seeks to provide unitholders with exposure to the performance of a diversified portfolio of high-quality Canadian dividend-paying equity securities that will provide regular income and that have the potential for long-term capital growth.

RCD holdings

| Name | Weight |

| Constellation Software Inc | 7.9% |

| Royal Bank of Canada | 6.4% |

| Enbridge Inc | 5.5% |

| Bank of Nova Scotia | 4.9% |

| The Toronto-Dominion Bank | 4.4% |

| BCE Inc | 4.3% |

| Canadian Imperial Bank of Commerce | 4.2% |

| Canadian National Railway Co | 3.6% |

| Barrick Gold Corp | 2.8% |

| Bank of Montreal | 2.4% |