- JEPI vs JEPQ: Which ETF is the Best Investment for You?

by Wyze InvestorExecutive summary JEPI and JEPQ are two leading income-focused ETFs using covered call strategies, but they serve different investors. JEPI offers stable income with broad diversification and lower volatility, while JEPQ provides higher yield driven by tech exposure. Understanding their objectives, risks, and market behavior helps identify which ETF fits your strategy best. JEPI Investment… Read more: JEPI vs JEPQ: Which ETF is the Best Investment for You?

by Wyze InvestorExecutive summary JEPI and JEPQ are two leading income-focused ETFs using covered call strategies, but they serve different investors. JEPI offers stable income with broad diversification and lower volatility, while JEPQ provides higher yield driven by tech exposure. Understanding their objectives, risks, and market behavior helps identify which ETF fits your strategy best. JEPI Investment… Read more: JEPI vs JEPQ: Which ETF is the Best Investment for You? - JEPQ Explained: High Monthly Income From Tech — Worth It?

by Wyze InvestorJEPQ (JPMorgan Nasdaq Equity Premium Income ETF) is a high-yield ETF designed for investors who want monthly income without having to trade options themselves. The fund uses a covered call strategy to enhance yield by selling call options on Nasdaq-100 exposure, allowing it to generate consistent premiums. This makes JEPQ particularly appealing for beginner investors,… Read more: JEPQ Explained: High Monthly Income From Tech — Worth It?

by Wyze InvestorJEPQ (JPMorgan Nasdaq Equity Premium Income ETF) is a high-yield ETF designed for investors who want monthly income without having to trade options themselves. The fund uses a covered call strategy to enhance yield by selling call options on Nasdaq-100 exposure, allowing it to generate consistent premiums. This makes JEPQ particularly appealing for beginner investors,… Read more: JEPQ Explained: High Monthly Income From Tech — Worth It? - VNQ Canadian Equivalent: How Canadians Can Invest in U.S. Real Estate Through ETFs

by Wyze InvestorThe goal: U.S. real estate exposure, Canadian simplicity Many Canadian investors want to add real estate exposure to their portfolio without buying property directly.In the U.S., one of the most popular choices is VNQ — the Vanguard Real Estate ETF.It offers simple, diversified exposure to U.S. Real Estate Investment Trusts (REITs) — companies that own… Read more: VNQ Canadian Equivalent: How Canadians Can Invest in U.S. Real Estate Through ETFs

by Wyze InvestorThe goal: U.S. real estate exposure, Canadian simplicity Many Canadian investors want to add real estate exposure to their portfolio without buying property directly.In the U.S., one of the most popular choices is VNQ — the Vanguard Real Estate ETF.It offers simple, diversified exposure to U.S. Real Estate Investment Trusts (REITs) — companies that own… Read more: VNQ Canadian Equivalent: How Canadians Can Invest in U.S. Real Estate Through ETFs - QYLD ETF Explained: High Yield, Monthly Income, and Key Risks

by Wyze InvestorInvestment objective The Global X Nasdaq-100 Covered Call ETF (QYLD) is one of the most popular income-oriented exchange-traded funds in the U.S. With a double-digit yield and the promise of monthly income, it attracts investors looking for consistent cash flow. But behind the headline yield, there are trade-offs that every investor should understand before buying.… Read more: QYLD ETF Explained: High Yield, Monthly Income, and Key Risks

by Wyze InvestorInvestment objective The Global X Nasdaq-100 Covered Call ETF (QYLD) is one of the most popular income-oriented exchange-traded funds in the U.S. With a double-digit yield and the promise of monthly income, it attracts investors looking for consistent cash flow. But behind the headline yield, there are trade-offs that every investor should understand before buying.… Read more: QYLD ETF Explained: High Yield, Monthly Income, and Key Risks - The Wheel Strategy: Generating Income with Options, Smart Spinning

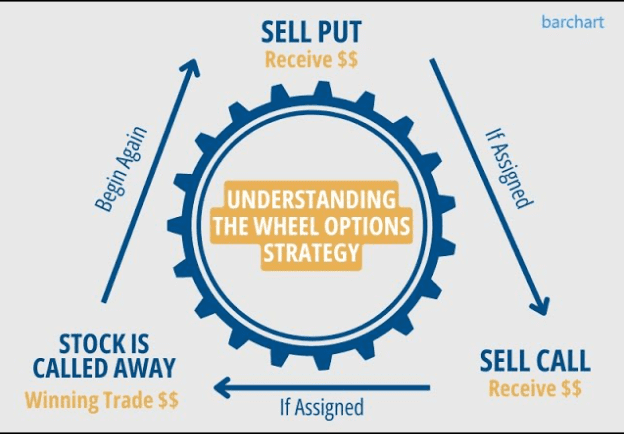

by Wyze InvestorIntroduction: A strategy to turn your portfolio around Investing in the stock market is more than just buying and selling stocks. For investors looking for additional income, options can offer attractive opportunities — provided they understand the risks and mechanisms. Among the strategies available to retail investors, the wheel strategy is becoming increasingly popular. It… Read more: The Wheel Strategy: Generating Income with Options, Smart Spinning

by Wyze InvestorIntroduction: A strategy to turn your portfolio around Investing in the stock market is more than just buying and selling stocks. For investors looking for additional income, options can offer attractive opportunities — provided they understand the risks and mechanisms. Among the strategies available to retail investors, the wheel strategy is becoming increasingly popular. It… Read more: The Wheel Strategy: Generating Income with Options, Smart Spinning - Apple Q2 2025 Earnings: Dividend Raised, $110B Buyback, But China Weakness Raises Questions

by Wyze InvestorTicker: AAPL (NASDAQ)Market Cap: ~$2.8 trillion (as of May 2025)Sector: Information Technology Apple released its Q2 FY2025 earnings on May 2, 2025. The company beat expectations on earnings per share, grew its services segment, raised its dividend, and announced the largest stock buyback in U.S. corporate history. Yet, not everything was perfect — sales in… Read more: Apple Q2 2025 Earnings: Dividend Raised, $110B Buyback, But China Weakness Raises Questions

by Wyze InvestorTicker: AAPL (NASDAQ)Market Cap: ~$2.8 trillion (as of May 2025)Sector: Information Technology Apple released its Q2 FY2025 earnings on May 2, 2025. The company beat expectations on earnings per share, grew its services segment, raised its dividend, and announced the largest stock buyback in U.S. corporate history. Yet, not everything was perfect — sales in… Read more: Apple Q2 2025 Earnings: Dividend Raised, $110B Buyback, But China Weakness Raises Questions - Alphabet (GOOGL) Q1 2025 Earnings: Cloud Profits, First Dividend, and What It Means for Canadian Investors

by Wyze InvestorTicker: GOOGL (NASDAQ)Market Cap: ~$2.1 trillion (as of May 2025)Sector: Communication Services Q1 2025 Highlights Alphabet delivered a strong Q1 on April 25, 2025, beating both revenue and earnings expectations. This was a breakout quarter for the tech giant, which also announced its first-ever dividend and a $70B stock buyback. Key Numbers (vs. expectations) Metric… Read more: Alphabet (GOOGL) Q1 2025 Earnings: Cloud Profits, First Dividend, and What It Means for Canadian Investors

by Wyze InvestorTicker: GOOGL (NASDAQ)Market Cap: ~$2.1 trillion (as of May 2025)Sector: Communication Services Q1 2025 Highlights Alphabet delivered a strong Q1 on April 25, 2025, beating both revenue and earnings expectations. This was a breakout quarter for the tech giant, which also announced its first-ever dividend and a $70B stock buyback. Key Numbers (vs. expectations) Metric… Read more: Alphabet (GOOGL) Q1 2025 Earnings: Cloud Profits, First Dividend, and What It Means for Canadian Investors - VUN vs VOO: A Comprehensive Guide for Canadian Investors to Maximize U.S. Market Exposure

by Wyze InvestorFor Canadian investors, choosing between the Vanguard U.S. Total Market Index ETF (VUN) and the Vanguard S&P 500 ETF (VOO) depends on several key factors such as diversification, tax efficiency, and currency considerations. Both ETFs are excellent options for gaining exposure to the U.S. stock market, but they cater to different investor needs. Here’s a… Read more: VUN vs VOO: A Comprehensive Guide for Canadian Investors to Maximize U.S. Market Exposure

by Wyze InvestorFor Canadian investors, choosing between the Vanguard U.S. Total Market Index ETF (VUN) and the Vanguard S&P 500 ETF (VOO) depends on several key factors such as diversification, tax efficiency, and currency considerations. Both ETFs are excellent options for gaining exposure to the U.S. stock market, but they cater to different investor needs. Here’s a… Read more: VUN vs VOO: A Comprehensive Guide for Canadian Investors to Maximize U.S. Market Exposure - Earn Passive Income Easily: The Covered Call Strategy with NVIDIA

by Wyze InvestorLeave a Comment / English, Best Dividend Stocks, Best Growth Stocks / By Wyze Investor Covered calls are a popular strategy to generate passive income while maintaining exposure to stocks in your portfolio. In this article, we explore this method using a practical example with NVIDIA (NVDA). We will also explain how to choose from… Read more: Earn Passive Income Easily: The Covered Call Strategy with NVIDIA

by Wyze InvestorLeave a Comment / English, Best Dividend Stocks, Best Growth Stocks / By Wyze Investor Covered calls are a popular strategy to generate passive income while maintaining exposure to stocks in your portfolio. In this article, we explore this method using a practical example with NVIDIA (NVDA). We will also explain how to choose from… Read more: Earn Passive Income Easily: The Covered Call Strategy with NVIDIA - Super Micro Computer (SMCI): A High-Stakes Bet in the Booming AI and Data Center Revolution

by Wyze InvestorSuper Micro Computer, Inc. (SMCI) is a prominent player in high-performance computing solutions, specializing in the design and manufacturing of servers, storage solutions, and data center technologies. Founded in 1993 and headquartered in San Jose, California, the company plays a crucial role in rapidly growing areas such as artificial intelligence (AI) and IT infrastructure. However,… Read more: Super Micro Computer (SMCI): A High-Stakes Bet in the Booming AI and Data Center Revolution

by Wyze InvestorSuper Micro Computer, Inc. (SMCI) is a prominent player in high-performance computing solutions, specializing in the design and manufacturing of servers, storage solutions, and data center technologies. Founded in 1993 and headquartered in San Jose, California, the company plays a crucial role in rapidly growing areas such as artificial intelligence (AI) and IT infrastructure. However,… Read more: Super Micro Computer (SMCI): A High-Stakes Bet in the Booming AI and Data Center Revolution - Top 6 ETFs to Invest in the Chinese Economy

by Wyze InvestorChina, the world’s second-largest economy, has become an attractive destination for global investors. Its strong growth over the past few decades and continued expansion in sectors like technology, consumer goods, and renewable energy make it a key player in the global economy. If you’re looking to diversify your portfolio and tap into China’s economic potential,… Read more: Top 6 ETFs to Invest in the Chinese Economy

by Wyze InvestorChina, the world’s second-largest economy, has become an attractive destination for global investors. Its strong growth over the past few decades and continued expansion in sectors like technology, consumer goods, and renewable energy make it a key player in the global economy. If you’re looking to diversify your portfolio and tap into China’s economic potential,… Read more: Top 6 ETFs to Invest in the Chinese Economy - Weekly Dividend ETFs: A Focus on QDTE and XDTE

by Wyze InvestorIntroduction to Weekly Dividend ETFs Weekly dividend ETFs are an intriguing option for investors looking to create a consistent cash flow. Unlike traditional dividend ETFs that typically pay out monthly or quarterly, these ETFs aim to provide income on a weekly basis. They achieve this through unique investment strategies that capitalize on market opportunities. Two… Read more: Weekly Dividend ETFs: A Focus on QDTE and XDTE

by Wyze InvestorIntroduction to Weekly Dividend ETFs Weekly dividend ETFs are an intriguing option for investors looking to create a consistent cash flow. Unlike traditional dividend ETFs that typically pay out monthly or quarterly, these ETFs aim to provide income on a weekly basis. They achieve this through unique investment strategies that capitalize on market opportunities. Two… Read more: Weekly Dividend ETFs: A Focus on QDTE and XDTE - JEPQ vs QYLD: Which Covered Call ETF is Right for You?

by Wyze InvestorInvesting in covered call ETFs can generate income while maintaining exposure to the stock market. The JPMorgan Equity Premium Income ETF (JEPQ) and the Global X NASDAQ 100 Covered Call ETF (QYLD) are two prominent options. Here’s a clear and concise guide to help you decide which ETF is better suited for your investment goals.… Read more: JEPQ vs QYLD: Which Covered Call ETF is Right for You?

by Wyze InvestorInvesting in covered call ETFs can generate income while maintaining exposure to the stock market. The JPMorgan Equity Premium Income ETF (JEPQ) and the Global X NASDAQ 100 Covered Call ETF (QYLD) are two prominent options. Here’s a clear and concise guide to help you decide which ETF is better suited for your investment goals.… Read more: JEPQ vs QYLD: Which Covered Call ETF is Right for You? - JEPQ vs QQQ: A Detailed Comparison of Two Leading ETFs for Tech Investors

by Wyze InvestorInvesting in the stock market can be overwhelming, especially when choosing the right exchange-traded funds (ETFs). Today, we’ll compare two popular ETFs: JEPQ and QQQ. Both target the tech sector but have different strategies and benefits. Let’s break down their features to help you make an informed decision. Executive Summary Feature JEPQ (JPMorgan Nasdaq Equity… Read more: JEPQ vs QQQ: A Detailed Comparison of Two Leading ETFs for Tech Investors

by Wyze InvestorInvesting in the stock market can be overwhelming, especially when choosing the right exchange-traded funds (ETFs). Today, we’ll compare two popular ETFs: JEPQ and QQQ. Both target the tech sector but have different strategies and benefits. Let’s break down their features to help you make an informed decision. Executive Summary Feature JEPQ (JPMorgan Nasdaq Equity… Read more: JEPQ vs QQQ: A Detailed Comparison of Two Leading ETFs for Tech Investors - Full list of ‘Dividend Kings’ stocks by sector – 2024

by Wyze InvestorDividend kings are stocks with an unparalleled track record of increasing their dividends over time. The minimum requirement to be considered in this elite list is 50 years of dividend increases. In this post, we will present these stocks by sector. We will also provide, for each stock, the current dividend yield, payout ratio, and… Read more: Full list of ‘Dividend Kings’ stocks by sector – 2024

by Wyze InvestorDividend kings are stocks with an unparalleled track record of increasing their dividends over time. The minimum requirement to be considered in this elite list is 50 years of dividend increases. In this post, we will present these stocks by sector. We will also provide, for each stock, the current dividend yield, payout ratio, and… Read more: Full list of ‘Dividend Kings’ stocks by sector – 2024 - Understanding the Canadian Equivalent of the XLK ETF

by Wyze InvestorIntroduction: .Identifying a Canadian ETF equivalent to the Technology Select Sector SPDR Fund (XLK) presents a unique challenge. XLK concentrates on prominent U.S. tech companies, a focus not directly replicated in the Canadian ETF landscape. Yet, there are alternatives that offer similar sector exposure. Let’s delve into these options to find the closest match for… Read more: Understanding the Canadian Equivalent of the XLK ETF

by Wyze InvestorIntroduction: .Identifying a Canadian ETF equivalent to the Technology Select Sector SPDR Fund (XLK) presents a unique challenge. XLK concentrates on prominent U.S. tech companies, a focus not directly replicated in the Canadian ETF landscape. Yet, there are alternatives that offer similar sector exposure. Let’s delve into these options to find the closest match for… Read more: Understanding the Canadian Equivalent of the XLK ETF - QQQ vs. VOO: A Tale of Two ETFs for Canadian Investors

by Wyze InvestorWhen it comes to investing in ETFs, Canadians often consider QQQ and VOO. Both are popular, but they serve different purposes. Let’s break down the differences. Executive summary Feature QQQ (Invesco QQQ ETF) VOO (Vanguard S&P 500 ETF) Index Tracked NASDAQ-100 Index S&P 500 Index Sector Focus Technology-heavy Diverse across various sectors Top Holdings Tech… Read more: QQQ vs. VOO: A Tale of Two ETFs for Canadian Investors

by Wyze InvestorWhen it comes to investing in ETFs, Canadians often consider QQQ and VOO. Both are popular, but they serve different purposes. Let’s break down the differences. Executive summary Feature QQQ (Invesco QQQ ETF) VOO (Vanguard S&P 500 ETF) Index Tracked NASDAQ-100 Index S&P 500 Index Sector Focus Technology-heavy Diverse across various sectors Top Holdings Tech… Read more: QQQ vs. VOO: A Tale of Two ETFs for Canadian Investors - US Stocks that pay monthly dividends (Full list by sector)

by Wyze InvestorFor this post, we will share the list of US stocks that pay monthly dividends! All these stocks are American companies (mid or large cap) with a minimum market capitalization of $300M. I excluded small caps stocks, because they are generally more risky. You will also find at the end of this post my top… Read more: US Stocks that pay monthly dividends (Full list by sector)

by Wyze InvestorFor this post, we will share the list of US stocks that pay monthly dividends! All these stocks are American companies (mid or large cap) with a minimum market capitalization of $300M. I excluded small caps stocks, because they are generally more risky. You will also find at the end of this post my top… Read more: US Stocks that pay monthly dividends (Full list by sector) - JEPI ETF REVIEW: JPMorgan Equity Premium Income

by Wyze InvestorWhat’s JEPI’s investment objective? The JPMorgan Equity Premium Income ETF (JEPI) is an income focused covered call ETF. It’s ideal for conservative investors who are seeking income and moderate growth. The manager of JEPI invests in a portfolio of stocks that combine 3 characteristics: This post is also available in video format. To enhance yield,… Read more: JEPI ETF REVIEW: JPMorgan Equity Premium Income

by Wyze InvestorWhat’s JEPI’s investment objective? The JPMorgan Equity Premium Income ETF (JEPI) is an income focused covered call ETF. It’s ideal for conservative investors who are seeking income and moderate growth. The manager of JEPI invests in a portfolio of stocks that combine 3 characteristics: This post is also available in video format. To enhance yield,… Read more: JEPI ETF REVIEW: JPMorgan Equity Premium Income - Exploring the Stability of SPLV: The Low Volatility ETF for Cautious Investors

by Wyze InvestorIn uncertain times, traditional stocks can be a roller-coaster of highs and lows. For the risk-averse investor, each dip can bring a pang of anxiety. Enter SPLV, the Invesco S&P 500® Low Volatility ETF, an investment designed to smooth out the ride. Let’s delve into the details of SPLV and understand why it might be… Read more: Exploring the Stability of SPLV: The Low Volatility ETF for Cautious Investors

by Wyze InvestorIn uncertain times, traditional stocks can be a roller-coaster of highs and lows. For the risk-averse investor, each dip can bring a pang of anxiety. Enter SPLV, the Invesco S&P 500® Low Volatility ETF, an investment designed to smooth out the ride. Let’s delve into the details of SPLV and understand why it might be… Read more: Exploring the Stability of SPLV: The Low Volatility ETF for Cautious Investors - Top US & Canadian Technology ETF – 2024

by Wyze InvestorTechnology plays a fundamental role in driving innovation and transforming industries in today’s rapidly evolving world. Capitalizing on the technology sector’s growth potential can be a prudent strategy for an investor. One way to achieve this exposure is by allocating a portion of your portfolio to Technology Exchange-Traded Funds (ETFs). This article discusses the best… Read more: Top US & Canadian Technology ETF – 2024

by Wyze InvestorTechnology plays a fundamental role in driving innovation and transforming industries in today’s rapidly evolving world. Capitalizing on the technology sector’s growth potential can be a prudent strategy for an investor. One way to achieve this exposure is by allocating a portion of your portfolio to Technology Exchange-Traded Funds (ETFs). This article discusses the best… Read more: Top US & Canadian Technology ETF – 2024 - Exploring the Best Semiconductor ETF for Investors

by Wyze InvestorThe semiconductor industry is a critical driver of technological advancements, with applications ranging from consumer electronics to advanced computing systems. For Canadian investors looking to gain exposure to this dynamic sector, the Global X Semiconductor Index ETF (CHPS) is an excellent option. This ETF provides a way to invest in a diversified portfolio of leading… Read more: Exploring the Best Semiconductor ETF for Investors

by Wyze InvestorThe semiconductor industry is a critical driver of technological advancements, with applications ranging from consumer electronics to advanced computing systems. For Canadian investors looking to gain exposure to this dynamic sector, the Global X Semiconductor Index ETF (CHPS) is an excellent option. This ETF provides a way to invest in a diversified portfolio of leading… Read more: Exploring the Best Semiconductor ETF for Investors - Hedged vs Unhedged funds ETF Canada – What’s better?

by Wyze InvestorWhen it comes to investing in international markets, Canadian investors are often faced with the issue of currency risk. Currency risk refers to the fluctuation of exchange rates between currencies, which can significantly impact investment returns. In this article, we’ll examine the pros and cons Hedged vs Unhedged ETF in Canada. History of the evolution… Read more: Hedged vs Unhedged funds ETF Canada – What’s better?

by Wyze InvestorWhen it comes to investing in international markets, Canadian investors are often faced with the issue of currency risk. Currency risk refers to the fluctuation of exchange rates between currencies, which can significantly impact investment returns. In this article, we’ll examine the pros and cons Hedged vs Unhedged ETF in Canada. History of the evolution… Read more: Hedged vs Unhedged funds ETF Canada – What’s better? - Best dividend stocks to buy – Dividend aristocrats 2024

by Wyze InvestorIn this article we will publish the complete list of stocks making the “S&P 500 Dividend aristocrat” by sector. Also, we will review the strategy of investing in dividend stocks. The “S&P 500 Aristocratic Dividend” is one of the most attractive indices for investors looking for a quality dividend Name and Symbols. The criteria’s for… Read more: Best dividend stocks to buy – Dividend aristocrats 2024

by Wyze InvestorIn this article we will publish the complete list of stocks making the “S&P 500 Dividend aristocrat” by sector. Also, we will review the strategy of investing in dividend stocks. The “S&P 500 Aristocratic Dividend” is one of the most attractive indices for investors looking for a quality dividend Name and Symbols. The criteria’s for… Read more: Best dividend stocks to buy – Dividend aristocrats 2024 - XYLD ETF review: Global X S&P 500 Covered Call ETF

by Wyze InvestorInvestment objective XYLD is a passive index ETF that uses a covered call strategy to enhance yield and lower volatility. The fund was created by Global X and tracks the S&P500. The manager follows a “covered call” or “buy-write” strategy, in which the Fund buys the stocks in the S&P 500 Index and “writes” or… Read more: XYLD ETF review: Global X S&P 500 Covered Call ETF

by Wyze InvestorInvestment objective XYLD is a passive index ETF that uses a covered call strategy to enhance yield and lower volatility. The fund was created by Global X and tracks the S&P500. The manager follows a “covered call” or “buy-write” strategy, in which the Fund buys the stocks in the S&P 500 Index and “writes” or… Read more: XYLD ETF review: Global X S&P 500 Covered Call ETF - TSLY ETF: Fund Overview and the Risks You Need to Know

by Wyze InvestorIn the world of exchange-traded funds (ETFs), one innovative offering has been generating significant buzz – the YieldMax™ TSLA Option Income Strategy ETF, known by its ticker symbol TSLY. This actively managed fund has a unique approach to generating income for investors by selling call options specifically on Tesla Inc. (TSLA). While the prospect of… Read more: TSLY ETF: Fund Overview and the Risks You Need to Know

by Wyze InvestorIn the world of exchange-traded funds (ETFs), one innovative offering has been generating significant buzz – the YieldMax™ TSLA Option Income Strategy ETF, known by its ticker symbol TSLY. This actively managed fund has a unique approach to generating income for investors by selling call options specifically on Tesla Inc. (TSLA). While the prospect of… Read more: TSLY ETF: Fund Overview and the Risks You Need to Know - Understanding VTI ETF for Canadian investors – Full review

by Wyze InvestorBonjour, chers investisseurs! Today, we’re exploring the Vanguard Total Stock Market ETF, commonly known as VTI. This ETF is a popular choice among investors, but what exactly is it, and why should you, as a Canadian investor, consider it? Let’s break it down. What is VTI ETF? VTI is an Exchange-Traded Fund (ETF) that tracks… Read more: Understanding VTI ETF for Canadian investors – Full review

by Wyze InvestorBonjour, chers investisseurs! Today, we’re exploring the Vanguard Total Stock Market ETF, commonly known as VTI. This ETF is a popular choice among investors, but what exactly is it, and why should you, as a Canadian investor, consider it? Let’s break it down. What is VTI ETF? VTI is an Exchange-Traded Fund (ETF) that tracks… Read more: Understanding VTI ETF for Canadian investors – Full review - Best Canadian Equivalent of VUG – Growth ETFs in Canada

by Wyze InvestorWhen it comes to investing in growth stocks through ETFs, the Vanguard Growth ETF (VUG) is a popular choice in the United States. But what if you’re in Canada and looking for a similar investment option? Understanding the Canadian equivalent of VUG is crucial for investors who want to tap into the growth segment of… Read more: Best Canadian Equivalent of VUG – Growth ETFs in Canada

by Wyze InvestorWhen it comes to investing in growth stocks through ETFs, the Vanguard Growth ETF (VUG) is a popular choice in the United States. But what if you’re in Canada and looking for a similar investment option? Understanding the Canadian equivalent of VUG is crucial for investors who want to tap into the growth segment of… Read more: Best Canadian Equivalent of VUG – Growth ETFs in Canada - Unlocking Potential: The Ultimate Guide to Vanguard Growth ETF (VUG)

by Wyze InvestorThe Vanguard Growth ETF (VUG) stands as a prominent player in the world of exchange-traded funds, specifically designed to mirror the performance of the CRSP US Large Cap Growth Index. In this comprehensive exploration, we delve into the intricacies of VUG, examining its investment approach, expenses, sector exposure, top holdings, performance, and associated risks. Investment… Read more: Unlocking Potential: The Ultimate Guide to Vanguard Growth ETF (VUG)

by Wyze InvestorThe Vanguard Growth ETF (VUG) stands as a prominent player in the world of exchange-traded funds, specifically designed to mirror the performance of the CRSP US Large Cap Growth Index. In this comprehensive exploration, we delve into the intricacies of VUG, examining its investment approach, expenses, sector exposure, top holdings, performance, and associated risks. Investment… Read more: Unlocking Potential: The Ultimate Guide to Vanguard Growth ETF (VUG) - IWM: Small Cap ETF from iShares: Unlocking Investment Opportunities

by Wyze InvestorInvesting in exchange-traded funds (ETFs) has become increasingly popular due to their simplicity and diversification benefits. When it comes to ETFs, investors have various options to choose from. In this article, we will discuss the advantages of investing in small-cap ETFs, particularly focusing on the iShares Russell 2000 ETF (IWM Stock), and what investors can… Read more: IWM: Small Cap ETF from iShares: Unlocking Investment Opportunities

by Wyze InvestorInvesting in exchange-traded funds (ETFs) has become increasingly popular due to their simplicity and diversification benefits. When it comes to ETFs, investors have various options to choose from. In this article, we will discuss the advantages of investing in small-cap ETFs, particularly focusing on the iShares Russell 2000 ETF (IWM Stock), and what investors can… Read more: IWM: Small Cap ETF from iShares: Unlocking Investment Opportunities - Investing in IVV – iShares Core S&P 500 ETF: A Comprehensive Guide

by Wyze InvestorInvestment Objective: The iShare Core S&P 500 ETF (IVV) stands out as a premier option for investors seeking exposure to large, established U.S. companies. The fund’s primary objective is to track the investment results of an index composed of large-capitalization U.S. equities, making it a robust choice for those looking for stability and growth in… Read more: Investing in IVV – iShares Core S&P 500 ETF: A Comprehensive Guide

by Wyze InvestorInvestment Objective: The iShare Core S&P 500 ETF (IVV) stands out as a premier option for investors seeking exposure to large, established U.S. companies. The fund’s primary objective is to track the investment results of an index composed of large-capitalization U.S. equities, making it a robust choice for those looking for stability and growth in… Read more: Investing in IVV – iShares Core S&P 500 ETF: A Comprehensive Guide - Investing in the Future: A Deep Dive into Metaverse ETFs

by Wyze InvestorThe concept of the metaverse, a collective virtual shared space created by the convergence of virtually enhanced physical reality and persistent virtual spaces, is no longer a sci-fi fantasy. It’s rapidly becoming a digital reality with significant investment implications. This post delves into the burgeoning world of Metaverse Exchange-Traded Funds (ETFs), offering investors a gateway… Read more: Investing in the Future: A Deep Dive into Metaverse ETFs

by Wyze InvestorThe concept of the metaverse, a collective virtual shared space created by the convergence of virtually enhanced physical reality and persistent virtual spaces, is no longer a sci-fi fantasy. It’s rapidly becoming a digital reality with significant investment implications. This post delves into the burgeoning world of Metaverse Exchange-Traded Funds (ETFs), offering investors a gateway… Read more: Investing in the Future: A Deep Dive into Metaverse ETFs - Top Industrial Sector ETFs to Invest in 2024

by Wyze InvestorExplore “Top Industrial Sector ETFs 2024” for a comprehensive look at the industrial sector. This key economic area includes aerospace, defense, construction, and logistics. Industrial Sector ETFs offer easy access to this diverse market. They combine various sub-sector firms, providing a broad and effective investment approach for 2024. Defining Industrial Sector ETFs Industrial Sector ETFs… Read more: Top Industrial Sector ETFs to Invest in 2024

by Wyze InvestorExplore “Top Industrial Sector ETFs 2024” for a comprehensive look at the industrial sector. This key economic area includes aerospace, defense, construction, and logistics. Industrial Sector ETFs offer easy access to this diverse market. They combine various sub-sector firms, providing a broad and effective investment approach for 2024. Defining Industrial Sector ETFs Industrial Sector ETFs… Read more: Top Industrial Sector ETFs to Invest in 2024 - Navigating Opportunities: Canadian Blue Chip Stocks at 52-Week Low

by Wyze InvestorIntro In the dynamic and ever-changing realm of the stock market, Canadian blue chip stocks have been synonymous with stability and robustness. Representing established companies known for their solid financial foundations, consistent dividend payouts, and reputable standing, these stocks are often seen as safe harbors in the tumultuous financial seas. However, even these stalwarts are… Read more: Navigating Opportunities: Canadian Blue Chip Stocks at 52-Week Low

by Wyze InvestorIntro In the dynamic and ever-changing realm of the stock market, Canadian blue chip stocks have been synonymous with stability and robustness. Representing established companies known for their solid financial foundations, consistent dividend payouts, and reputable standing, these stocks are often seen as safe harbors in the tumultuous financial seas. However, even these stalwarts are… Read more: Navigating Opportunities: Canadian Blue Chip Stocks at 52-Week Low - Review of XLE: The Energy Select Sector SPDR® Fund

by Wyze InvestorInvestment objective The Energy Select Sector SPDR® Fund (XLE Stock) invests in energy stocks that are part of the S&P 500. In other words, by holding XLE you’re investing in the largest US Energy companies. It’s an easy and effective to way to gain exposure to a diversified portfolio of energy stocks. XLE is a… Read more: Review of XLE: The Energy Select Sector SPDR® Fund

by Wyze InvestorInvestment objective The Energy Select Sector SPDR® Fund (XLE Stock) invests in energy stocks that are part of the S&P 500. In other words, by holding XLE you’re investing in the largest US Energy companies. It’s an easy and effective to way to gain exposure to a diversified portfolio of energy stocks. XLE is a… Read more: Review of XLE: The Energy Select Sector SPDR® Fund - IAT ETF: Full review of iShares U.S. Regional Banks ETF

by Wyze InvestorIn this post, we will review a popular sector ETF: the iShares U.S. Regional Banks ETF (IAT). We will first explain what’s a sector ETF. Then, we will discuss IAT’s historical performance, fees and holdings. Finally, we will compare IAT against similar ETFs. Updated daily – IAT Stock Full list of ‘Dividend Kings’ stocks by… Read more: IAT ETF: Full review of iShares U.S. Regional Banks ETF

by Wyze InvestorIn this post, we will review a popular sector ETF: the iShares U.S. Regional Banks ETF (IAT). We will first explain what’s a sector ETF. Then, we will discuss IAT’s historical performance, fees and holdings. Finally, we will compare IAT against similar ETFs. Updated daily – IAT Stock Full list of ‘Dividend Kings’ stocks by… Read more: IAT ETF: Full review of iShares U.S. Regional Banks ETF - PFF ETF Review: US Preferred Stock Ishares

by Wyze InvestorPFF ETF: Investment objectif The iShares Preferred and Income Securities ETF offers exposure to U.S. preferred stocks. It’s ideal for conservative investors who are pursuing income. The main objective sought is a higher return compared to an investment in bond funds. Both bonds and preferred shares are considered fixed income asses but these two investment… Read more: PFF ETF Review: US Preferred Stock Ishares

by Wyze InvestorPFF ETF: Investment objectif The iShares Preferred and Income Securities ETF offers exposure to U.S. preferred stocks. It’s ideal for conservative investors who are pursuing income. The main objective sought is a higher return compared to an investment in bond funds. Both bonds and preferred shares are considered fixed income asses but these two investment… Read more: PFF ETF Review: US Preferred Stock Ishares - Best AI Stocks for 2023 and beyond

by Wyze InvestorIn an era defined by technological transformation, the rise of Artificial Intelligence (AI) stands as one of the most profound shifts in the global landscape. AI, once confined to the realm of science fiction, has become a driving force behind innovation, reshaping industries. As the world becomes increasingly reliant on AI-driven solutions, the AI sector… Read more: Best AI Stocks for 2023 and beyond

by Wyze InvestorIn an era defined by technological transformation, the rise of Artificial Intelligence (AI) stands as one of the most profound shifts in the global landscape. AI, once confined to the realm of science fiction, has become a driving force behind innovation, reshaping industries. As the world becomes increasingly reliant on AI-driven solutions, the AI sector… Read more: Best AI Stocks for 2023 and beyond - Top Global X Covered Call ETF to boost your income (US)

by Wyze InvestorGlobal X is one of the largest ETF issuers in North America. In this post, we will focus on their covered call ETFs whose main objective is to maximize dividend yield. In fact, Covered call ETFs are more and more popular among income oriented investos. Global X had issued various ETFs within this category with… Read more: Top Global X Covered Call ETF to boost your income (US)

by Wyze InvestorGlobal X is one of the largest ETF issuers in North America. In this post, we will focus on their covered call ETFs whose main objective is to maximize dividend yield. In fact, Covered call ETFs are more and more popular among income oriented investos. Global X had issued various ETFs within this category with… Read more: Top Global X Covered Call ETF to boost your income (US) - AI ETF list: 5 Best Artificial intelligence ETFs in the US

by Wyze InvestorInvesting in an AI ETF can be a good way for investors to gain exposure to the potentially high-growth exponential technology sector without having to invest in individual Artificial Intelligence stocks. ETFs provide diversification by spreading your investment across multiple companies, which can help to reduce risk. In this post, we will discuss the most… Read more: AI ETF list: 5 Best Artificial intelligence ETFs in the US

by Wyze InvestorInvesting in an AI ETF can be a good way for investors to gain exposure to the potentially high-growth exponential technology sector without having to invest in individual Artificial Intelligence stocks. ETFs provide diversification by spreading your investment across multiple companies, which can help to reduce risk. In this post, we will discuss the most… Read more: AI ETF list: 5 Best Artificial intelligence ETFs in the US - 4 Highest Dividend paying Stocks near their 52 weeks lows

by Wyze InvestorThe recent stock market correction clearly represents an opportunity to acquire new shares of the highest dividend paying stocks. A good starting point are dividend stocks with a solid track record. In this post, we will be looking at 4 dividend stocks that are near their 52 weeks lows. For each stock, we will present… Read more: 4 Highest Dividend paying Stocks near their 52 weeks lows

by Wyze InvestorThe recent stock market correction clearly represents an opportunity to acquire new shares of the highest dividend paying stocks. A good starting point are dividend stocks with a solid track record. In this post, we will be looking at 4 dividend stocks that are near their 52 weeks lows. For each stock, we will present… Read more: 4 Highest Dividend paying Stocks near their 52 weeks lows - RY.TO Full review of Royal Bank dividend profile (TSX)

by Wyze InvestorTSX RY – Canadian Dividend aristocrat RY trades in the Toronto Stock Exchange (TSE). RY is a dividend artistocrat stock with 10 years consecutive dividend increases!. The list of Canadian ”Dividend Aristocrats” stocks is managed by the firm Standard and Poors. The index is titled the S&P Canadian Dividend Aristocrats. It requires a minimum of… Read more: RY.TO Full review of Royal Bank dividend profile (TSX)

by Wyze InvestorTSX RY – Canadian Dividend aristocrat RY trades in the Toronto Stock Exchange (TSE). RY is a dividend artistocrat stock with 10 years consecutive dividend increases!. The list of Canadian ”Dividend Aristocrats” stocks is managed by the firm Standard and Poors. The index is titled the S&P Canadian Dividend Aristocrats. It requires a minimum of… Read more: RY.TO Full review of Royal Bank dividend profile (TSX) - TSE TD – Full review of TD Bank dividend profile

by Wyze InvestorThe Toronto-Dominion Bank (the Bank) operates as a bank in North America. The Company’s segments include Canadian Retail, U.S. Retail, Wholesale Banking and corporate. TSE TD – Canadian Dividend aristocrat TD trades in the Toronto Stock Exchange (TSE). TD is a dividend artistocrat stock with 10 years consecutive dividend increases!. The list of Canadian ”Dividend… Read more: TSE TD – Full review of TD Bank dividend profile

by Wyze InvestorThe Toronto-Dominion Bank (the Bank) operates as a bank in North America. The Company’s segments include Canadian Retail, U.S. Retail, Wholesale Banking and corporate. TSE TD – Canadian Dividend aristocrat TD trades in the Toronto Stock Exchange (TSE). TD is a dividend artistocrat stock with 10 years consecutive dividend increases!. The list of Canadian ”Dividend… Read more: TSE TD – Full review of TD Bank dividend profile - Best Dividend Stocks 2022 – with Strong Cash Flow

by Wyze InvestorIn this post, we will go over five stocks that offer attractive dividend yields and strong cash flow ratios to sustain them. These stocks are ideal for long-term investors looking for the best dividend stocks 2022. We will analyze each stock: the dividend yield, dividend growth, return on equity, cash dividend payout ratio and free… Read more: Best Dividend Stocks 2022 – with Strong Cash Flow

by Wyze InvestorIn this post, we will go over five stocks that offer attractive dividend yields and strong cash flow ratios to sustain them. These stocks are ideal for long-term investors looking for the best dividend stocks 2022. We will analyze each stock: the dividend yield, dividend growth, return on equity, cash dividend payout ratio and free… Read more: Best Dividend Stocks 2022 – with Strong Cash Flow - Top 10 Best Dividend ETFs for 2023: Performance, and Analysis

by Wyze InvestorIn this article, we’ll conduct a comprehensive review of the Best 10 dividend ETFs in the United States for the year 2023. Our analysis will revolve around key metrics such as dividend yield, performance over a five-year span, and volatility. Within each ETF’s profile, we will offer insights into their investment objectives and holdings, providing… Read more: Top 10 Best Dividend ETFs for 2023: Performance, and Analysis

by Wyze InvestorIn this article, we’ll conduct a comprehensive review of the Best 10 dividend ETFs in the United States for the year 2023. Our analysis will revolve around key metrics such as dividend yield, performance over a five-year span, and volatility. Within each ETF’s profile, we will offer insights into their investment objectives and holdings, providing… Read more: Top 10 Best Dividend ETFs for 2023: Performance, and Analysis - Best Defensive Dividend Paying Stocks – Consumer staples

by Wyze InvestorDefensive stocks are back in force in the market. Indeed, the biggest names in the consumer staples sector have performed well in recent months. In addition, these same securities are recognized for the quality of their dividends and are sometimes even ‘Dividend Kings‘ or ‘Dividend Aristocrats’. In this article, we will present the best dividend… Read more: Best Defensive Dividend Paying Stocks – Consumer staples

by Wyze InvestorDefensive stocks are back in force in the market. Indeed, the biggest names in the consumer staples sector have performed well in recent months. In addition, these same securities are recognized for the quality of their dividends and are sometimes even ‘Dividend Kings‘ or ‘Dividend Aristocrats’. In this article, we will present the best dividend… Read more: Best Defensive Dividend Paying Stocks – Consumer staples - Best Dividend Contenders by sector (High Dividend Yields)

by Wyze InvestorDividend Contenders Stocks are U.S companies that have paid and raised their dividends each year for at least 10 years. Once a Dividend Contender Stocks exceeds 25 years of consecutive dividend increases, it becomes ‘Dividend Aristocrats’. High Dividend Stocks are very popular with investors. they are perceived as the best tools to build a passive… Read more: Best Dividend Contenders by sector (High Dividend Yields)

by Wyze InvestorDividend Contenders Stocks are U.S companies that have paid and raised their dividends each year for at least 10 years. Once a Dividend Contender Stocks exceeds 25 years of consecutive dividend increases, it becomes ‘Dividend Aristocrats’. High Dividend Stocks are very popular with investors. they are perceived as the best tools to build a passive… Read more: Best Dividend Contenders by sector (High Dividend Yields) - High Yield Dividend stocks 2022 (US)

by Wyze InvestorIn this post, we will be presenting 5 high dividend stocks. These stocks offer a very attractive yield while having an acceptable level of debt and growing revenues. The purpose here is to select businesses that are likely to continue paying dividends in the near and medium future. Best Canadian Bank Dividend Stocks Please do… Read more: High Yield Dividend stocks 2022 (US)

by Wyze InvestorIn this post, we will be presenting 5 high dividend stocks. These stocks offer a very attractive yield while having an acceptable level of debt and growing revenues. The purpose here is to select businesses that are likely to continue paying dividends in the near and medium future. Best Canadian Bank Dividend Stocks Please do… Read more: High Yield Dividend stocks 2022 (US) - 5 Highest dividend paying stocks US (Div. Aristocrats)

by Wyze InvestorIn this post, we will go over the highest dividend-paying stocks among US Dividend Aristocrats stocks. The S&P 500 Dividend aristocrat list includes businesses that have proven themselves as the best dividend-paying stocks in the US. These stocks have at least a 25 years track record of paying and increasing their dividends. They are a… Read more: 5 Highest dividend paying stocks US (Div. Aristocrats)

by Wyze InvestorIn this post, we will go over the highest dividend-paying stocks among US Dividend Aristocrats stocks. The S&P 500 Dividend aristocrat list includes businesses that have proven themselves as the best dividend-paying stocks in the US. These stocks have at least a 25 years track record of paying and increasing their dividends. They are a… Read more: 5 Highest dividend paying stocks US (Div. Aristocrats)