In an era defined by technological transformation, the rise of Artificial Intelligence (AI) stands as one of the most profound shifts in the global landscape. AI, once confined to the realm of science fiction, has become a driving force behind innovation, reshaping industries. As the world becomes increasingly reliant on AI-driven solutions, the AI sector is presenting investors with a wealth of opportunities. In this blog post, we’ll explore four Best AI stocks poised for exponential growth, delving into their promising prospects.

Meta Platforms (NASDAQ:META)

Profile

Meta Platforms, Inc. is a global company focused on creating products that facilitate connections and sharing among individuals across various platforms, including mobile devices, personal computers, virtual reality headsets, and wearables.

Summary

Meta Platforms, the parent company of Facebook, has experienced a remarkable surge in its stock price, soaring by almost 200% over the past year. This impressive growth is largely attributed to the company’s strategic investment in artificial intelligence. That investment has enabled it to navigate and overcome the challenges related to data privacy.

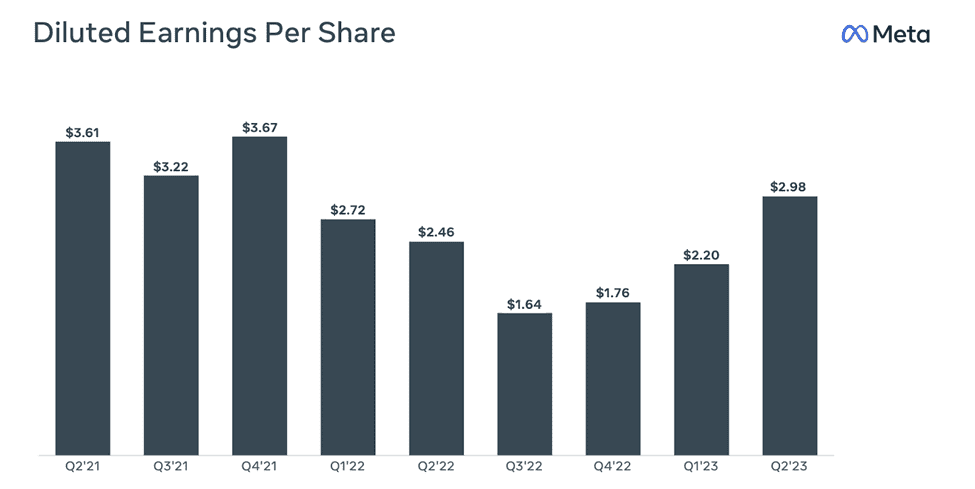

One noteworthy financial highlight is the substantial growth in diluted earnings per share (EPS), which has outpaced the growth in operating income, registering an impressive 21% year-over-year increase. This remarkable performance can be partly attributed to Meta’s aggressive share repurchase program, which benefits current shareholders.

However, despite these positive trends, there are several key concerns looming on the horizon for Meta Platforms. The ongoing Department of Justice (DOJ) antitrust trial against Google has raised questions about potential regulatory actions. The potentiel actions could impact Meta and its market dominance. Additionally, the company is facing profitability headwinds, which pose challenges to sustaining its current growth trajectory. Furthermore, the expanded valuation of Meta’s stock raises questions about its long-term sustainability and whether it can continue to justify its current market value in the face of these challenges.

Source: Earnings presentation – Best AI stocks

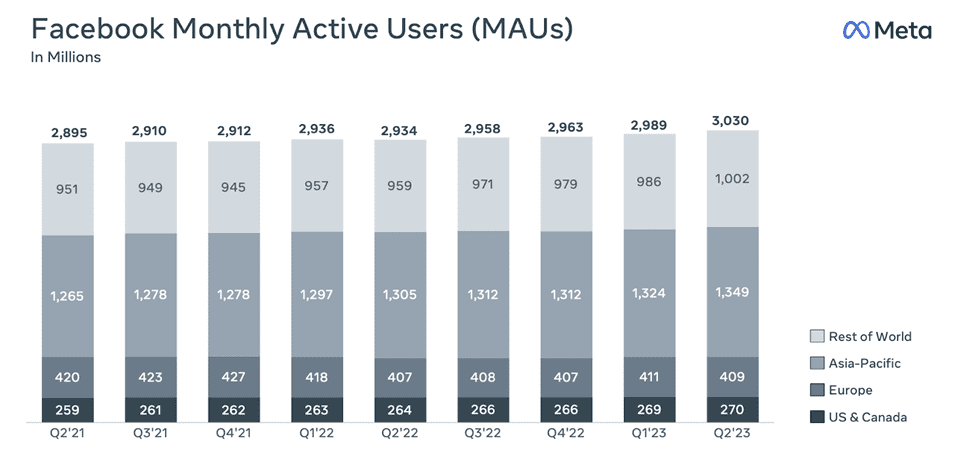

Meta observed a 1.4% sequential growth in its monthly active users (MAUs) on the Facebook platform.

US Stocks that pay monthly dividends (Full list by sector)

UiPath Inc. (NYSE:PATH)

Profile

UiPath Inc. is a prominent enterprise software company renowned for its comprehensive automation platform specializing in robotic process automation (RPA). With a strong presence in the United States, Romania, and Japan, UiPath revolutionizes business operations by leveraging RPA technology. RPA involves the utilization of software robots or digital workers to streamline and automate repetitive, rule-based tasks. Traded on the New York Stock Exchange under the ticker symbol PATH, UiPath Inc. is at the forefront of innovation in the field of automation solutions.

Summary

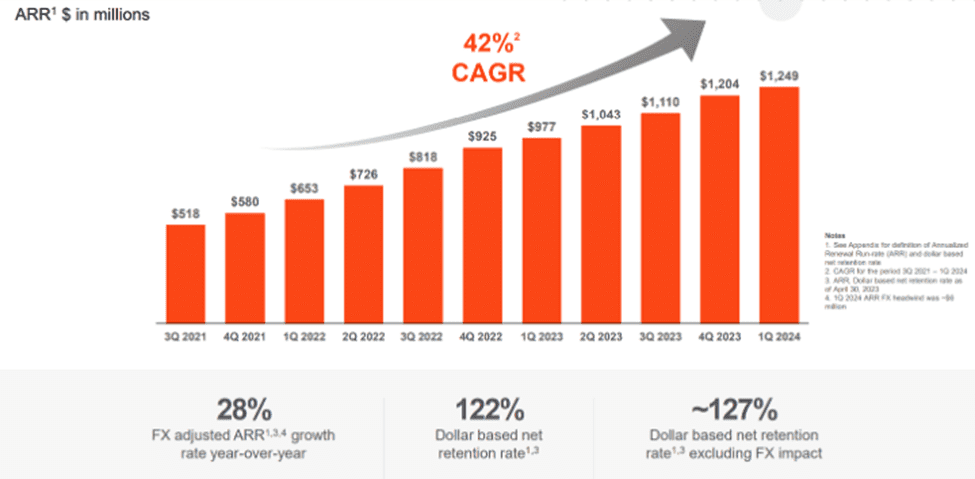

UiPath, trading under the ticker symbol PATH, stands as a prominent player in the enterprise software arena, renowned for its state-of-the-art robotic process automation (RPA) platform, underpinned by advanced AI technology. This RPA innovation not only aids corporations like Uber Technologies, Inc. (UBER) in cost reduction but also propels UiPath to the forefront of the automation industry. The company’s strategic alliances with major industry players have further cemented its leadership position.

Currently, UiPath is shifting towards a business automation platform with AI at its core. This strategic pivot furnishes the company with a distinct competitive advantage, particularly in terms of harnessing data and delivering user-friendly solutions.

From a financial standpoint, UiPath exhibits robust stability, characterized by an absence of debt and substantial cash reserves. In addition, the recorded consistently positive free cash flow. This financial prowess empowers the company to allocate resources towards vital research and development (R&D) initiatives and seize opportunities for mergers and acquisitions (M&A). These endeavors not only propel UiPath’s growth but also drive ongoing innovation within the automation sector.

Salesforce (NYSE:CRM)

Profile

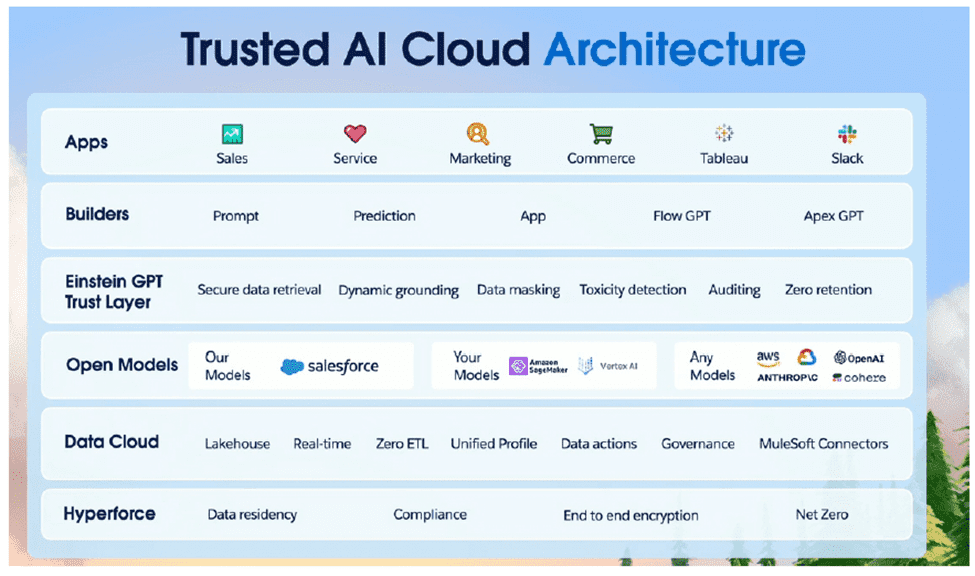

Salesforce, a trailblazer in the realm of Customer Relationship Management (CRM), leverages the power of cloud computing and artificial intelligence (AI) to champion customer success. The company’s comprehensive suite of services encompasses sales functionalities like data storage, lead tracking, progress monitoring, opportunity forecasting, analytics-driven insights, relationship intelligence, and the seamless generation of quotes, contracts, and invoices. In addition, Salesforce’s service arm empowers businesses to provide trustworthy and deeply personalized customer service and support on a large scale, ensuring the highest levels of customer satisfaction.

Summary

Salesforce (CRM) presents an enticing investment prospect with its combination of robust profitability, consistent double-digit revenue growth, and a strategic emphasis on AI-driven productivity. In its recent Q2 earnings report, Salesforce not only exceeded expectations but also revised its full-year guidance upward. This impressive performance is fueled by strong demand for the company’s AI tools seamlessly integrated throughout its software ecosystem, highlighting Salesforce’s promising position in the market.

Full list of ‘Dividend Kings’ stocks by sector – 2023

Okta, Inc. (NASDAQ:OKTA)

Profile

OKTA is a cloud-based cybersecurity company specializing in user identity authentication and management across various devices. Their Workforce Identity Cloud empowers organizations to enhance workforce security and establish secure collaborative solutions with partner networks.

Summary

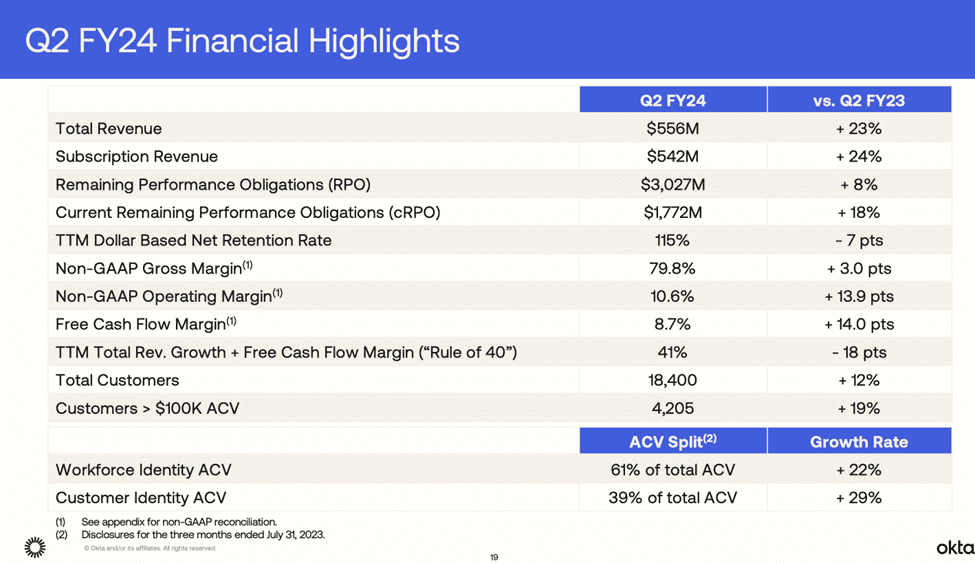

Okta (OKTA), a pioneer in identity management and single sign-on technology, has enjoyed a remarkable 30% surge in its stock price this year. This surge is indicative of the success of the company’s strategic shift towards becoming a comprehensive provider in the identity security market, and it suggests that its turnaround efforts are moving in a positive direction.

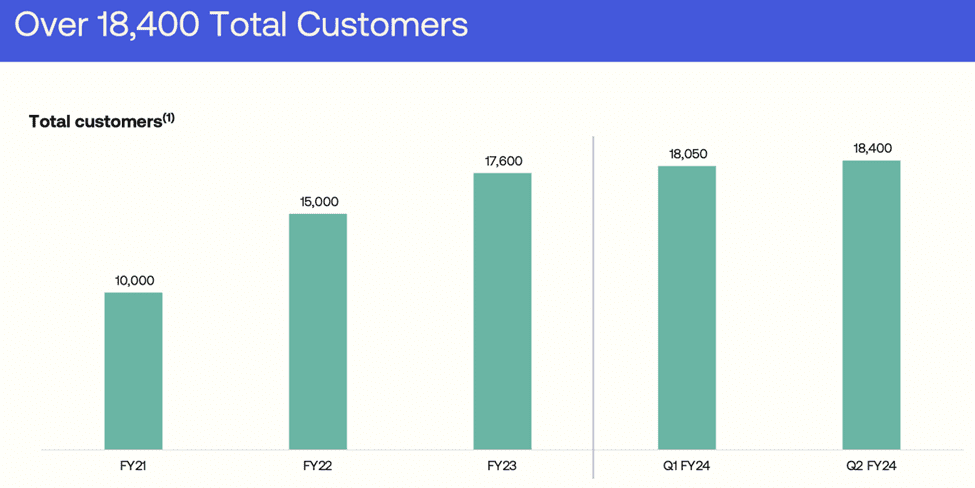

However, there is a noteworthy concern that has emerged over the past year: a slowdown in customer growth. In the second quarter, Okta was able to onboard 350 new customers, representing a growth rate of 12%, bringing its total customer base to 18,400. Despite these challenges in customer growth, Okta has demonstrated strong sales momentum and profitability, effectively acquiring new customers and expanding billing with existing ones.

It’s essential to acknowledge that Okta’s current valuation is relatively high. This valuation reflects the market’s optimism and high expectations regarding the company’s future potential and growth prospects.

.