Investing in an AI ETF can be a good way for investors to gain exposure to the potentially high-growth exponential technology sector without having to invest in individual Artificial Intelligence stocks. ETFs provide diversification by spreading your investment across multiple companies, which can help to reduce risk. In this post, we will discuss the most popular ETFs that give investors exposure to the AI sector (AI ETF List).

Artificial Intelligence

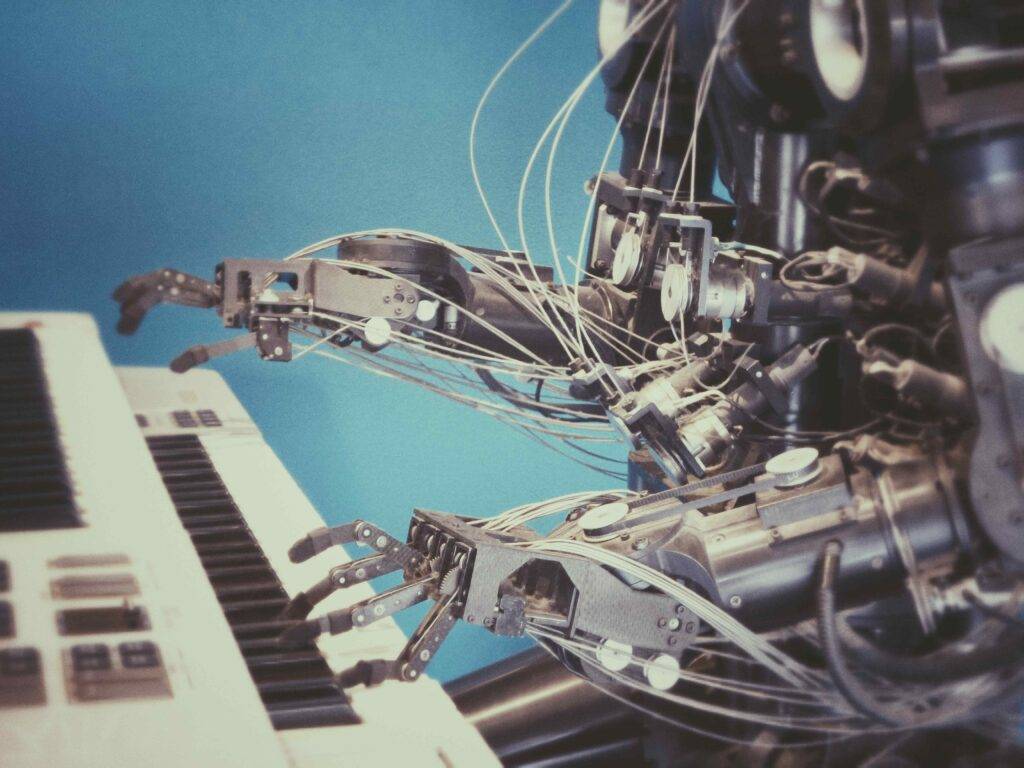

The digital revolution has given rise to artificial intelligence (AI), a disruptive technology that has a high potential for growth and is attracting the attention of asset managers as a means of achieving better performance. This technology enables machines and software to think like humans, and according to experts, it is a silent revolution that is already causing changes in various sectors and opening up new opportunities for development.

The AI market was worth $200 million in 2015, and it is projected to reach almost $90 billion by 2025, potentially adding up to €13.5 trillion to the global economy by 2030, as per PwC’s analysis. Accenture’s study from 2016 suggests that AI could increase global productivity by 40% by 2035, allowing workers to focus on more fulfilling tasks. Furthermore, according to the World Economic Forum, AI has the potential to create 133 million jobs while eliminating 75 million, resulting in a net positive of 58 million jobs.

Full review of XQQ: iShares NASDAQ 100 Index (CAD-Hedged)

QYLD ETF Review: Global X Nasdaq-100 Covered Call ETF

Best AI ETFs (List)

| ETF Name | Fees % |

|---|---|

| IYW – iShares U.S. Technology ETF | 0.39 |

| FTEC – Fidelity MSCI Information Technology Index ETF | 0.08 |

| FDN – First Trust Dow Jones Internet Index Fund | 0.52 |

| XT – iShares Exponential Technologies ETF | 0.47 |

| IXN – iShares Global Tech ETF | 0.46 |

Performance comparison (AI ETF list)

AI ETF list: performance comparison

IYW – iShares U.S. Technology ETF

IYW is the ticker symbol for the iShares U.S. Technology ETF. This exchange-traded fund (ETF) is designed to track the performance of the Dow Jones U.S. Technology Index, which includes some of the largest and most well-known technology companies in the United States.

Some of the top holdings of the IYW ETF include companies like Apple, Microsoft, and Amazon, which are all leaders in the technology industry. The ETF also includes exposure to other subsectors of the technology industry, such as software, internet services, and semiconductor companies.

IYW Holding allocation

| NAME | HOLDING ALLOCATION |

|---|---|

| Apple Inc. | 19.76% |

| Microsoft Corporation | 17.07% |

| Alphabet Inc. Class A | 5.29% |

| NVIDIA Corporation | 4.72% |

| Alphabet Inc. Class C | 4.63% |

| Meta Platforms Inc. Class A | 4.01% |

| Broadcom Inc. | 2.75% |

FTEC – Fidelity MSCI Information Technology Index ETF

FTEC is the ticker symbol for the Fidelity MSCI Information Technology Index ETF. This exchange-traded fund (ETF) is designed to track the performance of the MSCI USA IMI Information Technology Index, which includes a broad range of technology companies in the United States.

The FTEC ETF includes exposure to a wide range of technology subsectors, such as software, hardware, internet services, and semiconductor companies. Some of the top holdings of the FTEC ETF include companies like Apple, Microsoft, and Facebook, which are all leaders in the technology industry.

Full Review of XEQT: iShares Core Equity ETF Portfolio

Best ETF Canada: Top 7 offered by BMO – 2023

FTEC Holding allocation

| NAME | HOLDING ALLOCATION |

|---|---|

| Apple Inc. | 23.28% |

| Microsoft Corporation | 18.27% |

| NVIDIA Corporation | 6.03% |

| Visa Inc. Class A | 3.46% |

| Mastercard Incorporated Class A | 2.91% |

| Broadcom Inc. | 2.31% |

| Salesforce, Inc. | 1.77% |

FDN – First Trust Dow Jones Internet Index Fund

FDN is the ticker symbol for the First Trust Dow Jones Internet Index Fund. This exchange-traded fund (ETF) is designed to track the performance of the Dow Jones Internet Composite Index, which includes companies that generate at least 50% of their annual revenue from the internet.

The FDN ETF includes exposure to a wide range of internet subsectors, such as e-commerce, online advertising, and social networking companies. Some of the top holdings of the FDN ETF include companies like Amazon, Facebook, and Alphabet (Google), which are all leaders in the internet industry.

FTEC Holding allocation

| NAME | HOLDING ALLOCATION |

|---|---|

| Amazon.com, Inc. | 9.82% |

| Meta Platforms Inc. Class A | 7.87% |

| Alphabet Inc. Class A | 5.83% |

| Salesforce, Inc. | 5.42% |

| Alphabet Inc. Class C | 5.11% |

| Cisco Systems, Inc. | 4.98% |

| Netflix, Inc. | 4.67% |

XT – iShares Exponential Technologies ETF

XT is the ticker symbol for the iShares Exponential Technologies ETF. This exchange-traded fund (ETF) is designed to provide exposure to companies that are developing and utilizing exponential technologies, which are technologies that have the potential to significantly change the way we live and work.

The XT ETF includes exposure to a wide range of subsectors, such as robotics, artificial intelligence, nanotechnology, and energy storage. Some of the top holdings of the XT ETF include companies like Tesla, Amazon, and Alphabet (Google), which are all leaders in the exponential technology industry.

XT Holdings

| NAME | HOLDING ALLOCATION |

|---|---|

| Meta Platforms Inc. Class A | 0.90% |

| NVIDIA Corporation | 0.82% |

| Coinbase Global, Inc. Class A | 0.74% |

| Salesforce, Inc. | 0.72% |

| HubSpot, Inc. | 0.72% |

IXN – iShares Global Tech ETF

IXN is the ticker symbol for the iShares Global Tech ETF. This exchange-traded fund (ETF) is designed to provide exposure to global technology companies across a range of industries, including hardware, software, semiconductors, and internet services.

The IXN ETF includes exposure to companies from around the world, with top holdings including companies like Apple, Microsoft, and Taiwan Semiconductor Manufacturing. The fund aims to provide investors with broad exposure to the global technology sector, which can help to reduce risk by diversifying across multiple regions and industries.

IXN Holdings – AI ETF list

| NAME | HOLDING ALLOCATION |

|---|---|

| Apple Inc. | 22.82% |

| Microsoft Corporation | 19.65% |

| NVIDIA Corporation | 6.29% |

| Taiwan Semiconductor Manufacturing Co., Ltd. | 2.88% |

| Broadcom Inc. | 2.43% |

| Samsung Electronics Co., Ltd. | 2.32% |

| ASML Holding NV | 2.30% |