The recent stock market correction clearly represents an opportunity to acquire new shares of the highest dividend paying stocks. A good starting point are dividend stocks with a solid track record. In this post, we will be looking at 4 dividend stocks that are near their 52 weeks lows. For each stock, we will present the growth prospects and the risks. In addition, we will include growth statistics and other relevant ratios. This list is just a starting point for further research and not a buy recommendation.

Full list of ‘Dividend Kings’ stocks by sector – 2023

QYLD ETF Review: Global X Nasdaq-100 Covered Call ETF

10 Best Covered Call ETF Canada – High dividend yield

Selection criteria

- Minimum of 10 years of consecutive dividend payment and growth;

- High dividend safety (low payout ratio and strong balance sheet;

- An attractive dividend growth rate over the past five years;

- Stock trading close to its 52 weeks low.

- Large cap (Minimum 10B)

Review of XEI – Ishares S&P TSX Comp High Div Index ETF

Top 10 Best Growth ETF in Canada!

Highest Dividend paying Stocks near their 52 weeks low

Market Cap and Dividend yield

| Symbol | Market Cap | Div Yield |

| LHX | 35.28B | 2.42% |

| PKG | 11.50B | 3.87% |

| MAA | 17.64B | 3.60% |

| CINF | 16.41B | 2.70% |

Ex-Dividend date and Pay Out Ratio

| Symbol | Ex-Div Date | Payout Date | Payout Ratio |

| LHX | 6/1/2023 | 6/16/2023 | 35.66% |

| PKG | 6/14/2023 | 7/14/2023 | 47.13% |

| MAA | 7/13/2023 | 7/31/2023 | 87.50% |

| CINF | 6/15/2023 | 7/14/2023 | 79.66% |

Dividend growth metrics

| Symbol | Div Growth 5Y | Years of Growth | Consecutive Years |

| LHX | 14.97% | 21 Years | 33 Years |

| PKG | 14.69% | 12 Years | 18 Years |

| MAA | 8.13% | 12 Years | 24 Years |

| CINF | 6.79% | 62 Years | 62 Years |

LHX L3Harris Technologies, Inc.

L3Harris Technologies, Inc. is an aerospace and defense technology company providing mission-critical solutions for global government and commercial customers. Its offerings include multi-mission intelligence systems, communication systems, maritime and autonomous solutions, electro-optical and infrared solutions, space payloads, electronic warfare systems, tactical radios, and public safety equipment. The company was founded in 1895.

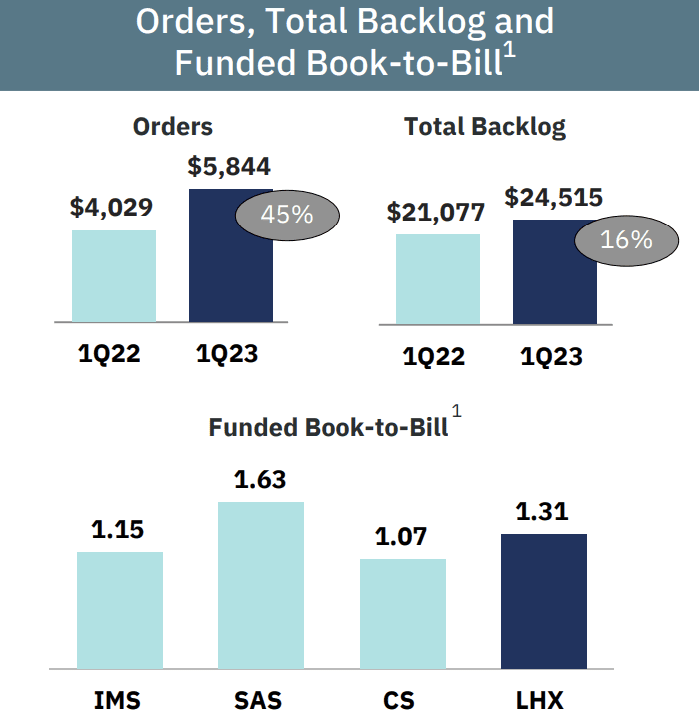

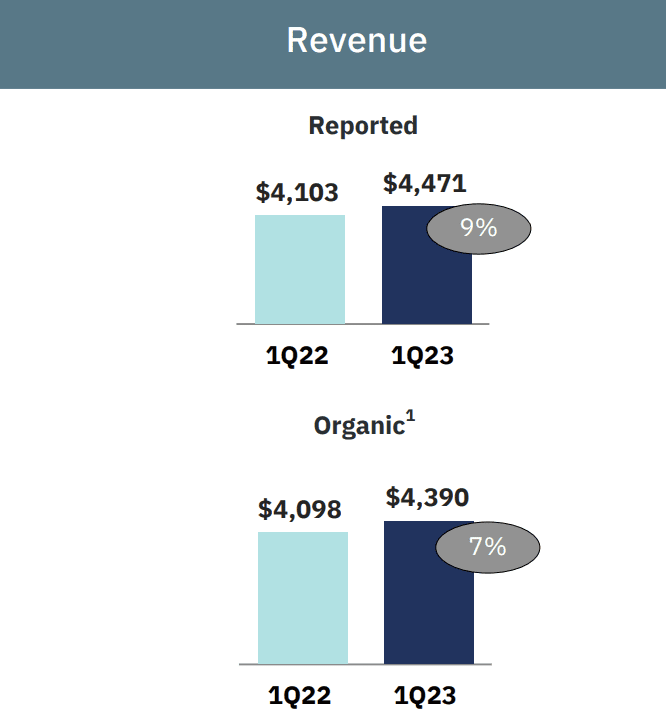

+ L3Harris, a defense contractor, presents an opportunity for investors seeking potentially undervalued stocks. Despite a bearish stock chart, the company has displayed strong revenue growth.

+ The recent acquisition of Aerojet Rocketdyne is expected to have a meaningful impact on future results.

+ The company benefits from a solid flow of new orders supported by an advanced product portfolio, with resolved supply chain issues.

+ L3Harris has shown steady revenue and EPS growth over the past decade.

+ The company’s reputation for dividend growth offers potential income stability for long-term investors.

+ L3Harris is well-positioned to potentially benefit from increased global defense spending.

+ The company’s valuation appears reasonable, although investors should be mindful of potential risks.

+ 21 consecutive years paying and growing their dividends while maintaining a low payout ratio

+ Dividend grew 14.97% in the past 5 years!

PKG – Packaging Corporation of America

Packaging Corporation of America (NYSE:PKG), established in 1867, is a leading producer of container board products, paper, and packaging materials in the United States. The company operates in three segments: Packaging (the largest division), Paper, and Corporate and Other. With a network of 8 mills, 89 corrugated products plants, and a facility in Hong Kong, they cater to businesses of all sizes, offering a diverse range of corrugated packing materials, including solutions for food and consumer products. Additionally, their paper segment specializes in both commodity and specialty paper products. Packaging Corporation of America is a trusted and long-standing presence in the industry.

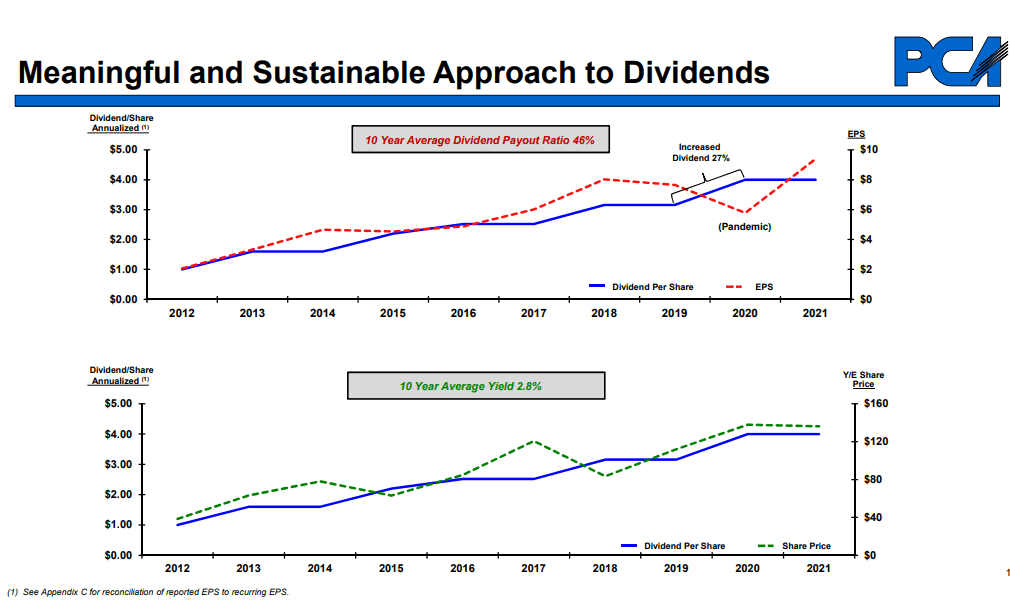

+ Strong fundamentals are supported by a strong balance sheet and cash flow statement.

– PKG operates in a highly competitive industry, which may impact its pricing power, margins, and profitability.

– The company’s dependence on key raw materials, such as paper and pulp, exposes it to market fluctuations and supply chain disruptions.

+ 12 consecutive years paying and growing their dividends while maintaining a low payout ratio

+ Dividend grew 14.69% in the past 5 years!

MAA – Mid-America Apartment Communities, Inc.

Mid-America Apartment Communities owns 101,986 apartment units, including those currently in development, across 16 states and Washington D.C. Their primary markets are:

Mid-America Apartment Communities owns 101,986 apartment units, including those currently in development, across 16 states and Washington D.C. Their primary markets are: the Southeast, Southwest and Mid-Atlantic regions of the United States.

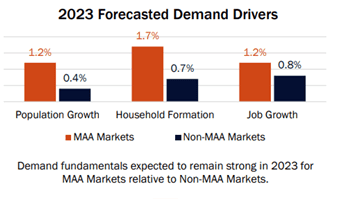

+ strong balance sheet and pays a well-covered and growing dividend.

+ Higher Population growth, Household Formation and Job growth in MAA Markets contributes to the company’s strong financial situation.

+ Higher interest rates benefit MAA by pricing out buyers from single-family homes, increasing demand for their apartment communities.

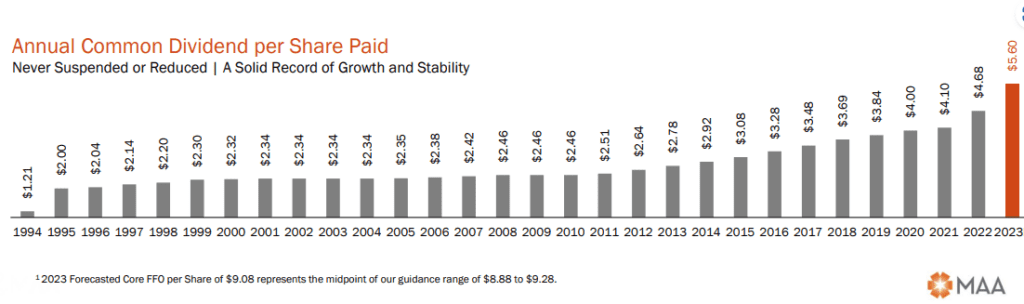

+ 12 consecutive years paying and growing their dividends while maintaining a low payout ratio.

+ Dividend grew 8.13% in the past 5 years!

CINF – Cincinnati Financial Corporation

Cincinnati Financial Corporation and its subsidiaries offer property casualty insurance products in the United States. The company operates through five segments: Commercial Lines Insurance, Personal Lines Insurance, Excess and Surplus Lines Insurance, Life Insurance, and Investments.

+ Dividend King stock with 62 consecutive years of dividend growth.

+ As interest rates rose, the stock market declined, which had a significant impact on Cincinnati’s stock portfolio. This downward trend in the stock market led to a noticeable decrease of 21% in total revenues compared to the same period in the previous year. However, it’s important to note that these losses are currently unrealized. When the market regains its strength and the portfolio’s investments appreciate in value, Cincinnati stands to benefit from the rebound, potentially offsetting the previous losses and generating positive returns.

+ Dividend grew 6.79% in the past 5 years!

Investing in dividend-paying stocks

Regarding dividend investing, investors understand the significance of selecting the right stocks. Those seeking a reliable and growing income stream prioritize stocks with a solid history of increasing dividends annually. This article explores the importance of investing in such dividend stocks and highlights four top picks currently trading near their 52-week lows.

Consistent Income Growth:

Dividend stocks with a consistent track record of increasing dividends provide investors with a relatively safe income stream.

Long-Term Wealth Generation:

Dividend growth stocks have proven to be excellent vehicles for long-term wealth generation. Investors can harness the power of compounding returns by reinvesting dividends or selectively deploying the cash flow into other investments. Over time, this compounding effect significantly boosts overall portfolio returns.

Stability and Resilience:

Companies that consistently increase dividends often exhibit stability and resilience in their business operations. These companies typically possess strong fundamentals, solid financial health, and sustainable growth prospects. Investing in dividend stocks with a solid track record helps investors mitigate risks associated with volatile market conditions.

Signal of Company Health:

Dividend increases year after year serve as positive signals of a company’s confidence in its prospects and financial strength. Consistently raising dividends reflects a company’s commitment to shareholder value, which signifies earnings growth and cash flow stability. Dividend growth becomes a valuable measure of a company’s health and long-term sustainability.