The DJQ1100, also known as the Desjardins Investment Savings Account – Series F, is an interesting savings solution for investors who want to maximize the security of their capital while maintaining great flexibility. In this article, we’ll explore why this product can be a great choice for investors looking to balance yield, security, and liquidity.

Why choose DJQ1100?

The DJQ1100 offers a unique combination of advantages, positioning it as a powerful tool for different investor profiles.

First of all, the DJQ1100 guarantees optimal security. Deposits in this account are insured by the Autorité des marchés financiers (AMF), which guarantees the protection of the capital invested. This feature makes this product an ideal choice for conservative investors who want to minimize risk.

Secondly, this account offers full liquidity. Funds are available at any time, with no lock-in period or withdrawal fees. This flexibility makes it particularly useful for short-term financial needs or in the event of unforeseen events.

In addition, the interest rates offered by the DJQ1100 are competitive. The return is calculated daily and paid monthly, ensuring steady and predictable capital growth.

In addition, this product does not have any fees. Unlike some mutual funds or guaranteed investment certificates (GICs), the DJQ1100 has no management or service fees, maximizing returns for investors.

Finally, the DJQ1100 is very accessible. A minimum initial investment of only $1,000 is required, making it affordable for a wide audience of investors. This accessibility, combined with other benefits, makes the DJQ1100 an attractive and versatile savings solution.

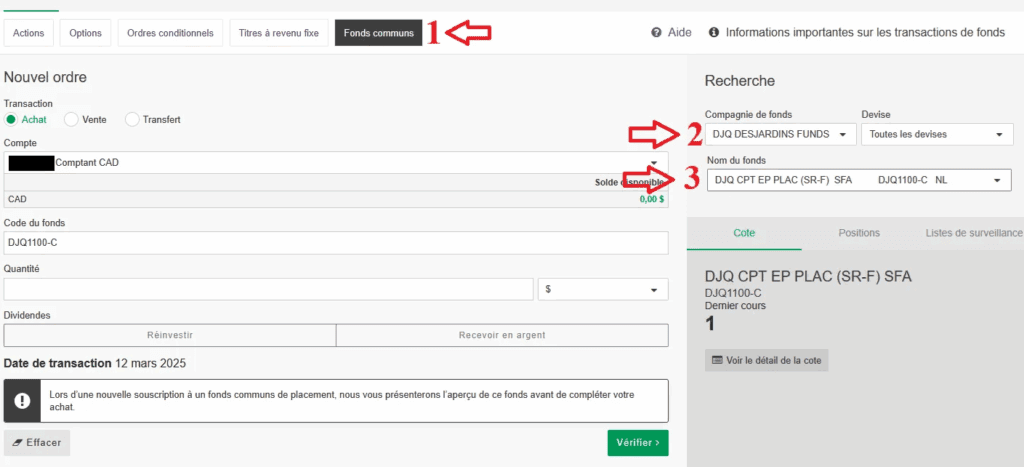

How to buy a Desjardins mutual fund (DJQ1100-C) step by step on your online broker

Step 1: Choose the “Mutual Funds” tab

- In the navigation bar (at the top), click on Mutual funds (arrow 1).

- This opens the form to place an order.

Step 2: Select the fund company

- In the menu on the right, select the fund company (e.g. DJQ DESJARDINS FUNDS) (arrow 2).

- You can also select the currency if necessary.

Step 3: Choose the fund

- In the “Fund name” field, select the desired fund (in this case, DJQ CPT EP PLAC (SR-F) SFA, code DJQ1100-C) (arrow 3).

- The fund code is automatically entered in the central section (“Fund Code”).

Step 4: Enter the transaction details

- Make sure that the Buy option is checked (top left).

- Choose your account (e.g. “CAD Cash”).

- Enter the amount in CAD or the quantity of units you want to buy.

- Choose what you want to do with the dividends : reinvest or receive cash.

Step 5: Verification and confirmation

- Checks the transaction date (example: March 12, 2025).

- Click on Check (green button at the bottom right).

- You will have an overview of the transaction before confirming the purchase.

Ideal investor profile

The DJQ1100 is designed for investors who:

Prioritize security: Ideal for protecting capital while earning a reasonable return.

Want flexibility: Perfect for investors who may need to access their funds quickly.

Plan for the short or medium term: Useful for building an emergency fund or preparing short-term projects.

Comparison with other financial products

| Characteristics | DJQ1100 | GIC (Guaranteed Investment Certificate) | Mutual Funds |

| Security | Guaranteed by the AMF | Capital guarantee | No warranty |

| Accessibility of Holdings | Available at all times | Locked-in until maturity | Liquid but with possible fees |

| Yield | Competitive rates, paid monthly | Fixed, predictable | Variable, market-dependent |

| Management fees | None | None | Often high |

| Investment horizon | Short to medium term | Short to medium term | Medium to long term |

Use Cases

1. Emergency Fund

The DJQ1100 is a great option for building an emergency fund thanks to its full liquidity and security. Investors can access them quickly when needed while enjoying a competitive return.

2. Transition to a long-term investment

If you’re waiting for the right time to invest in stocks or ETFs, DJQ1100 can serve as a temporary solution to grow your capital while waiting for an opportunity.

3. Short-term investment

For short-term projects like a trip, renovation, or major purchase, the DJQ1100 offers a stable return and easy access to funds.

Points to consider

Despite its many advantages, DJQ1100 has some limitations that investors should consider before committing.

First, yields are limited. While the product offers great security, the DJQ1100 does not offer the high returns that one might get with riskier investments, such as stocks or exchange-traded funds (ETFs). This is a trade-off to consider for those looking for maximum capital growth.

Secondly, this product does not promote long-term growth. The DJQ1100 is primarily designed to meet short- and medium-term needs. It is less suitable for investors who want to build wealth over several decades or maximize their long-term returns. As a result, investors looking for a sustainable and future-oriented solution may need to supplement this product with other investment options.

Summary table of benefits

| Benefits | Description |

| Security | Capital guaranteed by the AMF. |

| Flexibility | Full access to funds at any time, with no withdrawal fees. |

| Interest rate | Competitive, calculated daily and paid monthly. |

| No fees | No management or transaction fees. |

| Admissibility | Available for RRSPs, TFSAs and non-registered accounts. |

Conclusion

The DJQ1100 is a versatile financial product that offers security, flexibility and reasonable returns. It is ideal for conservative investors or those looking for a tool to manage short-term needs. However, for long-term growth objectives, it would be relevant to explore options such as ETFs or stocks.

If you’re looking for a balance between safety and return in the short term, DJQ1100 could be a smart choice. Don’t hesitate to consult a financial advisor to integrate this product into your overall strategy.