The Vanguard Growth ETF (VUG) stands as a prominent player in the world of exchange-traded funds, specifically designed to mirror the performance of the CRSP US Large Cap Growth Index. In this comprehensive exploration, we delve into the intricacies of VUG, examining its investment approach, expenses, sector exposure, top holdings, performance, and associated risks.

Investment Approach and Objectives

The Vanguard Growth ETF (VUG) utilizes a passively managed, full-replication approach to mirror the CRSP US Large Cap Growth Index, providing investors with exposure to significant growth stocks. Notably, the fund imposes distinctive limitations on 75% of its assets, avoiding concentrations exceeding 10% in any single issuer’s voting securities or 5% in total assets for that issuer. Launched in 2004 and sponsored by Vanguard, VUG has grown into one of the largest ETFs, amassing assets exceeding $91.84 billion. Focusing on large-cap companies with market capitalizations over $10 billion, VUG prioritizes stability and predictable cash flows. Its strategy aligns with the growth segment, emphasizing companies poised for above-average sales and earnings growth rates. This historical background and strategic approach position VUG as a substantial and preferred choice for investors seeking growth exposure within the dynamic landscape of the US equity market.

Expense Ratio and Cost Efficiency

One of the standout features of VUG is its remarkably low expense ratio of 0.04%. This cost efficiency sets it apart, especially when compared to the average expense ratio of similar funds, which stands at 0.96%. The significance of expense ratios in determining an ETF’s total return cannot be overstated, and VUG’s affordability positions it favorably for investors seeking long-term value.

In addition to the low expense ratio, VUG offers a 12-month trailing dividend yield of 0.61%, providing a potential income stream for investors. The combination of cost efficiency and a modest dividend yield enhances the overall appeal of the fund.

IAT ETF: Full review of iShares U.S. Regional Banks ETF

Sector Exposure and Top Holdings

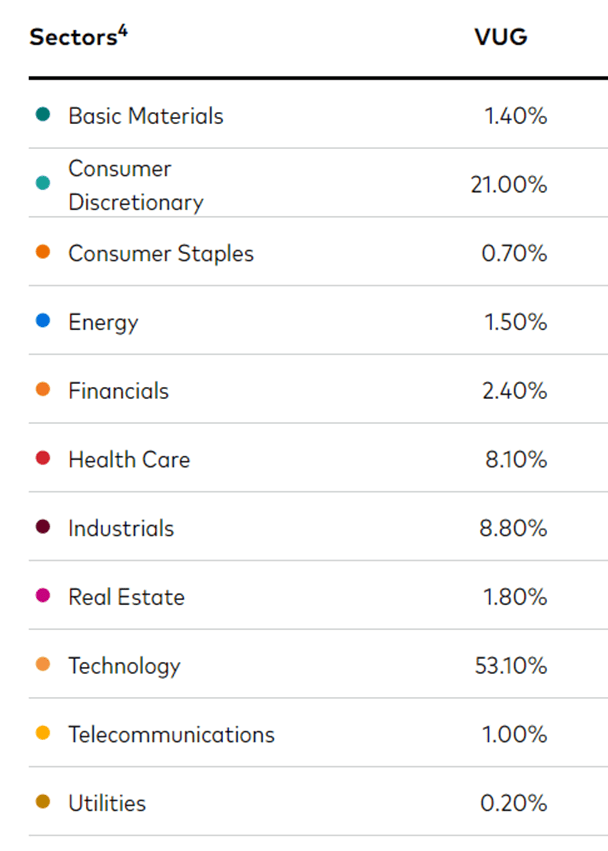

While ETFs inherently offer diversified exposure, a closer examination of a fund’s holdings provides valuable insights. VUG allocates a substantial portion of its portfolio to the Information Technology sector, accounting for about 42.60%. This sector dominance is reflective of the tech-driven nature of growth stocks in the current market landscape.

The top three sectors in VUG, after Information Technology, include Consumer Discretionary and Telecom. This sectoral diversification aims to minimize single-stock risk while capturing opportunities across different segments of the economy.

At an individual holdings level, VUG’s top three positions are occupied by Apple Inc. (AAPL), Microsoft Corp. (MSFT), and Amazon.com Inc. (AMZN). Apple, with approximately 13.64% of total assets, leads the pack, underscoring the fund’s exposure to influential and high-performing companies.

The top 10 holdings collectively represent about 51.08% of the total assets under management. They offer a snapshot of the fund’s concentration and highlighting the significance of these key players in driving VUG’s performance.

| Ticker | Holdings | % of fund |

| AAPL | Apple Inc. | 13.00 % |

| MSFT | Microsoft Corp. | 12.88 % |

| AMZN | Amazon.com Inc. | 6.33 % |

| NVDA | NVIDIA Corp. | 4.90 % |

| GOOGL | Alphabet Inc. Class A | 3.77 % |

| META | Facebook Inc. Class A | 3.43 % |

| GOOG | Alphabet Inc. Class C | 3.17 % |

| TSLA | Tesla Inc. | 2.78 % |

| LLY | Eli Lilly & Co. | 2.43 % |

VUG Historical performance

[stock_market_widget type=”table-quotes” template=”color-header-border” color=”#5679FF” assets=”VUG” fields=”symbol,ytd_return,three_year_average_return,five_year_average_return” display_header=”true” display_chart=”false” search=”false” pagination=”false” scroll=”false” rows_per_page=”5″ sort_direction=”asc” alignment=”left” api=”yf”]

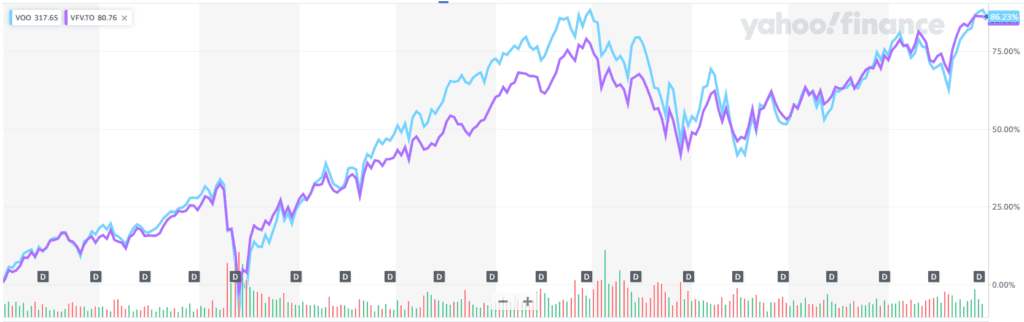

Performance and Risk Assessment

VUG’s primary objective is to replicate the performance of the CRSP U.S. Large Cap Growth Index before fees and expenses. The CRSP US Large Cap Growth Index serves as a benchmark, encompassing growth companies within the broader CRSP US Large Cap Index.

Growth stocks, as represented by VUG, typically exhibit higher sales and earnings growth rates. This positions them as attractive investments during strong bull markets. However, it’s essential for investors to acknowledge the inherent trade-off—while growth stocks offer the potential for higher returns, they also come with higher valuations and increased risk compared to other equity types.

The fund’s performance should be evaluated in the context of market conditions, considering the cyclical nature of growth stocks. In robust economic environments, growth stocks tend to outperform their counterparts. But, they may face challenges in less favorable market conditions.

Conclusion:

In conclusion, the Vanguard Growth ETF (VUG) presents investors with a cost-effective avenue to gain exposure to the CRSP US Large Cap Growth Index. Its passively managed approach, coupled with a remarkably low expense ratio. The fund is ideal for those seeking to align their portfolios with the performance of major growth stocks.

While the fund’s concentration in the Information Technology sector and top holdings like Apple, Microsoft, and Amazon underscores its growth-oriented nature. Investors should approach VUG with an awareness of the inherent risks associated with growth stocks.

- The Wheel Strategy: Generating Income with Options, Smart Spinning

- QYLD ETF Review: Global X Nasdaq-100 Covered Call ETF

- Apple Q2 2025 Earnings: Dividend Raised, $110B Buyback, But China Weakness Raises Questions

- Alphabet (GOOGL) Q1 2025 Earnings: Cloud Profits, First Dividend, and What It Means for Canadian Investors

- Review JEPQ: JPMorgan Nasdaq Equity Premium Income ETF

- VUN vs VOO: A Comprehensive Guide for Canadian Investors to Maximize U.S. Market Exposure

- Earn Passive Income Easily: The Covered Call Strategy with NVIDIA