HDIF (Harvest Diversified Monthly Income ETF) is a relatively new fund from Harvest ETFs (created on Feb 2022). It’s a covered call ETF and its main target audience are income/dividend investors. In this post, we will be reviewing the fund’s objective, fees and performance so far.

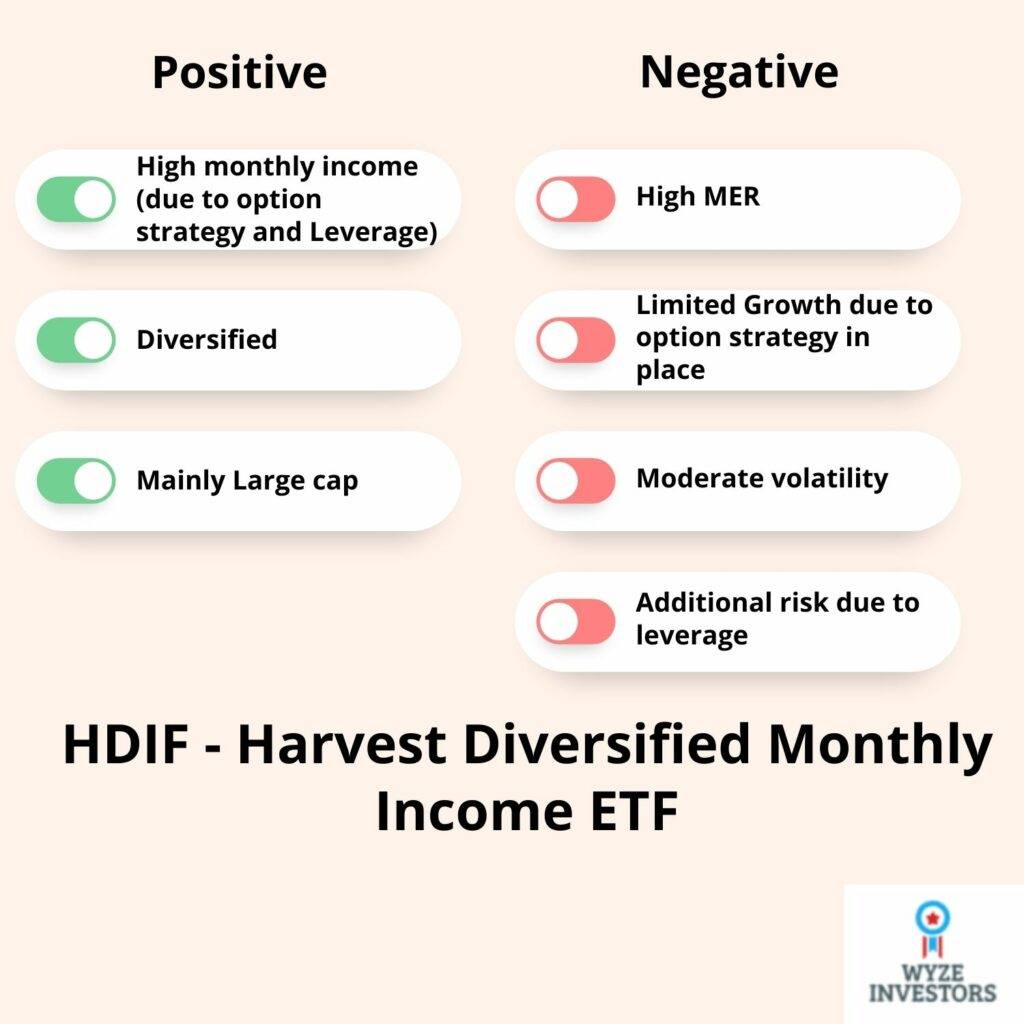

Executive Summary

Fund Objective

Harvest Diversified Monthly Income ETF operates as a fund of funds, meaning this ETF invests in other ETFs to offer investors diversification across various sectors of the economy, including Healthcare, Global Brands, Technology, Utilities, and US Banks. The primary objective of HDIF is to deliver a higher yield than traditional dividend ETFs through the utilization of a covered call strategy.

With a covered call strategy, investors not only receive dividends but also earn premiums when the fund issues covered calls. In total, the fund provides an appealing dividend yield, typically exceeding 9%. The fund managers aim to maintain a ‘target yield’ of 8.5%, and thus far, dividends have been consistently distributed on a monthly basis at the targeted rate.

It’s important to note that all the funds comprising HDIF are covered call ETFs offered by Harvest.

| Ticker | ETF Name |

|---|---|

| HTA | Harvest Tech Achievers Growth & Income ETF |

| HBF | Harvest Brand Leaders Plus Income ETF |

| HLIF | Harvest Canadian Equity Income Leaders ETF |

| HHL | Harvest Healthcare Leaders Income ETF |

| HUTL | Harvest Equal Weight Global Utilities Income ETF |

| HUBL | Harvest US Bank Leaders Income ETF |

| TRVI | Harvest Travel & Leisure Income ETF |

Here are some additional key details about HDIF:

Quarterly Portfolio Reconstitution and Rebalancing:

The fund’s portfolio undergoes reconstitution and rebalancing at least once every quarter. This process helps ensure that the fund’s holdings remain aligned with its investment objectives.

Covered Call Strategy on Up to 33% of Equity Securities:

HDIF applies a covered call strategy to a portion of the equity securities held in its underlying portfolios. Specifically, this strategy is employed on up to 33% of each equity security, allowing the fund to potentially enhance its returns through covered call options while managing risk.

Video

- Best US Dividend ETFs in Canada (2023)!

- Review of VDY – Vanguard FTSE Canadian High Dividend Yield Index

Can you lose money on a Covered Call ETF?

Covered call ETFs can be characterized by their inherent volatility, and their returns are intricately tied to the performance of the underlying asset. While these ETFs often provide generous dividends, it’s crucial to recognize that a lackluster performance in the ETF’s price can potentially negate these benefits. Therefore, the preferred strategy for investing in these types of ETFs is typically a long-term approach. In the context of a robust bull market, where the price of the underlying stock surpasses the strike price plus the option premium, the covered call writer may find themselves underperforming.

Nevertheless, covered call writers can expect to outperform in scenarios where they earn the option premium, particularly when compared to merely holding the stock in markets that are flat, decreasing, or experiencing only mild increases. This is because the option premium provides an additional income source that can cushion the impact of market fluctuations and potentially enhance overall returns, especially when market conditions are less favorable.

| Covered call strategy | |

| Bull Market | lags in terms of performance |

| Modest Bull Market | Outperforms the index |

| Volatile market (frequent ups and downs) | Outperforms the index |

| Beat market | Outperforms the index |

Quick summary: HDIF ETF review

This investment offers a compelling combination of benefits, including the potential for higher monthly income through its covered call strategy, diversification to spread risk across various assets or sectors, and access to 25% leverage at institutional rates, which come at a cost lower than that of retail margin accounts.

HDIF ETF Review: MER

The management expense ratio is 1.98%.

HDIF vs HDIV

Comparing HDIF by Harvest to HDIV by Hamilton, these two ETFs share striking similarities. Both employ a diversified approach and utilize the covered call strategy along with 25% leverage. However, their composition differs significantly. HDIF exclusively holds six ETFs issued by Harvest, while HDIV comprises seven covered call ETFs from various issuers, including BMO, Horizons, and Harvest, among others. As both funds are relatively new, it’s premature to declare a clear winner in this comparison. It’s worth noting that HDIV has not yet disclosed its Management Expense Ratio (MER), but given its diverse holdings from various issuers, one might anticipate a higher MER compared to HDIF.

These two ETFs are very similar. Both are diversified and use the covered call strategy with 25% leverage. HDIF hold 6 ETFs all issued by Harvest, whereas HDIV holds 7 covered call ETFs from various issuers (BMO, Horizons, Harvest…etc). It’s too soon to establish a winner here, since both funds are relatively new.

HDIV did not yet publish their MER. But since the fund is made up of funds owned by various issuers, one would expect the MER to be much higher than HDIF.

How profitable are covered call ETFs?

Covered call ETFs gained widespread popularity due to their attractive high dividend yields. Fund managers often market these products as offering a high yield and low volatility alternative to direct exposure to popular market indexes like the NASDAQ or S&P 500, as well as highly volatile sectors such as Gold or Oil. While these claims hold true to some extent, it’s crucial to recognize a significant drawback associated with the covered call strategy: it tends to underperform the tracked index significantly during bullish market conditions. Therefore, investors seeking substantial growth may find the covered call strategy disappointing.

In our view, HDIF can cater to a diverse range of investors:

It can serve as a tactical option during market corrections for growth-oriented investors, potentially offering opportunities for strategic plays.

For conservative buy-and-hold investors, it provides a means of earning income, offering a steady source of dividends and aligning with a conservative investment approach.

HDIF Dividends yield and Price performance

| Inception Date | Feb 11th, 2022 |

| ETF | Div Yield |

|---|---|

| HDIF | 10.91% |

HDIF pays a monthly dividend.

| ETF | 1M %Chg | 3M %Chg | 1yr |

|---|---|---|---|

| HDIF | -1.19% | -2.23% | 4.26% |

HDIF ETF review: Dividend distribution

| Amount | Ex-Div Date | Record Date | Pay Date |

|---|---|---|---|

| 0.0708 | 6/29/2023 | 6/30/2023 | 7/7/2023 |

| 0.0708 | 5/30/2023 | 5/31/2023 | 6/9/2023 |

| 0.0708 | 4/27/2023 | 4/28/2023 | 5/9/2023 |

| 0.0708 | 3/30/2023 | 3/31/2023 | 4/6/2023 |

| 0.0708 | 2/27/2023 | 2/28/2023 | 3/9/2023 |

| 0.0708 | 1/30/2023 | 1/31/2023 | |

Sector allocation

| Sector | % Allocations |

|---|---|

| Financial Services | 31.8% |

| Healthcare | 21.8% |

| Technology | 23.4% |

| Comm. Services | 15.0% |

| Utilities | 13.7% |

HDIF ETF review: Portfolio

Asset Class

| US Equity | 63.5% |

|---|---|

| CDN Equity | 50.4% |

| Int’l Equity | 13.0% |

Prefer – HDIF Over HYLD – due to no focused concentration to (gold or energy producers)

Eliminates bust &boom cycles

I agree with you!