JEPI vs JEPQ: Which ETF is the Best Investment for You?

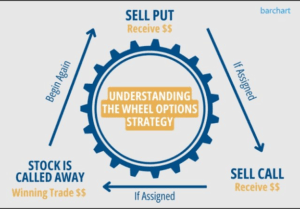

Executive summary JEPI and JEPQ are two leading income-focused ETFs using covered call strategies, but they serve different investors. JEPI […]

JEPI vs JEPQ: Which ETF is the Best Investment for You? Read More »