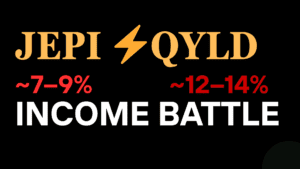

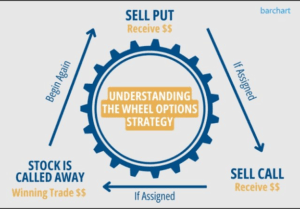

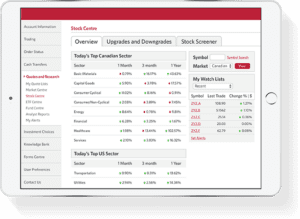

Can $200,000 Generate $1,000 per Month? 3 Structured Income Strategies for Canadian Investors

For many Canadian investors, $200,000 represents a significant milestone. The natural question becomes: Can this amount realistically generate $1,000 per […]