For Canadian investors focused on maximizing income, covered call ETFs have become some of the most popular investment choices. Many of these funds now manage billions of dollars in assets, showing just how much demand there is for predictable cash flow.

But what makes them so attractive for income seekers?

1. High Dividend Yields

Covered call ETFs generate extra income by selling call options on their holdings. The premiums collected can significantly boost distributions, often resulting in yields much higher than traditional dividend ETFs.

2. Smoother Ride (Lower Volatility)

The covered call strategy is designed to provide more stability. By selling upside potential in exchange for income, these ETFs tend to be less volatile than holding the underlying stocks directly.

3. Reliable Passive Income

If your main objective is to earn high monthly or quarterly distributions, covered call ETFs can be an appealing choice. They’re especially popular among retirees and income-focused investors who prioritize cash flow over long-term growth.

⚠️ Important Trade-off: The high yields come at a cost—limited capital appreciation. Because the upside is capped when call options are exercised, these ETFs usually underperform in strong bull markets.

What We’ll Cover in This Post

In this article, we’ll go beyond theory and look at the most popular covered call ETFs in Canada. We’ll break them down into two categories:

Diversified Income ETFs – funds that provide broad exposure across sectors while still generating high income.

Sector-Specific Covered Call ETFs – funds that focus on one sector (like banks, energy, or tech) and use covered calls to maximize income from those industries.

Finally, we’ll highlight our top picks in each category, so you can see which covered call ETFs may fit best into your portfolio.

Executive summary

List of Best Covered Call ETF in Canada

Performance and dividend yield comparison

| Yield / Performance | 1 Yr | 3 Yrs | 5 Yrs | |

| ZWB | 5.56% | 27.69% | 15.66% | 14.43% |

| ZWC | 5.93% | 17.49% | 11.69% | 12.27% |

| ZWP | 6.32% | 20.18% | 14.73% | 11.53% |

| ZWH | 5.97% | 5.73% | 9.44% | 10.97% |

| ZWK | 6.71% | 6.19% | 7.52% | 10.04% |

| HTA | 8.91% | 8.15% | 24.43% | 16.02% |

| HBF | 7.22% | 14.08% | 11.09% | 9.49% |

| HDIF | 9.97% | 7.94% | 12.99% | na |

| HDIV | 10.02% | 28.86% | 21.01% | na |

| HMAX | 12.56% | 21.99% | na | na |

| HYLD | 11.78% | 19.45% | 20.78% | na |

as of December 22nd 2025 – Source Yahoo finance – Performance = Total return incl. Dividends

Best Diversified Covered Call ETFs

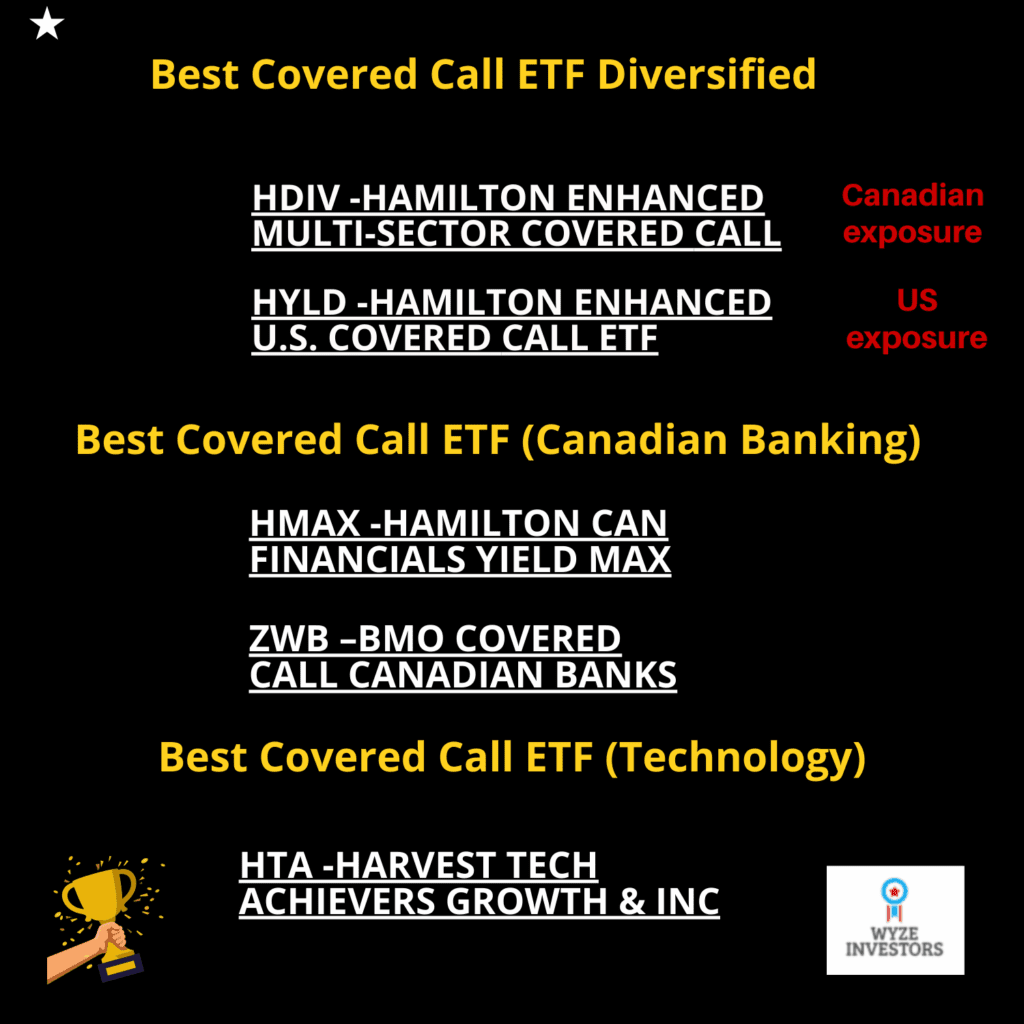

HDIV (Hamilton Enhanced Multi-Sector Covered Call)

Among the diversified funds, HDIV (Hamilton Enhanced Multi-Sector Covered Call) really stands out. It invests in seven different sector ETFs and adds modest leverage (25%) to enhance both yield and performance. With a 10.02% yield and the best 3-year total return in the group (28.86%), HDIV remains the strongest all-around option for investors who want high monthly income without betting on a single sector.

For those seeking U.S. exposure, HYLD (Hamilton Enhanced U.S. Covered Call) deserves attention. It focuses entirely on U.S. covered call ETFs and, like HDIV, uses 25% leverage. The result is a very attractive 11.78% yield and a strong 3-year total return of 19.45% (with 20.78% over 5 years). This makes HYLD a convenient way for Canadians to tap into U.S. income opportunities without having to piece together multiple funds.

HYLD (Hamilton Enhanced U.S. Covered Call)

HDIF (Harvest Diversified Monthly Income) plays a similar role but without leverage. It’s built as a “fund-of-funds,” spreading investments across banks, utilities, technology, healthcare, and global brands. Its yield remains close to double-digits at 9.97%, and it posted a 3-year total return of 7.94% (5-year data not available). For more conservative income seekers, HDIF can offer peace of mind thanks to a diversified structure and monthly distributions.

ZWC (BMO Canadian High Dividend Covered Call)

If you prefer a purely Canadian option, ZWC (BMO Canadian High Dividend Covered Call) remains a reliable choice. With a 5.93% yield and steady total returns (17.49% over 1 year and 12.27% over 5 years), it offers broad Canadian exposure with a covered call overlay designed to smooth volatility. It won’t match the yield of HDIV or HYLD, but it can be a more conservative, Canadian-focused core income holding.

Finally, HBF (Harvest Brand Leaders Plus Income) offers something different: exposure to global “top brands” combined with a covered call strategy. With a 7.22% yield and a solid 3-year total return of 14.08% (and 9.49% over 5 years), it’s attractive for investors who want blue-chip global exposure while still receiving monthly income.

Verdict – Diversified ETFs (Updated):

Best overall: HDIV, thanks to top-tier diversification and the strongest 3-year performance (28.86%) alongside a 10.02% yield.

Best U.S. play: HYLD, for high monthly income (11.78% yield) plus strong multi-year returns (19.45% / 3Y; 20.78% / 5Y).

Best conservative Canadian core: ZWC, lower yield but steady long-term profile (12.27% / 5Y) and Canadian exposure.

Best Sector-Focused Covered Call ETFs

For investors who want to concentrate on specific industries, banks and technology continue to dominate the sector ETF space.

ZWB (BMO Covered Call Canadian Banks) remains the benchmark. It’s the most established bank covered call ETF built on Canada’s Big Six. With a 5.56% yield and an excellent 3-year total return of 15.66% (and 14.43% over 5 years), ZWB continues to be a strong core option for investors who want Canadian bank exposure with smoother volatility and consistent income.

For those prioritizing maximum cash flow, HMAX (Hamilton Enhanced Canadian Bank ETF) remains hard to beat. Its 12.56% yield is among the highest in the category, supported by aggressive call-writing and leverage. Performance data shows a strong 1-year total return of 21.99% (longer-term data not available). The trade-off remains the same: higher yield usually comes with higher strategy risk and less long-term upside capture.

On the technology side, HTA (Harvest Tech Achievers) remains one of the best “growth + income” covered call ETFs. Even with call-writing capping part of the upside, it has delivered an impressive 5-year total return of 16.02%, while still yielding 8.91%. For investors who want exposure to tech leaders but prefer more stability and monthly income, HTA continues to stand out.

Lastly, ZWK (BMO Covered Call U.S. Banks) provides targeted U.S. financial exposure. With a 6.71% yield, total returns are more modest (6.19% over 1 year, 7.52% over 3 years, 10.04% over 5 years). It can still be useful as a complement for investors who want U.S. bank diversification, but it has lagged Canadian bank options over the last few years.

Verdict – Sector ETFs (Updated):

Best Canadian bank play: ZWB for stability and long-term track record (14.43% / 5Y).

Best high-yield bank play: HMAX for maximum monthly income (12.56% yield) with strong recent performance (21.99% / 1Y).

Best technology play: HTA for a strong blend of income (8.91% yield) and long-term performance (16.02% / 5Y).

📘 Get your free guide to start investing

Includes 4 passive growth portfolios

Final Takeaways

If you want maximum yield, look at HMAX, HYLD, and HDIV, but be aware they rely on leverage and/or more aggressive call-writing.

If you want stability and Canadian exposure, ZWC and ZWB remain solid choices with more moderate yields.

If you want long-term growth with income, HTA and HDIV stand out based on the updated multi-year performance data.

📌 A practical approach for Canadian income investors is to blend diversified funds (HDIV, HYLD, ZWC) with sector-focused ETFs (ZWB, HMAX, HTA) to combine monthly cash flow, diversification, and exposure to sectors that tend to drive returns.

Dividend frequency: Best Covered Call ETF Canada

| Frequency | |

| ZWB | Monthly |

| ZWC | Monthly |

| ZWP | Monthly |

| ZWH | Monthly |

| ZWK | Monthly |

| HTA | Monthly |

| HBF | Monthly |

| LIFE | Monthly |

| HDIF | Monthly |

| HDIV | Monthly |

| HMAX | Monthly |

Review of UMAX: Hamilton Utilities Yield Maximizer ETF (13% Target yield)

How had Covered call ETF’s performed historically?

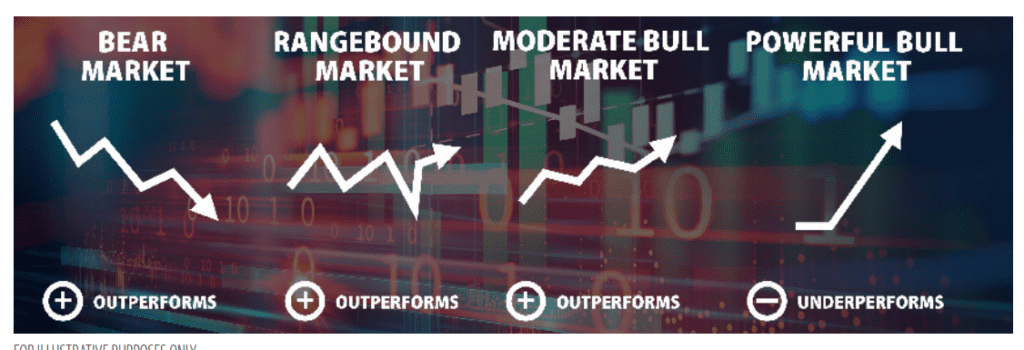

In historical contexts characterized by bear markets, range-bound markets, and moderate bull markets, a covered call strategy has typically demonstrated the ability to outperform its underlying securities. However, during robust bull markets, when the underlying securities experience frequent rises beyond their strike prices, covered call strategies have historically exhibited slower growth. Nevertheless, even in these bullish phases, investors typically realize moderate capital appreciation alongside the accrual of dividends and call premiums.

How writing a call option works?

Options make it possible to hedge a possible decline in a security and thus limit its loss through a gain on the option. To apply this hedging strategy, you have to take a short position on a call option, in other words sell a call.

The sale of calls achieves two objectives:

· Set the sale price of these securities (exercise price) and therefore set an acceptable loss.

· Collect a premium, i.e. additional income, or limit losses if the strike price is reached.

The option seller will be obligated to deliver the securities if exercised at the price fixed in advance. In this case the market will have evolved contrary to these expectations, it will have appreciated. The option investor will sell his securities for less than the market price.

Covered call options protect against downside risk. This being said, the covered call strategy provides limited downside protection. Also, when you write a covered call, you give up some of the stock’s potential gains. Covered call ETFs will tend to have a higher yield and a lower performance.

Popular Covered Call ETFs in Canada

| ETF | Focus / Objective | Sectors / Geography | Investor Appeal |

|---|---|---|---|

| ZWB – BMO Covered Call Canadian Banks | Canadian banks + call premiums | 100% Canadian Big 6 banks | Stable, income-focused play on Canadian banks |

| ZWC – BMO Canadian High Dividend CC | Broad Canadian high dividend portfolio | Financials & Energy = ~53% | Conservative, tax-efficient, steady monthly income |

| ZWP – BMO Europe High Dividend CC | European dividend payers + options | Switzerland, Germany, UK, France | Diversifies income outside North America |

| ZWH – BMO U.S. High Dividend CC | U.S. large-cap dividend names | Broad U.S. exposure, ~23% Tech | U.S. exposure with yield + lower volatility |

| ZWK – BMO Covered Call U.S. Banks | U.S. banking sector | 100% U.S. banks (~38 names) | Higher yield (~6%), targeted U.S. financials |

| HTA – Harvest Tech Achievers | Global tech leaders + covered calls | Heavy in semis + software | Tech growth exposure with reduced volatility |

| HBF – Harvest Brand Leaders | 20 global “top brands” | ~20% Financials, 20% Tech, 15% Comm. Services | Blue-chip global exposure, monthly distributions |

ZWB – BMO Covered Call Canadian Banks

The ZWB aims to provide exposure to a portfolio of dividend-paying securities (Canadian Banks), while collecting premiums related to call options. The portfolio is chosen on the basis of the criteria below:

• dividend growth rate; • yield; • payout ratio and liquidity.

ZWB holdings

| Name | Weight |

| BMO Equal Weight Banks ETF | 27.2% |

| Bank of Montreal | 12.9% |

| Canadian Imperial Bank of Commerce | 12.7% |

| Royal Bank of Canada | 12.1% |

| National Bank of Canada | 11.9% |

| The Toronto-Dominion Bank | 11.9% |

| Bank of Nova Scotia | 11.4% |

ZWC –BMO CDN High Div Covered Call

The BMO Canadian High Dividend Covered Call ETF (ZWC) has been designed to provide exposure to a dividend focused portfolio, while earning call option premiums. The underlying portfolio is yield-weighted and broadly diversified across sectors.

The fund selection methodology uses 4 factors: – Liquidity; – Dividend growth rate; – Yield and payout ratio.

ZWC is an excellent option for conservative investors looking for a steady income and low volatility. It’s tax-efficient because the dividends are all coming from Canadian companies. The financial sector and Energy represents 53% of the total overall sector allocation.

ZWC ETF Holdings

| Company Name | Allocation |

|---|---|

| Canadian National Railway Co | 5.4% |

| BCE Inc | 5.2% |

| TELUS Corp | 5.1% |

| Enbridge Inc | 5.0% |

| Royal Bank of Canada | 5.0% |

| Canadian Imperial Bank of Commerce | 4.9% |

| Bank of Nova Scotia | 4.7% |

| The Toronto-Dominion Bank | 4.6% |

| Manulife Financial Corp | 4.3% |

ZWP – BMO Europe High Dividend Covered Call ETF

The BMO Europe High Dividend Covered Call ETF (ZWP) has been designed to provide exposure to a dividend focused portfolio. These dividend paying companies are selected based on:

- dividend growth rate,

- yield,

- payout ratio and liquidity.

ZWP Dividend ETF Holdings

| Company Name | Allocation |

|---|---|

| Roche Holding AG | 4.0% |

| Nestle SA | 4.0% |

| Novartis AG | 4.0% |

| GlaxoSmithKline PLC | 4.0% |

| Sanofi SA | 3.8% |

| TotalEnergies SE | 3.7% |

| Unilever PLC | 3.7% |

| Enel SpA | 3.7% |

Geographic allocation

| Countries | Weight |

| Switzerland | 23.66% |

| Germany | 24.24% |

| United Kingdom | 18.76% |

| France | 16.72% |

| Other (multiple countries) | 16.62% |

Sector allocation

| Type | Fund |

| Information Technology | 6.22 |

| Industrials | 12.18 |

| Consumer Discretionary | 11.56 |

| Consumer Staples | 11.78 |

| Health Care | 16.56 |

| Financials | 14.79 |

| Materials | 9.48 |

| Communication | 8.10 |

| Energy | 3.89 |

| Utilities | 3.66 |

ZWH – BMO US High Dividend Covered Call ETF

ZWH has been designed to provide exposure to a dividend focused portfolio, while earning call option premiums. The underlying portfolio is yield-weighted and broadly diversified across sectors. The Fund utilizes a rules-based methodology that considers the following criteria:

dividend growth rate,

yield,

payout ratio,

liquidity.

ZWH Dividend ETF Holding

| Company Name | Allocation |

|---|---|

| Apple Inc | 4.2% |

| Microsoft Corp | 4.2% |

| Coca-Cola Co | 4.1% |

| AbbVie Inc | 4.1% |

| The Home Depot Inc | 4.1% |

| Procter & Gamble Co | 4.1% |

| Pfizer Inc | 4.0% |

Geographic allocation

| Country | Fund |

| USA | 100.0% |

Sector allocation

| Sector | Fund |

| Information Technology | 22.61% |

| Industrials | 8.39% |

| Consumer Discretionary | 10.06% |

| Health Care | 12.40% |

| Financials | 15.50% |

| Materials | 4.36% |

| Communication | 9.58% |

| Consumer Staples | 7.35% |

| Energy | 3.86% |

| Utilities | 3.84% |

| Real estate | 2.05% |

Please consult issuers’ website for up-to-date figures

ZWK -BMO Covered Call US Banks

The BMO Covered Call U.S. Banks ETF (ZWK) is professionally managed by BMO Global Asset Management. The fund has been designed to provide exposure to a portfolio of U.S. banks while earning call option premiums.

The fund invests in 38 US Banks. It’s ideal for investors looking for dividend income. The dividend yield on November 24th was 6.19%!

The fact that the fund uses call options accomplishes two things:

- increases the dividend yield;

- reduces volatility but also growth potential. So, it’s something to keep in mind.

| Weight (%) | Name |

|---|---|

| 5.86% | SIGNATURE BANK/NEW YORK NY |

| 5.58% | CITIZENS FINANCIAL GROUP INC |

| 5.55% | REGIONS FINANCIAL CORP |

| 5.52% | AMERIPRISE FINANCIAL INC |

| 5.52% | M&T BANK CORP |

| 5.46% | SVB FINANCIAL GROUP |

| 5.43% | KEYCORP |

| 5.41% | TRUIST FINANCIAL CORP |

| 5.40% | FIFTH THIRD BANCORP |

| 5.38% | BMO EQUAL WEIGHT US BANKS INDEX ETF |

HTA -Harvest Tech Achievers Growth & Income

HTA is an ETF that invests in an equally weighted portfolio of 20 large-cap technology companies (globally). In order to generate an enhanced monthly distribution yield, an active covered call strategy is engaged.

Covered call strategies are great as they generate additional income for investors (in the form of premiums). The strategy is somewhat conservative and aims at preserving the capital invested primarily. On the other hand, the strategy limits potential growth.

| Name | Weight | Sector |

|---|---|---|

| NVIDIA Corporation | 6.9% | Semiconductors |

| Advanced Micro Devices, Inc. | 6.5% | Semiconductors |

| QUALCOMM Inc | 6.5% | Semiconductors |

| Intuit Inc. | 5.5% | Software |

| Apple Inc. | 5.3% | Technology Hardware |

| Applied Materials | 5.2% | Semiconductors |

| Keysight Technologies | 5.2% | Electronic Equipment |

| Broadcom Inc. | 5.1% | Semiconductors |

| Microsoft Corp | 5.1% | Software |

| Adobe Inc. | 5.0% | Software |

HBF – Harvest Brand Leaders Plus Income

HBF is an equally weighted portfolio of 20 large companies selected from the world’s Top 100 Brands. The ETF is designed to provide a consistent monthly income stream with an opportunity for growth. In order to generate an enhanced monthly distribution yield, an active covered call strategy is engaged.

HBF Holding details

| Company Name | Allocation |

|---|---|

| JPMorgan Chase & Co | 5.4% |

| Royal Dutch Shell PLC ADR Class A | 5.3% |

| McDonald’s Corp | 5.3% |

| Alphabet Inc Class A | 5.2% |

| Microsoft Corp | 5.2% |

| Citigroup Inc | 5.1% |

| The Walt Disney Co | 5.1% |

HBF Sector breakdown

| Sector | % Allocation |

|---|---|

| Financial Services | 20.2% |

| Technology | 20.1% |

| Comm. Services | 15.3% |

HDIF -Harvest Diversified Monthly Income ETF

HDIF is a relatively new fund from Harvest ETFs (created on Feb 2022). It’s a covered call ETF and its main target audience are income/dividend investors.

HDIF is a fund of funds. It means this ETF invests in other ETFs to provide investors with diversification across various sectors of the economy ( Healthcare, Global Brands, Technology, Utilities, and US Banks). The primary objective is to provide a higher yield than traditional dividend ETFs by using a covered call strategy.

Additional facts about HDIF:

– The portfolio is reconstituted and rebalanced quarterly (minimum);

– The covered call strategy is applied on up to 33% of each equity securities held in underlying portfolios.

Sector allocation

| Sector | % Allocations |

|---|---|

| Financial Services | 31.8% |

| Healthcare | 21.8% |

| Technology | 23.4% |

| Comm. Services | 15.0% |

| Utilities | 13.7% |

HDIF ETF review: Portfolio

| ETF | Allocation |

|---|---|

| HUTL Harvest Equal Weight Glbl Utilts Inc | 20.5 |

| HHL Harvest Healthcare Leaders Inc | 20.3 |

| HBF Harvest Brand Leaders Plus Inc | 20.7 |

| HUBL Harvest US Bank Leaders Income Cl A | 20.7 |

| HTA Harvest Tech Achievers Gr&Inc | 20.7 |

| HLIF Harvest Canadian Equity Income Leaders ETF | 23.3 |

| Cash and other Liabilities | (26.2) |

Please visit issuers’ website for most up-to-date data

HDIV -Hamilton Enhanced Multi-Sector Covered Call

HDIV is a passive covered call ETF. It’s ideal for investors who seek high dividend income and low volatility. HDIV invests in a basket of 7 covered call & sector focus ETFs. The fund manager uses also cash leverage of 25% to enhance yield and growth potential. The index tracked is The Solactive Multi-Sector Covered Call ETFs Index TR x 1.25.

The ETFs held within HDIV invest primarly in large corporations. In addition to using the covered call strategy, the funds ensure diversification of your investments across various sectors. See below the list of the 7 ETFs that make up HDIV:

| HEP – Horizons Enhanced Income Gold Producers |

| NXF – CI Energy Giants Covered Call |

| ZWU – BMO Covered Call Utilities |

| HHL – Harvest Healthcare Leaders Income |

| FLI – CI U.S. & Canada Lifeco Income |

| ZWB – BMO Covered Call Canadian Banks |

| HTA – Harvest Tech Achievers Growth & Income |

All the funds that make up HDIV are covered call ETFs offered by various issuers such as: Harverst, BMO, CI Financial and Horizons.

Video HDIV overview

HMAX – Hamilton Canadian Financials Yield Maximizer

HMAX ETF is a new fund offered by Hamilton ETF. The fund invests in the Canadian banking sector. This fund aims to provide an attractive dividend yield (target 13%) using a covered call strategy. The strategy consists of writing call options on (50% of the portfolio) to collect premiums and maximize monthly distributions.

HMAX ETF Holdings

| NAME | WEIGHT |

| Royal Bank of Canada | 23.1% |

| Toronto-Dominion Bank | 20.5% |

| Bank of Montreal | 11.5% |

| Bank of Nova Scotia | 10.5% |

| Brookfield Corp | 10.0% |

| Canadian Imperial Bank of Commerce | 6.7% |

| Manulife Financial | 6.0% |

| Sun Life Financial | 4.8% |

| Intact Financial | 4.1% |

| National Bank of Canada | 4.1% |

HMAX ETF sector allocation

█ Asset Management 10.0%

█ Banks 76.4%

█ Insurance 14.9%

Video

HYLD – Hamilton Enhanced U.S. Covered Call ETF

Objective: Designed to provide attractive monthly income by investing in a diversified portfolio of U.S. equity covered call ETFs and applying modest leverage (25%) to enhance yield and growth potential.

Strategy:

Invests primarily in U.S.-focused covered call ETFs across different sectors (technology, healthcare, financials, etc.).

Uses covered call writing to generate option premiums.

Adds 25% cash leverage to boost distributions.

Investor Appeal: Suitable for Canadian investors seeking high monthly distributions from U.S. equities, while accepting capped upside and slightly higher risk due to leverage.

Q&A

Do covered call ETFs pay dividends?

Yes, Covered call ETF’s offer an excellent dividend yield. Their dividend yield is usually superior to ‘regular’ dividend ETF’s. Thanks to premiums collected issuing covered calls, the manager boost the fund distributions (Dividends plus Premiums), thus the dividend yield is usually high.

Some Covered Call ETFs use leverage to enhance returns even higher.

Do covered calls beat the market?

During market corrections, the answer would be probably yes. In essence, the covered call strategy is a convervative strategy that tends to forego profits for stability and income.

In a bull markets, covered call ETFs would have a lousy performance. A ‘regular’ dividend ETF would definitely perform better in bull market that a Covered call ETF.

If you are retired or close to retiring, a covered call ETF could be a better option for you. For young investors building wealth, covered call ETFs are not a good choice because they deprive their holders of growth perspective.

How risky is covered calls?

Covered call ETFs are generally low to medium risk funds. However, if the fund manager uses leverage, the fund would be considered medium to high risk.