HMAX ETF is a new fund offered by Hamilton ETF. The fund invests in the Canadian banking sector. This fund aims to provide an attractive dividend yield (target 13%) using a covered call strategy. The strategy consists of writing call options on (50% of the portfolio) to collect premiums and maximize monthly distributions. This post discusses the strategy used and compares HMAX to ZWB from BMO (BMO Covered Call Canadian Banks ETF).

Executive summary

How HMAX is able to keep such high dividend yield?

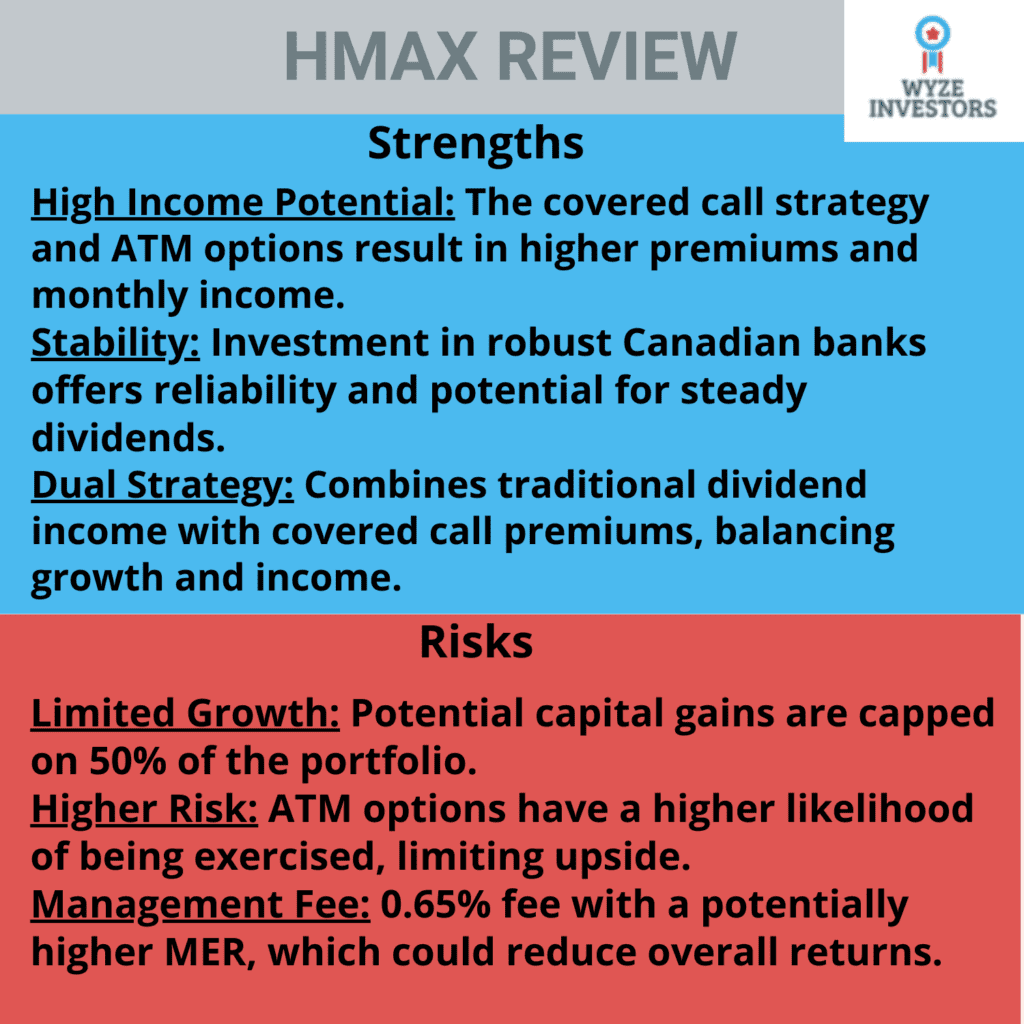

HMAX offers the potential for higher monthly income due to two key factors: Firstly, HMAX engages in writing covered call options on about 50% of its portfolio. Secondly, the fund currently writes options At The Money (ATM), which sets it apart from similar funds that write options Out of The Money (OTM).

1- HMAX writes covered call options on 50% of the portfolio

From an investor’s perspective, the initial point indicates that only half of your investment portfolio will be exposed to potential growth. This portion of the portfolio operates under a covered call strategy, where the potential for capital gains is exchanged for a monthly income derived from dividends and option premiums. These premiums are earned whenever the fund sells a call option in the market.

In summary, I view HMAX as a hybrid fund. The first 50% resembles a traditional dividend fund, offering the prospect of receiving dividends and witnessing long-term portfolio appreciation. In contrast, the remaining 50% adopts a more conservative approach, primarily focused on income generation but lacking the potential for portfolio appreciation.

2- The fund is currently writing option At The Money (ATM) whereas similar funds are writing options OTM (Out of The Money).

I encourage you to refer to the table below for a clearer understanding of the second point’s significance. As shown, the HMAX fund has chosen At The Money (ATM) call options due to their superior profitability compared to Out of The Money (OTM) options. In a nutschell, this decision is driven by two critical factors. Firstly, ATM options generate higher premiums than an OTM strategy. However, it’s important to note that this choice comes with an elevated level of risk.

In options trading, risk is closely linked to the likelihood of the option being exercised by the buyer. So, in the case of OTM options, where the strike price exceeds the current stock price, the likelihood of the option being exercised is low. Conversely, with ATM options, where the strike price is very close or identical to the stock’s current price, the possibility of the option being exercised becomes more realistic.

Tables

| Premium or option price | Risk | Reward | |

| ITM (In the money call option) Stock price > Strike price | High | High | High |

| OTM (Out of the money call option) Stock price < Strike price | Cheap | Low | Low |

| ATM (At The Money call option) Stock price = Strike price | Medium | Medium | Medium |

Option premium = Intrinsic value + Time value

| ITM | ATM | OTM | |

|---|---|---|---|

| INTRINSIC VALUE | YES | NO | NO |

| TIME VALUE | YES | YES | YES |

What is the Yield of HMAX?

According to the issuer’s website, the fund has a target yield of 13%. Upon examining the historical dividend payments, it appears that the fund has the potential to achieve, or even surpass, the specified target yield. See below the historical dividend payments made by HMAX. Currently the dividend yield is around 15%.

| Amount | Dividend Type | Ex-Div Date | Record Date | Pay Date |

|---|---|---|---|---|

| 0.1700 | Regular | 10/31/2024 | 10/31/2024 | 11/7/2024 |

| 0.1700 | Regular | 9/27/2024 | 9/27/2024 | 10/7/2024 |

| 0.1685 | Regular | 8/30/2024 | 8/30/2024 | 9/9/2024 |

| 0.1695 | Regular | 7/31/2024 | 7/31/2024 | 8/8/2024 |

What are the MER Fees for HMAX?

The Management Expense Ratio (MER) for HMAX is not disclosed, but there’s a noted management fee of 0.65%. Given the nature of covered call high yield ETFs, fees tend to run on the higher side and the MER could potentially be above 1%.

HMAX Sector allocation

█ Asset Management 10.6%

█ Banks 70.0%

█ Insurance 20.8%

What Does HMAX Hold?

| TICKER | NAME | WEIGHT |

| RY | Royal Bank of Canada | 22.7% |

| TD | Toronto-Dominion Bank | 17.2% |

| BMO | Bank of Montreal | 11.3% |

| BN | Brookfield Corp | 11.1% |

| BNS | Bank of Nova Scotia | 10.1% |

| CM | Canadian Imperial Bank of Commerce | 7.6% |

| MFC | Manulife Financial | 7.1% |

| SLF | Sun Life Financial | 5.1% |

| GWO | Great-West Lifeco | 4.8% |

| IFC | Intact Financial | 4.7 |

BMO Covered call ETF list – Full comparison

HMAX Total Return

[stock_market_widget type=”table-quotes” template=”basic” assets=”HMAX.TO” fields=”symbol,fund_inception_date” display_header=”true” display_chart=”false” search=”false” pagination=”false” scroll=”false” rows_per_page=”5″ sort_direction=”asc” alignment=”left” api=”yf”]

| 1 Month | 3 Months | 1-Year | |

| Total return | 4.18% | 12.59% | 24.36% |

[stock_market_widget type=”card” template=”basic” color=”#5679FF” assets=”HMAX.TO” api=”yf”]

[stock_market_widget type=”chart” template=”line” color=”#5679FF” assets=”HMAX.TO” range=”1mo” interval=”1d” border_width=”3″ tension=”0.5″ axes=”true” cursor=”true” range_selector=”true” api=”yf”]

How had Covered call ETF’s performed historically?

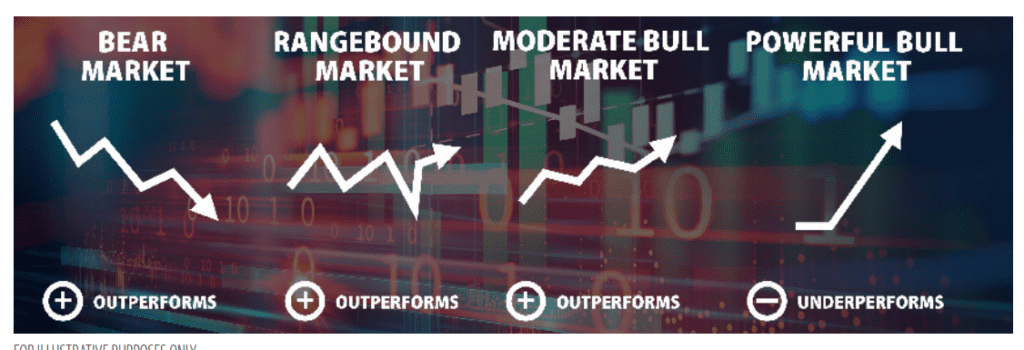

In historical contexts characterized by bear markets, range-bound markets, and moderate bull markets, a covered call strategy has typically demonstrated the ability to outperform its underlying securities. However, during robust bull markets, when the underlying securities experience frequent rises beyond their strike prices, covered call strategies have historically exhibited slower growth. Nevertheless, even in these bullish phases, investors typically realize moderate capital appreciation alongside the accrual of dividends and call premiums.

ZWB vs HMAX ETF

Strategy

The ZWB ETF from BMO sells out-of-the-money (OTM) call options on 50% of the stocks. The OTM strategy caps the return of the written positions at the option strike price until the option expires. Generally, for BMO ETFs, option expiries are 1 to 2 months.

| ETF | % portfolio | Option strategy | Dividend Yield |

| ZWB | 50% | OTM | 6-7% |

| HMAX | 50% | ATM | 13%* |

Portfolio allocation

| Big Can Banks | Insurance | Asset Management | |

| HMAX | 76.4% | 14.9% | 10% |

| ZWB | 100% | – | – |

ZWB (BMO Covered Call Canadian Banks ETF) and HMAX (Horizons Enhanced Income Equity ETF) cater to income-seeking investors but employ different strategies. First, ZWB uses a covered call strategy with out-of-the-money (OTM) options, potentially offering more growth but with a lower management expense ratio (MER) of 0.72%. Second, HMAX, with less than one year of existence and an undisclosed MER, writes at-the-money (ATM) options, aiming for higher immediate income. However, the MER should at the higher end, possibly around 2%. Notably, ZWB concentrates solely on banks, while HMAX offers a bit more diversification by investing in insurance and asset management companies.

Investors must consider their goals: ZWB offers growth potential with lower dividends, primarily focusing on banks. In contrast, HMAX aims for regular and higher income through diversification, although it may come with potentially higher fees. The undisclosed MER for HMAX introduces some uncertainty, and investors should weigh potential dividend income against expected expenses when making their choice.

- DGS ETF Explained: How Dividend Growth Split Corp Really Works — and the Risks Most Investors Miss

- Best Hamilton ETFs for Monthly Income in 2026 (High Yield, Covered Call ETFs)

- HHIS ETF Review: Harvest Diversified High Income Shares Explained

- JEPI vs QYLD: The Ultimate Covered Call Income Battle

- Best U.S. Covered Call ETFs (2026): High Income, Explained Clearly

HMAX vs HYLD

Hamilton ETFs is the issuer of both HYLD and HMAX, but they differ in their focus and objectives. On one hand, the Hamilton Canadian Financials Yield Maximizer ETF, primarily targets Canadian banks, constituting about 75% of its portfolio. And, it aims to provide a high initial monthly yield of over 13%, achieved by writing at-the-money options and maintaining a 50% options coverage ratio. This strategy balances income and potential capital appreciation for investors looking for higher monthly income from the Canadian banking sector.

In contrast, HYLD, the Hamilton Enhanced U.S. Covered Call ETF, focuses on the U.S. equity markets and aims for an overall sector mix that is “broadly similar” to the S&P 500. Indeed, it follows a similar structure to HDIV, designed for attractive monthly income and long-term capital appreciation from a diversified, multi-sector portfolio primarily composed of Canadian covered call ETFs.

While both HYLD and HMAX seek higher monthly income, HMAX concentrates on Canadian banks, whereas HYLD diversifies across U.S. sectors. Investors can choose between them based on their preferred geographical exposure and income objectives.

HMAX vs HCAL

The Hamilton Enhanced Canadian Bank ETF (HCAL) and the Hamilton Enhanced Financials Yield Maximizer ETF (HMAX) offer distinct investment approaches in the financial sector.

HCAL provides exposure to Canada’s “Big Six” banks with 25% leverage, emphasizing growth potential and higher dividends. It also utilizes a mean reversion strategy, historically outperforming equal weight and covered call strategies. HCAL targets monthly distributions, making it appealing to investors seeking growth and income from blue-chip Canadian banks.

In contrast, HMAX focuses on attractive monthly income with a market cap-weighted portfolio of Canadian financial services stocks. It employs an active covered call strategy to reduce volatility and enhance dividend income. HMAX is suitable for investors seeking consistent monthly income, blue-chip financial exposure, tax-efficient distributions, and reduced volatility through options.

For young investors with long-term objectives, I recommend considering the Hamilton Enhanced Canadian Bank ETF (HCAL) due to its growth potential. HCAL allows younger investors to capitalize on the potential for capital appreciation and dividend growth over time. While both HCAL and the Hamilton Enhanced Financials Yield Maximizer ETF (HMAX) have their merits, HCAL’s focus on growth makes it an attractive choice for young investors seeking to build wealth over the long haul.

Videos

review

JEPI ETF REVIEW: JPMorgan Equity Premium Income

HDIF ETF review: Harvest Diversified Monthly Income ETF

HMAX NAV

[stock_market_widget type=”table-quotes” template=”basic” assets=”HMAX.TO” fields=”symbol,price,nav” display_header=”true” display_chart=”false” display_currency_symbol=”true” pagination=”true” search=”false” rows_per_page=”5″ sort_field=”logo_name_symbol” sort_direction=”asc” alignment=”left” api=”yf” ]

Net Asset Value (NAV) is a financial term. It mean the total value of all the assets held by an exchange-traded fund (ETF) after subtracting its liabilities. In simpler terms, NAV reflects the underlying value of the ETF’s portfolio, including all the stocks, bonds, or other assets it holds, minus any expenses and debts it owes.

Frequently asked questions

Is HMAX a good investment?

To sum up, HMAX provides a well-rounded investment approach, offering a blend of growth potential and income. However, it’s essential to note that the use of At The Money (ATM) options adds a heightened level of risk. This ETF is ideal for investors comfortable with a hybrid strategy, particularly those seeking monthly income through a long-term buy-and-hold approach. Prospective investors should be aware of potential tax implications associated with dividend income. Before considering HMAX, it’s crucial to evaluate your risk tolerance, investment objectives, and alignment with the hybrid approach. Additionally, be mindful that covered call ETFs, including HMAX, can exhibit volatility and move in tandem with the underlying assets they track.

For young investors aiming for growth, a classic dividend ETF like ZEB may be a more suitable option, capitalizing on the growth potential of the banking sector. If you lean towards dividends but still want to capture 100% of the growth potential in the Canadian banking sector, ETFs such as HCAL or FIE might be better alternatives.

How often does HMAX pay dividends?

HMAX pays Dividends monthly.

Is there fees from Hamilton ETF when share of that EFT are sold. The prospectus indicate when sahre are sale at a value 95% of share value. Does that means Hamilton take 5% of the shares are sold?

Hi Francis, The management fee is 0.65%. from their website:

You don’t pay these expenses directly. They affect you because they reduce the ETF’s returns. The ETF’s expenses are made up of the management

fee, operating expenses and trading costs.

The ETF’s annual management fee is 0.65% of the ETF’s value

As this ETF is new, its operating expenses and trading costs are not yet available

Thanks for this good video. Can you please comment on erosion of capital over time with HMAX . It *appears that HMAX’s ATM option strategy might erode capital more than a “safer” OTM fund. I am ok with little or no capital gain when focused on a high income ETF, but the last thing I want is steady erosion of capital over time. Your thoughts on what the ATM option strategy does to put capital at risk is appreciated.

Hi,

Thanks for your comments. As a reminder, I am not a financial advisor or an expert; please research before investing.

First, only 50% of the portfolio uses the options strategy, so there is some potential growth in the remaining 50%. Only time will tell if the managers can generate some growth with the ATM strategy. It’s an active strategy, so the manager’s experience and abilities will be essential.

All of these ETFs are legal scams, Hyld is a classic one, declining NAV and high pay out which is all destructive return of capital. If you’re using the money for other things such as expenses and don’t reinvest distributions these are basically just legalized Ponzi schemes.

Hi,

Thanks for your comment Paul. I would not go as far as calling these types of funds a scam! They fit long-term income-oriented conservative investors who don’t mind the dividend taxation impact.

I believe what’s happening is these types of funds are attracting high dividend yield chasers who don’t realize that they are losing on the growth component of their investment.

The underlying stocks are some of the most stable investments in the history of the stock market, the monthly income is a mix of dividend and capital gains. I could care less what the NAV is as long as I get my income. The dividends payments to the ETF will increase over time as well. I would say that the strategy of investing in stocks with little or no return in the hope that they will be worth much more than when you purchased them is not a great strategy for many of us over age 60. If you invested in RY 50 years ago and earn huge dividends today would you care what the stock price is? Getting regular monthly income is better for many investors sense of security and well being. To say these are scams a nonsense comment.

I echo your sentiments David however my concern is how sustainable is the dividend payout of $.18 a share gonna be for the next 10 years

Since I hold many of the stocks individually as found in my covered call ETF’s I get the best of both! The dividend AND the upside of advancement. What’s not to like?

Hello Stanley,

You’re absolutely right! Holding individual stocks alongside covered call ETFs truly lets you enjoy both worlds: consistent dividends from the covered call strategy and the potential upside from the individual stocks themselves. This approach can be a smart way to balance income generation with growth potential.