Investment objective

XYLD is a passive index ETF that uses a covered call strategy to enhance yield and lower volatility. The fund was created by Global X and tracks the S&P500. The manager follows a “covered call” or “buy-write” strategy, in which the Fund buys the stocks in the S&P 500 Index and “writes” or “sells” corresponding call options on the same index. So far, XYLD has paid monthly distributions 9 years running.

Updated daily – XYLD ETF

Covered call ETF usually protect against downside risk. This being said, the covered call strategy provides limited downside protection. Also, when you write a covered call, you give up some of the stock’s potential gains. Covered call ETFs will tend to have a higher yield and a lower performance (in bull markets) than the portfolio they track.

- Full list of ‘Dividend Kings’ stocks by sector

- Best Dividend Contenders by sector (High Dividend Yields)

Is XYLD a good investment?

Positives

- Attractive yield thanks to money earned issuing call options;

- Lower volatility than investing in the S&P500 ETF such as SPY;

- Suits conservative investors and income seekers;

- High volatility usually increases the premiums earned by the fund;

- Saves you time and effort (if you were youself intesreted on writing call options in the S&P 500

- Liquidity: the fund has over 6 Billion dollars assets under management

- XYLD is a diversified inevestment

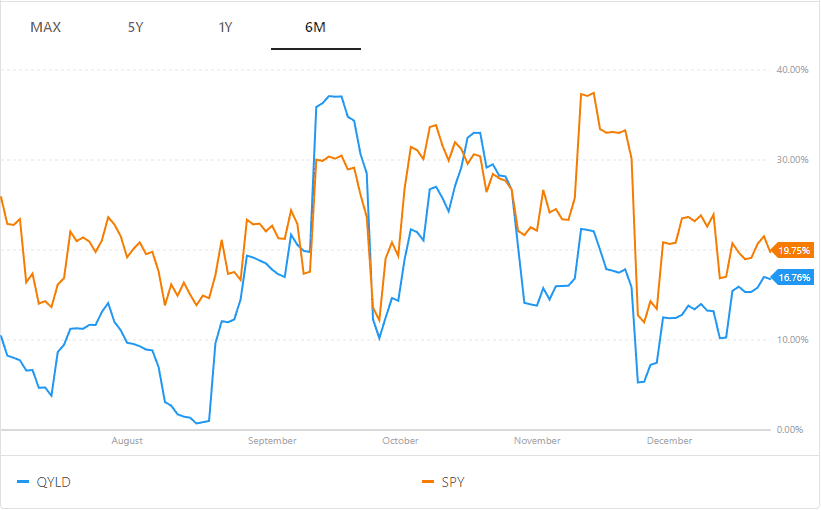

Volatility comparison: XYLD has a lower volatility than the S&P 500 (source of graphic: portfoliolabs.com)

Negatives

- Poor performance. You are essentially giving up on the upside potentiel of the S&P 500

- The strategy of covered calls becomes ineffective in an unpredictable market

Performance comparison XYLD vs SPY

Updated daily

Distributions

Is XYLD Sustainable? What is the risk of QYLD?

In my opinion, the dividend are not sustainable for one obvious reason: the primary source of dividend with QYLD is options’ premiums. Options by nature are volatile and their value depend greatly on market sentiment.

Is XYLD a monthly dividend ETF

Yes, QYLD offers a monthly dividend distribution.

XYLD ETF Holdings

| Net Assets (%) | Name |

|---|---|

| 6.09 | APPLE INC |

| 5.65 | MICROSOFT CORP |

| 2.35 | AMAZON.COM INC |

| 1.77 | BERKSHIRE HATH-B |

| 1.66 | ALPHABET INC-CL A |

| 1.60 | UNITEDHEALTH GROUP INC |

| 1.49 | JOHNSON & JOHNSON |

| 1.48 | ALPHABET INC-CL C |

| 1.44 | EXXON MOBIL CORP |

| 1.26 | JPMORGAN CHASE & CO |

Why covered call ETFs are popular?

Covered call ETFs are very popular with American investors. Some of these ETFs managers have billions of dollars under management. Two reasons push investors towards covered call ETFs:

High dividend yield: thanks to the premiums earned when writing call options, the manager under certain conditions can earn premiums and enhance distributions;

Low volatility. Writing a call option is a conservative strategy aimed at reducing volatility;

Great for passive income: if you’re main objective is to achieve high dividend yields and build passive income, then covered call ETFs are a good option. But, remember the high dividend yield comes at a price which very low growth potential.

Practice example: covered call strategy

An investor has 100 shares of Company A in his portfolio. Company A’s share is worth $ 30. He anticipates a stagnation or a slight drop in its price and he is ready to sell them at the price of 26 $. He decides to sell a call with the following characteristics:

• Exercise price: $ 26; Maturity: April; Option price: $ 4; Quantity: 100

He collects the following amount: 4 x 100 or 400 $ (premium)

Two cases should be distinguished:

CASE 1

Company A’s share price rose above the breakeven point of $ 30.

Break-even point = exercise price + premium = 26 + 4 = 30

The buyer of the option will choose to exercise his right to buy and, as the seller of the call, the seller will have to sell the shares at the strike price.

During this operation:

- the seller sold his shares for $ 26, which constitutes an acceptable loss for him.

- the seller collected the amount of the premium of $ 4, which helped boost the performance of his investments (yield).

CASE 2

Company A’s share price has fallen below the breakeven point of $ 30.

The buyer of the option will choose not to exercise his right to buy and the seller will not have to sell his shares.

Thanks to this operation, the seller keeps his shares in the portfolio and he collected the amount of the premium which generated an additional return.