The SMAX Hamilton U.S. Equity Yield Maximizer ETF presents an interesting option for those interested in the U.S. equity market, especially with a focus on income. Let’s explore its key aspects.

Executive summary

| Feature | Description |

|---|---|

| Large-Cap U.S. Equity Focus | Invests in large-cap U.S. stocks to mirror the sector distribution of the S&P 500, offering diversified exposure. |

| Active Covered Call Strategy | Managed by Nick Piquard with over 25 years in options; involves holding stocks and selling call options. |

| Coverage Ratio | Maintains a coverage ratio of about 30%, intending to enhance monthly income while preserving 70% growth potential. |

| No Leverage Utilization | Avoids using leverage in its investment strategy, potentially appealing to risk-averse investors. |

Investment Objective SMAX ETF

SMAX aims to provide investors with a portfolio primarily consisting of large-cap U.S. equity securities. Its key characteristics include:

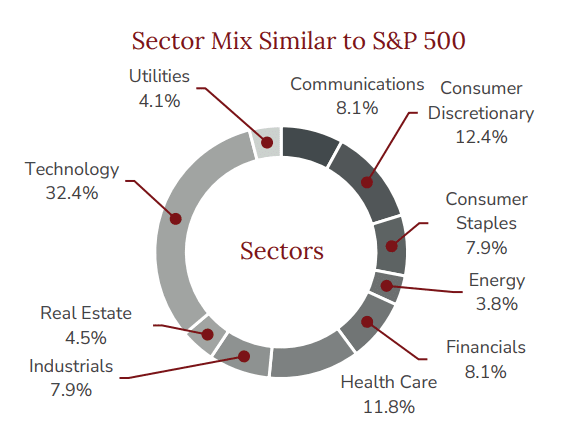

The SMAX Hamilton U.S. Equity Yield Maximizer ETF offers an investment approach centered around large-cap U.S. stocks. Its strategy is to replicate the sector distribution seen in the S&P 500. This approach aims to provide investors with diversified exposure to the U.S. equity market. By focusing on large-cap stocks, SMAX targets well-established companies that are significant players in their respective industries. This can offer a balance between stability and growth potential within the U.S. equity space.

A distinctive feature of SMAX is its active covered call strategy. This strategy is managed by Nick Piquard, a seasoned professional with over 25 years of experience in options trading. The active covered call strategy involves holding a stock while simultaneously selling call options on the same stock. This can potentially increase the dividend income from the investments. The call options provide an additional income stream, typically in the form of premiums paid by the option buyers. This strategy can be particularly appealing to investors looking for enhanced income along with their equity investments.

Regarding its coverage ratio and growth potential, SMAX maintains a coverage ratio of approximately 30%. This means that the ETF writes covered calls on about 30% of its portfolio. The intent behind this ratio is to strike a balance between income generation and growth potential. By limiting the coverage to 30%, the ETF aims to enhance its monthly income while allowing approximately 70% of the portfolio the potential for capital growth. This balance is key for investors who are seeking income but do not want to entirely forego growth opportunities.

Finally, an important aspect of SMAX is its approach to leverage. The ETF does not use leverage in its investment strategy. This is a crucial consideration for investors who are cautious about the risks associated with leverage. By avoiding leverage, SMAX positions itself as a potentially lower-risk option compared to leveraged investment vehicles. This could make it an attractive choice for risk-averse investors who are keen on U.S. equity exposure but wish to minimize exposure to leveraged risk.

In summary, the SMAX ETF offers a unique combination of large-cap U.S. equity exposure, an active covered call strategy for income enhancement, a balanced approach to growth potential, and a no-leverage policy, catering to a diverse range of investor preferences in the U.S. stock market.

Who Might Consider SMAX ETF?

SMAX could be a fit for:

- Investors seeking monthly income through dividends.

- Those looking for exposure to large-cap U.S. equities with a sector composition similar to the S&P 500.

- Investors comfortable with the use of an options strategy (covered calls) for income generation.

High Dividend ETF Duel: Analyzing HMAX vs BKCL

Sector mix SMAX ETF

Review JEPQ: JPMorgan Nasdaq Equity Premium Income ETF

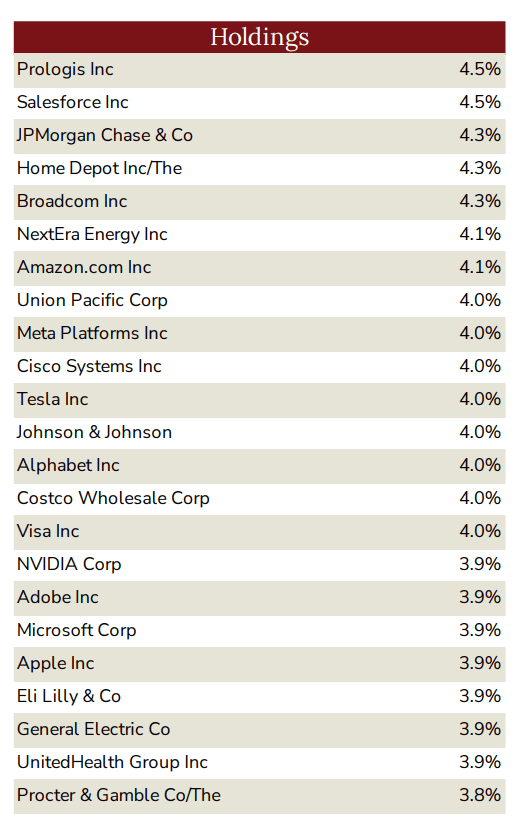

Top holdings

Understanding the Risks in Active Call Option Strategy

While the active covered call strategy can enhance income and reduce volatility, it’s crucial to understand the inherent risks:

Capped Upside Potential: When a call option is sold on a stock, the upside is capped. If the stock’s price rises significantly, the ETF only benefits up to the strike price of the call option.

Complexity and Management Risk: Active management of options requires skill and timing. Poor management decisions can lead to suboptimal outcomes.

Market Risk: Despite the strategy aiming to reduce volatility, tech stocks can be inherently volatile. The market risks are still present.

Dependence on Stock Performance: The effectiveness of the covered call strategy partly depends on the underlying stock’s performance. If the stocks in the portfolio perform poorly, the strategy may not generate expected income.

Latest posts

- QYLD ETF Review: Global X Nasdaq-100 Covered Call ETF

- Review JEPQ: JPMorgan Nasdaq Equity Premium Income ETF

- Best US Dividend ETF in canada (2025)!

- JEPI vs JEPQ: Which ETF is the Best Investment for You?

- HYLD vs HDIF: Hamilton ETFs – A Closer Look

- Unveiling the Investment Duel: A Comparative Analysis of HDIF vs HDIV

- HDIV ETF review: Hamilton Enhanced Multi-Sector Covered Call

- TXF ETF: Maximizing Income from Tech Giants – A Canadian Investor’s Guide

This post aims to provide an educational overview of SMAX.TO for Canadian investors. Remember, it’s important to do your own research and consult with a financial advisor for personalized advice.