Canadian Reits are listed companies that invest in real estate. A good number of investors would like to invest in real estate to diversify their investments, or out of the conviction. However, the direct management of a property presents many constraints, and requires time and skills. Also, delegating the management of the property to an agency does not solve all the problems. The solution lies in investing directly in Reits listed on the Toronto Stock Exchange.

How REITs operate?

A REIT is a real estate company. Its business is to invest the capital it raises in the acquisition or construction of buildings, with a the purpose of leasing them. Its activity provides it with rents and, where appropriate, capital gains. REITs are listed on the stock exchange, so REITs shares are open to individual investors within an regular investment account.

However, REITs have several particularities. They are present in different sectors of activity. They invest, for example, in different types of assets, such as shopping centres, offices, logistics buildings, hotels, among others. The other specificity of listed property companies is that they use financial leverage. That is to say that these companies will have equity to invest in real estate. But they will also use the loan to be able to maximize the return on their equity.

The third specificity of listed real estate investment companies is that they benefit from a tax exemption. Their income and capital gains are taxed at the level of its shareholders and not at the level of the property company itself. Note that REITs are required to redistribute to their shareholders at least 95% of their revenues. After deduction of costs, rents are distributed to shareholders as dividends, without being taxed at the company level.

15 Best Monthly Dividend Stocks in Canada for passive income

QYLD ETF Review: Global X Nasdaq-100 Covered Call ETF

Where can you hold a REIT?

You can hold REITs inside a Tax Free Saving Account or Registered Retirement Saving Plan, as well as a regular cash trading account. If you’re looking for an easy way to add the real estate asset class to your portfolio, REITs or ETFs might be the way to go.

Are there Risks with REITs?

Like a stock, a REIT is a market investment that fluctuates in value and is not guaranteed. Therefore, there are inherent risks when you invest in REITs. One example is how market cycles can impact REIT returns. When the real estate market drops, REITs tend to follow suit. REIT values can also fluctuate with interest rates. As rates rise, REIT values tend to rise, depending on other factors. This is why you should never invest all of your money in REITs, or any single asset class for that matter.

Top 5 best REITS in Canada

[stock_market_widget type=”table-quotes” template=”color-header-border” color=”#5679FF” assets=”GRT-UN.TO,AP-UN.TO,CAR-UN.TO,HR-UN.TO,CRT-UN.TO” fields=”name,price,change_pct,market_cap” links=”{‘GRT-UN.TO’:{},’AP-UN.TO’:{},’CAR-UN.TO’:{},’HR-UN.TO’:{},’CRT-UN.TO’:{}}” display_header=”true” display_chart=”false” display_currency_symbol=”true” pagination=”true” search=”false” rows_per_page=”5″ sort_field=”logo_name_symbol” sort_direction=”asc” alignment=”left” api=”yf”]

[stock_market_widget type=”table-quotes” template=”color-header-border” color=”#5679FF” assets=”GRT-UN.TO,AP-UN.TO,CAR-UN.TO,HR-UN.TO,CRT-UN.TO” fields=”symbol,dividend_yield,ex_dividend_date” links=”{‘GRT-UN.TO’:{},’AP-UN.TO’:{},’CAR-UN.TO’:{},’HR-UN.TO’:{},’CRT-UN.TO’:{}}” display_header=”true” display_chart=”false” display_currency_symbol=”true” pagination=”true” search=”false” rows_per_page=”5″ sort_field=”logo_name_symbol” sort_direction=”asc” alignment=”left” api=”yf”]

1) GRT-UN Granite REIT

Granite Real Estate Investment Trust (GRT-UN), commonly known as Granite REIT, is a Toronto-based real estate investment trust that focuses primarily on the acquisition, development, ownership, and management of industrial properties, including warehouses and logistics sites. The trust’s portfolio spans multiple countries, with a significant presence in North America and Europe, catering to a diverse range of tenants from various sectors.

Strengths

Diversified Portfolio: Granite REIT’s portfolio is geographically diversified across North America and Europe, reducing the risk associated with regional economic downturns. This diversification helps stabilize cash flows and revenue.

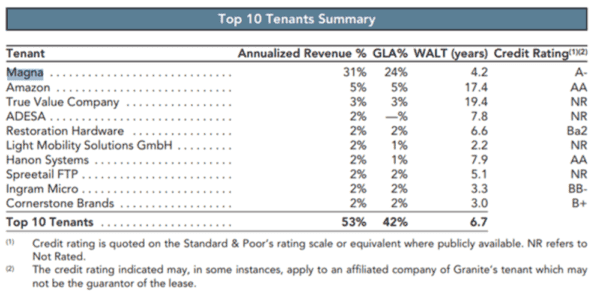

Quality Tenants: The trust tends to lease properties to high-quality, creditworthy tenants, which ensures steady rental income and reduces the risk of defaults.

Industrial Focus: The focus on industrial and logistics real estate is a significant strength, especially given the rising demand for warehousing and distribution centers driven by e-commerce growth and changes in global supply chains.

Financial Health: Historically, Granite REIT has maintained a solid balance sheet with reasonable levels of debt, which is crucial for sustaining operations and funding growth initiatives.

8 Best Canadian dividend stocks near their 52 weeks low

2) Allied Properties REIT (AP-UN)

Allied Properties Real Estate Investment Trust (AP-UN) is a leading owner, manager, and developer of urban office environments across major cities in Canada. Allied Properties REIT focuses on a distinctive niche, converting light industrial structures into modern office spaces, often catering to technology and creative industry tenants. This focus on urban workspaces in key Canadian markets, including Toronto, Montreal, and Vancouver, positions Allied in a unique segment of the real estate market.

Strengths

Urban Office Niche: Allied’s focus on transforming light industrial properties into trendy, urban office spaces appeals to a growing segment of the workforce, particularly in the technology and creative industries. This specialization differentiates Allied from other REITs with more traditional office or retail portfolios.

Prime Locations: Allied’s properties are strategically located in Canada’s major cities’ core urban areas, where space is at a premium and demand for office space remains strong, particularly from industries less affected by remote work trends.

Tenant Diversification: Despite a focus on specific sectors, Allied boasts a diversified tenant base within the tech and creative industries, reducing reliance on any single tenant or industry.

Sustainable Practices: Allied has a commitment to sustainability, which is increasingly important to tenants and investors. This includes maintaining and upgrading properties to high environmental standards, potentially reducing long-term operating costs and increasing appeal to eco-conscious tenants.

Adaptive Reuse Expertise: Allied’s expertise in the adaptive reuse of industrial buildings positions it well to capitalize on urban revitalization trends and the growing preference for unique, non-commodity office spaces.

3) Canadian Apartment REIT (CAR.UN)

Canadian Apartment Properties Real Estate Investment Trust (CAPREIT) (CAR.UN) is a publicly traded real estate investment trust specializing in the ownership and management of residential rental apartments, townhomes, and manufactured home communities across Canada. CAPREIT aims to provide secure, high-quality housing options to its tenants while delivering stable, long-term returns to its unitholders.

Strengths

Diverse Portfolio: CAPREIT boasts a large and diverse portfolio of residential properties, including apartment buildings, townhouses, and manufactured home communities. This diversity helps mitigate risks associated with regional economic downturns and fluctuating market conditions.

Geographical Spread: With properties spread across major urban centers and smaller cities in Canada, CAPREIT benefits from a broad geographical footprint. This spread can provide stability and growth opportunities, as the trust is not overly reliant on any single market.

High Occupancy Rates: CAPREIT typically enjoys high occupancy rates, a testament to the demand for its residential units and effective property management. High occupancy is crucial for generating steady rental income streams.

Experienced Management: The trust is managed by an experienced team with a proven track record in property management, acquisitions, and finance. This expertise is vital for strategic growth and operational efficiency.

Focus on Sustainability: CAPREIT has been focusing on sustainability initiatives, including energy-efficient upgrades and green building practices, which can lead to lower operating costs and appeal to environmentally conscious tenants.

4) CT REIT (CRT.UN)

CT Real Estate Investment Trust (CT REIT) (CRT.UN) is a Canadian-based closed-end real estate investment trust that focuses on owning and operating a portfolio of retail properties across Canada. Primarily anchored by Canadian Tire stores, CT REIT’s portfolio includes a mix of retail, mixed-use, and distribution centers. The trust’s strategic relationship with Canadian Tire Corporation provides a unique advantage in terms of tenant stability and portfolio focus.

Strengths

Strong Anchor Tenant: The majority of CT REIT’s properties are leased to Canadian Tire Corporation, one of Canada’s most recognized and established retail brands. This relationship provides a stable base of rental income and reduces the risk of significant vacancy rates.

Diverse Property Portfolio: Despite the strong association with Canadian Tire, CT REIT also owns and operates a variety of other retail and mixed-use properties, contributing to income diversification.

Strategic Growth Initiatives: CT REIT has demonstrated a capacity for strategic growth through the acquisition and development of new properties, as well as the expansion and improvement of existing ones, enhancing the overall value of its portfolio.

Long-Term Leases: Many of CT REIT’s leases are long-term agreements, which provides income stability and reduces the risk associated with tenant turnover.

Geographical Spread: With properties across various regions in Canada, CT REIT benefits from a broad market presence, mitigating the impact of regional economic fluctuations.

5) H&R REIT

H&R Real Estate Investment Trust (H&R REIT) is one of Canada’s largest diversified real estate investment trusts. H&R REIT’s portfolio spans a broad range of asset classes, including office, retail, industrial, and residential properties across Canada and the United States. This diversification across both geography and property types is a cornerstone of H&R REIT’s strategy, aiming to provide unitholders with stable and growing cash distributions by owning a diversified, growth-oriented portfolio.

Strengths

Diversified Portfolio: H&R REIT’s diversified asset base across various sectors—office, retail, industrial, and residential—helps mitigate the risk associated with any single market or economic sector. This diversification is a key strength, particularly in volatile market conditions.

Geographical Presence: With properties in both Canada and the United States, H&R REIT benefits from a broad market presence, which allows for capitalizing on different economic cycles and real estate markets in North America.

Scale and Scope: As one of Canada’s largest REITs, H&R has significant scale advantages, including access to capital, operational efficiencies, and the ability to engage in larger transactions that may not be accessible to smaller entities.

Experienced Management: H&R REIT benefits from an experienced management team with a proven track record in property management, acquisitions, and navigating the complexities of the real estate markets in North America.

Adaptive Strategy: H&R REIT has shown adaptability in its strategy, such as repositioning its portfolio by divesting non-core assets and focusing on high-growth areas, which can enhance long-term unitholder value.