CIBC Investor’s Edge is a division of CIBC Investor Securities Inc., a subsidiary of Canadian Imperial Bank of Commerce (CIBC). With relatively low transaction fees and discounts for students and active traders, this is a service worth considering.

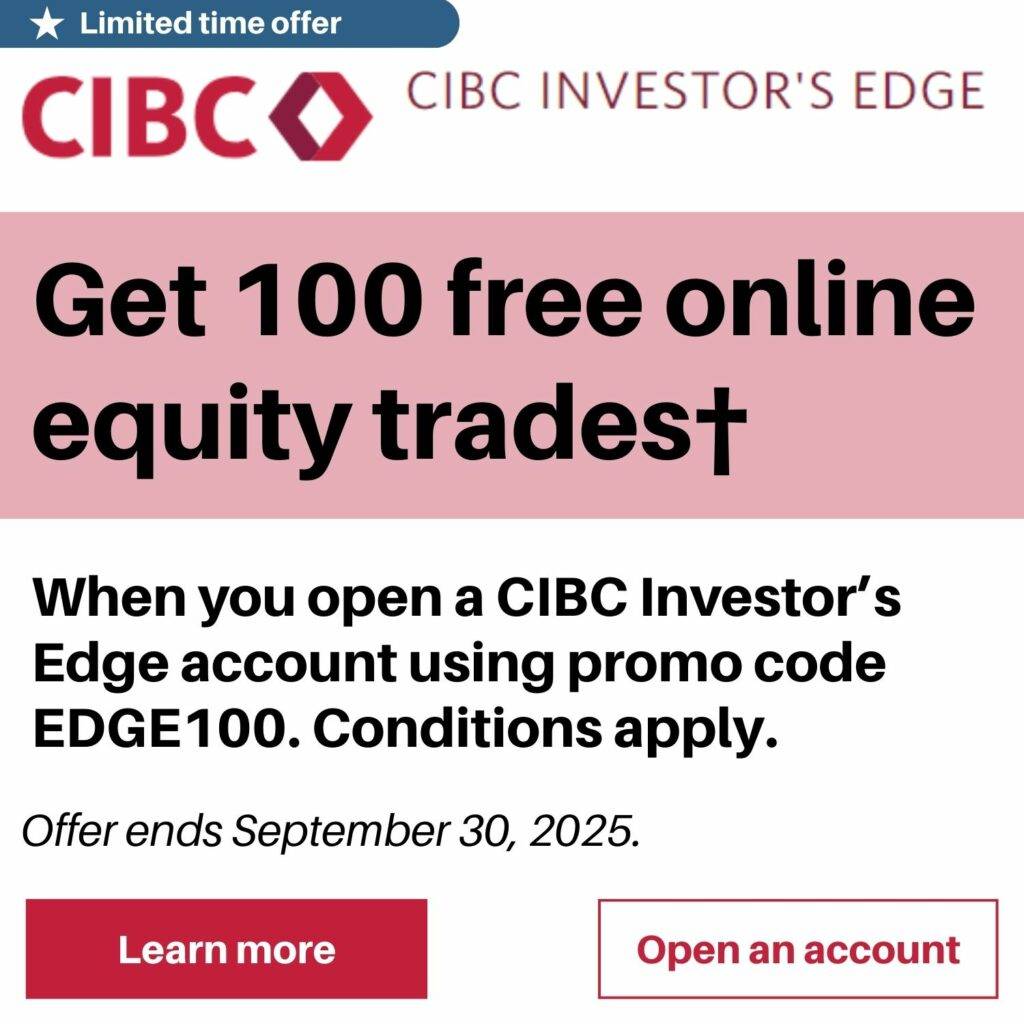

Current Offer

Why choose CIBC investors’ edge

If you want a one-stop-shop for your banking and investing needs, CIBC Investor’s Edge might actually be the best choice for you.

Overall, it offers:

Brokerage service offered by a major Canadian bank

Lower trading fees than other major banks

All account options available

Easy access from mobile and desktop devices

Commitment to updates and innovation

One-Stop Financial Service Center

List of qualifying accounts

RRSP, TFSA, RESP, RRIF, LIRA, LRIF and non-registered accounts qualify. The first qualified account of each type that is opened will receive the cash credit. For the purposes of the offer, joint accounts do not qualify as a different account type, thus any rebate will only be paid to one joint or individual account of each kind, not both.

CIBC investor-friendly Fees and commissions

The CIBC Investor’s Edge trading platform is not only competitive with other major banking brokerages in Canada, it is considerably cheaper when it comes to daily trading fees, reaching a flat fee of $6.95 per online transaction on stocks and ETFs.

This is lowered to $5.95 if you are still under a student account And $4.95 if you reach the ‘active trader’ threshold of 150 trades per quarter.

Although not quite on par with the leading low-cost (non-bank brokerage firms) like Questrade, Qtrade and Wealthsimple Trade, CIBC’s online discount brokerage beats all other major bank brokerage firms in this regarding trading fees.

Video (Take a tour)

Type of accounts offered

You can open all major investment accounts using CIBC Investor’s Edge, including:

- Tax-Free Savings Account (TFSA)

- Registered Retirement Savings Plan (RRSP)

- Registered Education Savings Plan (RESP)

- Registered Retirement Income Fund (RRIF)

- Locked-in RSP (LRSP)

- Locked-in retirement account (LIRA)

- Locked-in Retirement Income Fund (LRIF) and

- Prescribed Retirement Income Fund (PRIF)

Open a CIBC investor’s Edge account now!

Benefits of CIBC Investor’s Edge

No minimum investment required

That means you can transfer as much as you want and get started. This is especially useful if you are just learning trading and investing.

Security

CIBC is one of the largest banks in North America and one of the top five in Canada. Also, CIBC Investor’s Edge is a division of CIBC Investor Services Inc., a subsidiary of CIBC.

Note: CIBC Investor Services Inc. is a member of the Canadian Investor Protection Fund (CIPF) and the Investment Industry Regulatory Organization of Canada (IIROC).

Fee per transaction below average

$6.95 per stockand ETF trading is lower than most of the big 5 banks. The savings here can be significant.

Power up your trades with CIBC’s investor’s Edge tools and research! Learn more

Discount on trading commission for students

If you have a CIBC Smart™ account for students, you get $1 off every equity stock and ETF trade , making it a little easier to discover and learn.

Discount on transaction fees for active traders

If you make more than 150 trades per quarter, you can register as an “active trader”, which gives you an additional discount on fees, up to $4.95 per trade.

Investment research, free tools and advice

CIBC Investor’s Edge hosts a wide range of research, tools and educational resources. They even walk you clearly through the process of creating an account, transferring money, and your first transaction. You can open an account online as well using the CIBC Investor’s Edge online account open process. They also have agents available by phone, chat and email if you need help.

CIBC Investor’s Edge platform provides access to trending stocks and topics, drawing information from trusted news sources, blogs, and social media.

See below some key features:

- Utilize their technical analysis resources to explore new opportunities in stocks and ETFs.

- Stay informed about analyst performance to gain valuable insights for making informed decisions.

- Benefit from the expertise of leading economists, tax specialists, and investment analysts through publications, videos, and webinars.

- Sign up for their newsletters to receive a comprehensive market overview.

Ready to invest with Investor’s Edge? Open an account

CIBC investor-friendly (mobile app)

The CIBC Investor’s Edge mobile app offers users a convenient way to monitor account balances and trade stocks, ETFs and options anytime, from anywhere. Users can also stay informed about important investment news, such as new IPOs, so they can take advantage of new opportunities as they arise.

Users will also have access to charts and tables to help them analyze their entire portfolio in one easy-to-read view, or review different investment accounts separately.

FAQs (CIBC Investor’s Edge Review)

Does CIBC Investor’s Edge offer trading fee rebates?

They do. If you have a CIBC Smart account for students, you’ll pay $5.95 per stock and ETF trade instead of the usual $6.95 per equity trade .

If you make more than 150 trades per quarter, you can register as an “active trader” and get an additional $1 rebate, paying only $4.95 per trade.

I’m new to investing, is CIBC Investor’s Edge the right choice for me?

CIBC services offer a lot of support, information, and educational material for new traders. Please note, it does not offer practice accounts.

Is there a minimum investment required to start using CIBC Investor’s Edge?

There’s none. You can start with as much or as little money as you want.