Is HTA a good investment?

Investors seeking consistent monthly income with exposure to the dynamic tech sector may find Harvest Tech Achievers Growth & Income (HTA ETF) appealing. This investment suits income-oriented individuals who value the monthly dividend payouts, especially with an attractive yield of around 10%. The covered call strategy employed by HTA, while enhancing income potential, may have shortcomings. Investors who prioritize capital appreciation over income may find the strategy limiting, as it involves selling call options on underlying stocks, capping potential gains in exchange for premium income. Additionally, during periods of rapid market ascent, the covered call strategy may result in missed opportunities for substantial profit participation. Therefore, while HTA caters to income-focused investors, those seeking aggressive capital growth might explore alternative strategies.

[stock_market_widget type=”card” template=”basic” color=”#5679FF” assets=”HTA.TO” display_currency_symbol=”true” api=”yf”]

[stock_market_widget type=”chart” template=”basic” color=”#5679FF” assets=”HTA.TO” range=”1mo” interval=”1d” axes=”true” cursor=”true” range_selector=”true” display_currency_symbol=”true” api=”yf”]

Please consult our recent post comparing HTA with other popular High Dividend ETFs in Canada.

Historical performance

| ETF | Div Yld | |

|---|---|---|

| HTA | 9.62% |

[stock_market_widget type=”table-quotes” template=”color-text” color=”#0F3FF6″ assets=”HTA.TO” fields=”symbol,ytd_return,three_year_average_return,five_year_average_return” links=”{‘HTA.TO’:{}}” display_header=”true” display_chart=”false” display_currency_symbol=”true” pagination=”true” search=”false” rows_per_page=”5″ sort_field=”logo_name_symbol” sort_direction=”asc” alignment=”left” api=”yf”]

Historical performance updated daily

Best US Dividend ETFs in Canada (2023)!

How had Covered call ETF’s performed historically?

In historical contexts characterized by bear markets, range-bound markets, and moderate bull markets, a covered call strategy has typically demonstrated the ability to outperform its underlying securities. However, during robust bull markets, when the underlying securities experience frequent rises beyond their strike prices, covered call strategies have historically exhibited slower growth. Nevertheless, even in these bullish phases, investors typically realize moderate capital appreciation alongside the accrual of dividends and call premiums.

HTA ETF MER

| ETF | MER* % |

| HTA -Harvest Tech Achievers Growth & Inc | 0.99 |

Top 10 Best Growth ETF in Canada!

XIC vs XIU: Best Canadian Index ETFs

HTA ETF Stock Profile

[stock_market_widget type=”table-quotes” template=”color-text” color=”#0F3FF6″ assets=”HTA.TO” fields=”symbol,price,change_abs,change_pct,net_assets,nav,fund_family” links=”{‘HTA.TO’:{}}” display_header=”true” display_chart=”false” display_currency_symbol=”true” pagination=”true” search=”false” rows_per_page=”5″ sort_field=”logo_name_symbol” sort_direction=”asc” alignment=”left” api=”yf”]

Updated daily

HTA Stock 52 weeks high and low

[stock_market_widget type=”table-quotes” template=”color-text” color=”#0F3FF6″ assets=”HTA.TO” fields=”symbol,price,52_week_low,52_week_high,fund_inception_date” links=”{‘HTA.TO’:{}}” display_header=”true” display_chart=”false” display_currency_symbol=”true” pagination=”true” search=”false” rows_per_page=”5″ sort_field=”logo_name_symbol” sort_direction=”asc” alignment=”left” api=”yf”]

Updated daily

How often does HTA pay dividends?

HTA pays a monthly dividend.

| Amount | Frequency | Ex-Div Date | Record Date | Pay Date | Declare Date |

|---|---|---|---|---|---|

| 0.1200 | Monthly | 3/27/2024 | 3/28/2024 | 4/9/2024 | 3/21/2024 |

| 0.1200 | Monthly | 2/28/2024 | 2/29/2024 | 3/8/2024 | 2/22/2024 |

| 0.1200 | Monthly | 1/30/2024 | 1/31/2024 | 2/9/2024 | 1/24/2024 |

| 0.1200 | Monthly | 12/28/2023 | 12/29/2023 | 1/9/2024 | 12/15/2023 |

| 0.1200 | Monthly | 11/29/2023 | 11/30/2023 | 12/8/2023 | 11/16/2023 |

| 0.1200 | Monthly | 10/30/2023 | 10/31/2023 | 11/9/2023 | 10/16/2023 |

What are the top holdings of HTA?

| Name | Weight | Sector |

|---|---|---|

| Alphabet Inc. | 5.4% | Interactive Media & Services |

| ServiceNow, Inc. | 5.4% | Software |

| Adobe Inc. | 5.3% | Software |

| Accenture PLC | 5.2% | IT Services |

| Micron Technology, Inc. | 5.2% | Semiconductors & Semiconductor Equipment |

| Broadcom Inc. | 5.1% | Semiconductors & Semiconductor Equipment |

| Meta Platforms, Inc. | 5.1% | Interactive Media & Services |

| Microsoft Corporation | 5.1% | Software |

| Motorola Solutions, Inc. | 5.1% | Communications Equipment |

| NVIDIA Corporation | 5.1% | Semiconductors & Semiconductor Equipment |

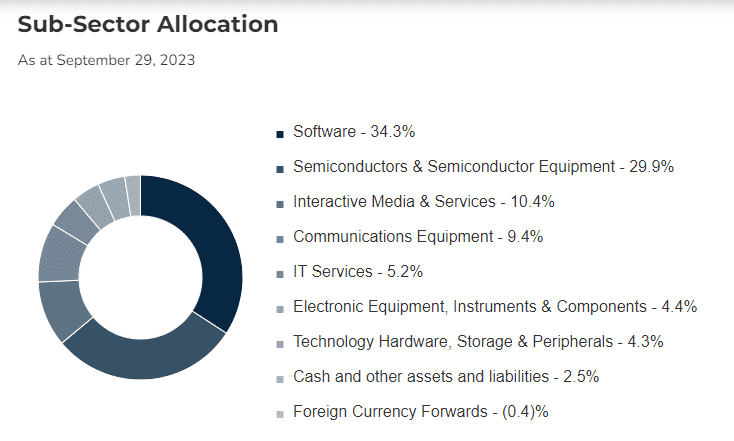

HTA ETF Sector allocation