XDIV ETF Investment objectif

XDIV invests in Canadian stocks with strong financials. The companies selected pay above-average dividend yields and have either paid steady or increasing dividends.

[stock_market_widget type=”card” template=”basic” color=”#5679FF” assets=”XDIV.TO” display_currency_symbol=”true” api=”yf”]

[stock_market_widget type=”chart” template=”basic” color=”#5679FF” assets=”XDIV.TO” range=”1mo” interval=”1d” axes=”true” cursor=”true” range_selector=”true” display_currency_symbol=”true” api=”yf”]

Best Canadian dividend ETF- Top 16

ZWB – Full review of BMO Covered Call Canadian Banks

What’s the MSCI Canada High Dividend Yield index?

XDIV is an index ETF that holds the constituents of the MSCI Canada High Dividend Yield. The replicated index is a quality index that includes strict criteria to achieve an equity portfolio of companies with solid fundamentals. Since XDIV is a dividend ETF, the focus is on achieving sustainable and persistent dividend payments.

Find below more details on the selection process:

targets companies with high dividend income

only stocks with higher than average dividend yields

companies with a track record of consistent dividend payments and with the capacity to sustain dividend payouts into the future

additional factos: return on equity (ROE), earnings variability, debt to equity (D/E), and price performance (past 12 months)

10% security capped index

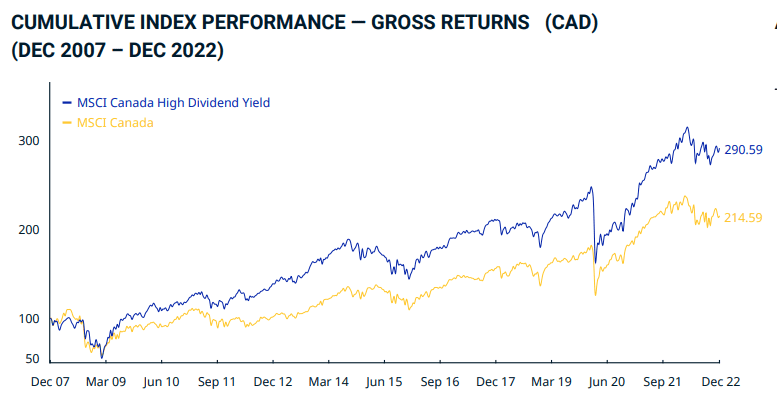

MSCI vs MSCI Canada High Dividend Yield – gross return comparison

XDIV Historical performance

[stock_market_widget type=”table-quotes” template=”color-header-border” color=”#5679FF” assets=”XDIV.TO” fields=”symbol,ytd_return,three_year_average_return,five_year_average_return” links=”{‘XDIV.TO’:{}}” display_header=”true” display_chart=”false” display_currency_symbol=”true” pagination=”true” search=”false” rows_per_page=”5″ sort_field=”logo_name_symbol” sort_direction=”asc” alignment=”left” api=”yf”]

XDIV vs VDY vs XDV

[stock_market_widget type=”table-quotes” template=”color-header-border” color=”#5679FF” assets=”XDIV.TO,XDV.TO,VDY.TO” fields=”symbol,ytd_return,three_year_average_return,five_year_average_return” links=”{‘XDIV.TO’:{},’XDV.TO’:{},’VDY.TO’:{}}” display_header=”true” display_chart=”false” display_currency_symbol=”true” pagination=”true” search=”false” rows_per_page=”5″ sort_field=”logo_name_symbol” sort_direction=”asc” alignment=”left” api=”yf”]

How to choose a good dividend ETF

– Total return: Though the focus here is on the dividend yield, you have to keep in mind the total return. The profit or loss we make on any investment combines both dividend income and capital gain or loss. Looking at the long-term performance of the fund is crucial. An ETF that provides a good capital appreciation with a high dividend yield is preferable.

–Diversification: A diversified ETF is always a safer option. Some high yield ETFs are sector-specific (Financials, Energy or Gold). The ones focused on Energy and Gold have had an inferior long-term performance and carry high volatility risk.

–Volume and liquidity of the ETF. The higher the asset under management, the lower the trading costs of the ETF (difference between the bid and ask price).

XDIV ETF Dividend distribution

| Amount | Ex-Div Date | Record Date | Pay Date | Declare Date |

|---|---|---|---|---|

| 0.1300 | 3/22/2024 | 3/25/2024 | 3/28/2024 | 3/18/2024 |

| 0.1300 | 2/23/2024 | 2/26/2024 | 2/29/2024 | 2/16/2024 |

| 0.1300 | 1/25/2024 | 1/26/2024 | 1/31/2024 | 1/19/2024 |

| 0.1030 | 12/28/2023 | 12/29/2023 | 1/4/2024 | 12/20/2023 |

| 0.1030 | 11/21/2023 | 11/22/2023 | 11/30/2023 | 11/15/2023 |

XDIV ETF portfolio

| Name | Weight (%) |

|---|---|

| ROYAL BANK OF CANADA | 8.74 |

| SUN LIFE FINANCIAL INC | 8.60 |

| MANULIFE FINANCIAL CORP | 8.57 |

| BANK OF NOVA SCOTIA | 8.56 |

| FORTIS INC | 8.15 |

| TORONTO DOMINION | 8.00 |

| RESTAURANTS BRANDS INTERNATIONAL I | 7.54 |

| ROGERS COMMUNICATIONS NON-VOTING I | 6.72 |

| SHAW COMMUNICATIONS INC CLASS B | 5.62 |

| EMERA INC | 4.44 |

Sector breakdown

| Type | Fund |

|---|---|

| Financials | 50.40 |

| Communication | 18.77 |

| Utilities | 16.83 |

| Consumer Discretionary | 10.05 |

| Energy | 1.91 |

| Materials | 1.72 |

| Cash and/or Derivatives | 0.34 |