Bonjour, chers investisseurs! Today, we’re exploring the Vanguard Total Stock Market ETF, commonly known as VTI. This ETF is a popular choice among investors, but what exactly is it, and why should you, as a Canadian investor, consider it? Let’s break it down.

What is VTI ETF?

[stock_market_widget type=”table-quotes” template=”color-header-border” color=”#5679FF” assets=”VTI” fields=”symbol,name,price,change_pct,net_assets” display_header=”true” display_chart=”false” search=”false” pagination=”false” scroll=”false” rows_per_page=”5″ sort_direction=”asc” alignment=”left” api=”yf”]

VTI is an Exchange-Traded Fund (ETF) that tracks the performance of the CRSP US Total Market Index. It’s managed by Vanguard, a well-known investment management company. The key features of VTI include:

Diversification:

The Vanguard Total Stock Market ETF, or VTI, is a great way to gain exposure to the entire U.S. stock market. What makes it special? It includes a wide range of stocks, from large-cap to mid-cap and even small-cap stocks. This means you’re not just investing in big, well-known companies, but also in smaller, potentially fast-growing ones. Diversification is like not putting all your eggs in one basket, and VTI does this well by spreading your investment across different company sizes.

Low-Cost:

Cost matters in investing. VTI stands out for its low expense ratio. This means it costs less to own compared to many other investment options. A lower expense ratio can have a big impact on your investment returns over time, making VTI an economical choice for investors.

Liquidity:

Now, let’s talk about liquidity. VTI is an ETF, which means it trades on the stock market just like any regular stock. Why is this good for you? It’s simple to buy and sell shares of VTI whenever the market is open. This ease of trading, or liquidity, is a big advantage, especially if you need to adjust your investments quickly.

Why Consider VTI as a Canadian Investor?

- U.S. Market Exposure: The U.S. stock market is one of the world’s largest and most dynamic. VTI lets you tap into this market.

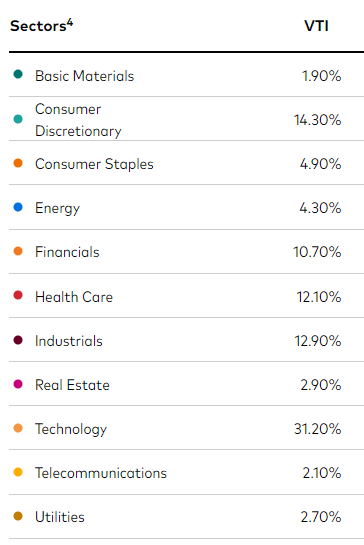

- Diversification Benefits: Adding VTI to your portfolio can reduce risk. It helps in spreading investments across different sectors and companies.

- Tax Efficiency: For Canadian investors, holding U.S. ETFs like VTI in specific accounts (like RRSP) can be tax-efficient due to tax treaties between Canada and the U.S.

VTI historical performance

[stock_market_widget type=”table-quotes” template=”color-header-border” color=”#5679FF” assets=”VTI” fields=”symbol,three_year_average_return,five_year_average_return” display_header=”true” display_chart=”false” search=”false” pagination=”false” scroll=”false” rows_per_page=”5″ sort_direction=”asc” alignment=”left” api=”yf”]

Historical performance updated daily – VTI ETF for Canadian investors

VTI Holdings

| Ticker | Holdings | % of fund |

|---|---|---|

| AAPL | Apple Inc. | 6.35 % |

| MSFT | Microsoft Corp. | 6.34 % |

| AMZN | Amazon.com Inc. | 3.05 % |

| NVDA | NVIDIA Corp. | 2.47 % |

| GOOGL | Alphabet Inc. Class A | 1.77 % |

| META | Facebook Inc. Class A | 1.64 % |

| GOOG | Alphabet Inc. Class C | 1.49 % |

| TSLA | Tesla Inc. | 1.46 % |

| BRK.B | Berkshire Hathaway Inc. Class B | 1.45 % |

Things to Keep in Mind

Currency Risk:

One critical aspect to consider with VTI is the currency risk. Since VTI is denominated in U.S. dollars, the value of your investment can be affected by changes in the exchange rate between the Canadian dollar (CAD) and the U.S. dollar (USD). This means if the CAD weakens against the USD, your investment in VTI could be worth more in CAD terms, and vice versa. It’s essential to be mindful of this currency dynamic, as it can impact your overall returns.

Tax Implications:

Another key factor to consider is the tax implications. Holding U.S. ETFs like VTI in accounts other than Registered Retirement Savings Plans (RRSPs) can have different tax consequences. In non-RRSP accounts, you might face withholding taxes on dividends from U.S. stocks. Understanding these tax nuances is crucial in making an informed investment decision. It’s always a good idea to consult with a tax professional to understand how these factors apply to your individual situation.

Long-Term Perspective:

Lastly, it’s important to recognize that ETFs like VTI are generally more suitable for long-term investing. Why? Because investing in the stock market involves volatility, and the value of your investments can fluctuate in the short term. By adopting a long-term perspective, you’re better positioned to ride out market fluctuations and benefit from the potential growth over time. This approach is especially relevant for a broad market ETF like VTI, which is designed to reflect the performance of the entire U.S. stock market.

How to Buy VTI in Canada?

You can purchase VTI through a brokerage account (Such as Questrade, Wealthsimple and CIBC Investors’ Edge…etc). Many Canadian brokerages offer access to U.S. markets. Remember to consider transaction fees and the exchange rate when buying.

Conclusion

VTI is a solid choice for those looking to diversify into the U.S. market. However, it’s crucial to consider your investment goals and understand the risks involved. Always do your due diligence before investing.

I hope this guide helps you understand VTI better. Remember, investing is a journey, and staying informed is key. Happy investing!