The TXF ETF, also known as the CI Tech Giants Covered Call ETF, is designed for investors who want exposure to large technology companies while generating income through a covered call strategy. In this post, we’ll explore how TXF works, its key features, and how it compares to similar ETFs like TEC.

What is TXF ETF?

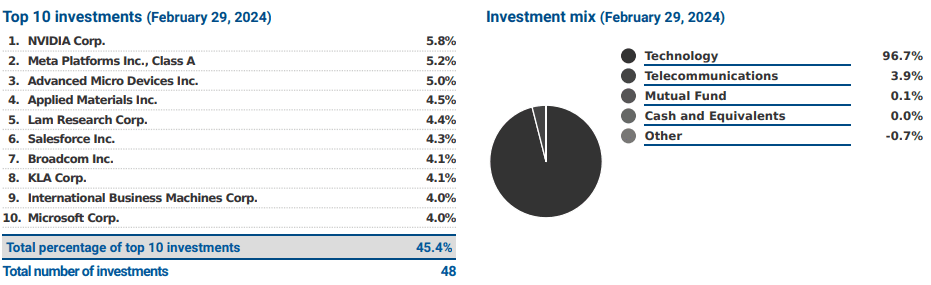

The TXF ETF provides exposure to some of the world’s largest technology companies, including Apple, Microsoft, Alphabet, and Intel. It combines this tech exposure with a covered call strategy, where the fund sells call options on 25% of its holdings. This generates income from option premiums but limits the upside potential on that portion of the portfolio.

TXF primarily targets U.S.-based tech companies across multiple sub-sectors like software, hardware, semiconductors, and telecommunications. These companies are global leaders in areas like cloud computing, artificial intelligence, and hardware manufacturing.

Comparing TXF and TXF.B: Hedged vs. Unhedged Options

Here’s a table summarizing the differences between TXF and TXF.B:

| Feature | TXF (CI Tech Giants Covered Call ETF) | TXF.B (CI Tech Giants Covered Call ETF – Unhedged) |

| Currency Hedging | Hedged to Canadian dollars (CAD) | Unhedged (exposed to U.S. dollar currency fluctuations) |

| Risk of Currency Exposure | Lower risk due to hedging | Higher risk due to exposure to USD/CAD exchange rates |

| Target Investor | Investors seeking stability from currency fluctuations | Investors wanting exposure to U.S. dollar movements |

| Objective | Provide steady returns with minimal currency impact | Provide returns with potential benefit/risk from U.S. dollar appreciation/depreciation |

| Ticker Symbol | TXF.TO | TXF.B.TO |

Key Features of TXF ETF

· Focus on Tech Giants: TXF holds shares in large-cap tech leaders like Apple, Microsoft, Alphabet, Adobe, and Intel, providing exposure to one of the fastest-growing sectors.

· Covered Call Strategy: TXF writes at-the-money or slightly out-of-the-money calls on 25% of its holdings, balancing income generation with growth potential. This lower coverage ratio allows investors to still benefit from market rallies on 75% of the portfolio.

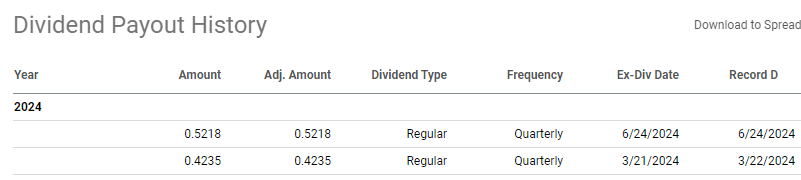

· High Dividend Yield: The ETF offers an attractive dividend yield of 8% to 10%, driven by:

- Dividends from underlying stocks like Microsoft and Intel.

- Premium income from selling options, which is higher in the volatile tech sector.

· Quarterly Distributions: Unlike many covered call ETFs that pay monthly, TXF offers quarterly distributions, aligning with corporate dividend schedules and paying out collected premiums.

· Management Fee: TXF charges a competitive 0.65% management fee, and the total Management Expense Ratio (MER) is 0.78%.

Performance and Risk

Source: Yahoo finance

TXF.TO (CI Tech Giants Covered Call ETF) has shown strong long-term performance, driven by its holdings in major tech companies like Apple, Microsoft, and Alphabet. These tech giants have delivered impressive growth over the years, fueling TXF’s solid returns, particularly over the 1-year (29.19%) and 5-year (16.33%) periods. The ETF employs a covered call strategy, generating additional income by selling call options on its holdings.

While TXF’s covered call strategy helps generate income even in fluctuating markets, it may underperform during strong market rallies due to the capped upside from the calls. However, TXF retains growth potential with 75% of the portfolio uncovered, allowing participation in tech sector growth.

Tax Efficiency

In non-registered accounts, the covered call income from TXF is tax-efficient. The premiums collected are typically treated as capital gains.

TXF vs TEC

Here’s a comparison between TXF and the TEC (TD Global Technology Leaders Index ETF):

| Feature | TXF (CI Tech Giants Covered Call ETF) | TEC (TD Global Technology Leaders Index ETF) |

| Holdings Focus | U.S. tech giants (Apple, Microsoft, Alphabet) | Global tech (U.S., Europe, Asia) |

| Covered Call Strategy | Yes (income generation, limited upside) | No (full market upside potential) |

| Income Generation | Higher due to covered call premiums | Lower income focus, more growth-oriented |

| Growth Potential | Moderate due to income strategy | Higher growth potential with global tech exposure |

| Currency Hedging | Hedged (TXF) or unhedged (TXF.B) | Unhedged, exposed to foreign currency fluctuations |

| Target Market | Primarily U.S. tech giants | Broader global tech sector |

| Risk Level | Lower volatility due to income strategy | Higher risk from global exposure and growth focus |

In summary, TXF uses a covered call strategy to generate steady income by selling options on U.S. tech giants, offering lower risk but limited upside during stock rallies. It’s ideal for income-focused investors who prefer more stability. In contrast, TEC is a growth-oriented ETF with full exposure to the global tech sector, offering higher upside but also greater risk due to market volatility. TEC suits investors seeking long-term growth without a focus on income.

Conclusion

The TXF ETF stands out as an ideal investment for those seeking exposure to high-growth tech companies while also generating significant income through a covered call strategy. Its lower coverage ratio allows for participation in tech stock rallies, making it attractive for growth-oriented investors who also want consistent, high-yield payouts. However, investors should be aware of the trade-offs, including potential underperformance in a rapidly rising market and the higher volatility associated with tech stocks.

As with any investment, ensure that TXF fits within your financial goals and risk tolerance