Introduction: A strategy to turn your portfolio around

Investing in the stock market is more than just buying and selling stocks. For investors looking for additional income, options can offer attractive opportunities — provided they understand the risks and mechanisms.

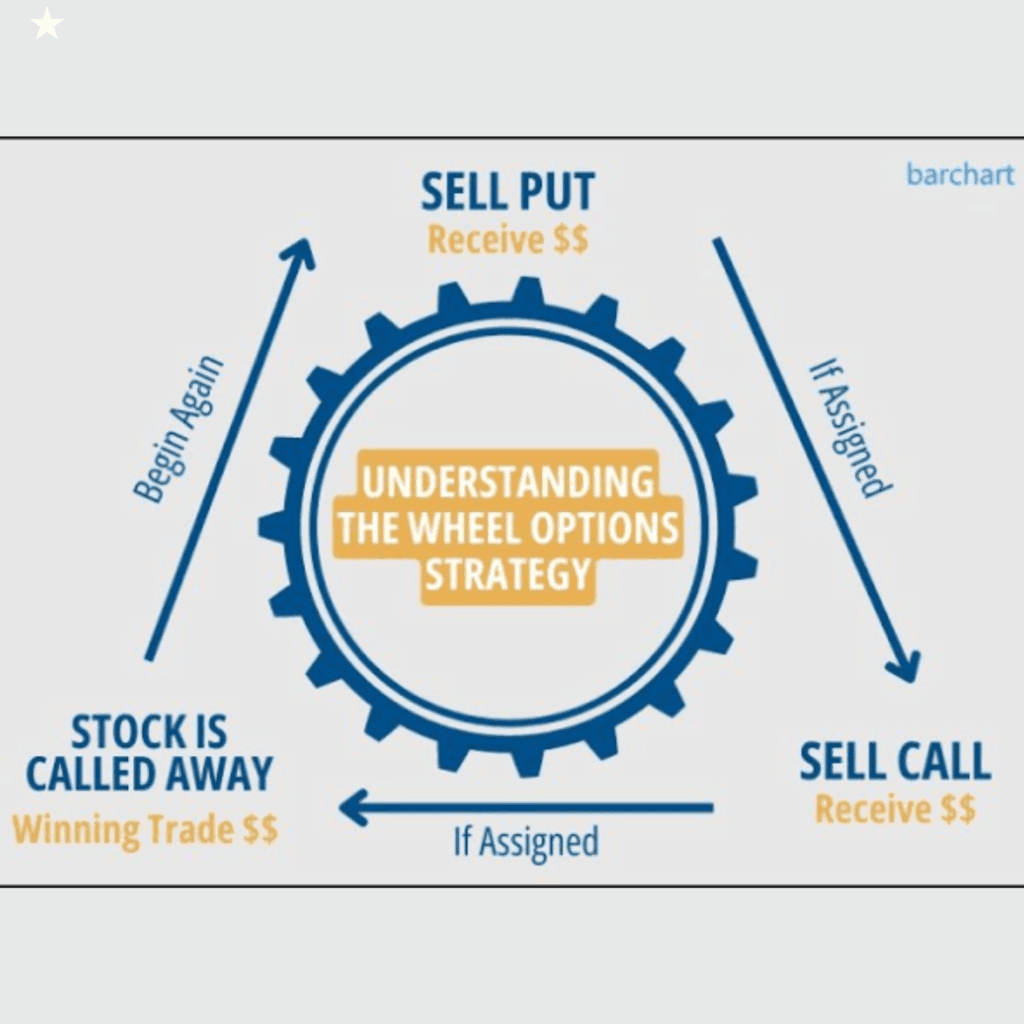

Among the strategies available to retail investors, the wheel strategy is becoming increasingly popular. It combines two types of options — puts and calls — in a logical cycle, aimed at acquiring shares at a good price and generating recurring revenue.

Let’s take a step-by-step look at how this strategy works, its benefits, its risks, and some concrete examples tailored to Canadian investors.

What is the wheel strategy?

The wheel strategy is an investment method based on covered calls and puts. It is based on a simple idea:

Buy a stock at a good price, then sell call options to generate income for as long as you own that stock.

It’s a passive income strategy that can work on quality stocks that you’d be willing to hold for the long term.

Conditions for applying the policy:

- Be willing to buy 100 shares of a security

- Use an account that allowsCovered Options Trading(e.g.:Questrade, Interactive Brokers, etc.)

- Understanding how cash-secured puts and covered calls work

The three phases of the wheel

Step 1: Sell a put (cash-secured)

You start by selling a put option on a stock you want to own. This means that you commit to buying 100 shares at a given strike price if the stock falls.

Example:

- You sell a $50 put on XYZ stock, expiring in 30 days.

- You receive a bonus of $1.50, or $150 (1.50 × 100).

- You must have $5,000 in cash available in case you need to buy the shares.

Two possible scenarios:

- The stock stays above $50 → you keep the premium, and you start over.

- The stock falls below $50 → you buy 100 shares at $50 (contract obligation).

Step 2: Sell a covered call

Now that you own all 100 stocks, you move on to the next phase: writing a covered call option. This commits you to selling your shares at a set price if the stock goes up.

Example:

- You hold 100 shares of XYZ purchased at $50.

- You sell a call at $55 for a premium of $1.00 → you cash in another $100.

Two possible scenarios:

- The stock stays below $55 → you keep your shares and the premium.

- The stock exceeds $55 → your shares are sold at $55 → you cash in a capital gain + the premium.

Step 3: Start the cycle again

Once your shares are sold via the call exercise, you return to step 1: sell a new put. And so on.

This is why it is called a “wheel strategy“: a continuous cycle of selling puts and calls, which can generate regular income.

Why use the wheel strategy?

Benefits:

- Regular passive income thanks to the premiums collected

- Ability to buy shares at a discount

- Suitable for stable and liquid stocks (e.g., Canadian banks, large corporations)

- Great strategy for long-term investors looking to accumulate capital

Disadvantages and risks:

- You must have enough capital to buy 100 shares

- If the stock falls sharply, you may incur an unrealized loss

- You limit your gains with calls if the stock goes up too quickly

- Premiums can vary greatly depending on volatility

The wheel strategy combines the selling of put options and call options to generate passive income while buying and selling stocks. It attracts investors who are looking for a disciplined and potentially profitable method.

Among the advantages, we note first of all the bonuses collected regularly, which bring an interesting income stream. Secondly, selling puts allows you to buy shares at a discount, under certain market conditions. This strategy is particularly suitable for stable and liquid stocks, such as large Canadian banks or TSX companies. It fits well into a long-term approach, focused on capital accumulation.

But the wheel also carries risks. You need to have enough capital to buy 100 shares per position. If the stock falls sharply, the investor can suffer a significant unrealized loss. In addition, the gains are limited if the stock rises quickly, since the call sets a sell price. Finally, income varies according to volatility: in quiet periods, premiums are lower.

It is therefore an interesting strategy, but one that requires rigour and understanding of the options.

A concrete example with a Canadian action

Let’s take a fictitious example with TD Bank (TD. TO):

Current Price: $102

You sell a put with a strike price of $98, 30-day expiration, and you receive a premium of $1.50→ You cash out $150 ($1.50 × 100 shares)

If the stock drops below $98 at maturity → you are assigned and you buy 100 TD shares at $98→ Total cost: $9,800, but your net cost is $9,650 (thanks to the premium received)

You now own the shares. You sell a covered call at $105 with a premium of $1.20→ You cash in another $120

Two possible scenarios:

- If TD exceeds $105 at maturity, your shares are sold at $105→ Capital gain of $700 ($105 – $98) + $120 premium = $820 total gain

- If TD stays below $105, you keep your shares and can sell another call

Tips for using the strategy well

- Choose strong stocks with good fundamentals

- Avoid stocks that are too volatile or highly speculative

- Use short maturities (7 to 30 days) to maximize premiums

- Always monitor your available capital to meet your commitments

- Keep a logbook of your transactions (premiums received, strike price, maturity)

If you apply the wheel strategy, whether in the Canadian or American market, there are some best practices that are still essential. Start by selecting quality stocks with good fundamentals, stable profitability and good liquidity. In Canada, securities such as banks (TD, BMO) or Enbridge are often used. In the United States, we find Apple, Coca-Cola and Pfizer.

Avoid highly volatile or speculative stocks, often found on the NASDAQ or Canadian small caps. They offer high premiums, but the risk is also greater.

Use short maturities (7 to 30 days) to maximize premiums and be able to react quickly if the market moves. This is true on both sides of the border.

Always watch your available capital, especially with the CAD/USD exchange rate if you operate in both markets. It is important to have enough cash to buy 100 shares if you are assigned.

Finally, keep an accurate logbook of your trades in both markets. Record the premiums collected, the strike price, the maturity dates and the results. This will help you better assess your overall performance.

Useful tools for Canadian investors

- Canadian exchanges: TSX, TSXV (use an option-eligible account)

- Compatible brokers : Questrade, BMO InvestorLine, Interactive Brokers, Desjardins Courtage en ligne

- Options Analysis Tools: Barchart.com, Market Chameleon, OptionStrat

- Position tracking: Excel, Google Sheets, or specialized software

In short

| Stage | Action | Objective |

| 1 | Sell a put | Trying to buy the stock at a good price + cashing in a premium |

| 2 | Sell a covered call | Generate income from the shares held |

| 3 | Recommence | Repeat the cycle for regular income |

Conclusion: A simple strategy, but not without risks

The wheel strategy is not a “sure shot,” but it can be a great tool for patient and disciplined investors. It allows you to turn market volatility into income, while remaining exposed to stocks you’d be willing to hold.

Before using it, make sure you understand the options, assess your financial goals, and start small, with something you’re familiar with.