The Hamilton Enhanced U.S. Covered Call ETF (HYLD) is attracting a lot of investors in Canada, particularly for its high monthly return. But behind the impressive casts is a question that many are asking:

👉 Does HYLD really pay dividends… or is it mainly a return of capital (ROC)?

In this comprehensive analysis, based on your Q&A, we clarify how distributions actually work, the difference between price and total return, and why ROC is not a danger sign — contrary to what many believe.

🟨 1. HYLD: A high-income ETF

HYLD is designed to offer a monthly cash flow through a combination of:

- options hedged across multiple multi-ETFs

- of full exposure to the U.S. market

- an optimized strategy to maximize returns

🎯 Target: ~12% return per yearHYLD explicitly targets high income, not unit price growth.

🟦 2. Price performance: an incomplete indicator

Many investors judge HYLD based solely on price. For example, over 5 years, the graph shows a relatively stable or even slightly declining performance.

But here’s the problem:

👉 The price does NOT reflect the actual performance of an income-oriented ETF.

This is because HYLD redistributes a large portion of the earnings in the form of monthly distributions, resulting that:

- The net asset value rises less

- But the total cash flow generated is very high

Looking only at the price is therefore ignoring 80–90% of the real return.

🟧 3. Total Return = Price + Dividends

To understand HYLD, you have to think in terms of total return.

📌 Formula:

Price Performance + Dividends = Total Return

The table shown in the video shows higher total return returns:

- 1 year: +25.9%

- 3-year annualized: +23%

- Since 2022: +11.5%/year

- YTD: +21.9%

➡️ Very solid figures, despite a price that is not exploding.

🟩 4. Distribution history: what the numbers tell us

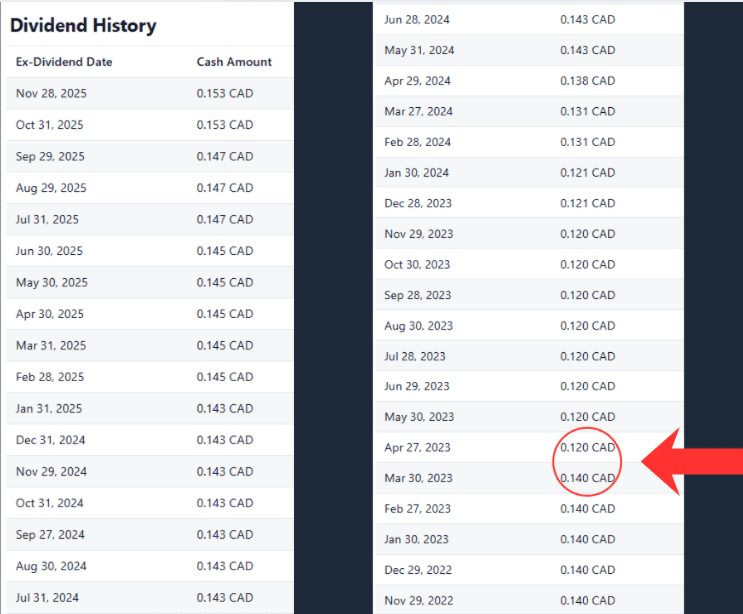

By analyzing the distribution history, we notice:

- Stable monthly payments

- sometimes a drop in distribution during difficult market periods

- the introduction of ROC as a major component in some years

A clear example:

📉 In 2022, the bear market forced HYLD to reduce its distributions (visible in April).

This shows that distributions are not guaranteed. They depend on option premiums and the health of the US market.

🟥 Article 5. Return of Capital (ROC): danger or simple tax classification?

Among the elements that most resonate with investors:

👉 Why does HYLD distribute so much ROC?

Here is the essential clarification:

ROC does NOT mean that the fund gives you back your own money.

This is NOT a sign that the fund is in trouble.

This is often the consequence of hedged options strategies.

When the gains generated by the options offset the decline in the underlying assets, there may be no taxable net gain. As a result, the distribution is classified as an ROC.

🟩 Significant tax effect:

ROC reduces the adjusted cost base (ACB), which can defer tax later.

So that’s not a bad thing — it’s an accounting reality linked to the fund’s strategy.

🟫 6. Simple example: GOOGL to understand the ROC

In the video, a clear example with GOOGL illustrates the phenomenon:

- The manager sells covered options.

- It generates bonuses every month.

- But if the stock falls during the year… → the options offset the loss→ there is no taxable gain

- Distributions cannot be reported as dividends or capital gains

- They therefore become Return of Capital

🎯 ROC = a tax adjustment, not a hidden risk.

🟦 7. Why HYLD Needs to Be Evaluated Differently

HYLD is not a growth ETF. It should not be evaluated as VFV or VOO.

Here’s what really matters:

- stable distributions

- Ability to generate bonuses

- Total Yield

- Adequacy with the income profile

The main conclusion:

👉 HYLD actually generates income through options. The ROC simply reflects how these revenues are classified.

HYLD is not a growth ETF and therefore should not be evaluated as VFV or VOO. Its main objective is to provide a high income, which involves using different criteria to measure its performance. What really matters is the stability of distributions, the fund’s ability to generate premiums, total return and its suitability for an income-oriented profile. In practice, HYLD does generate income through its hedged options strategies. The ROC is only a tax classification of these distributions, and not a sign of fragility.

🟨 8. Key points to remember

- HYLD is designed for high income, not growth.

- The ROC is not a sign of danger, but a fiscal reality.

- Distributions vary by market.

- The total return is much higher than the price suggests.

- HYLD is suitable for income-oriented investors, not extreme growth hunters.

- Hedged options limit upside potential, but stabilize revenues.

HYLD is primarily an ETF designed to generate high income, not to offer strong capital growth. This orientation explains why its price may seem stable or not very dynamic, while its total return, including monthly distributions, is actually much higher than what an investor who only sees the price chart. A point that is often misunderstood concerns the Return of Capital (ROC): far from being a sign of weakness, it reflects above all a tax reality resulting from the hedged option strategies used by the fund. Distributions can also vary over the course of the market, as they depend on the premiums generated and broader economic conditions. HYLD is therefore primarily suitable for investors focused on income and cash flow stability, rather than those looking for aggressive growth comparable to a traditional index ETF. Finally, it should be understood that the hedged options used in the fund’s strategy naturally limit the potential for appreciation in times of strong bullish rally, but they also help to stabilise income, making HYLD an attractive tool for a sustainable income strategy.

🟩 Conclusion

In conclusion, HYLD is a powerful ETF for investors looking for:

- high monthly income

- A simple solution to generate cash flow

- A diversified and option-optimised strategy

- An attractive total return despite a stable price

Return on Capital is an integral part of the operation of this type of fund and should be understood as a tax concept, not as an alarm.

➡️ HYLD can be a great component of an income portfolio, as long as you understand how it generates its distributions and what trade-offs this strategy entails.