Investment objective

HISA High Interest Savings Account Fund was launched by Evolve ETF on November 20, 2019. Its primary objective is the preservation of capital. The holdings of the fund are primarily high interest saving accounts.

Ticker: HISA.NE

HISA is great for:

– Conservative investors who would like to invest in a high interest low risk investment;

– Investors who would like to keep some cash on the side for future investment opportunities.

ZWC – Full review of BMO High Dividend ETF Covered Call

Review of VDY – Vanguard FTSE Canadian High Dividend Yield Index

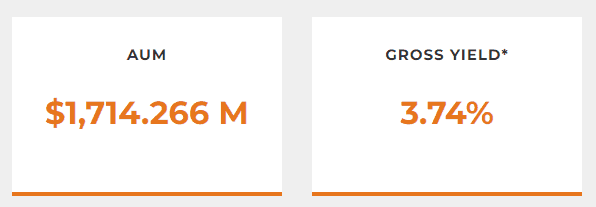

HISA ETF Dividend yield

The trailing dividend yield (past 12 months) is 1.16%. However, the forward dividend yield based on the last distribution is around 3%.

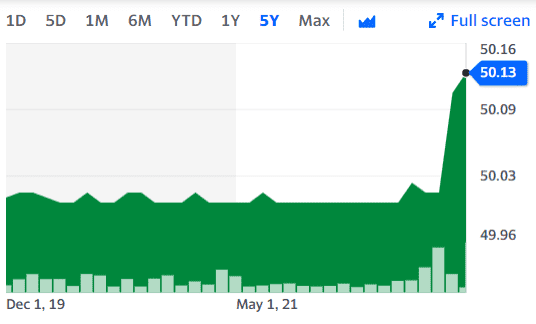

HISA ETF performance

| YTD | 1Y | 2Y | |

| HISA | 1.19 | 1.35 | 0.96 |

Review HYLD: Hamilton Enhanced U.S. Covered Call ETF

HISA Fees

The effective annual management fee for HISA will be five basis points (0.05%) plus applicable sales taxes. It’s one of the lowest among this category of ETFs. See below Evolve ETF’s announcement regarding their fees:

Evolve Announces Fee Reduction on High Interest Savings Account Fund (Ticker: HISA)

HISA ETF Dividend distribution

| EX-DIV DATE: | PAYMENT DATE: | PAYMENT AMOUNT |

|---|---|---|

| 01/31/22 | 02/07/22 | $0.02357 |

| 02/28/22 | 03/07/22 | $0.02059 |

| 03/31/22 | 04/07/22 | $0.03304 |

| 04/28/22 | 05/06/22 | $0.03956 |

| 05/30/22 | 06/07/22 | $0.05989 |

| 06/29/22 | 07/08/22 | $0.07468 |

| 07/28/22 | 08/08/22 | $0.09621 |

| 08/31/22 | 09/08/22 | $0.13448 |

| 09/28/22 | 10/07/22 | – |

| 10/31/22 | 11/07/22 | – |

What’s an ETF?

ETF is an exchange traded fund. This fund is managed by a professional manager. There are several ETF issuers in Canada:

• Banks (BMO, TD… etc)

• Investment companies such as (Vanguard, iShares, etc.)

There are currently over 1000 ETFs available on the market. There is an ETF for every type of investor. They are suitable for active or passive management.

What type of ETFs are there?

ETFs are so popular to the point where there is on for each taste:

- Index ETFs: tracks a major index like the TSX or the S&P500 or the NASDAQ…etc

- Fixed income ETFs: tracks an index but for fixed income (bonds, treasury bills…etc)

- Commodity ETFs: they track the price of a commodity Oil, Gas, Gold, Silver…etc

- Sector driven ETFs: they invest in a specific sector/industry for instance Blockchain, Retail, Energy…etc

- Multi asset ETF: they are a hybrid, they will invest for example 50% in Stock index and 50% in Bond index

You get the idea! You can constitute now a well diversified portfolio just by using ETFs. That’s why several companies are now offering ‘Robo advisor’ which is basically a portfolio of ETFs that fit your risk tolerance. They charge a small fee for this service.

How can I buy an ETF?

It’s the same process as buying a stock. You need simply to access the online website of your broker and place the order using the ticker/symbol of the ETF

Who are the main issues of ETFs in Canada?

- BMO Asset Management

- Claymore Investments

- BlackRock Inc

- Horizons ETFs Management

- Vanguard Investments Canada Inc.