When it comes to investing in international markets, Canadian investors are often faced with the issue of currency risk. Currency risk refers to the fluctuation of exchange rates between currencies, which can significantly impact investment returns. In this article, we’ll examine the pros and cons Hedged vs Unhedged ETF in Canada.

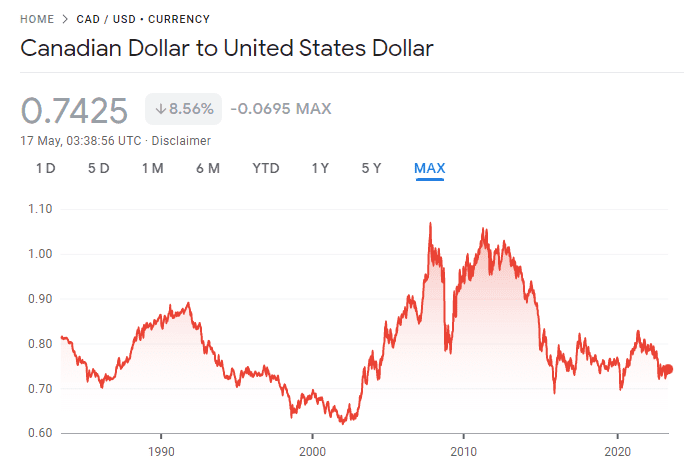

History of the evolution of the Canadian Dollar against the US Dollar

Hedged funds

Currency-hedged funds use hedging strategies to mitigate the impact of currency risk on returns. The idea is to protect investors against adverse exchange rate fluctuations by using futures, options or other financial derivative instruments to offset potential losses.

- Can $200,000 Generate $1,000 per Month? 3 Structured Income Strategies for Canadian Investors

- DGS ETF Explained: How Dividend Growth Split Corp Really Works — and the Risks Most Investors Miss

- Best Hamilton ETFs for Monthly Income in 2026 (High Yield, Covered Call ETFs)

- HHIS ETF Review: Harvest Diversified High Income Shares Explained

- JEPI vs QYLD: The Ultimate Covered Call Income Battle

The advantages and disadvantages of hedge funds

Currency risk minimization

By hedging currency risk, Canadian investors can avoid potential losses caused by exchange rate volatility. This preserves the value of their investments and avoids adverse effects on returns.

Return predictability

Hedged funds offer some stability in terms of returns as exchange rate fluctuations are smoothed out. This can be especially important for investors with short-term goals or looking for some security in their investments.

Ease of management

Hedged funds are generally professionally managed, so investors do not have to monitor hedging strategies actively. This can be advantageous for investors who prefer a more passive approach.

Additional costs

Funds hedged against currency risk often have additional costs related to the hedging strategies in place. These costs can reduce net returns to investors (higher Management Expense Ratio).

Potential loss of earnings

By protecting against adverse exchange rate movements, hedged funds can also limit potential gains when the foreign currency strengthens against the Canadian dollar. Investors may miss opportunities to benefit from foreign currency appreciation.

Funds not covered

These funds do not use currency hedging strategies. Investors who opt for unhedged funds accept currency risk and are exposed to fluctuations in exchange rates.

15 Best Monthly Dividend Stocks in Canada for passive income

10 Best Dividend ETF in Canada 2023

The pros and cons of NON-hedged funds

Higher earning opportunities

Unhedged funds do not seek to mitigate currency risk. So they can potentially benefit from favorable fluctuations in exchange rates. Investors may realize additional gains if the foreign currency in which the investment is denominated strengthens against the Canadian dollar.

Increased risk

Fluctuations in exchange rates can significantly impact the returns of investments denominated in a foreign currency. If the foreign currency depreciates against the Canadian dollar, investors may suffer losses in value and lower returns.

Increased volatility

Unhedged funds are often more volatile due to their direct exposure to currency risk. Fluctuations in exchange rates may cause significant movements in the value of foreign assets held in the fund. Therefore, investors should be prepared to accept some volatility in their investments and have an appropriate risk tolerance.

Conclusion

This article examined the pros and cons of currency-hedged and unhedged funds for Canadian investors. Hedged funds offer minimization of currency risk, predictability of returns and ease of management through the use of professional hedging strategies. However, these funds incur additional costs and may limit potential gains in the event of foreign currency appreciation.

On the other hand, unhedged funds offer higher opportunities for gains in the event of foreign currency appreciation. Still, they expose investors to a greater risk of downside losses and increased volatility due to direct exposure. Exchange risk.