For income-focused investors in Canada and the United States, covered call ETFs have gained massive popularity as a source of predictable monthly income. With assets under management reaching tens of billions of dollars, these strategies appeal to investors seeking cash flow and smoother returns in uncertain markets.

However, high income always comes with trade-offs. So how do covered call ETFs really work, and when do they make sense in a portfolio?

Executive Summary

Why Covered Call ETFs Are So Popular

High Income Potential

One of the main reasons covered call ETFs have become so popular is their ability to generate significantly higher income than traditional dividend ETFs. These funds boost cash flow by selling call options on their underlying holdings. The option premiums collected are distributed to investors, often resulting in yields well above standard equity income strategies.

While traditional dividend ETFs typically yield between 2% and 4%, covered call ETFs frequently offer 7% to 12% or more, depending on market conditions and how aggressively calls are written. This makes them especially attractive for investors who prioritize income over capital appreciation, such as retirees or those seeking predictable cash flow.

Lower Volatility Than Holding Stocks Directly

By selling upside potential in exchange for income, covered call ETFs tend to deliver a smoother return profile. The option premiums act as a partial buffer during sideways or mildly negative markets, helping reduce overall volatility compared to owning the underlying stocks outright.

This characteristic makes covered call ETFs appealing to investors who want equity exposure but prefer less dramatic market swings.

Predictable Monthly Cash Flow

Most U.S. covered call ETFs pay monthly distributions, which is a key advantage for income-focused investors. Regular payments simplify budgeting and portfolio planning, making these ETFs popular among retirees and those relying on investment income.

⚠️ Important Trade-Off

The downside of this strategy is limited upside participation. In strong bull markets, covered call ETFs usually underperform their underlying indexes because gains above the option strike price are capped. As a result, they are best viewed as income tools, not long-term growth engines.

List of Best U.S. Covered Call ETFs

| ETF | Focus | Yield* | AUM | MER |

| JEPI | S&P 500 (active) | ~8.1% | $41.6B | 0.35% |

| JEPQ | NASDAQ-100 | ~10.2% | $32.3B | 0.35% |

| QYLD | NASDAQ-100 | ~11.7% | $8.2B | 0.61% |

| QQQI | NASDAQ-100 | ~13.6% | $7.3B | 0.68% |

| SPYI | S&P 500 | ~11.5% | $6.7B | 0.68% |

| XYLD | S&P 500 | ~9.4% | $3.1B | 0.60% |

| GPIX | S&P 500 | ~8.0% | $2.6B | 0.29% |

| GPIQ | NASDAQ-100 | ~9.8% | $2.5B | 0.29% |

| RYLD | Russell 2000 | ~11.9% | $1.3B | 0.60% |

| TSLY | Single-stock (TSLA) | ~98%* | $1.2B | 1.04% |

*Yields are indicative and can fluctuate significantly.

Best Diversified U.S. Covered Call ETFs

JEPI – The Gold Standard for Income Stability

JEPI is widely regarded as one of the most balanced U.S. covered call ETFs available. Rather than selling call options directly on the index, it uses a combination of equity-linked notes (ELNs) and active management to generate income while aiming to preserve capital. This structure allows JEPI to deliver consistent monthly income with lower volatility than traditional equity exposure.

While upside participation is more limited than a pure equity ETF, JEPI provides strong downside protection and a smoother return profile, making it well suited for income-focused investors.

Best for: Investors seeking stable income with lower risk.

SPYI – Higher Yield, More Aggressive

SPYI applies a more systematic covered call strategy on the S&P 500, writing options more aggressively than funds like JEPI. This approach typically results in higher income, especially during periods of elevated market volatility. The trade-off, however, is greater price fluctuation and less downside protection during market drawdowns. While SPYI can deliver attractive monthly distributions, its returns tend to be more sensitive to market movements than more conservatively managed income ETFs. As a result, SPYI is better suited as a satellite holding rather than a core income position.

Best for: Income investors willing to accept higher volatility in exchange for higher yield.

GPIX – Low Fees, Conservative Approach

GPIX stands out primarily for its very low expense ratio (0.29%), making it one of the most cost-efficient covered call ETFs in the U.S. market. Its premium-income strategy is more conservative, prioritizing capital preservation and steady income rather than maximizing yield. As a result, GPIX typically offers lower distributions than more aggressive peers, but with a smoother risk profile and improved long-term efficiency. This makes it an appealing option for investors who value cost control and stability over headline yield.

Best for: Cost-conscious investors prioritizing efficiency, discipline, and long-term sustainability over maximum income.

Best NASDAQ-Focused Covered Call ETFs

JEPQ – Tech Income, Done Right

JEPQ applies the same philosophy as JEPI but focuses on the NASDAQ-100, making it one of the most balanced ways to generate income from technology-heavy equities. Instead of writing calls directly on the index, JEPQ uses equity-linked notes (ELNs) and active management to generate option income while aiming to preserve capital. This structure allows the fund to deliver attractive monthly distributions without fully sacrificing downside protection.

Compared to more aggressive NASDAQ covered call ETFs, JEPQ tends to experience lower volatility and better capital stability, particularly during market drawdowns. While upside participation is capped, it is not eliminated entirely, making JEPQ more suitable for long-term income investors than pure buy-write strategies.

Best for: Investors seeking technology exposure with disciplined income generation and a more defensive risk profile.

QQQI – Higher Income, Higher Risk

QQQI is designed to maximize income from the NASDAQ-100 by writing call options more aggressively than funds like JEPQ. This results in higher yields, especially in volatile or range-bound markets, but also introduces greater sensitivity to market swings. The more assertive call-writing approach limits upside participation more quickly and provides less downside cushioning during sharp corrections.

As a result, QQQI can deliver impressive monthly income, but long-term capital preservation is less consistent than with more conservatively managed strategies. Investors should view QQQI as an income-focused satellite holding, rather than a core portfolio position.

Best for: Investors prioritizing maximum income from technology stocks, who are comfortable with higher volatility and capped growth.

QYLD – The Original, But Aging

QYLD is one of the earliest and most widely recognized covered call ETFs, built around a systematic at-the-money (ATM) call-writing strategy on the NASDAQ-100. While this approach produces consistently high income, it has historically resulted in weak long-term capital preservation, as gains are frequently capped and losses are not fully offset.

Over time, this structure has led to limited total return growth compared to newer, more flexible strategies. QYLD remains effective in flat or mildly bearish markets, but it tends to lag significantly during strong bull markets.

Best for: Short-term income seekers focused primarily on cash flow.

Not ideal for: Investors targeting long-term total return or capital growth.

Sector & Aggressive Income ETFs

RYLD – Small Caps, Big Yield

RYLD applies a covered call strategy to the Russell 2000, an index composed of U.S. small-cap stocks. Because small caps tend to be more volatile than large caps, option premiums are generally higher, allowing RYLD to generate attractive monthly income compared to large-cap covered call ETFs. This makes RYLD an effective tool for boosting portfolio yield.

However, the higher income comes with greater volatility and weaker capital stability. Small caps are more sensitive to economic cycles, rising interest rates, and market stress, which can lead to larger drawdowns. While the covered call overlay helps monetize volatility, it does not eliminate downside risk.

RYLD works best in range-bound or choppy markets, but it often underperforms during strong small-cap bull markets due to capped upside.

Best for: Investors looking to diversify income sources beyond large caps, with an understanding of the higher risk profile.

TSLY – Extreme Income, Extreme Risk

TSLY is fundamentally different from traditional covered call ETFs. Instead of holding a diversified portfolio, it sells options on a single stock—Tesla. This concentrated approach can produce extremely high yields, especially during periods of elevated volatility, which is common for Tesla shares.

However, this income comes with very high capital risk. Because the strategy depends on one underlying stock, investors are exposed to sharp price swings, long drawdowns, and significant erosion of capital. While monthly distributions can appear impressive, total return can be highly unstable and unpredictable.

TSLY should not be viewed as a long-term income foundation. It is a tactical, speculative instrument, not a diversified ETF.

⚠️ This is not a core income ETF.

Best for: Experienced investors who understand the risks and are seeking short-term, high-risk income exposure only.

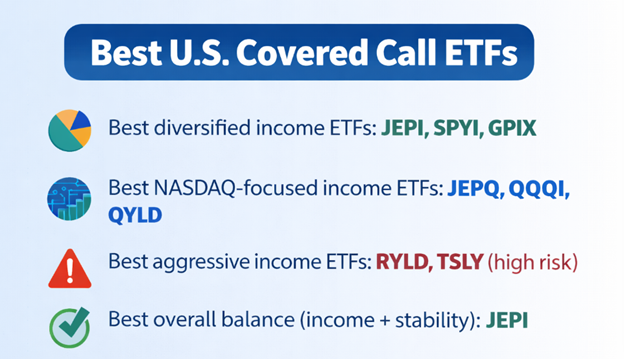

Final Takeaways

overed call ETFs are best understood as income tools, not long-term growth vehicles. Their primary objective is to convert market volatility into regular cash flow, not to maximize capital appreciation. Investors who approach these ETFs with a growth mindset often end up disappointed, especially during strong bull markets where upside participation is capped.

One of the most important principles to remember is that higher yield usually comes with a higher opportunity cost. ETFs offering double-digit yields often achieve this by writing calls more aggressively or concentrating exposure, which limits upside and can weaken long-term total returns. Yield alone should never be the sole selection criterion.

Among the broad universe of U.S. covered call ETFs, JEPI and JEPQ remain the strongest core holdings. They strike a better balance between income generation, capital preservation, and volatility management, making them suitable as long-term income foundations for many investors.

More aggressive ETFs such as QYLD, RYLD, and TSLY should be treated as satellite positions only. While they can enhance portfolio income in the short term, their higher risk profiles and weaker capital preservation make them unsuitable as core income holdings.

📌 Best strategy:

For balanced monthly income, consider blending one diversified covered call ETF (such as JEPI or SPYI) with one technology-focused income ETF (such as JEPQ or QQQI). This approach helps diversify income sources, smooth volatility, and avoid over-reliance on a single strategy.

When used intentionally and in moderation, covered call ETFs can play a valuable role in an income-focused portfolio.

Bottom Line

U.S. covered call ETFs can play a powerful role in an income-focused portfolio, but only when used with clear expectations. They are designed to monetize volatility, not to outperform in bull markets.

Used correctly, they provide:

- Reliable cash flow

- Lower volatility

- Predictable monthly income

Used incorrectly, they can erode long-term returns.