When it comes to investing in ETFs that track the S&P 500, Canadian investors often find themselves comparing VFV (Vanguard S&P 500 Index ETF) and VOO (Vanguard S&P 500 ETF). These ETFs are similar in that they both aim to replicate the performance of the S&P 500 Index, but they have distinct differences that can affect investment outcomes, especially when held in different account types like a Tax-Free Savings Account (TFSA) or a Registered Retirement Savings Plan (RRSP).

Executive summary VFV vs VOO

Here’s a summary table comparing the characteristics of holding a US-denominated ETF (like VOO) versus a Canadian-denominated ETF (like VFV), particularly in the context of Canadian investors:

| Factor | US-Denominated ETF (e.g., VOO) | Canadian-Denominated ETF (e.g., VFV) |

|---|---|---|

| Currency of Trade | Traded in US dollars. | Traded in Canadian dollars. |

| Exchange | Traded on a US exchange, such as the New York Stock Exchange. | Traded on the Toronto Stock Exchange. |

| Dividend Withholding Tax | In an RRSP, US dividends are not subject to withholding tax due to the tax treaty. In other accounts, 15% withholding tax applies. | Dividends are subject to a 15% withholding tax regardless of the account, though it can be recoverable in non-registered accounts. |

| Currency Conversion Costs | Currency conversion is required if the investor’s base currency is not USD. This can lead to conversion fees. | No currency conversion needed for Canadian investors, saving on conversion fees. |

| Expense Ratios | Generally lower expense ratios due to larger scale and competition in the US market. | Slightly higher expense ratios but still relatively low for international investments. |

| Liquidity | Often higher trading volumes and liquidity. | Slightly lower liquidity compared to their US counterparts. |

| Currency Risk | Exposure to currency risk if the investor’s base currency is not USD. | Choose a Hedged ETF to reduce currency risk. If non hedged the currency risk exist but can also be considered as a way of diversification |

Understanding VFV and VOO

VFV:

VFV, or Vanguard S&P 500 Index ETF, commenced its journey on November 2, 2012, and is managed by Vanguard Investments Canada Inc. It encompasses 507 stocks, predominantly in the large-cap blend sector, indicating a focus on well-established companies. The ETF has a set management expense ratio (MER) of 0.09%, offering a reasonable cost structure for its investment services. Classified with a medium risk level, VFV is tailored to investors seeking a balanced approach to equity investment. The ETF yields dividends between 1.23% and 1.98%, demonstrating its ability to generate regular income for its shareholders.

Trading on the Toronto Stock Exchange (TSX) in Canadian dollars, VFV is particularly advantageous for Canadian investors looking to gain exposure to the US S&P 500 Index without incurring currency conversion costs. By tracking this index, VFV enables investors to participate in the performance of large-cap U.S. companies, thereby aiming for long-term capital growth. The ETF employs index/passive management techniques, ensuring a diversified investment in some of the largest and most innovative companies, while maintaining a straightforward and cost-effective investment approach. For Canadian investors keen on accessing U.S. markets with the convenience of domestic currency trading, VFV presents a compelling option.

VOO:

The Vanguard S&P 500 ETF, commonly known as VOO, was established on September 7, 2010, and is managed by The Vanguard Group. It consists of 507 stocks, focusing primarily on a large-cap blend of market capitalizations. VOO is recognized for its low management expense ratio (MER) of 0.03%, appealing to investors conscious of minimizing costs. The ETF is categorized with a moderate to aggressive risk level, reflecting its all-equity composition and market position. In terms of returns, it offers a dividend yield ranging between 1.23% and 1.98%.

VOO operates on the New York Stock Exchange (NYSE) and is denominated in US dollars. The ETF’s strategy is to track the performance of the US S&P 500 Index, providing investors exposure to some of the largest and most established companies in the United States. Its 100% equity allocation underscores its objective of long-term capital growth, targeting investors who are looking for robust growth potential in their portfolio and are comfortable with the associated risk level. VOO’s exceptionally low expense ratio combined with its strategic focus on large-cap U.S. companies makes it an attractive option for investors looking at significant exposure to the U.S. market.

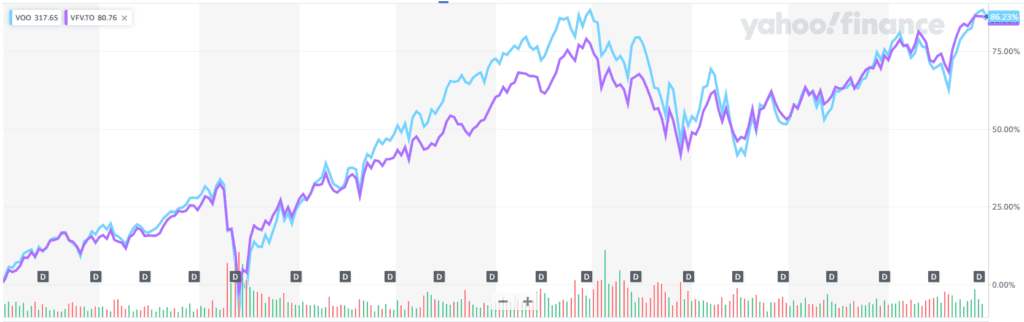

Comparing Performance VFV vs VOO

VFV vs VOO

When comparing VFV (Vanguard S&P 500 Index ETF) and VOO (Vanguard S&P 500 ETF), several factors such as performance, costs, tax implications, and currency considerations come into play. Each has its unique advantages and considerations, which vary depending on the investor’s situation, investment goals, and account type.

Performance and Expense Ratio VFV vs VOO:

- VFV has shown to be a strong performer for Canadian investors seeking exposure to the U.S. S&P 500 index without the hassle of currency conversion, as it trades in Canadian dollars on the Toronto Stock Exchange. It has a slightly higher management expense ratio (MER) of 0.09% compared to VOO. However, its performance has been commendable, often attributed to the currency fluctuations between the CAD and USD.

- VOO, on the other hand, trades on the New York Stock Exchange in U.S. dollars and is known for its low MER of 0.03%. This lower cost structure can potentially translate into higher returns for investors over time. The fund’s performance is directly related to the U.S. market and currency, providing a purer form of exposure to the S&P 500 for those who hold U.S. dollars.

Dividend Yield and Tax Implications:

- VOO tends to have a higher dividend yield and, importantly, dividends from VOO are not subject to the 15% withholding tax in RRSP and RRIF accounts due to the U.S.-Canada tax treaty. This makes it an attractive option for those holding these accounts, as it optimizes the dividend income.

- VFV, while offering a competitive dividend yield, has dividends subject to a 15% withholding tax. This tax impact can reduce the overall return, especially in accounts like TFSA where you cannot recover the withholding tax. However, in non-registered accounts, the foreign tax credit can offset some of these taxes.

Currency Considerations:

- The choice between VFV and VOO may also hinge on the investor’s currency preference. VFV allows Canadian investors to invest directly in Canadian dollars, avoiding the currency exchange fees. This makes it a convenient and cost-effective option for those who do not wish to engage in currency conversions.

- VOO requires Canadian investors to convert their CAD to USD, incurring conversion fees unless they already have USD or use strategies like Norbert’s Gambit to minimize these costs. However, holding U.S. dollars might be more efficient for those who anticipate making several investments in U.S. securities or for those who already hold U.S. income or savings.

Investment Horizon and Usage:

- For individuals, particularly those nearing or in retirement, frequent currency conversion between CAD and USD can be cumbersome and costly. In such scenarios, VFV might be more beneficial despite the tax on dividends. It eliminates the need for ongoing currency management and can provide a simpler investment experience.

- Conversely, for long-term investors or those with a significant time horizon, transitioning to USD and investing in VOO might be more cost-effective in the long run. The lower fees and tax efficiency in specific account types can compound significantly over time, enhancing overall returns.

Special Considerations:

- Investors particularly concerned about currency risk might not find either VFV or VOO ideal if they are looking for currency-hedged options. In such cases, exploring currency-hedged versions of S&P 500 ETFs would be more appropriate to mitigate currency fluctuation risks (such as VSP).

Holding in TFSA vs RRSP

When deciding between holding these ETFs in a TFSA or an RRSP, it’s crucial to understand the tax implications:

TFSA:

- US Dividend Withholding Tax: 15% withholding tax on dividends from US stocks applies.

- Capital Gains: Tax-free.

- Currency Conversion: If investing in VOO, investors need to convert CAD to USD, incurring additional costs.

TFSAs are great for tax-free growth and withdrawals, but the 15% withholding tax on US dividends diminishes the returns from US-based ETFs like VFV and VOO. However, it’s a flexible account that allows for tax-free withdrawals at any time.

RRSP:

- US Dividend Withholding Tax: Exempt for US stocks or ETFs like VOO.

- Capital Gains: Tax-deferred until withdrawal.

- Currency Conversion: Necessary for VOO, but no conversion needed for VFV.

RRSPs offer a tax-deferred growth environment, making them particularly beneficial for holding US securities like VOO. The exemption from the US dividend withholding tax enhances the appeal of VOO in an RRSP. However, consider that eventual withdrawals from RRSPs are taxed as income at your marginal rate.

Factors to Consider

Currency Conversion and Costs: VFV allows Canadians to invest in the S&P 500 without currency conversion fees, making it more straightforward and cost-effective. VOO requires currency conversion, adding a layer of cost and complexity. However, if you have USD or are willing to use currency conversion strategies like Norbert’s Gambit, VOO’s lower MER might be more appealing.

Tax Implications: The choice between TFSA and RRSP is critical. VFV’s dividend withholding tax applies regardless of the account, while VOO’s exemption in RRSPs can be a significant advantage. Consider your current and future tax brackets, as well as the purpose of your investment (e.g., retirement savings vs. general investment).

Investment Goals and Risk Tolerance: Both VFV and VOO are 100% invested in equities, making them volatile. Ensure these ETFs fit within your broader investment strategy and risk tolerance. Diversification and understanding your long-term goals are key to making the right choice.

Performance and Returns: While historical performance isn’t indicative of future results, the difference in returns due to expense ratios, withholding taxes, and currency fluctuations should be considered. VFV’s outperformance might be attractive, but remember to consider all factors, including costs and taxes.

Conclusion VFV vs VOO

Choosing between VFV and VOO, and deciding whether to hold them in a TFSA or an RRSP, is a decision that should be tailored to your individual circumstances, goals, and financial situation. VFV offers ease and cost-effectiveness for Canadians, while VOO appeals with its low expense ratio and tax efficiency in RRSPs. Consider all aspects, including currency conversion, tax implications, fees, and your investment strategy, before making a decision. As always, consider consulting with a financial advisor to understand how these choices fit into your overall financial plan. Your investment journey should be as unique as your financial goals, and understanding the nuances