The iShares PHLX Semiconductor ETF (SOXX) is a popular investment choice for those looking to gain exposure to the semiconductor industry. This ETF aims to track the performance of the PHLX Semiconductor Sector Index, which includes companies primarily involved in the design, distribution, manufacture, and sale of semiconductors. Below, we explore the key aspects of SOXX, its performance, and why it might be a suitable addition to your investment portfolio.

Overview of SOXX

Fund Objective: The primary objective of the iShares Semiconductor ETF (SOXX) is to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the PHLX Semiconductor Sector Index.

[stock_market_widget type=”table-quotes” template=”color-header-border” color=”#5679FF” assets=”SOXX” fields=”symbol,name,market_cap” display_header=”true” display_chart=”false” search=”false” pagination=”false” scroll=”false” rows_per_page=”5″ sort_direction=”asc” alignment=”left” api=”yahoo-finance”]

Holdings: The ETF comprises a diversified portfolio of semiconductor companies, including well-known names like NVIDIA, Intel, and Texas Instruments. This broad exposure helps mitigate the risk associated with investing in individual stocks.

Expense Ratio: The expense ratio for SOXX is 0.46%, which is relatively low considering the specialized nature of the fund. This makes it a cost-effective way to invest in the semiconductor sector.

Why Invest in SOXX?

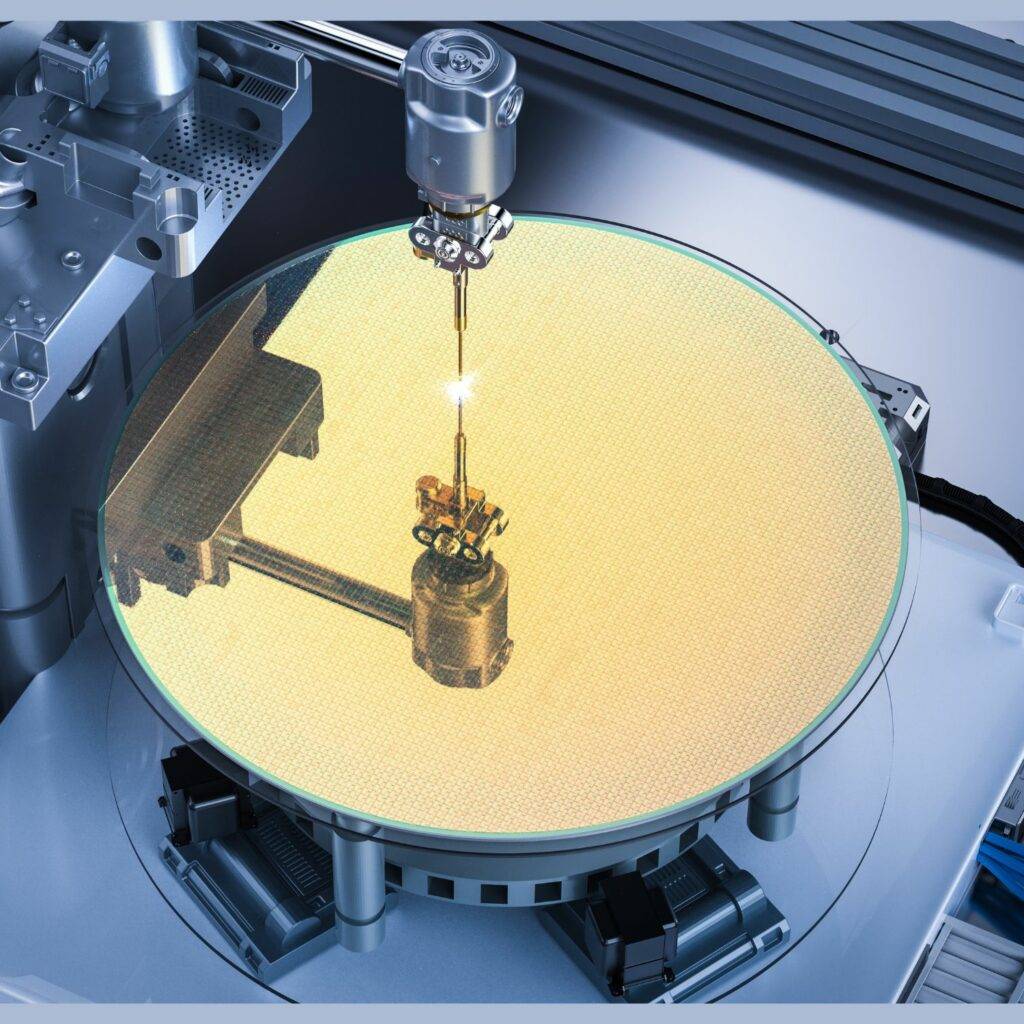

Growth Potential: The semiconductor industry is at the heart of technological advancements. Semiconductors are essential components in a wide range of devices, from smartphones to advanced computing systems. As technology continues to evolve, the demand for semiconductors is expected to rise, driving growth for companies in this sector.

Diversification: Investing in SOXX provides exposure to a broad range of companies within the semiconductor industry. This diversification reduces the risk associated with investing in individual stocks, as the performance of the ETF is not overly reliant on any single company.

Accessibility: ETFs like SOXX offer an easy and cost-effective way for investors to gain exposure to international semiconductor companies. Instead of buying individual stocks, investors can purchase shares of SOXX to gain a diversified exposure to the sector.

Historical Performance: SOXX has demonstrated strong historical performance, reflecting the overall growth of the semiconductor industry. Its past returns indicate its potential for future growth, making it an attractive option for investors looking to capitalize on the semiconductor boom.

[stock_market_widget type=”table-quotes” template=”color-header-border” color=”#5679FF” assets=”SOXL,SOXX,SMH” fields=”symbol,ytd_return,three_year_average_return,five_year_average_return” display_header=”true” display_chart=”false” search=”false” pagination=”false” scroll=”false” rows_per_page=”5″ sort_direction=”asc” alignment=”left” api=”yahoo-finance”]

Key Holdings

The iShares Semiconductor ETF (SOXX) includes several key players in the industry:

- NVIDIA (NVDA): A leading designer of GPUs, critical for gaming, AI, and data centers.

- Intel Corporation (INTC): A dominant force in the CPU market, providing processors for personal computers and servers.

- Texas Instruments (TXN): Known for its analog and embedded processing products, which are vital for various electronic devices.

These holdings represent some of the most innovative and influential companies in the semiconductor sector.

Conclusion

The iShares Semiconductor ETF (SOXX) offers investors a robust and diversified way to invest in the semiconductor industry. With its strong performance, low expense ratio, and exposure to leading semiconductor companies, SOXX is an excellent option for those looking to benefit from the growth of this critical sector. As always, consider your investment goals and risk tolerance before investing.

For more detailed information and to invest in SOXX, visit the iShares official website.