The Horizons Equal Weight Canadian Bank Covered Call (BKCL ETF) is designed to provide exposure to a diversified array of Canadian banks. The fund aims to achieve two primary objectives: (a) mimicking the performance of Solactive Equal Weight Canada Banks Index, comprised of equally-weighted shares from a variety of Canadian banks, and (b) delivering attractive monthly distributions derived from both dividends and income generated from call options.

BKCL employs a dynamic covered call option writing program as a means to generate income. This strategy involves selling call options on the underlying equities held within the ETF’s portfolio. The goal is to generate additional returns from the premiums collected through these options, which can provide a cushion against potential downward movements in the market.

A distinctive feature of BKCL is its utilization of leverage. Leverage, in this context, involves borrowing funds to enhance investment potential. BKCL employs leverage at a controlled ratio of approximately 125%, which means that for every dollar of the ETF’s assets, an additional 25 cents are borrowed. This approach has the potential to amplify the fund’s performance, both in growth periods and when aligned with the performance of the Underlying Index.

BKCL was introduced on July 05, 2023. The Target Yield is 15% based on the fund fact sheet.

How writing a call option works at Horizons ETF?

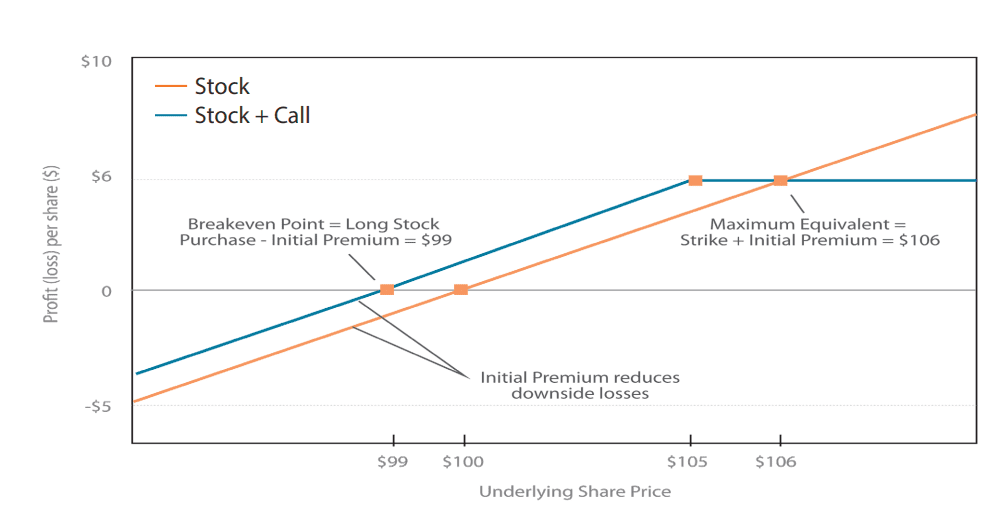

Although Horizons’ actively managed covered call ETFs are flexible in their management, they adhere to key investment principles that optimize their strategic performance. Across all equity-focused covered call ETFs, a consistent practice involves writing covered calls with certain characteristics. Specifically, these ETFs tend to engage in the writing of shorter-dated (expiring in less than two months) and out-of-the-money (OTM) covered call options. Shorter-dated options strike a balance between earning attractive premiums and increasing the likelihood that the options will not be exercised in-the-money, which is advantageous for those who write covered calls.

The team responsible for writing options generally focuses on covering up to 50% of the underlying equities portfolio. This strategic approach aims to safeguard a portion of the potential price gains in the underlying securities. Consequently, these ETFs exhibit a close correlation with the performance of the securities upon which they write calls. Investors should expect to follow a trajectory that aligns with the underlying securities’ performance, enhanced by the additional income from the generated call option premiums.

It is important to note that the risk profile of covered call ETFs utilizing OTM options closely resembles that of the underlying securities they invest in. The following example illustrates how the OTM strategy aims to generate a total return primarily comprising a segment of the underlying security’s price return, combined with the value of the option premium generated through writing calls.

Source: Horizons ETF website

How had Covered call ETF’s performed historically?

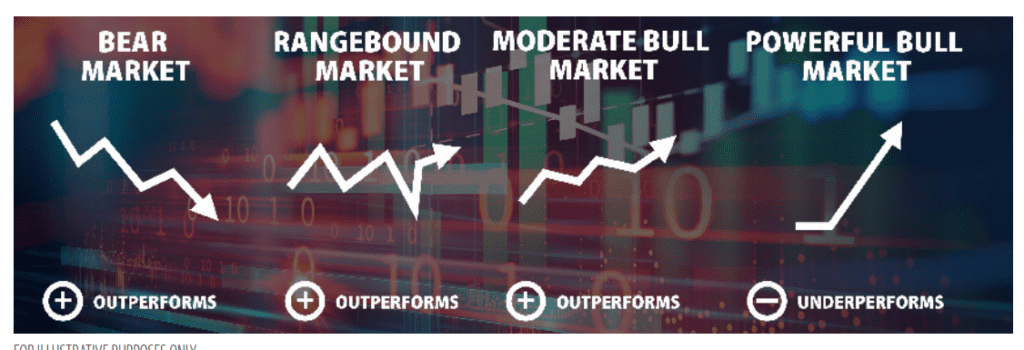

In historical contexts characterized by bear markets, range-bound markets, and moderate bull markets, a covered call strategy has typically demonstrated the ability to outperform its underlying securities. However, during robust bull markets, when the underlying securities experience frequent rises beyond their strike prices, covered call strategies have historically exhibited slower growth. Nevertheless, even in these bullish phases, investors typically realize moderate capital appreciation alongside the accrual of dividends and call premiums.

BKCL vs HMAX! comparison

Strategy

The BKCL ETF from Horizons sells out-of-the-money (OTM) call options on 50% of the stocks. The OTM strategy caps the return of the written positions at the option strike price until the option expires. Generally, for Horizons ETFs, option expiries are 1 to 2 months.

| % portfolio | Option strategy | Dividend Yield | Leverage | |

| BKCL | 50% | OTM | 15%* | 1.25 |

| HMAX | 50% | ATM | 13%* | NA |

Covered call strategy – HMAX vs BKCL; * the target yield

Portfolio allocation

| Big Can Banks | Insurance | Asset Management | |

| BKCL | 100% | – | – |

| HMAX | 76.4% | 14.9% | 10% |

BKCL ETF: Dividend history

| Ex-Div Date | Record Date | Payment Date | Payment Amount | Distrib Period |

|---|---|---|---|---|

| 07/28/2023 | 07/31/2023 | 08/08/2023 | 0.257 | Monthly |

Review of HMAX: Hamilton Canadian Financials Yield Maximizer

Review of UMAX: Hamilton Utilities Yield Maximizer ETF (13% Target yield)

BKCL Holdings