In this post, we will be comparing major Canadian Banks. The comparison will include historical performance, Growth metrics, and Valuation. Then, we will pick the TOP 3 Best Canadian Bank Dividend Stocks! Our top 3 includes National Bank, TD, and Royal Bank.

Please consult a financial advisor before making any financial decision.

Historical performance

| Name | YTD %Chg | 52W %Chg | 3Y %Chg |

| National Bank (NA) | +3.81% | +21.92% | +63.33% |

| Cibc (CM) | +8.40% | +31.87% | +43.26% |

| Royal Bank (RY) | +3.58% | +26.69% | +33.79% |

| Bank of Montreal (BMO) | +8.45% | +37.63% | +43.58% |

| Toronto-Dominion (TD) | +1.30% | +24.48% | +35.63% |

| BNS (BNS) | +4.77% | +21.88% | +28.98% |

Growth metrics

| Symbol | 5Y Div% | 5Y Earn% | 5Y Rev% |

| NA.TO | 5.43% | 22.19% | 8.14% |

| CM.TO | 4.22% | 5.42% | 6.69% |

| RY.TO | 5.92% | 10.28% | 5.67% |

| BMO.TO | 4.51% | 10.85% | 5.14% |

| TD.TO | 7.91% | 10.58% | 4.45% |

| BNS.TO | 4.56% | 5.94% | 3.50% |

Valuation and Dividends

| Symbol | ROE% | P/E (ttm) | Div yld |

| NA.TO | 19.91% | 10.64 | 3.46 |

| CM.TO | 16.07% | 11.12 | 4.02 |

| RY.TO | 18.28% | 12.44 | 3.49 |

| BMO.TO | 14.20% | 12.75 | 3.60 |

| TD.TO | 15.27% | 13.15 | 3.51 |

| BNS.TO | 14.72% | 12.10 | 4.29 |

18 Best Monthly Dividend Stocks in Canada for passive income

5 Highest dividend paying stocks US (Div. Aristocrats)

TD Bank stock

Strenghts

– Cross-border diversification. TD continues to expand in the US market. The latest trend is the announcement of a merger agreement that will unite TD and First Horizon. The deal will still need to obtain approval from US regulators. Following this merger, TD will be the sixth-largest bank in the US!

– Cost synergies expected from TD and Fisrt Horizon merger;

– Gorwth opportunities in the US retail market;

– 10 consecutive years of dividend increases.

Weaknesses:

– TD’s premium leisure and travel-oriented credit card business has been weak during the pandemic;

– The pandemic negatively impacted the growth in both personal and business lowns segments;

– Competition from both large banks and fintech companies.

Top 10 Best Canadian Dividend Stocks – 2022

Canadian dividend aristocrats list by sector 2022

Royal Bank stock

Strenghts

– Royal Bank of Canada holds a very strong balance sheet and is fundamentally sound;

– Well-positioned to take advantage of an environment with rising interest rates;

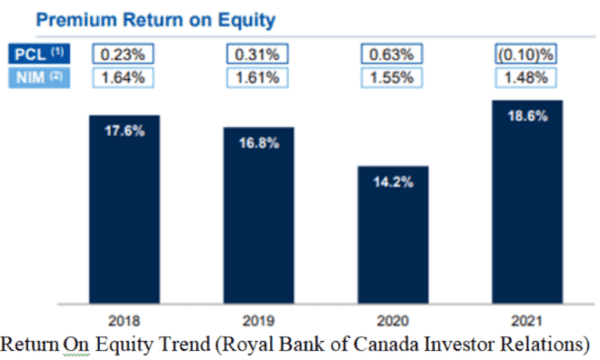

– Excellent Return On Equity (ROE) at 18.28% (back to pre-pandemic levels);

– 10 consecutive years of dividend increases.

Weaknesses

– High valuation;

– Competition from both large banks and fintech companies.

ZEB ETF Review: BMO Equal Weight Banks Index

National Bank stock

Strenghts

– National Bank’s return on equity is the highest among the six largest banks in Canada;

– Revenues grew by 8% in the past five years;

– Reported stellar financial results in Q1 fiscal 2022;

– Strong wealth management segment;

– 11 consecutive years of dividend increases.

Weaknesses:

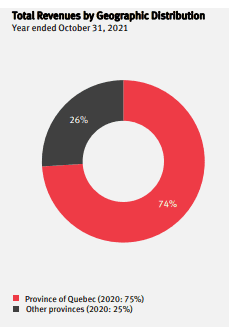

– Most revenues are from Quebec (74%), which makes NA less diversified than competition;

– Competition from both large banks and fintech companies.