Executive summary

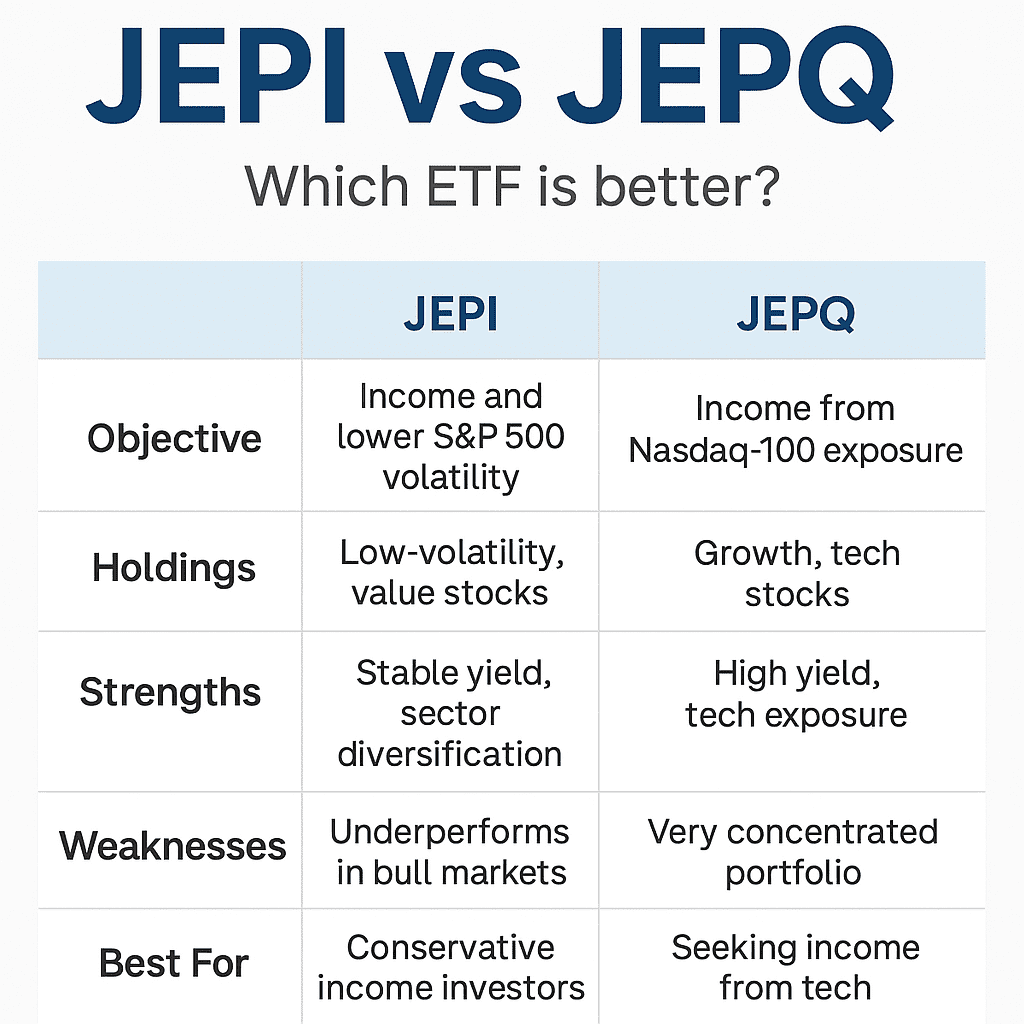

JEPI and JEPQ are two leading income-focused ETFs using covered call strategies, but they serve different investors. JEPI offers stable income with broad diversification and lower volatility, while JEPQ provides higher yield driven by tech exposure. Understanding their objectives, risks, and market behavior helps identify which ETF fits your strategy best.

JEPI

Investment objective

The JPMorgan Equity Premium Income ETF (JEPI) is an income focused covered call ETF. It’s ideal for conservative investors who are seeking income and moderate growth. The manager of JEPI invests in a portfolio of stocks that combine 3 characteristics:

Part of the S&P 500, so in other word large cap stocks only;

Low volatility stocks, meaning, stocks that fluctuate far less than the market. This is generally the case of defensive stocks operating in stable industries. The main metric used by the fund manager of JEPI to assess volatility is the Beta. Beta is a coefficient risk, for instance a Beta of 0.5 would indicate that the stock exhibits 50% of the volatility of the stock market;

Value stocks: the analysts’ team of JEPI will conduct a fundamental bottom up approach to select only stocks that are considered undervalued.

Advantages

JEPI, an ETF focused on issuing call options, offers several advantages that might appeal to certain investors. Firstly, it boasts an attractive yield derived from the money earned through call option writing. Moreover, JEPI exhibits lower volatility compared to investing directly in an S&P 500 index ETF like SPY, making it a suitable option for conservative investors and income seekers.

Another positive aspect of JEPI is its ability to capitalize on high volatility, which often translates to increased premiums for the fund. Additionally, investors can save valuable time and effort by avoiding the need to personally write call options on the S&P 500, as JEPI handles this strategy on their behalf. Furthermore, with relatively low fees of 0.35% total expense ratio, JEPI presents a cost-effective investment choice. The ETF’s diversification across various sectors adds another layer of appeal, spreading risk across different industries.

However, JEPI does have some drawbacks that potential investors should consider. In bull markets, it is expected to underperform the S&P 500 index due to the call option writing strategy, which reduces volatility but also limits its performance during bullish periods.

Recap

Positives

- Attractive yield thanks to money earned issuing call options;

- Lower volatility than investing in a S&P500 index ETF such as SPY;

- Suits conservative investors and income seekers;

- High volatility usually increases the premiums earned by the fund;

- Saves you time and effort (if you were yourself interested on writing call options on the S&P 500);

- Relatively low fees (0.35% total expense ratio);

- Diversification: JEPI is highly diversified across various sectors.

Negatives

- In bull market, investors should expect a lower performance than the S&P 500 index. Issuing call options reduces volatility at the expense of higher performance in bull markets;

JEPQ

Investment objective

JEPQ (JPMorgan Nasdaq Equity Premium Income ETF) is a high distribution yield ETF. It focuses on providing investors with a monthly income stream using covered call strategies. These strategies enhance yield by collecting premiums on call options. JEPQ invests in large cap Teck stocks that are part of the NASDAQ. Using a proprietary selection criteria, the manager would select companies with the highest prospects for growth seeking the highest adjusted return possible (low volatility combined with high returns).

Advantages

JEPQ ETF, focused on writing call options on the NASDAQ 100, offers similar benefits to JEPI. It provides an attractive yield from call option writing and boasts lower volatility compared to a NASDAQ 100 ETF like QQQ, appealing to conservative investors and income seekers.

However, JEPQ has some significant negatives that investors need to be aware of. It tends to perform poorly during bullish market conditions, as the covered call strategy curtails the upside potential of the NASDAQ 100.

Furthermore, JEPQ’s lack of diversification is a notable concern, with a heavy concentration in tech firms dominating the fund. This lack of diversification exposes investors to higher risks compared to a more balanced investment approach.

Recap

Positives

Attractive yield thanks to money earned issuing call options;

Lower volatility than investing in a NASDAQ 100 ETF such as QQQ;

Suits conservative investors and income seekers;

High volatility usually increases the premiums earned by the fund;

Saves you time and effort (if you were yourself interested on writing call options in the NASDAQ 100;

Relatively low fees (0.35% total expense ratio).

Negatives

Poor performance (compared to the index in bull markets). You are essentially giving up on the upside potentiel of the NASDAQ 100;

The strategy of covered calls becomes ineffective in an unpredictable market;

JEPQ is dominated by Tech firms so it’s far from being a diversified investment;

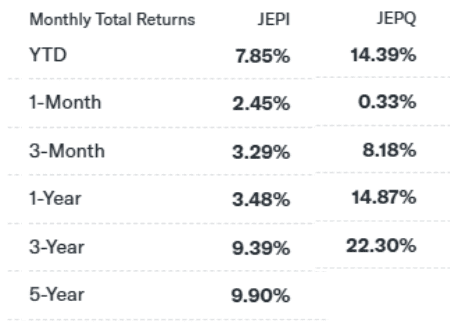

Yahoo finance as of December 10th

Conclusion

Ultimately, whether JEPI or JEPQ is a good investment depends on individual investor preferences, risk tolerance, and market outlook. JEPI’s lower volatility and diversification across sectors could be attractive to those seeking stability and income, while JEPQ’s focus on the NASDAQ 100 may appeal to tech-focused investors. It is crucial for investors to conduct thorough research, consider their financial goals, and consult with a financial advisor to make informed investment decisions.