If you follow institutional flows in the Canadian ETF market, you know that a million-dollar inflow barely registers. A hundred-million-dollar inflow might earn a headline. But a $1.73 billion surge in a single month represents something far more structural — a repositioning of capital at scale.

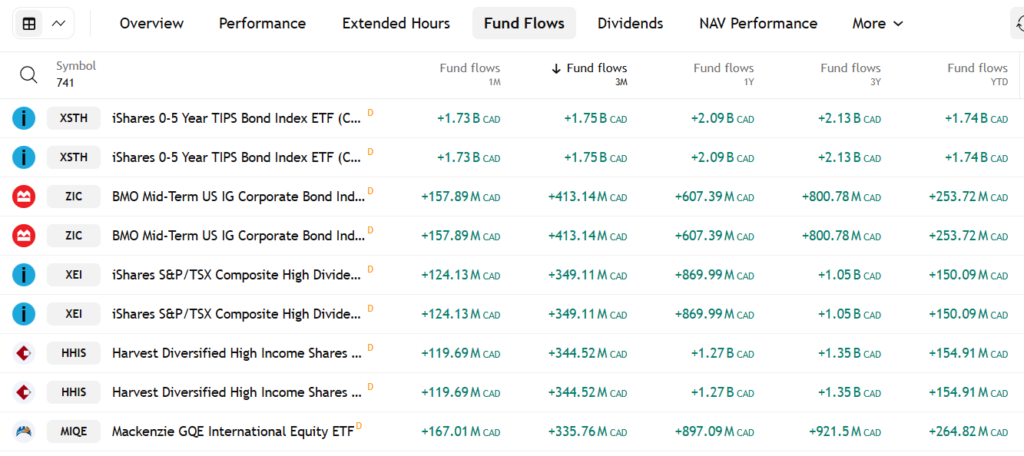

Source: Fund Inflows Statistics – Tradingview as of February 12th, 2026

That is exactly what happened recently with the iShares 0–5 Year TIPS Bond Index ETF (CAD-Hedged), trading under ticker XSTH. The magnitude of this inflow is not random. It reflects institutional conviction about inflation risk, interest-rate direction, and portfolio defensiveness heading into 2026.

For income investors, this move is not just informative — it is actionable. Understanding why capital is flowing into short-duration inflation-protected bonds can help you better position your own portfolio for the evolving macro environment.

Part 1 — What Is XSTH? The “Safety-First” Inflation Hedge

XSTH provides exposure to U.S. Treasury Inflation-Protected Securities, commonly known as TIPS. Unlike traditional bonds that pay a fixed coupon on a static principal, TIPS adjust their principal value based on inflation, as measured by the Consumer Price Index (CPI).

When inflation rises, the principal value of the underlying bonds increases. Because coupon payments are calculated as a percentage of that principal, the income generated by the bond rises as well. At maturity, investors receive the fully inflation-adjusted principal, preserving real purchasing power.

What makes XSTH particularly defensive is its focus on short-term maturities — bonds with durations between zero and five years. This dramatically reduces interest-rate sensitivity. Long-term bonds can experience significant price declines when yields rise, but short-term TIPS are far more stable because they mature quickly and can be reinvested at new rates.

The ETF is also currency-hedged back to Canadian dollars. Since the underlying securities are denominated in U.S. dollars, hedging eliminates exchange-rate volatility for Canadian investors. This ensures returns reflect inflation protection and bond performance — not CAD/USD swings.

Part 2 — Decoding the $1.7 Billion Institutional Surge

Large inflows into niche fixed-income ETFs rarely occur without a macro catalyst. Pension funds, insurers, and sovereign allocators do not deploy billions tactically — they reposition strategically.

The $1.73 billion surge into XSTH signals that institutional investors are increasingly concerned about persistent — not transitory — inflation.

Several macro forces are converging in early 2026.

Global trade tensions and tariff risks are resurfacing, particularly across industrial supply chains and energy markets. Commodity volatility remains elevated, with oil and natural gas prices reacting to geopolitical instability. At the same time, fiscal spending across developed economies continues to run above historical norms, supporting demand-side inflation pressures.

In this environment, institutional capital is seeking protection — not just yield. TIPS provide what nominal bonds cannot: contractual inflation adjustment backed by the U.S. Treasury.

There is also a liquidity dimension. When billions enter a fixed-income ETF, secondary-market liquidity deepens. Bid-ask spreads tighten, and execution efficiency improves. For retail investors, that institutional participation effectively creates a liquidity floor, making the ETF easier to trade even during volatile markets.

Part 3 — The Income Investor’s Perspective: Yield and Cash Flow Stability

From an income standpoint, XSTH plays a different role than high-yield dividend ETFs or covered-call strategies.

Its yield is composed of two components: the real yield embedded in TIPS and the inflation adjustment to principal. As inflation rises, distributions can increase because the underlying bond principal rises. This creates a dynamic income stream that adjusts to macro conditions rather than remaining fixed.

Distributions are paid monthly, making the ETF operationally compatible with income portfolios structured around regular cash flow.

However, the purpose of XSTH is not yield maximization — it is yield stabilization. High-yield equities may offer 6% to 10% distributions, but those payouts are tied to market risk. If equities correct, capital losses can overwhelm income.

XSTH, by contrast, provides lower but more resilient income, backed by government securities and inflation indexing. It acts as a ballast rather than a growth engine.

Part 4 — Why 2026 Is the Year of the “TIPS Hedge”

As of early 2026, monetary policy sits at an inflection point. Central banks, including the Bank of Canada and the Federal Reserve, have paused aggressive tightening, but inflation has not fully normalized to target levels.

Markets are now navigating three simultaneous risks.

The first is tariff-driven inflation. Trade restrictions increase import costs, feeding directly into CPI. TIPS automatically adjust to this environment, whereas nominal bonds lose purchasing power.

The second is equity volatility. Dividend stocks, REITs, and utilities — staples of income portfolios — remain sensitive to interest-rate expectations and recession fears. During risk-off events, capital often rotates into government securities, benefiting TIPS.

The third is the yield-chasing trap. Many investors pursue double-digit yields through covered-call ETFs or leveraged income funds. While attractive on paper, these strategies can suffer capital erosion during drawdowns. Inflation-protected bonds provide a defensive counterweight, preserving portfolio stability.

Portfolio Integration: How XSTH Fits in an Income Strategy

XSTH is best viewed as a defensive sleeve within a diversified income allocation.

In portfolio construction terms, it can serve as:

- An inflation hedge alongside nominal bonds

- A volatility dampener against equities

- A liquidity reserve during market stress

- A capital-preservation layer for retirees

For investors running high-yield ETF portfolios — particularly those heavy in covered-call or dividend strategies — adding short-term TIPS introduces macro diversification. Income remains intact while downside sensitivity declines.

This institutional barbell approach — pairing yield assets with inflation-protected bonds — is precisely what large allocators are implementing today.

Costs, Efficiency, and Structural Advantages

One of the most compelling aspects of XSTH is cost efficiency. With a management expense ratio near 0.10%, it represents one of the lowest-cost inflation-protected vehicles available to Canadian investors.

The ETF structure also provides daily liquidity, transparent pricing, and automatic reinvestment of inflation adjustments — advantages not easily replicated through direct bond purchases.

For retail investors, accessing a laddered portfolio of short-term U.S. TIPS with currency hedging would be operationally complex. XSTH packages that exposure into a single, tradeable instrument.

Risks and Considerations

Despite its defensive profile, XSTH is not risk-free.

If inflation declines faster than expected, TIPS breakeven rates compress, reducing relative performance. In disinflationary environments, nominal bonds may outperform inflation-protected securities.

Currency hedging, while stabilizing returns, introduces hedging costs that can marginally reduce yield. Additionally, because duration is short, capital appreciation potential is limited compared to long-duration bonds during rate cuts.

Investors should therefore view XSTH as protection — not performance leverage.

The Bottom Line

The $1.7 billion inflow into XSTH is not noise. It is a signal that institutional investors are repricing inflation risk and reinforcing portfolio defenses.

In an era where protecting purchasing power is as critical as generating income, short-term TIPS provide a rare combination of government credit quality, inflation adjustment, and low duration risk.

For Canadian income investors, XSTH offers monthly distributions, currency-hedged exposure, and structural resilience against macro shocks — all at a minimal cost.

Following “smart money” does not mean copying trades blindly. It means understanding the macro thesis behind capital flows.

Right now, that thesis is clear: inflation may be moderating, but the world’s largest investors are still buying insurance.

And XSTH is one of the most direct ways to own it.