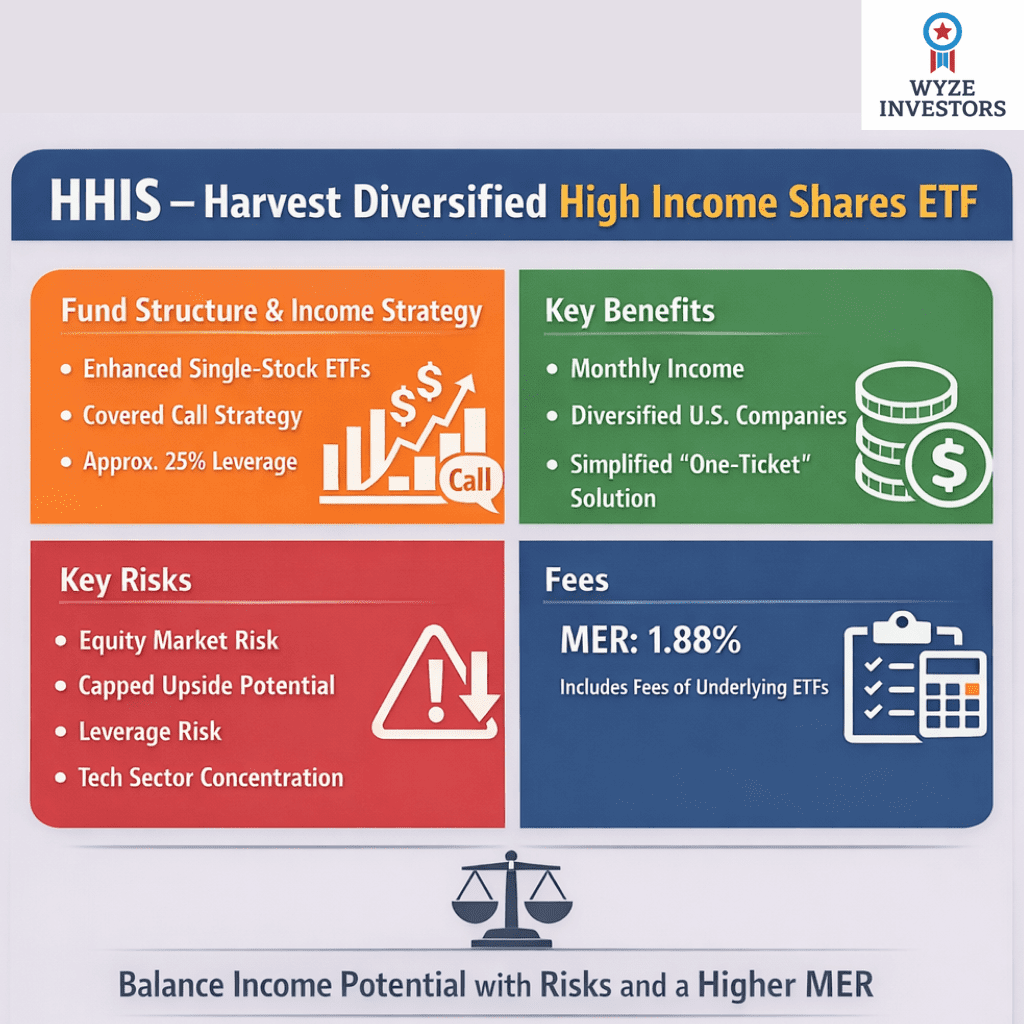

The Harvest Diversified High Income Shares ETF (TSX: HHIS) is designed to provide investors with diversified exposure to U.S. companies while generating a relatively high level of monthly income. It does this primarily through a portfolio of enhanced single-stock ETFs that use an active covered call strategy, and in certain cases, modest leverage. HHIS may appeal to investors looking for income from companies that are traditionally associated with growth rather than dividends.

This article provides an objective overview of how HHIS is structured, what it holds, how income is produced, potential advantages, risks, and how the ETF may fit within an investment portfolio.

Executive summary

ETF Objective and Investment Approach

HHIS seeks to combine three elements in one product:

- exposure to large, well-known U.S. companies

- monthly cash distributions

- diversification through a basket of individual enhanced income ETFs

The ETF does not attempt to track a specific index. Instead, it is actively managed. Portfolio managers select and weight holdings and determine covered call activity levels. The primary income source is option premium generated by selling covered call options on the underlying positions.

HHIS is available in Canadian dollar and U.S. dollar trading classes, making it accessible to investors with income preferences in either currency.

Video

Portfolio Structure and Holdings

HHIS holds a portfolio of Harvest single-stock High Income Shares ETFs rather than owning individual securities directly. Each of those underlying ETFs typically:

- focuses on one publicly listed U.S. company

- writes covered calls on a portion of its position

- may employ modest leverage (approximately 25% in enhanced series)

- distributes income monthly

Therefore, HHIS functions as a fund-of-funds.

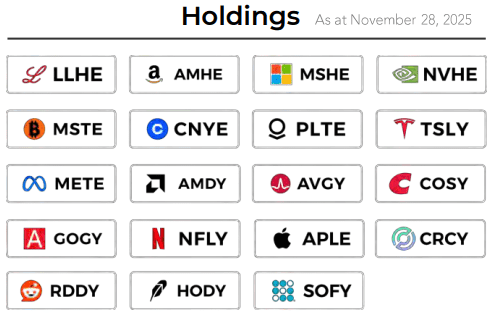

Holdings are diversified across several well-known U.S. companies in areas such as technology, e-commerce, semiconductors, pharmaceuticals, and fintech. Examples include ETFs tied to:

Allocations may change over time as the manager adjusts exposures. Investors should consult the most recent fact sheet or management report for precise weighting and current holdings.

Covered Call Strategy

The defining feature of HHIS is its covered call writing strategy implemented at the underlying ETF level. A covered call involves:

- holding a stock or ETF

- selling call options on that asset

- collecting option premiums in exchange for giving up some potential upside

Option premiums collected contribute materially to monthly distributions. However, covered call writing also reduces participation in strong upside price movements because gains above the option strike price are limited or foregone when calls are exercised.

Harvest typically limits overwrite levels to a maximum of 50% of the portfolio, allowing some portion of assets to remain uncovered, which preserves participation in potential growth.

The strategy is actively managed, meaning:

- coverage levels may be adjusted based on volatility

- strike selection varies

- expiration timing can change based on market conditions

When volatility increases, option income potential typically rises but so does equity risk. When volatility is low, premium income declines but market conditions may be calmer.

Use of Leverage

Some of the single-stock enhanced ETFs within HHIS use approximately 25% leverage. The stated goal is to:

- increase exposure to core holdings

- potentially increase option premium income

- enhance total return over time

However, leverage also magnifies losses during market downturns and increases portfolio volatility. Borrowing costs associated with leverage can rise when interest rates increase, which can impact fund performance and net income.

Investors considering HHIS should be aware that leverage is a meaningful risk factor and contributes to both higher income potential and increased drawdown risk.

Return of Capital (ROC): What HHIS investors should know

Investors in HHIS will notice that distributions may sometimes include Return of Capital (ROC). This is common among covered-call income ETFs and fund-of-fund structures. Understanding ROC is important because it affects taxation, adjusted cost base, and long-term returns.

What ROC is (and isn’t)

ROC is a distribution that is not immediately taxed as income when received in a taxable account. Instead, it is treated as a return of your own invested capital. Because it is not taxed when paid, ROC reduces your Adjusted Cost Base (ACB). When you eventually sell units, a lower ACB may result in a larger capital gain.

ROC does not automatically mean the fund is “giving your money back.” In covered-call ETFs, ROC can result from:

option premium income

portfolio rebalancing

distribution-smoothing policy

fund-of-fund tax mechanics

However, if ROC remains persistently high and NAV declines over time, investors should evaluate whether distributions are being supported by option income or primarily by capital erosion

Key Advantages

Objectively, potential advantages of HHIS include:

Diversified exposure to leading companies

Investors gain access to multiple large-cap and innovative U.S. businesses in one ETF, which may reduce single-stock risk compared with owning only one growth company.

Monthly income distribution

The covered call strategy produces option premiums that support regular monthly cash flow, which can be attractive for those drawing income or reinvesting distributions.

Simplicity

HHIS combines:

- security selection

- option writing

- rebalancing

- distribution management

into one product, reducing the need for active involvement from the investor.

Lower capital threshold

Some underlying U.S. companies trade at high share prices. HHIS allows fractional exposure through an ETF trading on the TSX at a typically lower per-unit price.

Key Risks, Limitations and Fees

HHIS also carries meaningful risks. Key considerations include:

Equity market risk

The ETF primarily invests in equities. Market downturns can significantly reduce net asset value.

Capped upside potential

Covered call strategies limit capital appreciation during strong bull markets because option income is earned in exchange for foregoing some gains.

Leverage risk

Leverage magnifies returns in both directions. Losses are accelerated during market drawdowns and borrowing costs can affect returns when interest rates are high.

Sector concentration risk

Although diversified by issuer, many holdings are concentrated in technology-oriented industries. Sector-specific downturns can materially affect fund performance.

Distribution risk

Monthly distributions are not guaranteed and can fluctuate or be reduced depending on market conditions and option income availability.

Fees

Fees deserve special attention. HHIS has a Management Expense Ratio (MER) of 1.88%. This figure already includes its proportionate share of the fees of the underlying ETFs in which it invests. The MER is typical for actively managed, leveraged, covered-call fund-of-funds structures in Canada, but it is higher than broad index ETFs and some U.S.-listed covered call ETFs, which can be cheaper. Investors should weigh the higher cost against what they receive in exchange: professional options management, leverage handling, and a bundled one-ticket portfolio of single-stock covered call strategies.

Performance / Distributions

The Performance / Distributions table provides information about HHIS’s cash-flow history rather than its total return, because performance figures cannot be shown until the ETF has completed one full year from its inception date of January 16, 2025. Until that milestone is reached, the table focuses on distributions. It lists the record date, ex-dividend date, payment date, monthly amount per unit, and the cumulative total since inception. The amounts shown indicate that HHIS has made consistent monthly distributions, with payments of $0.25 per unit initially and a gradual increase to $0.27 per unit later in the year. This table helps investors understand the income stream generated so far, the timing of distributions, and how much has been paid in total since launch, even though full performance metrics such as total return and risk statistics will only be available after the first year of operation.

| Record Date | Ex-Dividend Date | Pay Date | Amount per Unit | Type |

| 2025-12-31 | 2025-12-31 | 2026-01-06 | $0.2700 | Monthly |

| 2025-11-28 | 2025-11-28 | 2025-12-05 | $0.2700 | Monthly |

| 2025-10-31 | 2025-10-31 | 2025-11-06 | $0.2600 | Monthly |

| 2025-09-29 | 2025-09-29 | 2025-10-09 | $0.2500 | Monthly |

| 2025-08-29 | 2025-08-29 | 2025-09-09 | $0.2500 | Monthly |

Who HHIS May Be Suitable For

HHIS may be considered by investors who:

- seek income from U.S. equity exposure

- prefer simplified “one-ticket” diversified products

- do not want to write options themselves

- are comfortable with equity risk and distribution variability

- understand that upside potential may be partially capped

- accept leverage as part of the strategy

It may appeal to:

- income-focused investors

- retirees or pre-retirees seeking cash flow

- investors who hold traditional index ETFs but want income-tilted exposure

- those seeking diversification among several well-known U.S. companies

Financial advisors and portfolio managers may also use HHIS in discretionary portfolios for income mandates.

About the ETF Provider

HHIS is managed by Harvest ETFs, an independent Canadian asset manager specializing largely in income-oriented exchange-traded funds. The firm emphasizes investment in established companies combined with disciplined options strategies. Harvest manages multiple High Income Shares ETFs and a variety of sector and thematic income funds.

Conclusion

HHIS offers a way to obtain diversified exposure to major U.S. companies while generating consistent monthly income through an active covered call approach. Its structure simplifies access to covered call strategies and enhanced single-stock ETFs in a single product. However, investors must balance the benefits of income and diversification against the trade-offs of capped upside, leverage, sector concentration, and equity market risk.

HHIS may be appropriate for investors seeking income-focused equity exposure who understand how covered calls and leverage affect risk and return. As with any investment decision, prospective investors should review the prospectus, management reports of fund performance, and risk disclosures, and consider how HHIS fits within their broader financial objectives and risk tolerance.

Excellent Analysis! Detailed, Balanced and unbiased!

Thank you, Krish — I really appreciate the feedback.

Glad you found the analysis detailed and balanced. HHIS is a product that looks simple on the surface, but the structure really matters, so I’m happy this helped clarify things. Thanks for taking the time to comment 👍