A financial crisis is usually associated with a recession, which marks a period of declining economic performance across the economy. Investing in such circumstances involves risk as market volatility is high. In this post, we will discuss four of the best dividend stocks in 2022. These stocks are known for their brand power and excellent fundamentals. We will also present key aspects of investing during a recession.

Key Aspects of Investing in a Recession

Diversification

“Don’t put all the eggs in one basket,” the saying goes. A diversified portfolio will reduce specific risk thereby minimizing total risk.

Depending on the investor’s risk appetite, part of the portfolio may consist of relatively low-risk investments (stocks with strong dividends, government bonds, precious metals and cash), while the rest of the money can be allocated to riskier assets (growth stocks and commodities).

Investing regularly vs timing the market

Investing regularly (also called dollar cost averaging strategy) is the best approach to investing for risk-averse investors. Breaking your investment into smaller pieces reduces volatility risk.

On the other hand, the notion of timing the market consists of buying low and selling high. Though, this strategy is simple to understand, it’s quite difficult to apply. You can be lucky once in a while, but beating systematically the market is simply non realistic.

Don’t let fear control your emotions

Investing during a recession is definitely going to be extremely upsetting for some investors – just imagine your portfolio losing 10% of its value in a single day. Some market players are unable to weather such an environment, although markets could potentially rebound somewhere in the near future. Therefore, one must be aware that crisis investing always requires patience.

8 Best Canadian dividend stocks near their 52 weeks low

15 Best Monthly Dividend Stocks in Canada for passive income

Full list of ‘Dividend Kings’ stocks by sector – 2022

Recession-proof stocks – Dividend paying stocks

Economic contractions have investors worried about the future of many companies. Uncertainty contributes to panic, which actually has potential benefits for investors because it creates opportunities in stock markets. Some point out that investing during a recession is like trying to catch a falling knife, which is true because the risk of a double-dip recession or another sell-off is always present. However, by investing in quality stocks, investors can achieve postive returns, especially if they apply a long-term approach.

Many rational investors prefer to focus on safe stocks to invest in during a recession. How to identify stocks that are doing well in a recession? It would be reasonable to invest in high-quality companies with good fundamentals, including strong balance sheets and low leverage. Other than that, stocks for a recession should be marked by stable and predictable cash flows. These counter-cyclical companies are often found among industries that historically do well during tough times. Below, we present some industries, which can be considered relatively recession-proof:

- Healthcare – modern healthcare is essential all year round in developed economies. Demand for healthcare services is expected to remain relatively stable even during a recession.

- Basic consumer goods – food and drink, household items, personal care products or tobacco are considered non-cyclical, meaning they are always in demand. A rapid market sell-off could be an opportunity to buy well-established consumer staples.

- Utilities – the supply of electricity, gas or water to communities is absolutely crucial. Therefore, some investors may view utility companies as the best stocks to buy in a recession.

Dividend aristocrats vs S&P500

Overall, smart investing during a recession could also be associated with dividend-paying stocks, as these companies are generally considered well-established and market-leading companies. The best dividend paying stocks in the US market are dividend aristocrats. These are stocks with over 25 years of consecutive dividend increases.

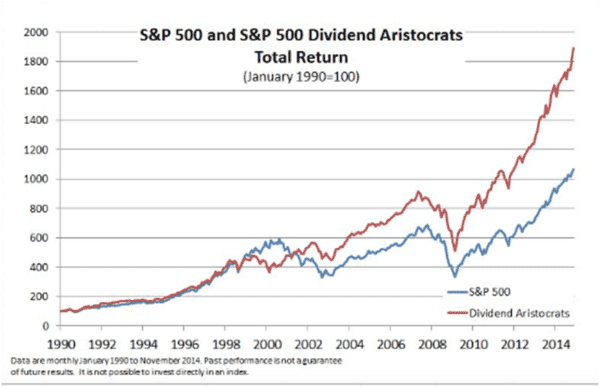

Below, it’s a comparison between the total return of the S&P500 and the S&P Dividend aristocrats. We can see that since 2001, dividend aristocrats have offered better overall return than investing in the S&P500.

Kimberly-Clark (KMB)

| Market Cap | 45B |

| Beta (5Y Monthly) | 0.35 |

| PE Ratio (TTM) | 26.12 |

| EPS (TTM) | 5.18 |

| Earnings Date | Jul 26, 2022 |

| Forward Dividend & Yield | 4.64 (3.44%) |

- Yahoo finance July 12th

Kimberly-Clark Corporation manufactures and markets personal care and consumer tissue products worldwide. It operates through three segments: Personal Care, Consumer Tissue, and K-C Professional.

+ Market leader (top spot or second position) in over 80 countries.

+ KMB enjoys brand power. Its products are known around the world. Some of the big names consumers will be familiar with include Huggies, Cottonelle, and Scott.

– Supply chain disruptions, inflation, and strengthening dollar effects are very likely to continue putting pressure on margins

– Kimberly-Clark delivered mixed results for its full-year 2021 and also Q1 2022 earnings, mixing some organic growth but also margin pressure

Altria (MO)

| Market Cap | 76B |

| Beta (5Y Monthly) | 0.63 |

| PE Ratio (TTM) | 25.64 |

| EPS (TTM) | 1.65 |

| Earnings Date | Jul 28, 2022 |

| Forward Div & Yield | 3.60 (8.58%) |

Altria Group sells the Marlboro cigarette brand in the U.S. and a number of other non-smokeable brands, including Skoal and Copenhagen.

+The flagship brand continues to be Marlboro, which commands over 40% retail market share in the U.S. Marlboro alone commands about 40% of the U.S. cigarette market. Other popular products are: chewing tobacco (55% market share) and cigars (26% market share).

+ Sales of tobacco are not impacted by the economic environement. In fact, customers are extremely brand loyal and sales grew in the last recession. Loyalty allows the company to raise its prices every year, which compensate for the lower volumes being sold.

+ Offers an attractive dividend. The dividend is relatively safe considering the company’s dividend payout ratio;

+ Altria is a dividend king with over 50 years of dividend increases;

+ The company has 10% stake in global beer giant Anheuser-Busch InBev

– Growth opportunities are limited for Altria (highly regulated industry);

– The FDA decided recently a total ban on Juul electronic cigarettes. This caused Altria’s shares to drop.

US Stocks that pay monthly dividends (Full list by sector)

Best dividend stocks to buy – Dividend aristocrats 2022

Coca-Cola Company (KO)

| Market Cap | 271B |

| Beta (5Y Monthly) | 0.56 |

| PE Ratio (TTM) | 26.44 |

| EPS (TTM) | 2.37 |

| Earnings Date | Jul 26, 2022 |

| Forward Dividend & Yield | 1.76 (2.80%) |

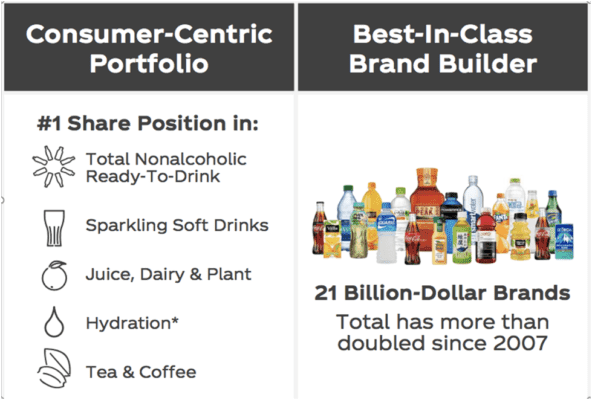

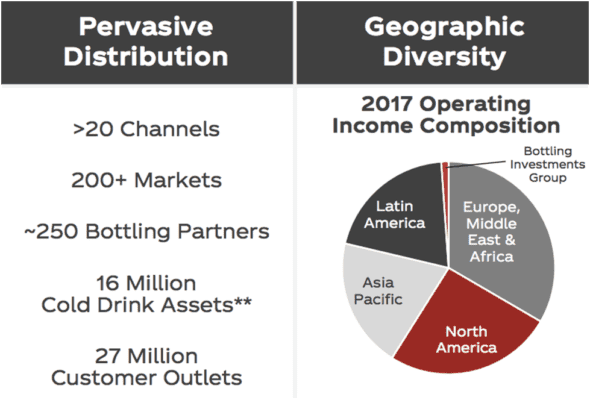

The Coca-Cola Company manufactures, markets, and sells various nonalcoholic beverages worldwide. The company provides sparkling soft drinks; flavored and enhanced water, and sports drinks; juice, dairy, and plant based beverages; tea and coffee; and energy drinks..

+ Coca-Cola has paid dividends for 60 straight years (Dividend King);

+ Coca-Cola has increased its dividend for more than 25 straight years. KO offers growing dividends which is always welcome to neutralize the impact of inflation;

+ Brand power: The company owns 21 brands that generate over $1 billion in sales including: Coke, Powerade, Dasani water, and Simply and Minute Maid juices.

+ Focus on healthier drinks is driving growth. Sales of teas, juices, and water continue to grow strongly in both developed and emerging economies.

+ On February 17, 2022, KO raised their dividend again to $0.44 from the previous $0.42 an almost 5% increase.

+ Restructuring plan: KO executives expect its operating margin and free cash flow margin to rise to 34% and 27%, respectively.

+ Coca-Cola is Berkshire Hathaway’s third-largest investment.

Source: Coca-Cola Presentation – Best dividend stocks 2022

Johnson & Johnson (JNJ)

| Market Cap | 462B |

| Beta (5Y Monthly) | 0.63 |

| PE Ratio (TTM) | 23.70 |

| EPS (TTM) | 7.42 |

| Earnings Date | Jul 19, 2022 |

| Forward Dividend & Yield | 4.52 (2.53%) |

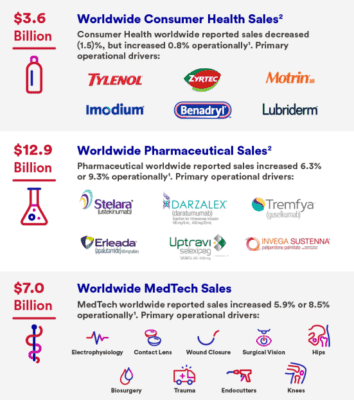

JNJ is the largest global medical conglomerate with over 250 subsidiaries operating across more than 60 countries.

+ Johnson & Johnson has managed to raise its dividend each year for more than half a century, demonstrating its ability to endure many different economic environments.

+ J&J has continuously show ability to innovate. Over 20% of sales are also from new products

+ The company operates in three different segments. This diversification strengthens the company’s resilience to economic cycles.

+ Strong credit rating which makes this stock trustworthy even during a recession.

+ The pharmaceuticals segment saw a 14% rise in 2021 sales while the medical devices segment sales were up 18%. Analysts expect this strong performance to continue.

Procter & Gamble (PG)

| Market Cap | 347B |

| Beta (5Y Monthly) | 0.39 |

| PE Ratio (TTM) | 25.31 |

| EPS (TTM) | 5.72 |

| Earnings Date | Jul 29, 2022 |

| Forward Dividend & Yield | 3.65 (2.52%) |

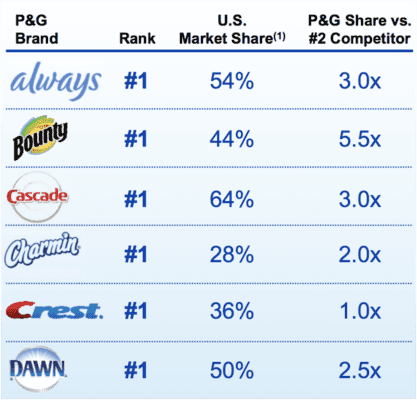

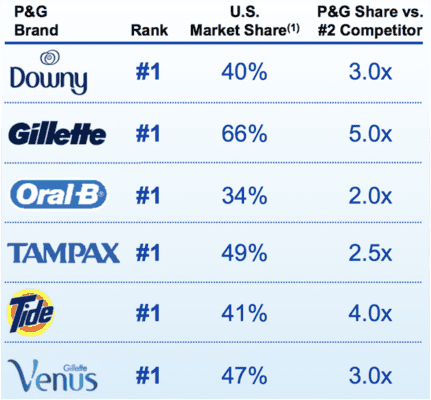

Procter & Gamble is one of the world’s largest consumer staples companies, selling 65 products in over 180 countries.

+ Following a recent restructuring, P&G was able to reduce costs by $7 billion. The firm’s executives believe they can cut costs further by introducing more factory automation and refocusing their advertising strategy.

“Together with Microsoft, P&G intends to make manufacturing smarter by enabling scalable predictive quality, predictive maintenance, controlled release, touchless operations and manufacturing sustainability optimization — which has not been done at this scale in the manufacturing space to date,” said P&G CIO Vittorio Cretella, in a joint Microsoft and P&G press release announcing the relationship.

+ The company continues to focus on its most profitable brands which is appreciated by shareholders

+ P&G has increased its dividend for 66 consecutive years (Dividend King)

Source: Procter & Gamble Presentation – Best dividend stocks 2022