In this post, we will go over five stocks that offer attractive dividend yields and strong cash flow ratios to sustain them. These stocks are ideal for long-term investors looking for the best dividend stocks 2022. We will analyze each stock: the dividend yield, dividend growth, return on equity, cash dividend payout ratio and free cash flow growth.

Methodology

Below are the criteria used to select the best long term Dividend stocks:

- Have a minimum capitalization of 10 billion dollars;

- offer a minimum dividend yield of 4%;

- Price earning ratio below 25;

- Cash Dividend Payout ratio below 50%

- A high return on equity

- Growing Free Cashflows

- Recent dividend increases

Cash dividend payout ratio vs Dividend payout ratio

The Dividend distribution rate is the ratio between the dividends paid and the company’s profits. A sustainable payout ratio can vary from one industry to another and from company to company. Indeed, there is no standard. Some ‘mature’ industries with little growth potential can have dividend payout rates up to 100% of their profits. In extreme cases, some companies take on long-term debt to be able to pay their dividends in the short term!

This is why investors should pay particular attention to the distribution rate. The purpose is to assess the sustainability of dividends.

The best indicators are:

– A dividend payout ratio below 80%. But since this ratio is the ratio between dividends and earnings, analysts prefer the cash dividend payout ratio. Companies can manipulate earnings but not the cash in hand!

– Analysis of cash flow growth is also an excellent indicator of the sustainability of dividends. Indeed, the continued decline in the company’s cash flows indicates a possible future dividend cut.

– The level of Debt (Debt to Equity ratio, Long-term debt to Equity, Current ratio, Interest coverage and Cash ratio). The purpose is to assess both long-term and short-term debt and the pressure they have on the company’s financial situation.

Best Dividend Stocks 2022

Devon Energy (DVN)

Devon Energy Corporation engages in the exploration, development, and production of oil, natural gas, and natural gas liquids in the United States.

| Ticker | DVN |

| Name | Devon Energy |

| Div Yield | 7.75% |

| Market Cap | 39.37B |

| Return on Equity | 57.26% |

| Payout Ratio | 45.20% |

| Free Cashflow per Share (Annual) | 4.349 |

| Dividend Growth 1yr | 34.83% |

| Div paid (TTM) | 3.6 |

| Dividend Growth 5yr | 36.22% |

| Free Cashflow 3yrs Growth | 75.72% |

| Cash Dividend Payout ratio | 45.47% |

Strengths

+ The company has enough free cashflow to sustain its dividends. The payout ratio is at 45%;

+ Attractive dividend yield 7.75%!

+ Devon increased its dividends in each of the last 5 years. Overall in the past 5 years, the dividend grew by 36%. As mentioned above, the dividend can be considered safe since Devon’s cash payout ratio is really low;

Weaknesses

-Devon is an energy play which means its short-term performance is heavily dependent on the price of oil. The Beta is at 2.55 meaning DVN is much more volatile than the overall market.

LyondellBasell Industries NV (LYB)

LyondellBasell Industries N.V. operates as a chemical company in the United States and internationally. The company is a major producer and refiner of plastic resins.

The company operates in six segments:

- Olefins and Polyolefins

- Olefins and Polyolefins (International)

- Intermediates and Derivatives;

- Advanced Polymer Solutions;

- Refining; and

- Technology.

| Ticker | LYB |

| Name | LyondellBasell Industries NV |

| Div Yield | 6.16% |

| Market Cap | 24.56B |

| Return on Equity | 45.94% |

| Payout Ratio | 59.29% |

| Free Cashflow per Share (Annual) | 17.17 |

| Div paid (TTM) | 9.78 |

| Dividend Growth 5yr | 5.92% |

| Free Cashflow 3yrs Growth | 19.44% |

| Cash Dividend Payout ratio | 25.91% |

Strengths

+ Diversified segments which help the company alleviate the risk of a recession in the economy

+ Strong balance sheet with higher Return On Equity than competitors. A higher ROE indicate sound management of expenditures especially during time of rising costs

+ Attractive dividend yield over 6%

+ Low price to earning ratio which indicate that the stock at the current levels is affordable

+ Dividend increased 12 years in a row and the cash dividend ratio is less than 30%! This means the dividend is sustainable in the future. In addition, management supports continuing its current dividend policy. CEO Peter Vanacker said in a statement, “As the incoming CEO, I would like to make it very clear that I support the continuation of our balanced and disciplined capital allocation strategy with both dividends and share repurchases playing a central role.”

Weaknesses

–In case Natural Gaz prices soar and stay high in the long term, the company’s financial position might deteriorate since Natural gas is its main input cost

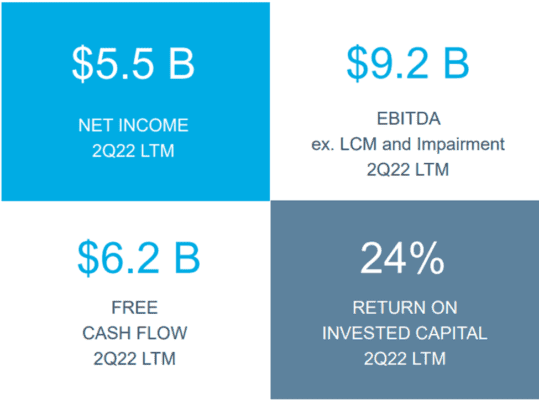

Source: LyondellBasell Investors’ relations

Canadian Natural Resources Ltd (CNQ)

Canadian Natural Resources Limited acquires, explores for, develops, produces, markets, and sells crude oil, natural gas, and natural gas liquids (NGLs). CNQ is present primarily in Western Canada; the UK; and Offshore Africa.

Strengths

| Ticker | CNQ |

| Name | Canadian Natural Resources Ltd |

| Div Yield | 4.74% |

| Market Cap | 53.76B |

| Return on Equity | 30.68% |

| Payout Ratio | 23.35% |

| Free Cashflow per Share (Annual) | 6.712 |

| Dividend Growth 1yr | 11.03% |

| Div paid (TTM) | 2.01 |

| Dividend Growth 5yr | 17.55% |

| Free Cashflow 3yrs Growth | 22.03% |

| Cash Dividend Payout ratio | 21.73% |

+ Low Cash Dividend Payout ratio which that CNQ’s dividend is sustainable

+ Market conditions have been so far favourable to Energy stocks. The S&P/TSX Capped Energy Index is up 34.4% so far year (in comparison to the S&P/TSX Composite Index, which is down -13%).

+ Operating cash flow doubled, to $5.9 billion (Canadian dollars). This great performance pushed CNQ increased its dividend and pay a special dividend of $1.50 a share on August 28.

+ CNQ is Canadian dividend aristocrats with 22 years of dividend increases

AbbVie (ABBV)

AbbVie Inc. discovers, develops, manufactures, and sells pharmaceuticals in the US and international markets.

| Ticker | ABBV |

| Name | AbbVie Inc |

| Div Yield | 4.12% |

| Market Cap | 237.30B |

| Return on Equity | 87.20% |

| Payout Ratio | 76.46% |

| Free Cashflow per Share (Annual) | 12.37 |

| Dividend Growth 1yr | 2.07% |

| Div paid (TTM) | 5.42 |

| Dividend Growth 5yr | 17.93% |

| Free Cashflow 3yrs Growth | 19.80% |

| Cash Dividend Payout ratio | 42.11% |

Strengths

+ AbbVie’s best selling drug (Humira) is widely used for a variety of conditions and continues to boost profits. Anlaysts expect however sales of Humira to slow with the loss of Humira’s exclusivity

+ Immunology and the neuroscience segments grew in the double digits in the last quarter. In the immunology field, drugs such as Rinvoq and Skyrizi should insure AbbVie profitability in the future. Analysts expect the combined sales of these two drugs to reach $15 Billion in 2025

+ Currently the stock’s Price earning ratio is low which indicates that it’s affordable at these levels

+ AbbVie is a Dividend Kings with a long history of paying and increasing its dividends every year for over 50 years! The dividend is sustainable in the future considering the company cash dividend payout ratio is still relatively low at 40%

+ Dividend yield is 4.12% which higher than similar firms in the pharmaceutical field

Weaknesses

-Investors continue to worry about the loss of exclusivity for the company’s star drug ‘Humira’. The stock’s price performance is directly related to the capacity of management to prove that the new developed drugs will sustain its revenues in the future.

Royal Bank stock (RY)

Royal Bank of Canada is a Canadian multinational bank and the largest bank in Canada by market capitalization. The bank has $1.690 billion in assets, about 86,000 employees along with 1,300 bank branches and almost 4,400 ATMs and is, without a doubt, one of the largest and most successful banks in the world.

| Ticker | RY |

| Name | Royal Bank of Canada |

| Div Yield | 4.18% |

| Market Cap | 125.31B |

| Return on Equity | 16.88% |

| Payout Ratio | 41.36% |

| Free Cashflow per Share (Annual) | 32.79 |

| Dividend Growth 1yr | 3.60% |

| Div paid (TTM) | 3.766 |

| Dividend Growth 5yr | 7.04% |

| Free Cashflow 3yrs Growth | 57.20% |

| Cash Dividend Payout ratio | 10.91% |

Strengths

+ Royal Bank of Canada holds a very strong balance sheet and is fundamentally sound;

+ Well-positioned to take advantage of an environment with rising interest rates;

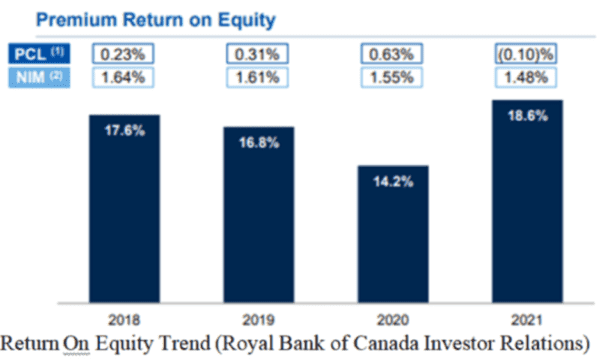

+ Excellent Return On Equity (ROE) at 18.28% (back to pre-pandemic levels);

+ 10 consecutive years of dividend increases.

Weaknesses

– Competition from both large banks and fintech companies.